Will Minnesota Film Tax Credits Attract More Productions?

Table of Contents

The Current State of Minnesota's Film Tax Credit Program

Minnesota's film tax credit program offers a valuable incentive to filmmakers, but its structure and impact are subjects of ongoing discussion. The program provides a credit against Minnesota corporate franchise or income tax, offering a percentage of qualified production expenses incurred within the state. While the exact percentage and cap fluctuate, it's crucial to understand the specifics to assess its effectiveness.

- Credit Percentage and Cap: The current percentage and cap on the credit should be clearly stated here (this information needs to be obtained from official Minnesota state government sources and updated regularly). For example: "Currently, the program offers a [Percentage]% tax credit, capped at [Dollar Amount] per production."

- Eligible Production Types: The program typically covers various production types, including feature films, television series, commercials, and documentaries. Specific criteria for each type should be outlined.

- Requirements for Claiming the Credit: Filmmakers must meet specific requirements, such as spending a minimum amount within Minnesota, employing a certain number of Minnesota residents, and adhering to specific reporting procedures. These requirements should be detailed.

- Data on Job Creation: Statistics on job creation resulting from the program, ideally sourced from the Minnesota Department of Employment and Economic Development (DEED) or other reputable sources, are essential to evaluating its economic impact. This could include direct and indirect job creation numbers. For instance: "According to [Source], the film tax credit program created [Number] jobs in [Year]."

Comparing Minnesota's Incentives to Other States

Minnesota's film tax credit program must be assessed within a competitive landscape. Neighboring states like Wisconsin, Iowa, and North Dakota, as well as major production hubs like California, Georgia, and New York, offer varying incentives and production environments. A simple comparison of tax credit rates alone is insufficient; a holistic assessment is crucial.

- Comparative Table: A table comparing tax credit rates, caps, and other relevant incentives across different states provides a quick and effective visual representation. This should include not just the percentage but also any stipulations or limitations.

- Skilled Crew Base: Minnesota needs a robust and skilled crew base to attract major productions. Assessing the availability of experienced professionals in various film crew roles (e.g., cinematographers, editors, sound designers) is crucial.

- Production Costs: Overall production costs – including labor, equipment rental, and location fees – significantly influence a production company's location decision. Comparing Minnesota's costs to other states reveals its competitive position.

The Economic Impact of Film Tax Credits in Minnesota

The economic impact of film tax credits is a subject of ongoing debate. Proponents argue that they generate significant economic activity, while opponents question their cost-effectiveness. A balanced perspective is needed, analyzing both potential benefits and drawbacks.

- Direct Job Creation: This includes jobs directly related to film production, such as actors, directors, crew members, and production staff.

- Indirect Job Creation: Film productions stimulate other sectors, creating jobs in hospitality, catering, transportation, and local businesses.

- Revenue Generation: Film productions can attract tourism, generating revenue for local businesses and boosting the state's economy.

- Long-Term Growth Potential: Attracting film productions can foster long-term growth by establishing a skilled workforce, attracting related businesses, and creating a positive image for the state. This needs to be supported by evidence and projections.

Challenges and Opportunities for the Minnesota Film Industry

Beyond the tax credit program, several factors influence Minnesota's film industry's success. Addressing existing challenges and capitalizing on opportunities is crucial for sustained growth.

- Infrastructure Limitations: Minnesota may lack sufficient studio space, soundstages, and other essential infrastructure compared to larger production hubs. Identifying these limitations is crucial.

- Workforce Development: Investing in workforce training programs to develop and retain a skilled workforce is vital for the industry's long-term health.

- Marketing and Promotion: Targeted marketing campaigns are necessary to highlight Minnesota's attractive filming locations, skilled workforce, and supportive environment to attract productions.

Conclusion: The Future of Film Production in Minnesota and the Role of Tax Credits

Determining whether Minnesota's film tax credits are effectively attracting more productions requires a nuanced approach. While the program offers a valuable incentive, its success hinges on various factors including its competitiveness compared to other states, the availability of skilled crews, the state's overall production costs, and the development of essential infrastructure. Addressing the challenges and capitalizing on the opportunities outlined above, particularly through collaboration between the state government, private sector, and film organizations, is essential to maximizing the program's impact. Explore the potential of Minnesota film tax credits and discover how your production can benefit from this initiative. Learn more about Minnesota's film tax credits and contribute to the growth of a vibrant and promising film industry.

Featured Posts

-

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025 -

Understanding Tylor Megills Effectiveness With The New York Mets

Apr 29, 2025

Understanding Tylor Megills Effectiveness With The New York Mets

Apr 29, 2025 -

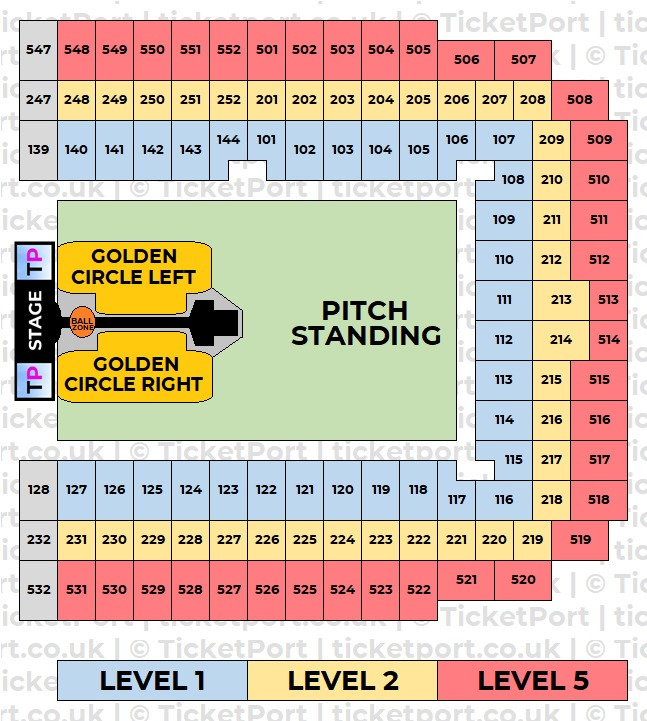

Capital Summertime Ball 2025 A Comprehensive Ticket Buying Guide

Apr 29, 2025

Capital Summertime Ball 2025 A Comprehensive Ticket Buying Guide

Apr 29, 2025 -

Concerns Rise For Missing Paralympian In Las Vegas

Apr 29, 2025

Concerns Rise For Missing Paralympian In Las Vegas

Apr 29, 2025 -

Where To Watch Lionel Messis Inter Miami Mls Games Live Stream Schedule And Betting Odds

Apr 29, 2025

Where To Watch Lionel Messis Inter Miami Mls Games Live Stream Schedule And Betting Odds

Apr 29, 2025