5 Key Do's & Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do: Understand Your Risk Tolerance and Investment Goals in the Private Credit Market

Before diving into the private credit market, a thorough self-assessment is paramount. Your success hinges on aligning your investment strategy with your personal risk profile and financial objectives.

Assess your risk appetite. Are you comfortable with illiquidity and potentially longer investment horizons?

- Conservative investors: Prefer lower risk, prioritize capital preservation, and may opt for senior secured loans with established borrowers.

- Moderate investors: Accept moderate risk for potentially higher returns, diversifying across various private credit asset classes.

- Aggressive investors: Embrace higher risk for the potential of significantly greater returns, potentially focusing on mezzanine debt or distressed debt strategies.

Aligning investment goals with your risk tolerance is crucial:

- Capital preservation: Focus on strategies minimizing principal loss, such as senior secured loans.

- Income generation: Prioritize investments offering consistent interest payments, such as direct lending.

- Capital appreciation: Seek out opportunities for significant capital growth, potentially involving more junior debt or equity components.

Diversify your private credit portfolio across different asset classes and borrowers.

Effective diversification is key to mitigating risk within the private credit market:

- Asset class diversification: Explore various investment types, including direct lending (providing loans directly to companies), mezzanine debt (subordinated debt offering higher returns but greater risk), and distressed debt (investing in debt of financially struggling companies).

- Geographical diversification: Spread investments across different regions to reduce exposure to localized economic downturns.

- Industry diversification: Avoid over-concentration in a single industry, shielding your portfolio from sector-specific shocks.

Don't: Neglect Due Diligence in the Private Credit Market

Due diligence is the cornerstone of successful private credit investing. Thorough investigation protects your investment and minimizes potential losses.

Thoroughly vet potential borrowers and their businesses.

Comprehensive due diligence requires a multi-faceted approach:

- Credit analysis: Assess the borrower's creditworthiness using various financial ratios and credit scoring models.

- Financial statement analysis: Analyze financial statements to understand the borrower's financial health, profitability, and cash flow.

- Industry research: Evaluate the borrower's industry and competitive landscape to assess the long-term viability of their business.

- Independent legal and valuation reviews: Secure professional opinions on legal aspects and the fair market value of the investment.

Overlook the importance of robust legal documentation.

Protecting your interests requires comprehensive legal documentation:

- Comprehensive loan agreements: Ensure loan agreements clearly define terms, conditions, repayment schedules, and remedies in case of default.

- Experienced legal counsel: Engage lawyers specializing in private credit transactions to review and negotiate agreements.

Do: Build a Strong Network and Leverage Relationships in the Private Credit Market

Networking is invaluable in the private credit market. Building strong relationships unlocks opportunities and provides valuable insights.

Network with experienced professionals in the private credit industry.

Expand your network by:

- Attending industry conferences: Connect with investors, fund managers, and other professionals.

- Joining professional organizations: Engage with like-minded individuals and gain access to valuable resources.

- Building relationships with fund managers: Explore potential co-investment opportunities and gain access to deal flow.

Seek out experienced advisors and mentors.

Benefit from the knowledge and expertise of seasoned professionals:

- Mentorship programs: Seek guidance and support from experienced private credit investors.

- Consultants and advisors: Engage specialized professionals for expert advice on strategy and due diligence.

Don't: Underestimate the Importance of Liquidity Management in the Private Credit Market

Liquidity is a critical consideration in private credit investing. Unlike publicly traded securities, private credit investments are typically illiquid.

Understand that private credit investments are generally illiquid.

- Long-term horizons: Private credit investments often require a long-term commitment, potentially spanning several years.

- Limited trading opportunities: Exiting private credit investments before maturity can be challenging and may result in losses.

Properly plan for potential liquidity needs.

Maintain sufficient liquidity:

- Cash reserves: Maintain adequate cash reserves to cover unexpected expenses and potential shortfalls.

- Diversified liquid assets: Include other liquid assets in your portfolio to meet unexpected needs.

Do: Stay Informed About Market Trends and Regulatory Changes in the Private Credit Market

Staying informed is crucial in the dynamic private credit market. Awareness of market trends and regulatory changes is vital for success.

Keep abreast of economic conditions and their impact on the private credit market.

Monitor key macroeconomic indicators:

- Interest rates: Changes in interest rates significantly affect borrowing costs and investment returns.

- Inflation: Inflation impacts borrowing costs and the real return on investments.

- GDP growth: Economic growth influences the creditworthiness of borrowers and investment opportunities.

Stay updated on regulatory changes and compliance requirements.

Understanding and complying with regulations is paramount:

- Regulatory updates: Monitor regulatory changes in the private credit market to ensure compliance.

- Legal and tax implications: Understand the legal and tax implications of your investments.

