Record Gold Prices: A Trade War Haven For Bullion Investors

Table of Contents

Why Gold Prices Surge During Trade Wars

The relationship between gold prices and global market stability is inversely proportional. When global markets are stable and economies are thriving, gold's appeal diminishes somewhat, as investors seek higher-yielding assets. However, during periods of heightened uncertainty, such as those triggered by trade wars, gold's value typically rises. Trade wars introduce a significant level of economic uncertainty, leading investors to seek the safety and stability of precious metals like gold. This flight to safety is driven by several key factors:

- Increased volatility in stock markets: Trade wars often lead to unpredictable market swings, causing investors to reduce their risk exposure by shifting investments to less volatile assets like gold.

- Weakening of currencies: Currency fluctuations are common during trade wars, creating further uncertainty. Gold, being a global commodity, acts as a hedge against currency devaluation.

- Concerns about inflation: Trade wars can disrupt supply chains and lead to increased prices for goods and services, fueling inflationary pressures. Gold is often viewed as an inflation hedge, maintaining its purchasing power even during inflationary periods.

- Safe-haven demand for gold: Gold's inherent properties – its scarcity, durability, and historical use as a store of value – solidify its position as a preferred safe-haven asset during times of geopolitical and economic turmoil. This increased demand directly impacts its price, driving it upwards.

Gold as a Hedge Against Inflation

Trade wars frequently exacerbate inflationary pressures. Increased government spending to offset economic downturns, disruptions to global supply chains leading to shortages and higher prices, and the devaluation of currencies all contribute to a rise in inflation. Historically, gold has served as a reliable inflation hedge, protecting investors' purchasing power. Its value tends to rise alongside inflation, acting as a safeguard against the erosion of monetary value. This is due to:

- Increased government spending: Governments often increase spending during economic slowdowns caused by trade wars, which can be inflationary.

- Supply chain disruptions: Trade wars often lead to disruptions in international trade, reducing the supply of goods and pushing prices higher.

- Devaluation of currencies: Governments might devalue their currencies to stimulate exports during a trade war, which erodes the value of savings in that currency. Gold, however, retains its value relatively independent of such actions.

- Gold's inherent value as a tangible asset: Unlike fiat currencies, gold possesses intrinsic value as a rare and durable metal, making it a stable investment.

Analyzing the Impact of Trade Wars on Gold Investment Strategies

Investing in gold during periods of trade war uncertainty offers various approaches, each with its own advantages and disadvantages:

- Physical gold: Buying physical gold bars or coins offers a tangible asset, but requires secure storage and incurs storage costs.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs provide a convenient and liquid way to invest in gold without the need for physical storage. They offer diversification benefits within a broader investment portfolio.

- Gold mining stocks: Investing in gold mining companies offers potentially higher returns than simply holding gold itself, but also carries significantly higher risk. The performance of mining stocks is influenced by various factors beyond just the gold price.

Choosing the right strategy depends on your risk tolerance, investment goals, and financial situation. Diversification is key; consider spreading investments across different asset classes to mitigate risk.

The Future Outlook for Gold Prices and Trade Relations

Predicting the future of gold prices and trade relations is inherently challenging, but several factors could influence future price movements:

- Potential resolution of trade disputes: A de-escalation of trade tensions could lead to a decrease in gold prices as investors shift back to higher-risk assets.

- Escalation of trade tensions: Conversely, further escalation of trade wars could significantly boost gold prices as investors continue to seek safe havens.

- Impact of global economic growth: Global economic growth could impact gold prices, with strong growth potentially reducing demand for gold as a safe haven.

- Long-term outlook for gold prices: Many analysts predict continued strong demand for gold in the long term, driven by factors like inflation and geopolitical uncertainty.

Expert opinions vary widely, but many agree that gold remains a valuable asset in a volatile global landscape.

