400% XRP Price Increase: Is It Sustainable? A Buyer's Guide

Table of Contents

Factors Contributing to the Recent XRP Price Surge

Several key factors have contributed to the recent dramatic XRP price increase. Understanding these elements is crucial for assessing the sustainability of this growth and making informed investment decisions.

Positive Ripple Legal Developments

The ongoing Ripple vs. SEC lawsuit has been a major driver of XRP's price volatility. Positive developments in the case have significantly boosted investor confidence. A favorable outcome could dramatically reduce regulatory uncertainty surrounding XRP, leading to increased institutional investment and wider adoption.

- Favorable legal precedents: Recent court rulings, even in unrelated cases, can set precedents that positively influence the Ripple case.

- Reduced regulatory uncertainty: A clear legal victory for Ripple would significantly reduce the uncertainty surrounding XRP's regulatory status, attracting more institutional investors.

- Increased institutional interest: Many institutional investors were hesitant to invest in XRP due to the legal uncertainty. A positive resolution could unlock significant institutional capital inflow.

Growing Adoption and Utility

Beyond the legal battles, XRP's increasing adoption and utility are driving its price upward. Its use in cross-border payments and other financial transactions continues to expand.

- Increased transaction volume: The growing number of transactions processed using XRP demonstrates its increasing practical application.

- Growing network effect: As more businesses and financial institutions utilize XRP, its network effect strengthens, further increasing its value.

- Expansion into new markets: Ripple's partnerships and collaborations are expanding XRP's reach into new markets and applications, fostering broader adoption.

Overall Market Sentiment and Crypto Bull Run

The broader cryptocurrency market also plays a significant role. A general bullish sentiment and a crypto bull run can lift all boats, including XRP.

- Positive Bitcoin price action: Bitcoin's price movements often influence the entire crypto market, impacting XRP's price as well.

- Increased investor confidence in crypto: Positive news and developments within the cryptocurrency space overall bolster investor confidence, driving demand for various cryptocurrencies, including XRP.

- General market optimism: A positive outlook on the global economy can spill over into the cryptocurrency market, pushing prices upward.

Analyzing the Sustainability of the XRP Price Increase

While the recent surge is impressive, determining its long-term sustainability requires careful analysis of both potential risks and XRP's inherent strengths.

Potential Risks and Challenges

Despite the positive developments, several risks could hinder XRP's sustained growth.

- Ongoing regulatory uncertainty: Even a favorable ruling in the Ripple case doesn't guarantee complete regulatory clarity in all jurisdictions.

- Competition from other cryptocurrencies: The cryptocurrency market is highly competitive. New and established cryptocurrencies constantly vie for market share.

- Market volatility: The inherent volatility of the cryptocurrency market means XRP's price can fluctuate dramatically, potentially leading to significant losses.

Fundamental Analysis of XRP

A thorough fundamental analysis is crucial for evaluating XRP's long-term prospects.

- Technological advancements: Ripple continues to develop and improve XRP's underlying technology, aiming for enhanced scalability and efficiency.

- Scalability and efficiency improvements: Improvements in transaction speed and cost-effectiveness are vital for XRP's continued competitiveness.

- Community support and development: A strong and active community is essential for the long-term growth and sustainability of any cryptocurrency.

Technical Analysis of XRP Price Charts

While not a primary factor, observing technical indicators like support and resistance levels and moving averages can offer insights into potential price movements. However, relying solely on technical analysis for investment decisions is risky.

- Support and resistance levels: Identifying key price levels where buying or selling pressure is expected can help predict potential price movements.

- Moving averages: Tracking moving averages can help gauge the overall trend and potential momentum shifts.

- Trading volume: High trading volume often signifies strong buying or selling pressure, offering insights into market sentiment.

A Buyer's Guide to XRP

Investing in XRP, like any cryptocurrency, carries significant risk. This section provides a guide to help navigate the process safely and responsibly.

Understanding the Risks of Cryptocurrency Investment

Before investing in XRP, it's crucial to fully comprehend the inherent risks.

- High risk, high reward: Cryptocurrency investments offer the potential for substantial returns but also carry the risk of significant losses.

- Market volatility: The cryptocurrency market is highly volatile; prices can fluctuate dramatically in short periods.

- Potential for loss of capital: There's a real possibility of losing all or part of your investment.

Where to Buy XRP

Several reputable cryptocurrency exchanges offer XRP trading. Choose an exchange based on factors like fees, security, and user experience. Always thoroughly research any exchange before using it.

- Binance: A large and popular exchange with low fees and high liquidity.

- Kraken: A well-established exchange known for its security and regulatory compliance.

- Coinbase: A user-friendly exchange popular among beginners. (Note: Availability may vary by region)

Secure Storage of XRP

Securing your XRP holdings is paramount. Never leave significant amounts on exchanges.

- Hardware wallets (Ledger, Trezor): These offer the highest level of security for storing cryptocurrencies.

- Software wallets: Software wallets provide a convenient option but generally offer less security than hardware wallets.

- Exchange security measures: While exchanges implement security measures, they are not immune to hacking or theft.

Conclusion

The recent 400% XRP price increase presents a compelling opportunity but also significant risks. Positive legal developments and increasing adoption offer optimism, but regulatory uncertainty and market volatility remain considerable challenges. Before investing in XRP, thoroughly research its fundamentals, understand the risks involved, and only invest what you can afford to lose. Make informed decisions about your XRP investment strategy and remember that the cryptocurrency market is inherently unpredictable.

