XRP Trading Volume Outpaces Solana Amidst ETF Speculation

Table of Contents

XRP's Recent Price Performance and Trading Volume Increase

XRP's trading volume has seen a dramatic increase in the past [Number] weeks, outperforming Solana by a considerable margin. While precise figures fluctuate depending on the exchange and data provider, several reputable sources indicate a [Percentage]% increase in XRP trading volume compared to Solana's volume during this period. This surge is not merely a fleeting phenomenon; it signifies a significant shift in investor sentiment towards XRP.

- Specific Dates and Volume Figures: Between [Start Date] and [End Date], XRP trading volume on major exchanges like Coinbase, Binance, and Kraken averaged [Average Volume] daily, exceeding Solana's average daily volume of [Solana Average Volume] by [Difference].

- Comparison to Previous Periods: This represents a [Percentage]% increase compared to the average daily XRP trading volume observed in [Previous Period].

- Key Exchanges Contributing: The majority of this increased volume seems to originate from [List Key Exchanges], suggesting strong institutional and retail investor participation.

The price of XRP has also mirrored this increased trading activity, exhibiting a [Percentage]% increase during the same period. This positive correlation between volume and price suggests strong buying pressure driving the upward momentum. Analyzing this price movement in conjunction with the volume surge paints a compelling picture of increasing investor confidence in XRP.

The Impact of Potential XRP ETF Approvals

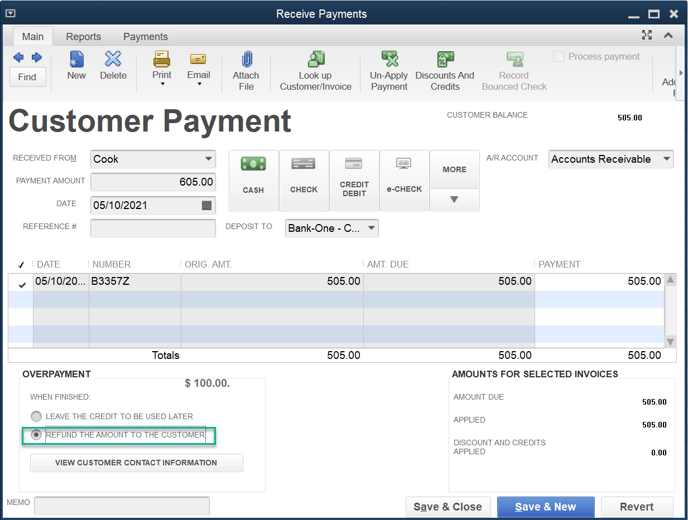

The anticipation of potential XRP ETF (Exchange-Traded Fund) approvals is a significant catalyst for the recent surge in XRP trading volume. ETFs offer a regulated and accessible way for investors to gain exposure to cryptocurrencies, making them considerably more appealing to institutional investors who may have previously been hesitant due to regulatory uncertainties and security concerns.

- Overview of Current ETF Applications: Several firms have submitted applications to the SEC for XRP ETFs. The status of these applications is [Current Status – Briefly Explain].

- Increased Accessibility and Liquidity: The approval of an XRP ETF would significantly enhance liquidity in the XRP market, leading to increased price stability and potentially attracting a much larger pool of investors.

- Positive and Negative Impacts of ETF Approval: While ETF approval is widely considered positive for XRP's price, potential negative impacts include increased regulatory scrutiny and the possibility of price volatility immediately following approval or rejection.

The mere possibility of ETF approval is enough to ignite speculation and drive significant trading activity, as investors position themselves to capitalize on potential price appreciation.

Solana's Performance and Comparative Analysis

While XRP's trading volume has soared, Solana's performance has been comparatively muted. Solana's recent price action has shown [Describe Price Movement], and its trading volume has remained relatively stable at [Average Volume].

- Recent Solana Price Movements and Volume Figures: Provide specific data points comparing Solana's price and volume to XRP's over the relevant period.

- Key Technological Differences and Use Cases: Solana and XRP differ significantly in their underlying technology and use cases. Solana is a high-throughput blockchain designed for decentralized applications (dApps), while XRP is primarily used for cross-border payments. These differences impact their respective market positions and attract different types of investors.

- Factors Affecting Solana’s Current Market Position: Discuss factors contributing to Solana's current market position, such as competition, network performance, and overall market sentiment.

This comparative analysis highlights the distinct market dynamics affecting XRP and Solana, with ETF speculation playing a crucial role in driving XRP’s outperformance.

Technical Analysis of XRP's Chart and Future Price Predictions (Optional)

(Disclaimer: This section presents a technical analysis and is not financial advice. Investing in cryptocurrencies involves significant risk, and past performance is not indicative of future results.)

A technical analysis of XRP's chart reveals [Describe Chart Patterns - Support, Resistance, Moving Averages]. Based on these indicators, [Discuss Potential Future Price Movements – Cautiously and with disclaimers].

- Key Technical Indicators: Mention specific indicators used (e.g., RSI, MACD, moving averages).

- Supporting Charts and Graphs: Include relevant charts and graphs illustrating the analysis.

- Disclaimers: Clearly state that price predictions are speculative and involve inherent risk.

Conclusion: XRP's Momentum and the Future of ETF Speculation

The surge in XRP trading volume, outpacing Solana, is primarily driven by the strong anticipation of potential XRP ETF approvals. This increased accessibility and liquidity, if realized, could significantly impact XRP's price and market position. However, regulatory hurdles and overall market conditions remain significant uncertainties. While the future remains unclear, the current momentum surrounding XRP and ETF speculation is undeniable.

Stay tuned for updates on the future of XRP trading volume and the potential impact of ETF approvals on the cryptocurrency market. Follow our blog for more insights into XRP and related cryptocurrencies.

Featured Posts

-

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025 -

Your Guide To The March 2024 Ps Plus Premium And Extra Games

May 08, 2025

Your Guide To The March 2024 Ps Plus Premium And Extra Games

May 08, 2025 -

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025 -

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025 -

Chinas Impact On Bmw And Porsche Market Share And Future Prospects

May 08, 2025

Chinas Impact On Bmw And Porsche Market Share And Future Prospects

May 08, 2025

Latest Posts

-

Reclaiming Unpaid Universal Credit Hardship Payments Your Rights

May 08, 2025

Reclaiming Unpaid Universal Credit Hardship Payments Your Rights

May 08, 2025 -

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025 -

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025 -

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025 -

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025