XRP Technical Analysis: $2 Support – Reversal Signal Or False Breakout?

Table of Contents

The price of XRP has recently been fluctuating around the crucial $2 support level, sparking debate among traders and investors. This technical analysis will delve into the current market situation, examining key indicators and chart patterns to determine whether this support level represents a genuine reversal signal for XRP or simply a deceptive false breakout. We'll explore various factors to help you understand the potential future price movement of XRP and inform your trading decisions. Understanding this could be crucial for navigating the volatile cryptocurrency market and potentially maximizing your profits.

Assessing the $2 Support Level

The $2 level acts as a significant psychological barrier and historical support level for XRP. Analyzing the behavior of the price around this level is crucial to predict future movement.

Volume Analysis

High volume during price drops around the $2 support indicates strong selling pressure, suggesting a potential breakdown below this key level. This signifies a lack of confidence from buyers and a potential continuation of the downtrend. Conversely, low volume during price drops could indicate a lack of conviction behind the selling, potentially setting the stage for a bounce.

- Examine candlestick patterns: Look for candlestick patterns like hammers or dojis near the $2 level. These reversal patterns suggest buyers are stepping in to defend the support. A strong bullish candlestick after a period of decline is particularly significant.

- Compare current volume with past data: Comparing the current trading volume to previous periods when the $2 level acted as support or resistance provides valuable context. Higher volume during a break below $2 would be far more bearish than a low-volume break.

Moving Averages

Moving averages, such as the 50-day and 200-day simple moving averages (SMAs), provide insights into the overall trend. A price bounce off these averages can indicate bullish momentum, suggesting the support level may hold.

- Price relative to moving averages: Is the XRP price currently trading above or below the 50-day and 200-day SMAs? A move above these averages is generally bullish.

- Trend of moving averages: Are the moving averages themselves trending upwards or downwards? Upward-trending moving averages suggest a bullish overall market sentiment for XRP, increasing the likelihood of the $2 support holding.

Identifying Potential Chart Patterns

Chart patterns can offer valuable clues about potential future price movements. Recognizing these patterns can improve your XRP price prediction accuracy.

Head and Shoulders Pattern

The head and shoulders pattern is a bearish reversal pattern that suggests a continuation of the downtrend. If confirmed, it would be a negative sign for the $2 support.

- Identifying the pattern: Look for the clear formation of a head, left shoulder, and right shoulder, with a neckline connecting the troughs of the shoulders.

- Confirmation: A breakdown below the neckline confirms the pattern and suggests a potential move significantly lower than $2.