Conclusion: Mastering the Private Credit Market: Your Path to Success

Successfully navigating the private credit market requires a strategic approach. Understanding your risk tolerance, performing thorough due diligence, building a strong network, managing liquidity effectively, and staying informed are all crucial elements for success in private credit investing. By following these do's and don'ts, you can significantly improve your chances of achieving your investment goals within this dynamic market. Take control of your private credit investment journey today!

Featured Posts

-

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025 -

Vatican Defrauded London Property Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Property Deal Ruled Fraudulent By British Court

Apr 29, 2025 -

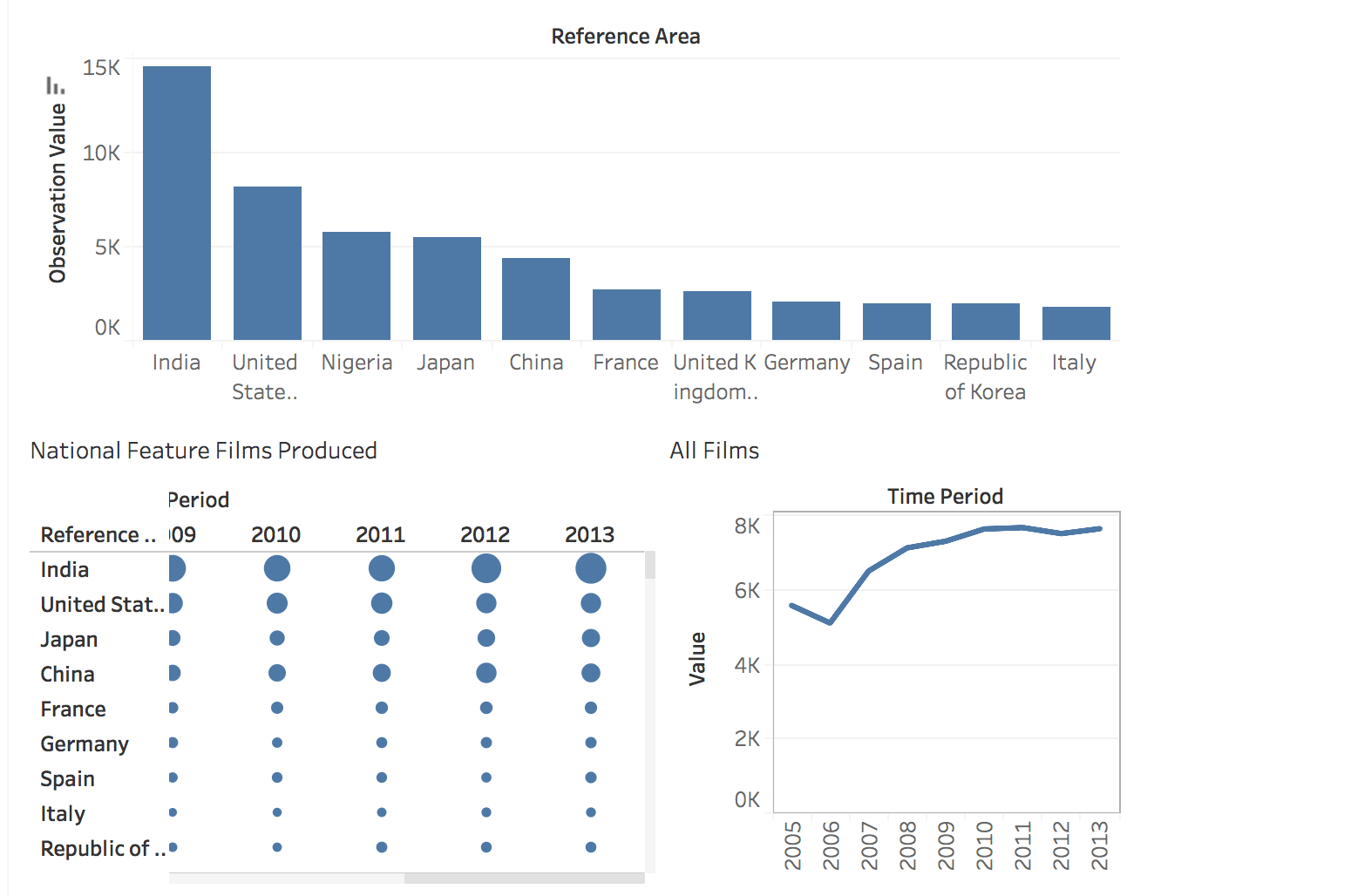

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025 -

Buying Capital Summertime Ball 2025 Tickets Official Ticket Outlets

Apr 29, 2025

Buying Capital Summertime Ball 2025 Tickets Official Ticket Outlets

Apr 29, 2025 -

Us Trade Actions Cast Shadow Over Upcoming Canadian Federal Election

Apr 29, 2025

Us Trade Actions Cast Shadow Over Upcoming Canadian Federal Election

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni