$500 Instant Loans From Chime: Who Qualifies And How It Works

Table of Contents

Unexpected expenses can pop up at any time. A sudden car repair, a medical bill, or even a pressing household emergency – these situations often demand quick cash. If you're a Chime customer, you might be wondering: can I get a $500 instant loan? This article will delve into the possibility of securing a $500 instant loan through Chime, outlining the eligibility requirements and walking you through the application process. We'll cover everything you need to know to determine if a Chime loan is right for you.

Who Qualifies for a $500 Instant Loan from Chime?

Securing a $500 instant loan from Chime isn't guaranteed. Several factors determine your eligibility. While Chime doesn't explicitly offer a standalone "$500 instant loan" product in the traditional sense, their SpotMe feature and potential partnerships could provide similar short-term financial assistance. Let's explore the criteria.

Minimum Requirements:

Meeting these minimum requirements is a crucial first step, but it's important to remember that they don't guarantee approval:

- Minimum Age: You must be of legal age in your state to enter into a financial agreement.

- Active Chime Account: You need an active Chime checking account in good standing.

- Positive Account Balance: Maintaining a positive balance in your Chime account demonstrates responsible financial management.

- Consistent Direct Deposit History: Regular direct deposits show income stability, a key factor in loan approvals. The frequency and amount of deposits will be considered.

- Sufficient Available Credit (if applicable): Depending on any potential partnered lending options, sufficient available credit might be a requirement. This varies and is not always a factor.

- Clean Credit History (Impact of Credit Score): While not explicitly stated, a good credit history will likely improve your chances, though it's not a guaranteed requirement for all Chime-related financial assistance options.

Factors Affecting Approval:

Several factors beyond the minimum requirements influence your chances of approval:

- Income Stability: A consistent and reliable income stream is a major indicator of your ability to repay the loan.

- Debt-to-Income Ratio: Your debt-to-income ratio (the percentage of your income allocated to debt payments) is carefully considered. A lower ratio indicates better financial health.

- Account History with Chime: Your overall history with Chime, including your account activity and responsible financial behavior, plays a role.

- Credit Checks (How Chime Uses Credit Checks): Chime may or may not perform credit checks depending on the specific financial product you apply for. This is not always a requirement for all their financial offerings.

Understanding Your Chances:

It's crucial to have realistic expectations. Meeting the minimum requirements doesn't guarantee approval for a $500 loan or similar financial assistance from Chime. The approval process depends on a holistic assessment of your financial situation.

How Does the $500 Instant Loan Process Work with Chime? (or Similar Financial Assistance)

While Chime doesn't offer a traditional $500 loan, let's explore how their SpotMe feature and potential partnerships work to provide short-term financial assistance.

Application Process:

The application process for Chime's SpotMe or any similar program typically happens within the Chime app:

- Online Application through the Chime App: The application process is typically streamlined and entirely within the Chime mobile app.

- Required Documentation: You may need to provide basic identification and possibly income verification, depending on the financial product you're applying for.

- Instant Decision (Clarification): While the term "instant" is often used, it usually means a very fast decision, not necessarily immediate access to funds. The processing time varies depending on the specific product.

Loan Repayment (for applicable products):

Repayment terms will vary depending on the specific financial product offered. It is crucial to understand these terms before proceeding:

- Repayment Schedule: Repayment schedules typically range from a few days to a few weeks, depending on the financial product.

- Interest Rates and Fees: There might be associated fees or interest rates, depending on the specific financial product. Transparency regarding fees is essential.

- Methods of Repayment: Repayment is usually automatic, deducted from your Chime account.

- Late Payment Consequences: Late payments may result in fees or penalties, so adherence to the repayment schedule is crucial.

Alternatives to Chime's $500 Loan:

If you don't qualify for SpotMe or a similar Chime-related financial option, consider these alternatives:

- Payday Loans: (Caution: High interest rates.)

- Personal Loans from Credit Unions: (Often have lower interest rates than payday loans.)

- Borrowing from Family or Friends: (Interest-free option.)

Chime SpotMe vs. $500 Instant Loans: What's the Difference?

Chime SpotMe is an overdraft protection feature, not a loan. It allows for small overdrafts up to a certain limit, determined by your account activity and other factors. A $500 instant loan (or similar product from Chime or a partnered lender) would likely involve a formal application process, a repayment schedule, and potentially interest charges.

- SpotMe: Offers small amounts of overdraft protection, often with a smaller limit and lower fees than a formal loan.

- $500 Loan (or equivalent): Provides a larger sum but usually involves more formal requirements and potentially higher interest rates.