Featured Posts

-

Analyzing China Lifes Profit Rise The Role Of Strategic Investments

May 01, 2025

Analyzing China Lifes Profit Rise The Role Of Strategic Investments

May 01, 2025 -

Turning Poop Into Profit How Ai Digests Repetitive Scatological Documents For Podcast Production

May 01, 2025

Turning Poop Into Profit How Ai Digests Repetitive Scatological Documents For Podcast Production

May 01, 2025 -

Sheens Million Pound Documentary Defending The Project Amidst Criticism

May 01, 2025

Sheens Million Pound Documentary Defending The Project Amidst Criticism

May 01, 2025 -

Italys Little Tahiti Powdery White Sands And Turquoise Waters

May 01, 2025

Italys Little Tahiti Powdery White Sands And Turquoise Waters

May 01, 2025 -

Actress Priscilla Pointer Dead At 100 A Legacy Remembered

May 01, 2025

Actress Priscilla Pointer Dead At 100 A Legacy Remembered

May 01, 2025

Latest Posts

-

1 050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

May 01, 2025

1 050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

May 01, 2025 -

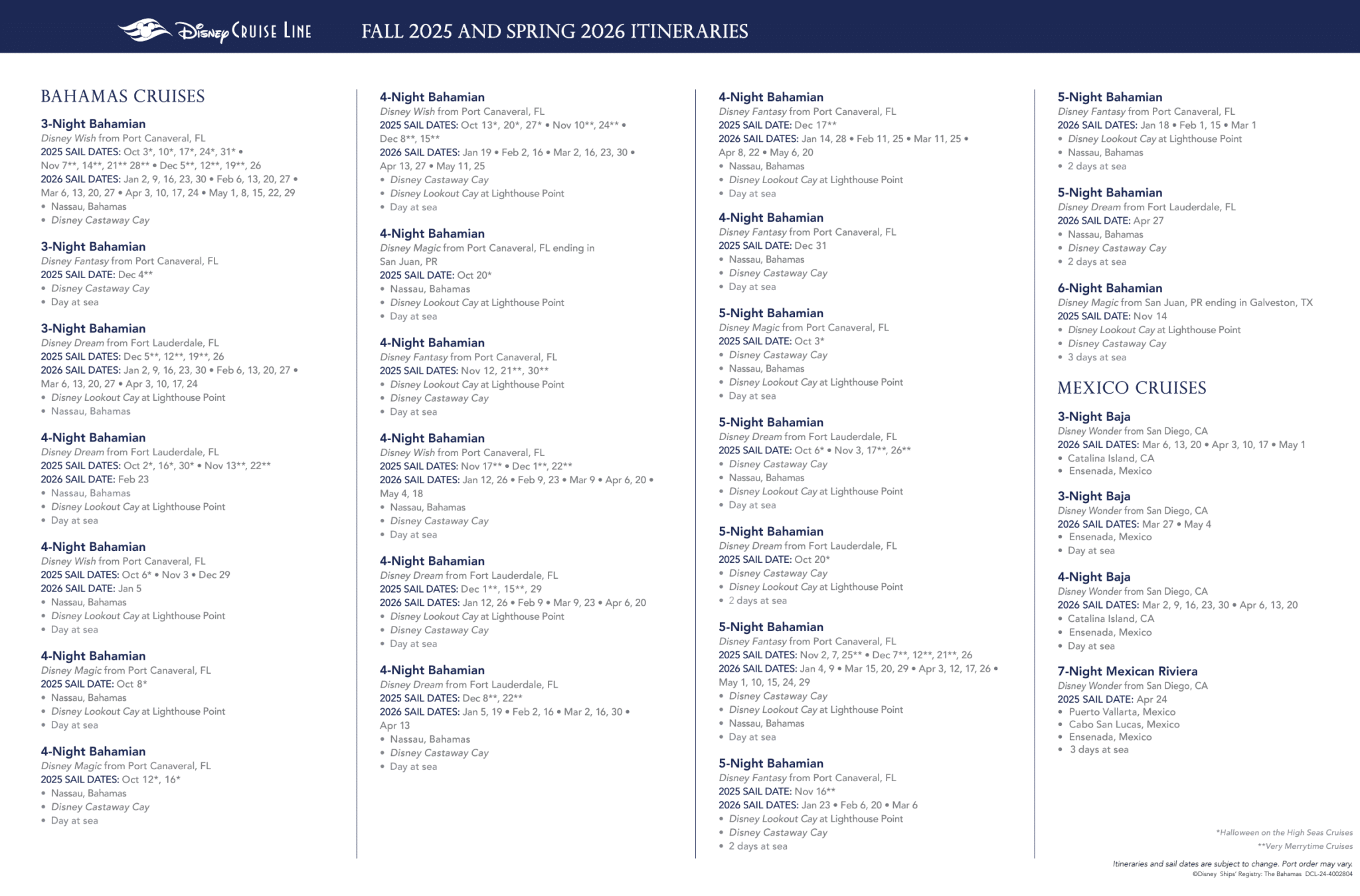

Disneys Alaskan Adventure Two Cruise Ships Set For Summer 2026

May 01, 2025

Disneys Alaskan Adventure Two Cruise Ships Set For Summer 2026

May 01, 2025 -

V Mware Costs To Skyrocket At And T Reports 1 050 Price Increase From Broadcom

May 01, 2025

V Mware Costs To Skyrocket At And T Reports 1 050 Price Increase From Broadcom

May 01, 2025 -

Nclh Earnings Beat And Raised Guidance Drive Stock Price Higher

May 01, 2025

Nclh Earnings Beat And Raised Guidance Drive Stock Price Higher

May 01, 2025 -

Nclh Stock Soars Strong Earnings And Upgraded Guidance

May 01, 2025

Nclh Stock Soars Strong Earnings And Upgraded Guidance

May 01, 2025