13 Analysts Weigh In: Your Guide To Principal Financial Group (PFG) Stock

Table of Contents

Analyst Ratings and Price Targets for PFG Stock

Thirteen financial analysts have weighed in on Principal Financial Group (PFG) stock, providing a diverse range of opinions and price targets. While a complete consensus is rare, understanding the spread of opinions can inform your own investment strategy. The consensus leans slightly towards a "hold" rating, with a significant number of analysts suggesting a cautious approach.

-

Range of Price Targets: The price targets vary considerably, ranging from a low of (insert low price) to a high of (insert high price). This discrepancy highlights the differing perspectives on PFG's future performance.

-

Significant Discrepancies: Some analysts emphasize PFG's strong dividend yield and stable earnings as reasons for a "buy" rating, while others express concerns about potential regulatory changes or economic slowdowns, leading them to favor a "hold" or even a "sell" rating.

| Analyst | Rating | Price Target | Date |

|---|---|---|---|

| Analyst A | Buy | $85 | October 26, 2023 |

| Analyst B | Hold | $78 | November 1, 2023 |

| Analyst C | Hold | $82 | November 7, 2023 |

| Analyst D | Buy | $90 | November 15, 2023 |

| Analyst E | Hold | $75 | November 20, 2023 |

| Analyst F | Sell | $70 | November 22, 2023 |

| Analyst G | Hold | $80 | November 29, 2023 |

| Analyst H | Buy | $88 | December 5, 2023 |

| Analyst I | Hold | $79 | December 12, 2023 |

| Analyst J | Buy | $86 | December 19, 2023 |

| Analyst K | Hold | $81 | December 26, 2023 |

| Analyst L | Hold | $77 | January 2, 2024 |

| Analyst M | Buy | $92 | January 9, 2024 |

(Note: Replace the bracketed information with actual analyst data. Ensure dates are current.)

Keywords: PFG stock price target, PFG analyst ratings, PFG buy/sell rating, PFG stock forecast.

Key Factors Influencing Analyst Opinions on PFG

Analyst opinions on PFG stock are shaped by a complex interplay of macroeconomic factors, company performance, and competitive dynamics.

-

Macroeconomic Factors: Interest rate fluctuations, inflation levels, and overall economic growth significantly impact PFG's performance. Rising interest rates, for instance, can boost investment income but may also affect consumer spending and demand for financial products.

-

Financial Performance: PFG's recent earnings reports, revenue growth, and dividend payouts are crucial indicators of its financial health. Consistent earnings growth and strong dividend payouts often attract investors, while declining performance can raise concerns.

-

Competitive Landscape: PFG operates in a competitive market, and its market position relative to competitors influences analyst sentiment. Innovation, market share, and competitive advantages are key factors to consider in evaluating PFG's prospects.

-

Strategic Initiatives: PFG's strategic initiatives, such as expansion into new markets or the development of innovative financial products, can significantly influence its future growth prospects and, consequently, analyst ratings.

Keywords: PFG financial performance, PFG competitive analysis, PFG growth prospects, PFG macroeconomic factors.

PFG's Dividend Policy and its Impact on Investor Decisions

PFG's dividend policy is a key factor influencing analyst recommendations. A consistent and growing dividend can attract income-oriented investors, boosting demand for the stock.

-

Dividend History and Yield: Analyze PFG's dividend history to assess its consistency and growth trajectory. The current dividend yield provides a measure of the dividend's attractiveness relative to the stock price.

-

Dividend Payout Ratio: Understanding PFG's dividend payout ratio—the percentage of earnings paid out as dividends—is essential for assessing the sustainability of its dividend policy. A high payout ratio might indicate a risk of future dividend cuts.

Keywords: PFG dividend yield, PFG dividend payout ratio, PFG dividend history, PFG dividend growth.

Risks and Opportunities Associated with Investing in PFG Stock

Like any investment, PFG stock carries both risks and opportunities. Understanding these is crucial for informed investment decisions.