SpotMe Pros: Convenience, readily available if eligible. SpotMe Cons: Low limits, eligibility criteria.

$500 Loan (or equivalent) Pros: Larger amounts of money available. $500 Loan (or equivalent) Cons: Stricter eligibility criteria, potential for higher interest rates.

Conclusion:

Securing quick cash can be challenging, but understanding your options is crucial. While Chime doesn't offer a traditional $500 instant loan, options like SpotMe and potential partnerships can provide short-term financial assistance. Remember, eligibility depends on several factors, including your account history, income stability, and creditworthiness. Carefully review the terms and conditions of any financial product before proceeding.

Call to Action: Need a quick financial boost? Check your eligibility for Chime's SpotMe or explore other financial tools offered through the Chime app today! If SpotMe isn't suitable, explore alternative options such as small personal loans from credit unions or borrowing from trusted sources. Don't hesitate to contact Chime customer support for further clarification on available financial products. [Link to Chime website]

Featured Posts

-

Snow White Remake How A 1987 Horror Film Predicted Disneys Changes

May 14, 2025

Snow White Remake How A 1987 Horror Film Predicted Disneys Changes

May 14, 2025 -

Man United Transfer Targets Amorims Seven Player List

May 14, 2025

Man United Transfer Targets Amorims Seven Player List

May 14, 2025 -

The Next King Of Country Parker Mc Collum Eyes George Straits Crown

May 14, 2025

The Next King Of Country Parker Mc Collum Eyes George Straits Crown

May 14, 2025 -

La Liga Espanola Celta Vs Sevilla Fecha 35 En Vivo

May 14, 2025

La Liga Espanola Celta Vs Sevilla Fecha 35 En Vivo

May 14, 2025 -

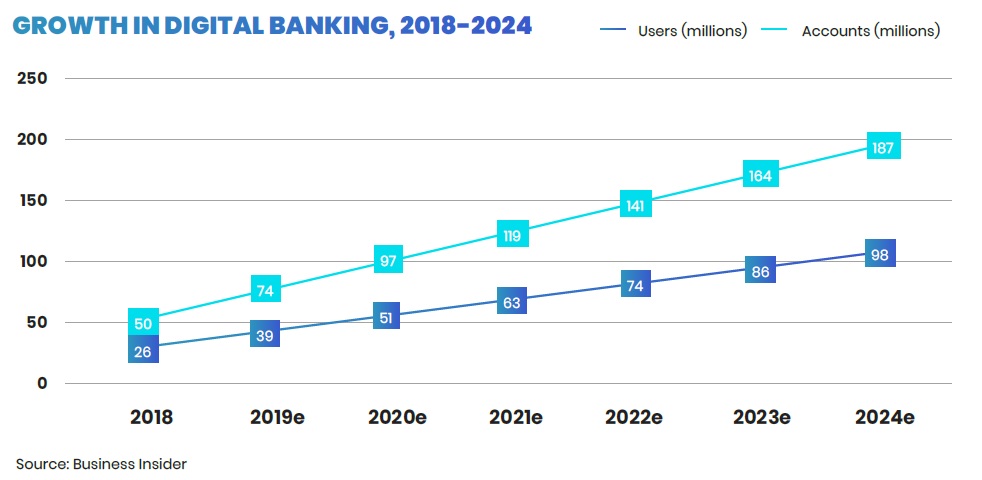

Us Ipo Filing Chimes Rise In Digital Banking And Revenue Growth

May 14, 2025

Us Ipo Filing Chimes Rise In Digital Banking And Revenue Growth

May 14, 2025

Latest Posts

-

Lindt Unveils Grand Chocolate Shop In Central London

May 14, 2025

Lindt Unveils Grand Chocolate Shop In Central London

May 14, 2025 -

A Chocolate Lovers Dream Lindt Opens Flagship Store In Central London

May 14, 2025

A Chocolate Lovers Dream Lindt Opens Flagship Store In Central London

May 14, 2025 -

Discover Lindts New Chocolate Haven In Central London

May 14, 2025

Discover Lindts New Chocolate Haven In Central London

May 14, 2025 -

New Lindt Chocolate Shop Opens In Central London A Sweet Treat Awaits

May 14, 2025

New Lindt Chocolate Shop Opens In Central London A Sweet Treat Awaits

May 14, 2025 -

Experience Chocolate Heaven Lindt Opens In Central London

May 14, 2025

Experience Chocolate Heaven Lindt Opens In Central London

May 14, 2025