10-Week High Breached: Bitcoin's Ascent Towards US$100,000

Table of Contents

Analyzing the Recent Bitcoin Price Surge

Technical Analysis

Technical analysis provides valuable insights into Bitcoin's price movements. Several key indicators support the recent surge:

- Moving Averages: The 50-day and 200-day moving averages have shown a bullish crossover, a classic sign of an upward trend. This suggests sustained buying pressure and a positive outlook for the Bitcoin price.

- Relative Strength Index (RSI): The RSI, a momentum indicator, is currently above 50, indicating bullish momentum. While not extremely overbought, it suggests further upward potential.

- Moving Average Convergence Divergence (MACD): The MACD histogram shows a positive trend, further confirming the bullish momentum observed in other indicators.

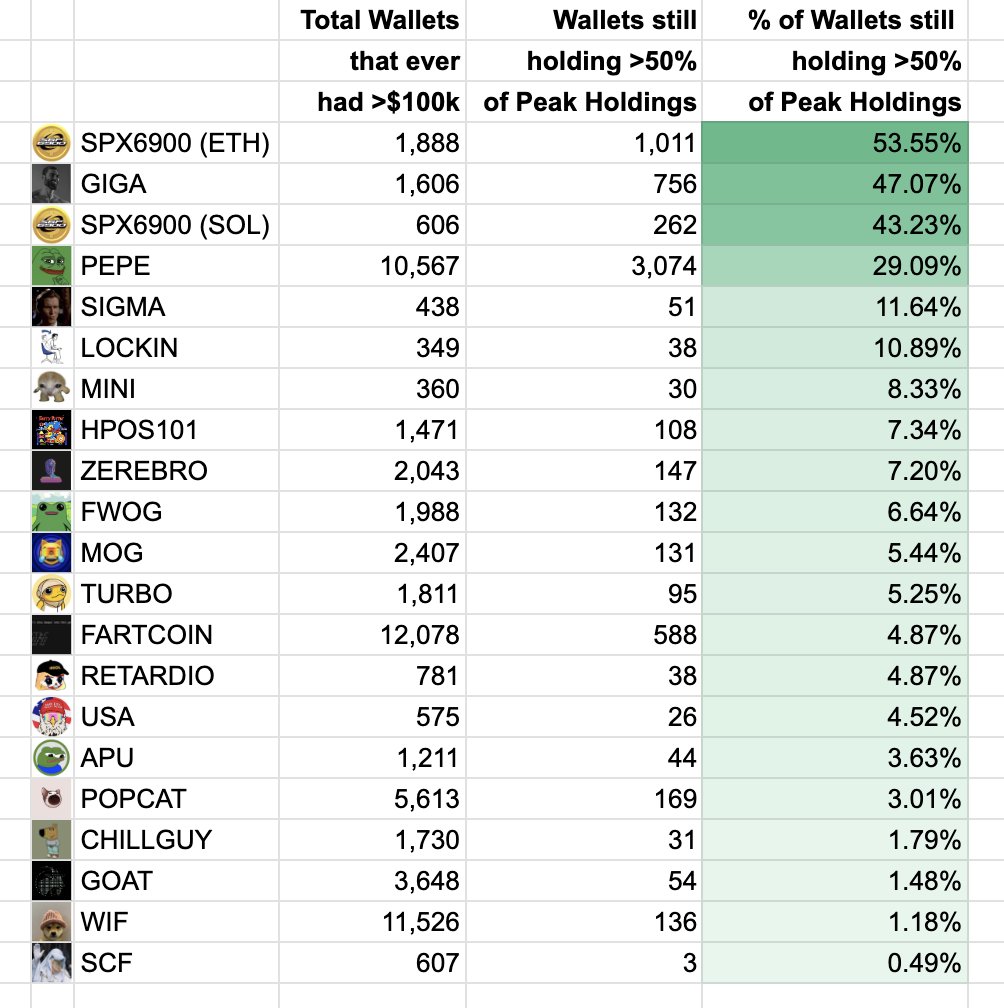

[Insert chart/graph illustrating these indicators here]

On-Chain Metrics

Examining on-chain data provides a deeper understanding of the underlying strength of the Bitcoin network and its potential for future growth:

- Transaction Volume: Increased transaction volume indicates higher activity and demand for Bitcoin.

- Active Addresses: A rising number of active addresses suggests growing user engagement and adoption of Bitcoin.

- Mining Hash Rate: A strong mining hash rate indicates a secure and robust network, fostering investor confidence in the Bitcoin ecosystem.

Data from reputable sources like Glassnode (link to Glassnode) and CoinMetrics (link to CoinMetrics) consistently reveal positive on-chain metrics, suggesting strong fundamentals for Bitcoin's price appreciation.

Market Sentiment and News

Positive news and overall market sentiment play a crucial role in influencing Bitcoin's price.