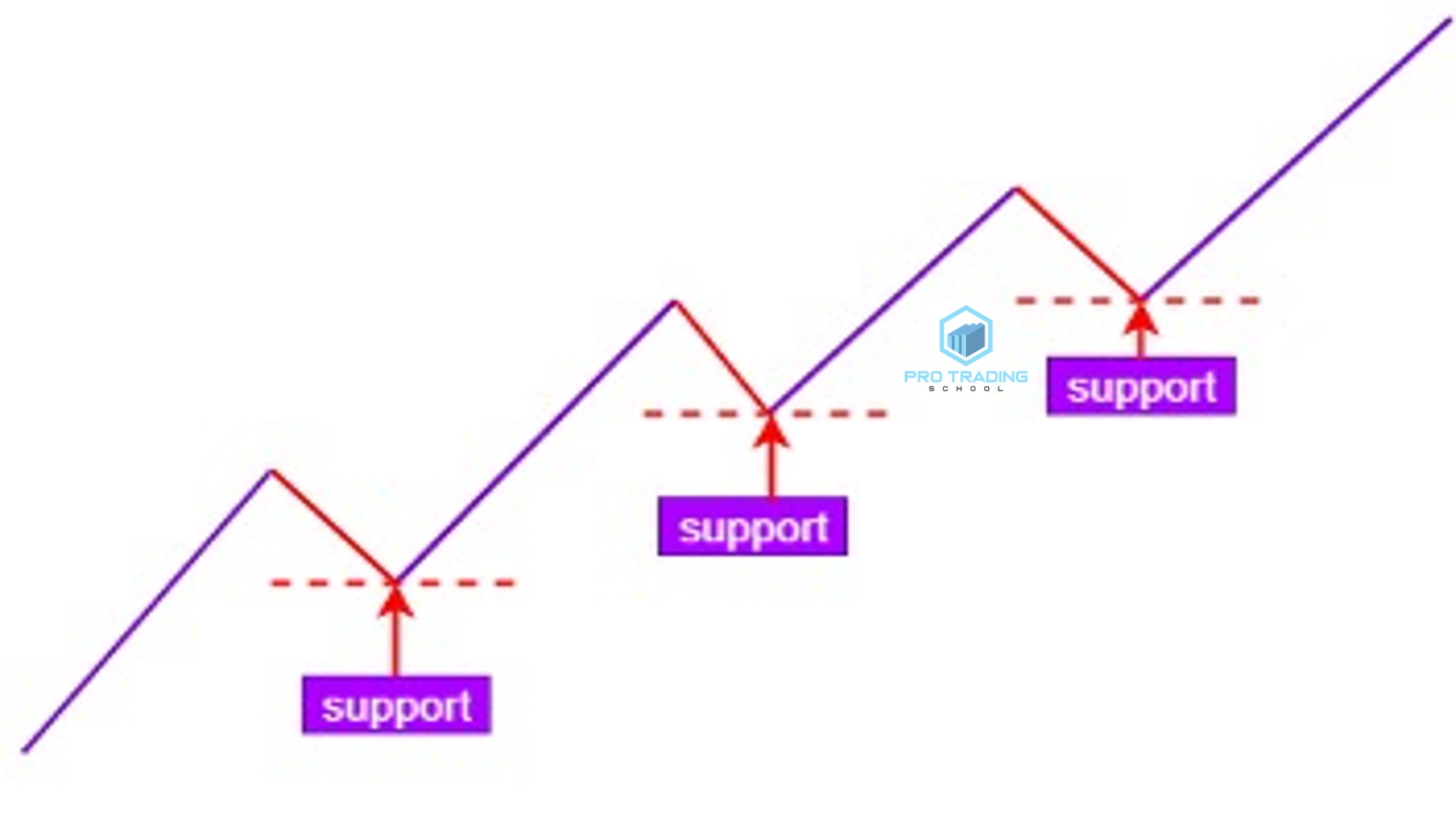

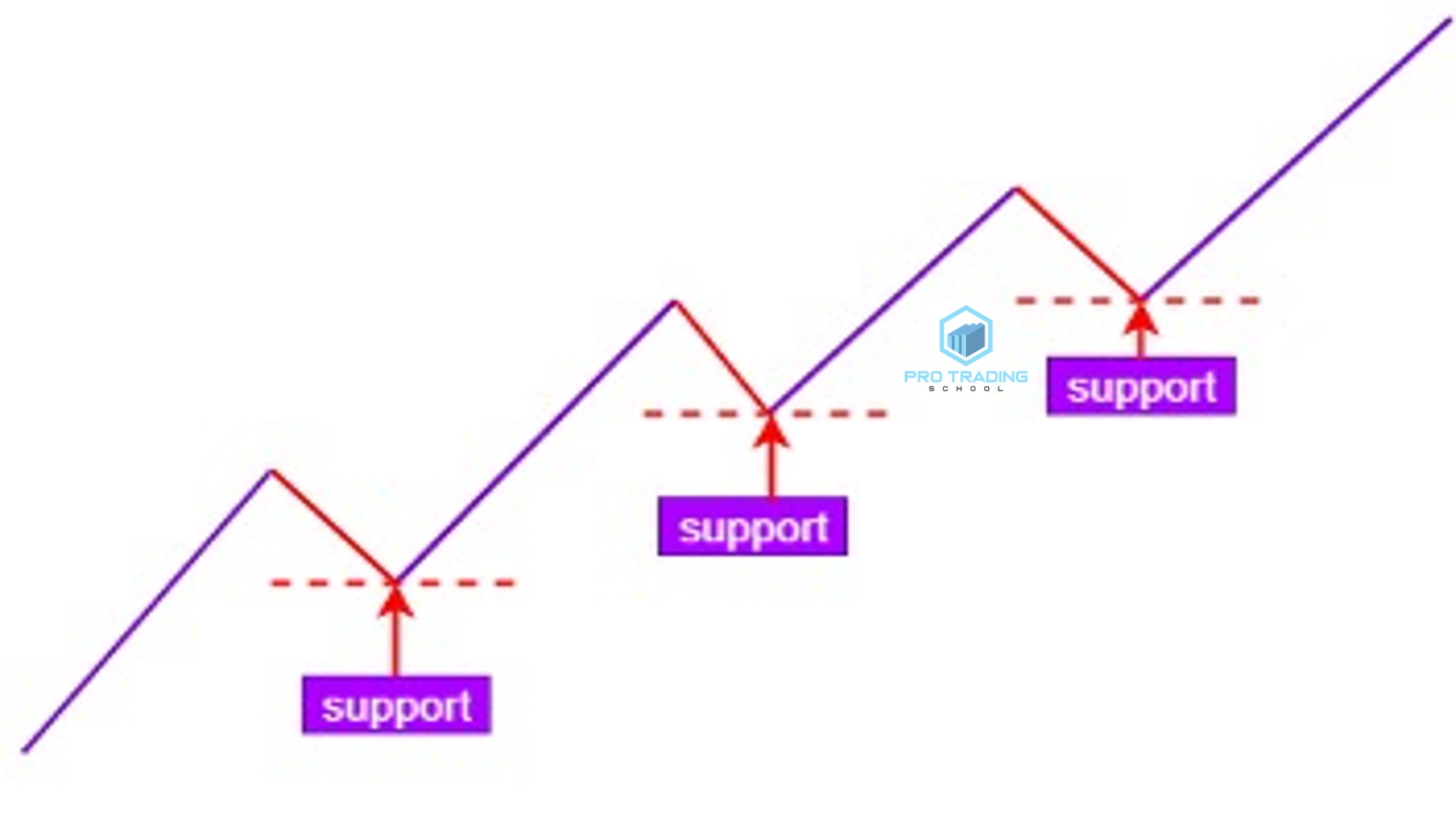

Double Bottom Pattern

The double bottom pattern is a bullish reversal pattern, suggesting a potential rebound from the $2 support level. This pattern is far more positive for XRP holders.

- Identifying the pattern: Look for two relatively equal lows followed by a subsequent upward trendline breakout. The breakout above the neckline connecting the two lows is the key confirmation signal.

- Volume confirmation: Increased trading volume during the breakout significantly strengthens the bullish signal.

Considering Other Technical Indicators

Technical indicators provide additional signals that can help confirm or contradict the information gained from chart patterns and volume analysis.

RSI (Relative Strength Index)

The RSI is a momentum oscillator that helps identify overbought and oversold conditions. An oversold condition (RSI below 30) can suggest a potential bounce from the $2 support.

- RSI divergence: Look for divergence between the price action and the RSI. If the price makes lower lows, but the RSI makes higher lows, this bullish divergence suggests a potential trend reversal.

- RSI confirmation: Use the RSI in conjunction with other indicators to increase the reliability of your analysis.

MACD (Moving Average Convergence Divergence)

The MACD is another momentum indicator that can signal potential buy or sell opportunities. A bullish crossover (MACD line crossing above the signal line) could be a positive sign.

