XRP: The Complete Guide For Investors And Traders

Table of Contents

Understanding XRP and the Ripple Ecosystem

XRP is a cryptocurrency designed to facilitate seamless and cost-effective cross-border payments within the Ripple ecosystem. Ripple, the company, created a network called RippleNet, a suite of products leveraging blockchain technology to enable financial institutions to send and receive money globally. XRP plays a crucial role in accelerating these transactions through its use in Ripple's On-Demand Liquidity (ODL) solution and other products like xRapid and xCurrent. It's vital to understand the distinction: Ripple is the company, while XRP is the digital asset it created.

- RippleNet's Functionality: RippleNet uses XRP to reduce transaction fees and processing times compared to traditional methods, significantly improving efficiency for international money transfers.

- XRP's Technical Specifications: XRP boasts a large supply but uses a unique consensus mechanism, resulting in fast transaction speeds and low energy consumption compared to some proof-of-work cryptocurrencies.

- Advantages of XRP for International Transfers:

- Lower transaction fees compared to SWIFT or other international payment systems.

- Faster transaction speeds, often settling in seconds or minutes.

- Increased transparency and traceability of transactions.

- Comparison with Other Cryptocurrencies: While Stellar Lumens (XLM) shares a similar goal of facilitating cross-border payments, XRP benefits from a more established network and broader adoption among financial institutions.

XRP Price Analysis and Market Trends

XRP's price history is characterized by dramatic swings, reflecting the influence of various factors. Understanding these drivers is critical for both investment and trading decisions. Analyzing historical price charts, considering market sentiment, and monitoring regulatory developments are essential for gauging XRP's potential.

- Factors Influencing XRP Price:

- Regulatory Developments: The ongoing SEC lawsuit against Ripple significantly impacts XRP's price. Positive developments in this case can lead to price surges, while negative developments may trigger significant drops.

- Market Sentiment: General market sentiment towards cryptocurrencies, overall economic conditions, and specific news impacting Ripple can heavily influence XRP's price.

- Adoption Rate: The increased adoption of RippleNet by financial institutions and the expansion of ODL services directly influence the demand for XRP and, subsequently, its price.

- Technical and Fundamental Analysis: Technical analysis, using tools such as charts and indicators, helps identify potential price trends and entry/exit points. Fundamental analysis focuses on assessing the underlying value of XRP, based on factors like adoption, utility, and the overall health of the Ripple ecosystem.

- Key Resources for Tracking XRP Price and Market Data: CoinMarketCap, CoinGecko, and various cryptocurrency exchanges provide real-time price data, trading volume, and market capitalization information for XRP.

Investing and Trading Strategies for XRP

Investing or trading XRP demands a clear understanding of different strategies and effective risk management. The approach you adopt depends on your financial goals, risk tolerance, and understanding of the market.

- Investment Strategies:

- Long-Term Holding (HODLing): This strategy involves buying and holding XRP for an extended period, anticipating long-term price appreciation.

- Day Trading: This high-risk, high-reward strategy involves buying and selling XRP within the same day to profit from short-term price fluctuations.

- Swing Trading: This strategy involves holding XRP for a few days or weeks to capitalize on medium-term price swings.

- Risk Management Techniques:

- Stop-Loss Orders: These orders automatically sell your XRP if the price drops below a predetermined level, limiting potential losses.

- Diversification: Spreading your investment across multiple assets, including other cryptocurrencies or traditional investments, reduces overall portfolio risk.

- Understanding Your Risk Tolerance: Before investing in XRP, it's crucial to assess your risk tolerance and only invest what you can afford to lose.

Regulatory Landscape and Legal Considerations for XRP

The regulatory landscape surrounding XRP is complex and dynamic, significantly impacted by the ongoing SEC lawsuit against Ripple. Understanding these legal battles and their implications is vital for any XRP investor or trader.

- The SEC Lawsuit: The SEC alleges that XRP is an unregistered security, a claim Ripple contests. The outcome of this lawsuit will have a profound impact on XRP's future price and regulatory status.

- Regulatory Landscape in Different Jurisdictions: Cryptocurrency regulations vary considerably across different countries and jurisdictions. Investors need to be aware of the legal requirements in their respective locations.

- Best Practices for Legal Compliance: Staying informed about regulatory developments and seeking legal counsel when necessary are crucial for responsible XRP investment and trading.

Conclusion: Making Informed Decisions with XRP

XRP, with its role in the Ripple ecosystem and potential for cross-border payment revolution, presents both significant opportunities and considerable risks. Understanding the technology behind XRP, analyzing market trends, and implementing robust risk management strategies are critical for making informed decisions. This guide has explored the key aspects of XRP, from its functionality within RippleNet to the regulatory challenges it faces. Remember that thorough research and a clear understanding of your risk tolerance are crucial before investing or trading in XRP. Share your thoughts and experiences with XRP in the comments below. Let's continue the conversation and learn together about this evolving digital asset.