- Positive News: Recent positive news, such as institutional adoption (discussed further below) and positive regulatory developments in certain jurisdictions, contributed to the bullish sentiment.

- Regulatory Developments: While regulatory uncertainty remains a factor, some positive regulatory developments in specific regions are contributing to a more positive market outlook for Bitcoin.

- Market Sentiment: Currently, the overall market sentiment towards Bitcoin is leaning towards bullish, primarily driven by the factors mentioned above.

Factors Contributing to Bitcoin's Potential Rise to $100,000

Institutional Adoption

Institutional investors are increasingly recognizing Bitcoin's potential as a valuable asset.

- Examples: Major corporations and hedge funds are adding Bitcoin to their portfolios, signifying a growing acceptance of Bitcoin as a viable investment option.

- Impact: This institutional adoption fuels demand and provides significant price support for Bitcoin, driving its price upward.

Growing Demand and Scarcity

Bitcoin's limited supply (21 million coins) and growing demand contribute significantly to its price appreciation.

- Fixed Supply: The fixed supply of Bitcoin makes it a deflationary asset, unlike fiat currencies prone to inflation.

- Increasing Adoption: As adoption increases among both retail and institutional investors, the demand for Bitcoin outpaces the supply, leading to price increases.

Macroeconomic Factors

Global macroeconomic conditions can significantly impact Bitcoin's price.

- Inflation and Geopolitical Instability: Inflation and geopolitical instability often push investors towards Bitcoin as a hedge against risk and a store of value, increasing demand.

- Fiat Currency Devaluation: The devaluation of fiat currencies in many countries further strengthens Bitcoin's appeal as an alternative asset.

Potential Risks and Challenges

Regulatory Uncertainty

Regulatory uncertainty remains a significant risk for Bitcoin.

- Varying Regulations: Different countries have vastly different regulatory approaches to cryptocurrencies.

- Negative Impact: Unfavorable regulations or crackdowns can significantly impact Bitcoin's price negatively.

Market Volatility

The cryptocurrency market, including Bitcoin, is inherently volatile.

- Price Corrections: Sharp price corrections are common in the cryptocurrency market.

- Risk Management: Investors need to carefully manage their risk exposure in this volatile market.

Competition from Altcoins

The emergence of other cryptocurrencies (altcoins) poses a competitive threat to Bitcoin's dominance.

- Altcoin Competition: Numerous altcoins offer potentially higher returns, potentially diverting investment away from Bitcoin.

- Market Share: Competition could impact Bitcoin's market share and influence its price.

Conclusion: Bitcoin's Journey Towards $100,000: A Summary and Call to Action

Bitcoin's recent 10-week high, fueled by positive technical indicators, robust on-chain metrics, and positive market sentiment, suggests a strong upward trajectory. Institutional adoption, growing demand, and macroeconomic factors further contribute to its potential to reach $100,000. However, regulatory uncertainty, market volatility, and competition from altcoins present significant challenges. While this analysis suggests potential, remember that this is not financial advice. Conduct thorough research and consider your risk tolerance before investing in Bitcoin. The future of Bitcoin and its potential to reach $100,000 remains an exciting prospect; further research into Bitcoin investment, $100,000 Bitcoin price predictions, and the Bitcoin future is encouraged.

Featured Posts

-

New Evidence Suggests Rihanna And A Ap Rocky Are Dating

May 07, 2025

New Evidence Suggests Rihanna And A Ap Rocky Are Dating

May 07, 2025 -

Papal Election The Role And Process Of The Conclave

May 07, 2025

Papal Election The Role And Process Of The Conclave

May 07, 2025 -

La Lucha De Simone Biles Tras La Revelacion De Mi Cuerpo Se Derrumbo

May 07, 2025

La Lucha De Simone Biles Tras La Revelacion De Mi Cuerpo Se Derrumbo

May 07, 2025 -

Crypto Whales Target New Xrp 5880 Potential Gains

May 07, 2025

Crypto Whales Target New Xrp 5880 Potential Gains

May 07, 2025 -

Novinite Za Riana Ot Ed Shiyrn

May 07, 2025

Novinite Za Riana Ot Ed Shiyrn

May 07, 2025

Latest Posts

-

How Flooding Impacts Livestock And Farm Operations

May 07, 2025

How Flooding Impacts Livestock And Farm Operations

May 07, 2025 -

Flooding A Grave Threat To Livestock And Farms

May 07, 2025

Flooding A Grave Threat To Livestock And Farms

May 07, 2025 -

Commerce Adviser Highlights Governments Efforts For Ldc Graduation

May 07, 2025

Commerce Adviser Highlights Governments Efforts For Ldc Graduation

May 07, 2025 -

Ldc Graduation Governments Role And Strategies

May 07, 2025

Ldc Graduation Governments Role And Strategies

May 07, 2025 -

5 Crucial Nie Articles You Need To Read Q1 2025

May 07, 2025

5 Crucial Nie Articles You Need To Read Q1 2025

May 07, 2025