XRP Up 400% In Three Months: Investment Opportunities And Potential Risks

Table of Contents

Factors Contributing to XRP's Price Surge

Several key factors have contributed to XRP's remarkable price surge. Understanding these drivers is vital for assessing its future potential.

Increased Institutional Adoption

Institutional investors are increasingly recognizing XRP's potential. This growing interest is a significant driver of the recent price increase.

- Recent Partnerships and Investments: Several large financial institutions have partnered with Ripple, the company behind XRP, signaling growing confidence in the technology and its potential applications. These partnerships often involve pilot programs for cross-border payments, further boosting XRP's legitimacy and demand.

- Ripple's Legal Battle: The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) continues to cast a shadow. While uncertainty remains, positive court developments could significantly boost institutional confidence and drive further price increases. Conversely, negative rulings could severely impact XRP's value.

- Large-Scale Investor Influence: The entry of large-scale investors, often referred to as "whales," into the XRP market can significantly influence its price. Their buying activity can create upward pressure, accelerating price increases.

- Positive Court Rulings: Positive legal outcomes in the SEC case could dramatically increase institutional adoption, leading to a substantial surge in XRP's price. This makes understanding the legal developments critical for any XRP investor.

Growing Decentralized Finance (DeFi) Ecosystem

XRP's integration into the decentralized finance (DeFi) ecosystem is another factor fueling its price rise.

- DeFi Applications: XRP is increasingly used in various DeFi applications, offering features like faster and cheaper transactions compared to other cryptocurrencies. This enhanced functionality attracts users and developers alike.

- Specific DeFi Projects: Several notable DeFi projects have integrated XRP, leveraging its speed and efficiency for various financial applications. The success of these projects directly contributes to increased demand for XRP.

- Liquidity and Accessibility: XRP's high liquidity and accessibility across various exchanges make it an attractive asset for DeFi applications. This ease of use further fuels its adoption within the DeFi space.

- Future DeFi Growth: The potential for new and innovative DeFi applications using XRP remains substantial. Continued growth in this sector could further drive demand and price increases.

Enhanced Technological Developments

Ongoing improvements to the XRP Ledger (XRPL) are contributing to XRP's long-term viability and appeal.

- XRPL Upgrades: Ripple consistently upgrades the XRPL, improving its scalability, transaction speed, and energy efficiency. These enhancements are crucial for attracting users and maintaining its competitiveness in the cryptocurrency market.

- Scalability and Efficiency: The XRPL’s focus on scalability and efficiency is a key differentiator. It enables faster and cheaper transactions compared to many other blockchains.

- Partnerships and Collaborations: Ripple's collaborations with various organizations further enhance XRP’s functionality and adoption. These partnerships often focus on integrating XRP into existing payment systems, broadening its reach.

- Long-Term Viability: The continuous development and improvement of the XRPL underscore XRP’s long-term potential and appeal to investors seeking a stable and efficient digital asset.

Investment Opportunities in XRP

Despite the risks, XRP presents potential investment opportunities. However, careful consideration and thorough due diligence are crucial.

Potential for High Returns

XRP's past performance, although volatile, demonstrates the potential for substantial returns. However, this should not be interpreted as a guarantee of future success.

- High-Risk, High-Reward: XRP is a high-risk, high-reward investment. Past performance does not predict future results, and significant losses are possible.

- Thorough Research: Before investing in XRP, it's crucial to conduct thorough research, understanding the technological underpinnings, market dynamics, and regulatory landscape.

- Investment Strategies: Investors can employ various strategies, such as long-term holding (hodling) or short-term trading, each carrying its own level of risk.

- Portfolio Diversification: Diversifying your cryptocurrency portfolio is vital to mitigate risk. Don't put all your eggs in one basket.

Access to Global Transactions

XRP's efficiency in facilitating cross-border payments presents a significant investment opportunity.

