1,050% Price Hike For VMware? AT&T Highlights Broadcom's Extreme Proposal

Table of Contents

The proposed acquisition of VMware by Broadcom has sent shockwaves through the tech industry, with AT&T highlighting a potential 1,050% price hike for VMware software licenses. This extreme price increase raises serious concerns about potential monopolistic practices and the impact on businesses relying on VMware virtualization solutions. This article delves into the details of AT&T's claims and explores the broader implications of Broadcom's acquisition strategy, focusing on the potential for a massive VMware price increase.

AT&T's Allegations and the 1,050% VMware Price Hike

AT&T, a major telecommunications company and significant VMware customer, alleges that Broadcom's acquisition of VMware will lead to a dramatic increase in licensing costs. Their claim centers on a potential 1,050% price hike for certain VMware products. While the exact figures and specific product lines affected remain somewhat opaque, the sheer magnitude of the alleged increase has ignited considerable debate and concern. Sources close to AT&T suggest internal documentation and projected pricing models support this alarming figure.

- Specific examples of VMware products and their projected price increases: While AT&T hasn't publicly released a detailed list, reports suggest that key products within the vSphere suite, including licensing for vCenter Server and ESXi, could face the most significant price increases.

- How this increase impacts businesses using these products: For businesses relying heavily on VMware for virtualization, a 1,050% increase represents a catastrophic cost escalation, potentially forcing them to reconsider their IT infrastructure and explore alternative solutions. This could significantly impact budgets and long-term IT strategies.

- AT&T’s position within the market and why this matters: AT&T's size and reliance on VMware makes their concerns particularly relevant. Their public outcry adds significant weight to the argument against the acquisition, highlighting the potential negative consequences for large enterprises. Their concerns underscore the potential for Broadcom to leverage its market power post-acquisition.

Broadcom's Response and Acquisition Strategy

Broadcom has refuted AT&T's allegations, stating that the price increase predictions are exaggerated and based on inaccurate assumptions. They maintain that the acquisition will benefit customers through increased innovation and cost efficiencies. However, Broadcom's acquisition history warrants scrutiny. Broadcom has a track record of acquiring companies, often followed by integration and cost-cutting measures that can impact pricing.

- Broadcom's stated reasons for acquiring VMware: Broadcom cites synergies between their existing portfolio and VMware's virtualization technology, aiming to create a more comprehensive offering for enterprise customers. They also highlight potential for cost savings through consolidation and efficiency improvements.

- Potential synergies and cost-cutting measures Broadcom plans to implement: While Broadcom hasn't explicitly detailed their cost-cutting plans, industry analysts predict that streamlining operations, reducing redundancies, and potentially consolidating product lines are likely strategies. These strategies could result in price increases for some products.

- Past examples of Broadcom's acquisitions and their aftermath: Broadcom's past acquisitions offer mixed results. Some have yielded successful integrations and innovation, while others have led to concerns about pricing and reduced competition. Analyzing these past acquisitions is crucial in evaluating the potential impact of the VMware acquisition.

Antitrust Concerns and Regulatory Scrutiny

The potential for a massive VMware price increase raises significant antitrust concerns. Regulatory bodies, including the FTC in the US and the EU Commission, are carefully examining the acquisition to determine whether it could stifle competition and harm consumers. The substantial increase in VMware licensing costs, as alleged by AT&T, is a central focus of these investigations.

- Potential legal challenges to the acquisition: Several industry groups and competitors are likely to launch legal challenges if they believe the acquisition will harm competition. These challenges could delay or even block the acquisition.

- Concerns about reduced competition in the virtualization market: The combined market power of Broadcom and VMware could significantly reduce competition in the virtualization market, potentially leading to higher prices and less innovation.

- The likelihood of the acquisition being approved or blocked: The outcome of the regulatory review process remains uncertain. The magnitude of the potential price increase, as highlighted by AT&T, is a critical factor that regulators will consider.

Impact on Businesses and the IT Industry

The potential 1,050% VMware price hike would have profound implications for businesses relying on VMware solutions. Many organizations would face difficult decisions, potentially impacting budgets and long-term IT strategies. The impact extends beyond individual businesses, affecting the broader IT industry and fostering uncertainty.

- Cost implications for businesses if the price increase is implemented: The cost implications are staggering, forcing businesses to reassess their IT spending and potentially leading to budget overruns.

- Potential migration strategies for businesses seeking alternatives: Businesses might need to explore alternative virtualization platforms, like Microsoft Hyper-V, Citrix XenServer, or open-source solutions like Proxmox VE. This migration process can be complex and time-consuming.

- Impact on innovation and competition within the virtualization market: Reduced competition could stifle innovation and negatively affect the development of new virtualization technologies.

Conclusion

AT&T's allegations of a potential 1,050% VMware price hike following Broadcom's acquisition are a serious concern. Broadcom's response and its history of acquisitions, coupled with ongoing antitrust scrutiny, highlight the potential for significant negative impacts on businesses and the IT industry. The regulatory review process will play a crucial role in determining the future of VMware pricing and the competitive landscape of the virtualization market.