Featured Posts

-

Bbc Two Hd Tv Guide When And Where To Watch Newsround

May 02, 2025

Bbc Two Hd Tv Guide When And Where To Watch Newsround

May 02, 2025 -

Esir Ailelerinin Israil Meclisi Protestosu Guevenlik Goerevlileri Ile Arbede

May 02, 2025

Esir Ailelerinin Israil Meclisi Protestosu Guevenlik Goerevlileri Ile Arbede

May 02, 2025 -

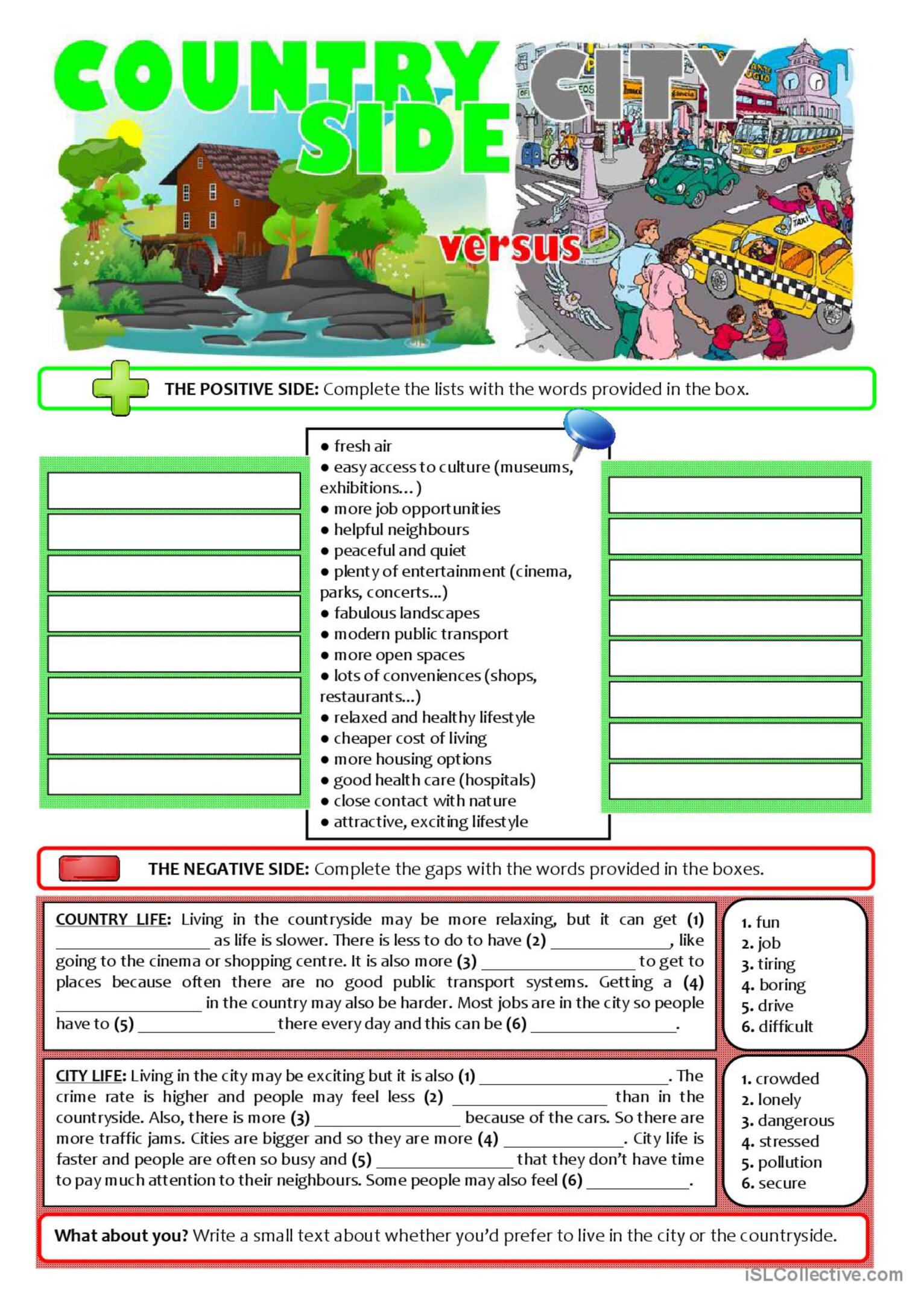

The Complete Guide To This Country From City To Countryside

May 02, 2025

The Complete Guide To This Country From City To Countryside

May 02, 2025 -

Breda Stroomstoring 30 000 Klanten Treft Uitval Elektriciteit

May 02, 2025

Breda Stroomstoring 30 000 Klanten Treft Uitval Elektriciteit

May 02, 2025 -

Todays Lotto Results Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025

Todays Lotto Results Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025