- Cross-Border Payments: XRP offers faster and cheaper cross-border payments compared to traditional banking systems. This advantage is increasingly attractive to businesses and individuals alike.

- Speed and Low Fees: XRP's speed and low transaction fees are significant advantages over traditional payment methods, reducing processing times and costs.

- Financial Institution Partnerships: Partnerships with financial institutions will further increase XRP's adoption and usage for international transactions.

- Growing Demand: The demand for efficient and cost-effective cross-border payment solutions is growing rapidly, creating a fertile ground for XRP's expansion.

Potential Risks Associated with XRP Investment

While the potential rewards are enticing, several significant risks are associated with XRP investment.

Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC significantly impacts XRP's future.

- SEC Lawsuit: The SEC lawsuit against Ripple creates regulatory uncertainty, potentially affecting XRP's price and adoption.

- Regulatory Landscape: The regulatory landscape for cryptocurrencies varies significantly across different jurisdictions, introducing additional complexities and risks.

- Regulatory Scrutiny: Investing in assets facing regulatory scrutiny inherently carries higher risk. The outcome of the SEC lawsuit could dramatically alter XRP's trajectory.

- Impact on Price: Uncertainty about regulatory outcomes contributes to price volatility, making XRP a riskier investment than more established assets.

Market Volatility

The cryptocurrency market is notoriously volatile, and XRP is no exception.

- Price Fluctuations: XRP's price can fluctuate dramatically in short periods, leading to significant gains or losses.

- Risk Management: Implementing robust risk management strategies, including setting stop-loss orders and diversifying your portfolio, is essential.

- Risk Tolerance: Only invest what you can afford to lose. Understand your personal risk tolerance before investing in XRP.

- Historical Volatility: Examining XRP's historical price fluctuations helps understand its volatility and potential risks.

Security Risks

Like all cryptocurrencies, XRP is susceptible to various security risks.

- Hacks and Scams: The cryptocurrency space is susceptible to hacks, scams, and phishing attempts. Be cautious and use reputable platforms.

- Secure Wallets and Exchanges: Use only reputable and secure cryptocurrency wallets and exchanges to minimize the risk of theft or loss.

- Storage Risks: Storing large amounts of XRP requires robust security measures to prevent theft or loss.

- Security Best Practices: Educate yourself on secure cryptocurrency practices, including using strong passwords, two-factor authentication, and regularly updating your software.

Conclusion

XRP's recent 400% surge presents both exciting investment opportunities and considerable risks. While the potential for high returns is alluring, it's crucial to carefully weigh the factors contributing to this growth alongside the regulatory uncertainties and inherent market volatility. Thorough research, risk assessment, and a diversified investment strategy are essential before considering any XRP investment. Remember, this article is for informational purposes only and does not constitute financial advice. Do your own due diligence before investing in XRP or any other cryptocurrency. Understand the risks and rewards associated with XRP investment before making any decisions.

