Yuan Support Measures Underwhelm: A First For This Year

Table of Contents

The PBoC's Recent Interventions and Their Limited Effect

The PBoC has employed a range of tools in its attempts to bolster the Yuan, also known as the RMB (Renminbi). These have included setting the daily fixing rate for the Yuan against the US dollar, adjusting reserve requirements for commercial banks, and conducting open market operations to influence liquidity. These actions are designed to counter Yuan depreciation and stabilize the RMB exchange rate. However, their effectiveness has been significantly muted this year.

-

Expected Impact: The PBoC's interventions were expected to increase demand for the Yuan, pushing its value upwards against other currencies, particularly the US dollar. Adjusting reserve requirements aims to control the amount of money circulating in the economy and influence interest rates, thereby influencing the attractiveness of the Yuan. Open market operations aim to inject liquidity into the market when needed.

-

Reasons for Failure: The measures' limited impact can be attributed to several factors. Firstly, the sheer scale of external pressures on the Yuan is significant. Secondly, the effectiveness of these traditional methods might be waning in the face of increased global market volatility. Finally, speculative activity against the Yuan continues to exert downward pressure, negating some of the PBoC’s efforts.

-

Data Points: While precise figures vary depending on the data source and timing, we've seen that following the recent interventions, the Yuan's performance against the US dollar has remained relatively weak. This contrasts with previous years where similar measures resulted in a more significant strengthening of the currency. This highlights a growing concern about the efficacy of existing monetary policy tools in managing the Yuan's exchange rate.

-

Market Reaction: The market's reaction to the PBoC's actions has been largely muted. Investors appear unconvinced that these measures alone are sufficient to address the underlying economic challenges impacting the Yuan's value, leading to continued uncertainty in the forex market.

Underlying Economic Factors Contributing to Yuan Weakness

Beyond the PBoC's direct interventions, several deeper economic factors are contributing to the Yuan's weakness. These factors are largely outside the immediate control of the central bank.

-

Slowdown in Chinese Economic Growth: The Chinese economy, while still growing, is experiencing a slowdown compared to previous years. This reduced growth rate diminishes the attractiveness of the Yuan as an investment currency.

-

Geopolitical Tensions and Trade: Ongoing geopolitical tensions and lingering effects of past trade disputes continue to weigh on investor confidence and impact foreign direct investment (FDI) flows into China. This, in turn, puts downward pressure on the Yuan.

-

Capital Outflow: Concerns about China's economic future and potentially higher returns in other markets have led to capital outflow, putting pressure on the Yuan's exchange rate. This capital flight reduces the demand for the currency.

-

Rising US Interest Rates: The increase in US interest rates makes US dollar-denominated assets more attractive to international investors, drawing capital away from Yuan-denominated assets and contributing to Yuan depreciation. This is a classic example of how global monetary policy affects individual currencies.

Market Sentiment and Investor Confidence

Negative news and ongoing uncertainty surrounding the Chinese economy have significantly impacted market sentiment towards the Yuan. Investor confidence is fragile, and risk aversion is high.

-

Impact of Negative News: Reports of slower-than-expected economic growth, ongoing regulatory crackdowns in certain sectors, and persistent geopolitical uncertainties all contribute to a negative narrative around the Chinese economy, negatively influencing the Yuan.

-

Speculation and Currency Trading: Speculative trading and currency arbitrage further exacerbate the volatility and weakness of the Yuan. Traders betting on further depreciation can create a self-fulfilling prophecy.

-

Impact on FDI: Negative market sentiment and Yuan weakness can discourage foreign direct investment (FDI) flows into China. Uncertainty about the future value of the Yuan makes investment in China less attractive to foreign entities.

Future Outlook for Yuan Support Measures and the Currency

The PBoC may need to consider more aggressive interventions to stabilize the Yuan. This could include further adjustments to reserve requirements, more targeted open market operations, and potentially, even direct intervention in the forex market.

-

More Aggressive Interventions: The PBoC might explore more aggressive measures, but these carry their own risks, potentially affecting domestic monetary conditions.

-

Structural Reforms: Longer-term solutions might involve structural economic reforms aimed at boosting economic growth, improving investor confidence, and enhancing the Yuan's global appeal as a reserve currency.

-

Risks and Challenges: The challenges facing the Chinese economy and currency are complex and interconnected. Successfully navigating this turbulent period requires a multifaceted approach encompassing monetary policy, fiscal policy, and structural reforms. The global economic slowdown adds another layer of complexity.

Conclusion

The underwhelming impact of recent Yuan support measures marks a significant shift and raises concerns about the effectiveness of current PBoC strategies. While the PBoC has historically been able to effectively manage the Yuan's exchange rate, the confluence of internal economic challenges and external global pressures has presented a more complex scenario. Understanding the underlying economic factors and the shifting market sentiment is critical to forecasting the future trajectory of the Yuan. Further analysis and monitoring of Yuan support measures and their efficacy will be crucial in the coming months. Stay informed on the latest developments regarding the Chinese economy and the RMB exchange rate to effectively navigate this dynamic market.