-

Potential Risks: Regulatory changes impacting the financial services industry, economic downturns that reduce consumer spending, and increased competition from other financial institutions are all potential risks.

-

Potential Opportunities: Expansion into new markets, the development of innovative financial products, and strategic acquisitions could create significant opportunities for PFG's future growth.

Keywords: PFG investment risks, PFG investment opportunities, PFG risk assessment, PFG future outlook.

Comparing PFG with its Competitors

Analyzing PFG's performance relative to its key competitors provides valuable context for evaluating its investment potential.

-

Competitive Advantage: Identify PFG's strengths and weaknesses compared to its rivals. Does it possess a unique competitive advantage in specific market segments?

-

Market Share: Tracking PFG's market share and its growth trajectory can reveal valuable insights about its competitive position and future prospects.

Keywords: PFG competitors, PFG competitive advantage, PFG market share, PFG industry comparison.

Conclusion: Making Informed Decisions About Principal Financial Group (PFG) Stock

The analysis of 13 analyst reports on Principal Financial Group (PFG) stock reveals a diverse range of opinions, underscoring the complexity of financial market analysis. While a clear consensus isn't present, understanding the differing perspectives and the underlying rationale provides valuable insights. Remember that thorough research is crucial before investing in PFG stock or any other financial asset. Consider multiple perspectives, consult diverse sources of information, and always consult with a financial advisor to ensure your investment strategy aligns with your risk tolerance and financial goals. Make informed decisions about your PFG stock investment, understanding the nuances of PFG investment strategies, and building a sound financial plan.

Featured Posts

-

May 16 Oil Market Report Prices Trends And Analysis

May 17, 2025

May 16 Oil Market Report Prices Trends And Analysis

May 17, 2025 -

New Lawsuit Accuses Epic Games Of Misleading Practices In Fortnites In Game Store

May 17, 2025

New Lawsuit Accuses Epic Games Of Misleading Practices In Fortnites In Game Store

May 17, 2025 -

Krizis V Ferrexpo Zhevago Ugrozhaet Prekratit Investitsii V Ukrainu

May 17, 2025

Krizis V Ferrexpo Zhevago Ugrozhaet Prekratit Investitsii V Ukrainu

May 17, 2025 -

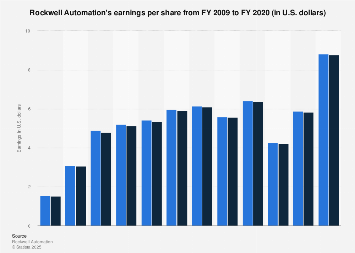

Rockwell Automation Earnings Surprise Stock Soars With Other Market Movers

May 17, 2025

Rockwell Automation Earnings Surprise Stock Soars With Other Market Movers

May 17, 2025 -

Fortnite Tmnt Skins Locations Release Dates And Acquisition Methods

May 17, 2025

Fortnite Tmnt Skins Locations Release Dates And Acquisition Methods

May 17, 2025

Latest Posts

-

Analyzing The Knicks Overtime Loss What Went Wrong

May 17, 2025

Analyzing The Knicks Overtime Loss What Went Wrong

May 17, 2025 -

Knicks Overtime Heartbreak A Close Call

May 17, 2025

Knicks Overtime Heartbreak A Close Call

May 17, 2025 -

Rockwell Automation Angi And Borg Warner Among Top Performers Market Update

May 17, 2025

Rockwell Automation Angi And Borg Warner Among Top Performers Market Update

May 17, 2025 -

Did The Knicks Avoid Disaster In Overtime Defeat

May 17, 2025

Did The Knicks Avoid Disaster In Overtime Defeat

May 17, 2025 -

Market Surge Rockwell Automation Angi Borg Warner And Others Post Significant Gains

May 17, 2025

Market Surge Rockwell Automation Angi Borg Warner And Others Post Significant Gains

May 17, 2025