Featured Posts

-

Nrc Vandaag Krijgt Nieuwe Presentator Bram Endedijk

May 02, 2025

Nrc Vandaag Krijgt Nieuwe Presentator Bram Endedijk

May 02, 2025 -

England Stages Late Comeback To Defeat France

May 02, 2025

England Stages Late Comeback To Defeat France

May 02, 2025 -

Endonezya Ve Tuerkiye Ortak Gelecege Dogru Imzalar

May 02, 2025

Endonezya Ve Tuerkiye Ortak Gelecege Dogru Imzalar

May 02, 2025 -

Hario Poterio Parkas Sanchajuje Atidarymas 2027 Metais

May 02, 2025

Hario Poterio Parkas Sanchajuje Atidarymas 2027 Metais

May 02, 2025 -

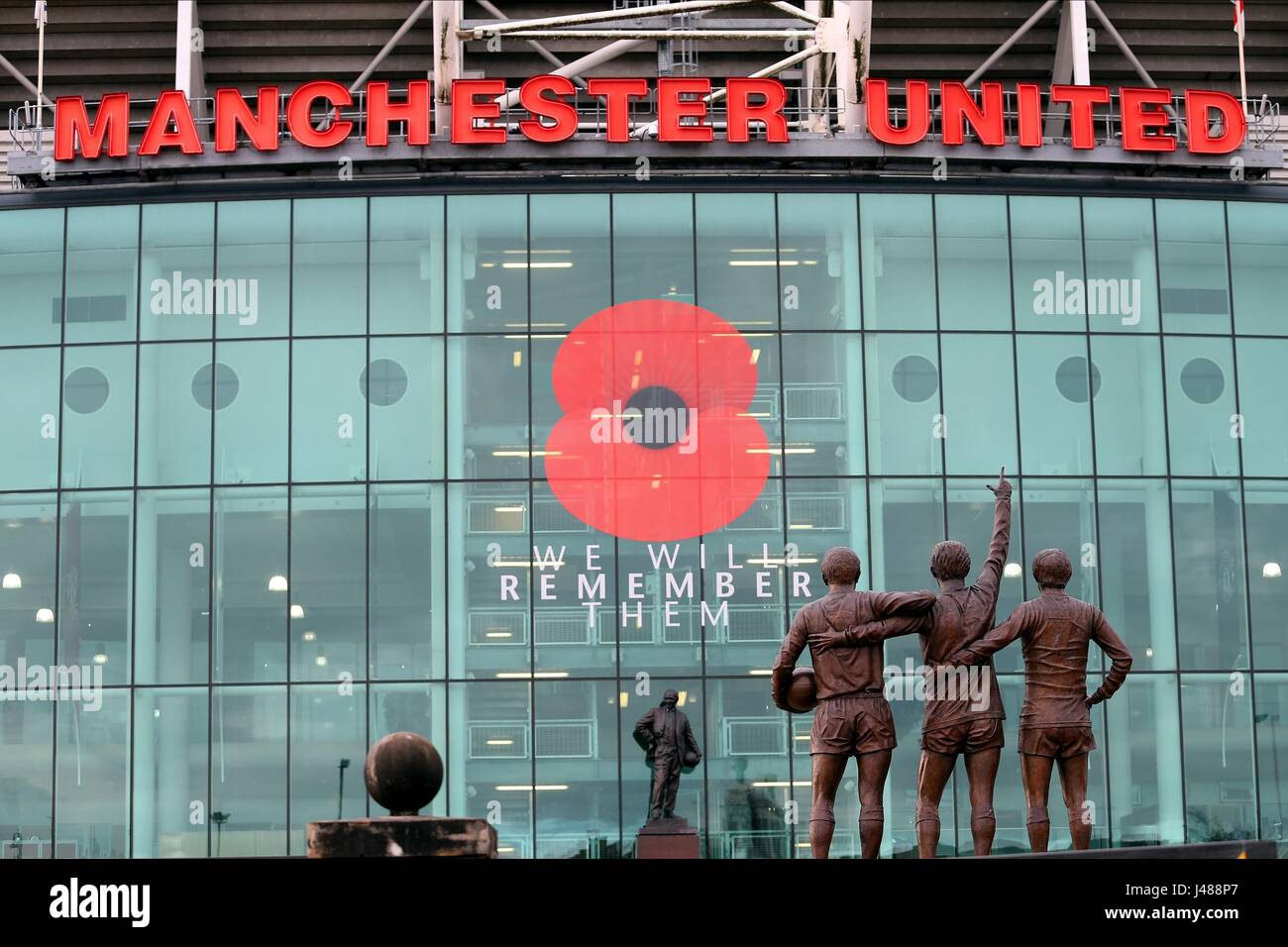

Familys Tearful Farewell To Young Manchester United Supporter Poppy

May 02, 2025

Familys Tearful Farewell To Young Manchester United Supporter Poppy

May 02, 2025