Capitalize on Record Gold Prices – A Strategic Investment Opportunity

In summary, record gold prices are closely tied to the uncertainties created by ongoing trade wars. Gold's role as a safe haven, its effectiveness as an inflation hedge, and the diverse investment strategies available make it a compelling asset to consider. With high gold prices currently prevailing and the ongoing uncertainty in the global economic climate, now might be an opportune time to explore incorporating gold into your investment portfolio. Secure your investment with gold and consider exploring different investment options to find the best strategy for your financial goals. [Link to reputable investment firm or gold price tracking website]

Featured Posts

-

20

Apr 26, 2025

20

Apr 26, 2025 -

Severe Rail Disruptions In The Randstad Amsterdam Track Failures Cause Chaos

Apr 26, 2025

Severe Rail Disruptions In The Randstad Amsterdam Track Failures Cause Chaos

Apr 26, 2025 -

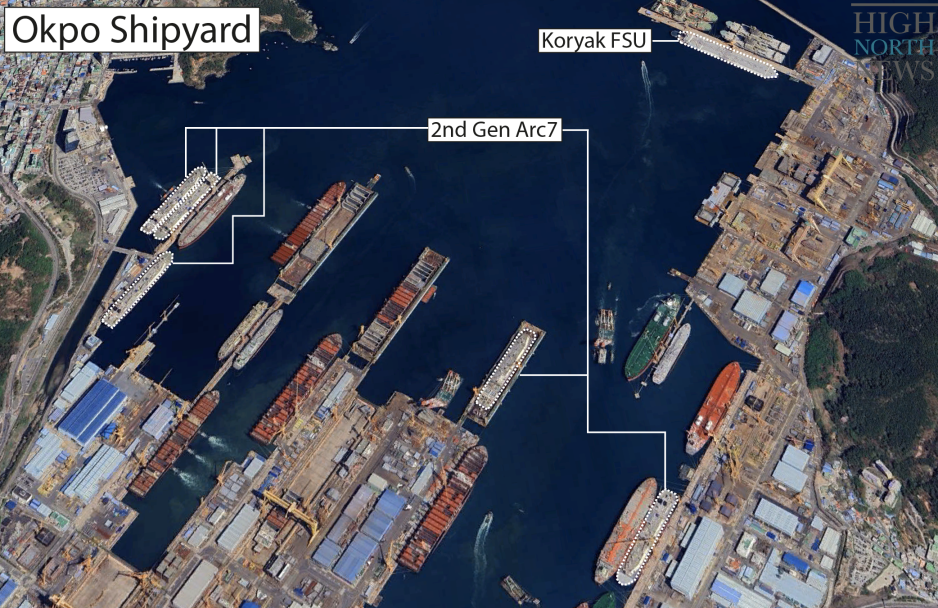

The Continuing Supply Chain European Shipyards And Russian Arctic Gas

Apr 26, 2025

The Continuing Supply Chain European Shipyards And Russian Arctic Gas

Apr 26, 2025 -

The Feds Tightrope Walk Trumps Policies And The Incoming Chair

Apr 26, 2025

The Feds Tightrope Walk Trumps Policies And The Incoming Chair

Apr 26, 2025 -

Strasbourg Guillaume Scheer Reprend Le Zuem Ysehuet Le 13 Juin

Apr 26, 2025

Strasbourg Guillaume Scheer Reprend Le Zuem Ysehuet Le 13 Juin

Apr 26, 2025

Latest Posts

-

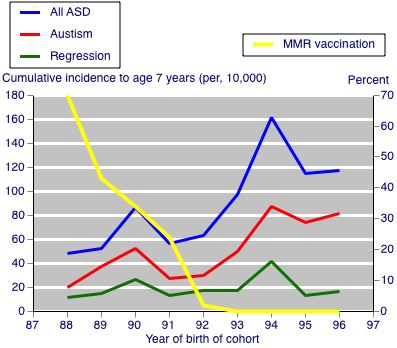

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025