Featured Posts

-

Padres Vs Cubs Predicting The Outcome And A Potential Cubs Victory

May 15, 2025

Padres Vs Cubs Predicting The Outcome And A Potential Cubs Victory

May 15, 2025 -

Zuckerberg And The Trump Era A New Phase For Meta

May 15, 2025

Zuckerberg And The Trump Era A New Phase For Meta

May 15, 2025 -

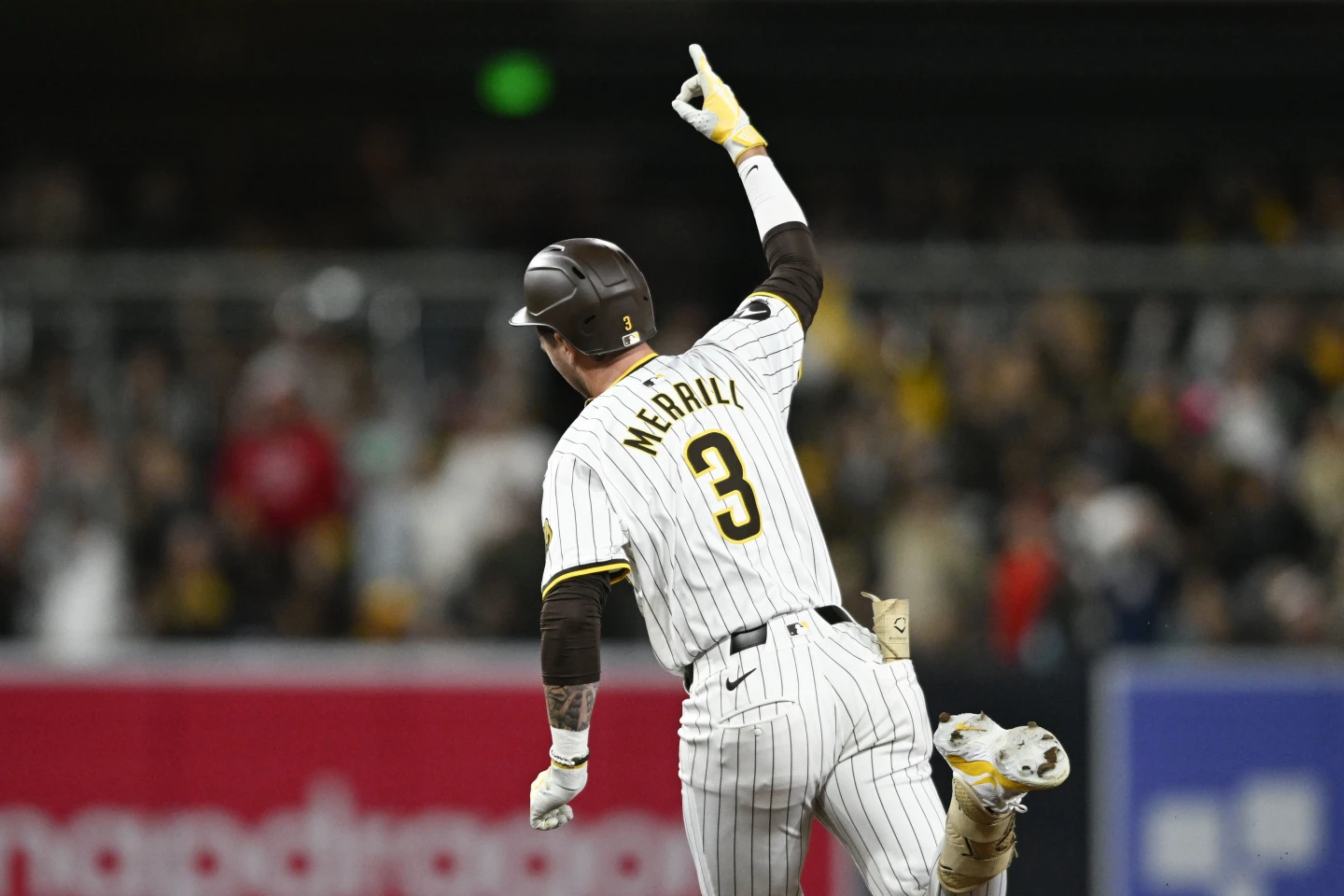

Late Game Heroics Gurriels Rbi Single Secures Padres 1 0 Win Over Braves

May 15, 2025

Late Game Heroics Gurriels Rbi Single Secures Padres 1 0 Win Over Braves

May 15, 2025 -

Goldman Sachs Trumps Stance On 40 50 Oil After Social Media Review

May 15, 2025

Goldman Sachs Trumps Stance On 40 50 Oil After Social Media Review

May 15, 2025 -

Tientallen Medewerkers Beschuldigen Npo Baas Van Angstcultuur

May 15, 2025

Tientallen Medewerkers Beschuldigen Npo Baas Van Angstcultuur

May 15, 2025

Latest Posts

-

Padres Historic Mlb Feat Unmatched Since 1889

May 15, 2025

Padres Historic Mlb Feat Unmatched Since 1889

May 15, 2025 -

Complete Sweep Rays Defeat Padres In Dominant Fashion

May 15, 2025

Complete Sweep Rays Defeat Padres In Dominant Fashion

May 15, 2025 -

Padres Fall To Rays In Series Sweep Fm 96 9 Highlights

May 15, 2025

Padres Fall To Rays In Series Sweep Fm 96 9 Highlights

May 15, 2025 -

Gurriels Pinch Hit Key Rbi Single Leads Padres To Win Against Braves

May 15, 2025

Gurriels Pinch Hit Key Rbi Single Leads Padres To Win Against Braves

May 15, 2025 -

Tampa Bay Rays Sweep San Diego Padres A Dominant Performance

May 15, 2025

Tampa Bay Rays Sweep San Diego Padres A Dominant Performance

May 15, 2025