Call to Action: Stay informed about the ongoing developments in the Broadcom-VMware acquisition. Continue monitoring for updates on regulatory decisions and potential pricing changes affecting VMware products. Understand the potential implications of this massive acquisition on your business’s VMware licensing costs and prepare for potential changes. Research alternative virtualization solutions to mitigate risks associated with the potential 1,050% VMware price hike. Don't wait until it's too late; proactively assess your options and plan accordingly.

Featured Posts

-

The New Android Design Language A Deep Dive

May 16, 2025

The New Android Design Language A Deep Dive

May 16, 2025 -

Resultado Belgica Portugal 0 1 Analisis Del Partido

May 16, 2025

Resultado Belgica Portugal 0 1 Analisis Del Partido

May 16, 2025 -

Mdah Ka Tam Krwz Ke Jwtwn Pr Pawn Rkhna Ayk Hyran Kn Waqeh

May 16, 2025

Mdah Ka Tam Krwz Ke Jwtwn Pr Pawn Rkhna Ayk Hyran Kn Waqeh

May 16, 2025 -

Paddy Pimbletts Fiery Response To Critics After Ufc 314 Victory

May 16, 2025

Paddy Pimbletts Fiery Response To Critics After Ufc 314 Victory

May 16, 2025 -

Blocking Triggers And Circumvention How Block Mirror Works

May 16, 2025

Blocking Triggers And Circumvention How Block Mirror Works

May 16, 2025

Latest Posts

-

San Jose Earthquakes Three Game Losing Streak Continues With 4 1 Defeat To Charlotte Fc

May 16, 2025

San Jose Earthquakes Three Game Losing Streak Continues With 4 1 Defeat To Charlotte Fc

May 16, 2025 -

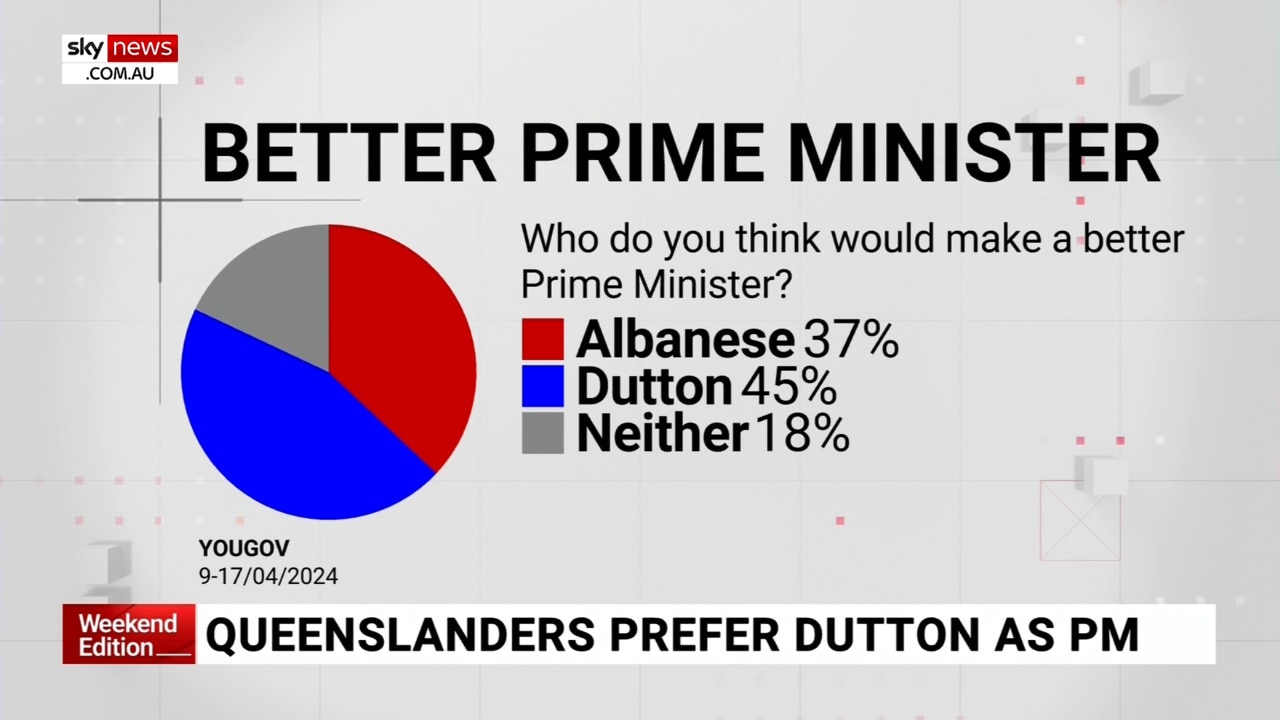

Australian Election 2024 Analyzing Albanese And Duttons Campaign Platforms

May 16, 2025

Australian Election 2024 Analyzing Albanese And Duttons Campaign Platforms

May 16, 2025 -

Albanese And Duttons Election Strategies A Comparative Overview

May 16, 2025

Albanese And Duttons Election Strategies A Comparative Overview

May 16, 2025 -

The Albanese Dutton Debate A Deep Dive Into Their Campaign Strategies

May 16, 2025

The Albanese Dutton Debate A Deep Dive Into Their Campaign Strategies

May 16, 2025 -

103 X Vont Weekend A Visual Summary April 4 6 2025

May 16, 2025

103 X Vont Weekend A Visual Summary April 4 6 2025

May 16, 2025