Analyzing China Life's Profit Rise: The Role Of Strategic Investments

Table of Contents

China Life Insurance, a leading force in the Chinese insurance market, has recently witnessed a substantial increase in profits. This article analyzes the key factors driving this impressive growth, with a particular focus on the role of China Life Strategic Investments. We will examine the types of investments fueling this success, the influence of government policies, and the future prospects for the company's investment portfolio. Understanding these strategies provides crucial insights into China Life's financial performance and the broader Chinese investment landscape.

Increased Returns from Equity Investments

China Life's strategic investment decisions in equity markets have significantly contributed to its profit surge. This success stems from two key areas: a focus on high-growth sectors and proactive portfolio management.

Focus on High-Growth Sectors: China Life has strategically shifted its investments towards rapidly expanding sectors, generating substantial returns.

- Investment in leading tech companies listed on the Shanghai and Shenzhen stock exchanges: This exposure to China's booming technology sector has yielded significant dividends, aligning China Life's investment strategy with the nation's technological advancement. The company's due diligence process and selection criteria for these high-growth tech firms are critical to this success.

- Strategic partnerships with renewable energy firms driving sustainable growth: Investing in renewable energy aligns with global sustainability goals and capitalizes on China's massive push towards green energy initiatives. These partnerships not only generate financial returns but also enhance China Life's corporate social responsibility profile.

- Participation in large-scale infrastructure projects across China: China's ongoing infrastructure development provides ample opportunities for lucrative long-term investments. China Life's involvement in these projects offers stable returns and contributes to the nation's economic growth.

Active Portfolio Management: China Life's proactive portfolio management strategy further maximizes returns.

- Utilizing sophisticated quantitative models for investment decisions: The company leverages advanced analytics to identify promising investment opportunities and mitigate potential risks, demonstrating a commitment to data-driven decision-making in their China Life strategic investments.

- Employing a diverse team of experienced investment professionals: A team of skilled professionals with diverse expertise ensures well-informed investment decisions and adept risk management. Their collective knowledge is a vital component of the company's investment success.

- Regular portfolio reviews and risk assessment procedures: Continuous monitoring and adaptation to market conditions allow China Life to optimize its portfolio and minimize potential losses, highlighting the importance of dynamic risk management in their China Life strategic investments.

Expansion into Alternative Investments

Beyond equity investments, China Life's diversification into alternative investment strategies has also played a crucial role in its profit growth.

Real Estate and Private Equity: Venturing into real estate and private equity has broadened revenue streams and reduced dependence on traditional investments.

- Investments in prime commercial properties in major Chinese cities: These investments provide stable, long-term returns, capitalizing on the robust growth of China's urban centers. Careful property selection and market analysis are key factors in the success of this strategy within China Life strategic investments.

- Strategic partnerships with leading private equity firms for diversified returns: Collaborating with established firms provides access to a wider range of investment opportunities and leverages the expertise of experienced partners.

- Focus on long-term value creation rather than short-term gains: A long-term perspective minimizes short-sighted decisions and fosters sustainable growth within China Life strategic investments.

International Investment Opportunities: Expanding globally further diversifies risk and unlocks new growth avenues.

- Investments in overseas infrastructure projects: International projects offer diversified exposure and access to potentially higher returns.

- Acquisitions of international insurance companies: These acquisitions expand China Life's global reach and market share, enhancing their overall competitive position.

- Strategic alliances with global financial institutions: Partnerships with global players facilitate access to new markets and investment opportunities, further strengthening China Life strategic investments.

The Impact of Government Policies and Regulations

Government policies and regulations have significantly influenced China Life's investment success.

Favorable Regulatory Environment: Supportive government initiatives have created a positive investment climate.

- Government initiatives to stimulate economic growth: Policies aimed at stimulating economic growth have created a favorable environment for investments across various sectors.

- Relaxation of certain investment restrictions: Easing restrictions has opened up new avenues for investment and increased market access.

- Increased foreign investment opportunities: Greater access to foreign investment opportunities has broadened China Life's investment horizon.

Navigating Regulatory Changes: China Life's ability to adapt to regulatory shifts is crucial for its continued success.

- Proactive engagement with regulatory bodies: Maintaining strong relationships with regulatory bodies ensures compliance and proactive responses to policy changes.

- Strict adherence to compliance standards: Stringent compliance ensures smooth operations and minimizes potential regulatory risks.

- Implementation of robust risk management procedures: Effective risk management is essential for mitigating potential issues arising from regulatory changes.

Conclusion:

China Life's remarkable profit increase is directly attributable to its sophisticated and adaptable China Life strategic investments. Through portfolio diversification, active asset management, and skillful navigation of the regulatory environment, China Life has secured a position for ongoing success. Analyzing these strategies offers invaluable insights into the dynamics of the Chinese insurance and investment markets. To stay informed on the latest developments in China Life's investment strategies and their impact on profitability, continue following our analysis of China Life Strategic Investments and related keywords like "China Life investment portfolio," "China Life financial performance," and "China Life risk management."

Featured Posts

-

Disney Cruise Lines Expanded Alaskan Offerings For Summer 2026

May 01, 2025

Disney Cruise Lines Expanded Alaskan Offerings For Summer 2026

May 01, 2025 -

Cruises Com Launches Innovative Points Based Rewards Program For Cruisers

May 01, 2025

Cruises Com Launches Innovative Points Based Rewards Program For Cruisers

May 01, 2025 -

Kshmyr Tnaze Bhart Ky Fwjy Taqt Awr Mdhakrat Ky Ahmyt

May 01, 2025

Kshmyr Tnaze Bhart Ky Fwjy Taqt Awr Mdhakrat Ky Ahmyt

May 01, 2025 -

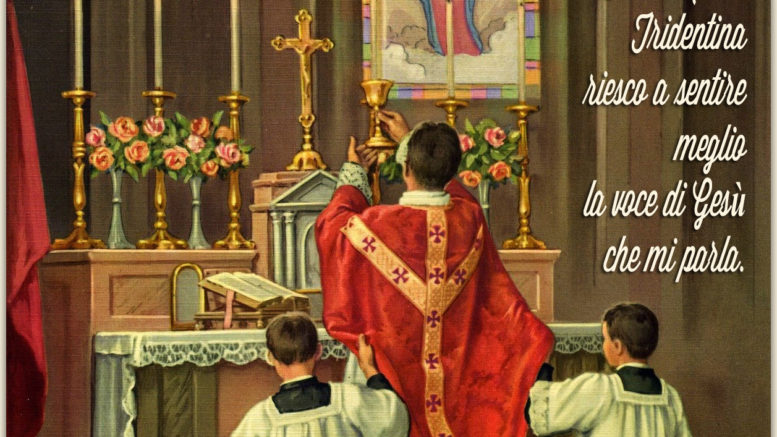

Un Interpretazione Del Venerdi Santo Secondo Feltri

May 01, 2025

Un Interpretazione Del Venerdi Santo Secondo Feltri

May 01, 2025 -

China Life Investment Strength Fuels Profit Increase

May 01, 2025

China Life Investment Strength Fuels Profit Increase

May 01, 2025