- MACD crossover: Observe the MACD for bullish or bearish crossovers. A bullish crossover is a potential buy signal.

- MACD histogram: Analyze the MACD histogram for confirmation. Increasing histogram bars support the bullish signal.

Conclusion

The $2 support level for XRP is a critical juncture. While the potential for a reversal exists, as suggested by potential double bottom patterns and potentially oversold conditions, a definitive conclusion requires ongoing monitoring of volume, moving averages, and other technical indicators. The presence of a potential head and shoulders formation introduces significant uncertainty. Careful consideration of these factors is vital for informed trading decisions. Keep a close eye on XRP price action and further technical analysis to determine whether the $2 support holds or if a more significant price correction is imminent. Conduct your own thorough research and risk management before making any investment decisions related to XRP or any other cryptocurrency. Stay informed with further XRP technical analysis updates to refine your trading strategy and potentially capitalize on future price movements.

Featured Posts

-

Live Stream Inter Vs Barcelona Champions League Match

May 08, 2025

Live Stream Inter Vs Barcelona Champions League Match

May 08, 2025 -

Can You Name The Nba Playoffs Triple Doubles Leader A Challenging Quiz

May 08, 2025

Can You Name The Nba Playoffs Triple Doubles Leader A Challenging Quiz

May 08, 2025 -

Kripto Piyasalari Icin Spk Dan Oenemli Aciklama Yeni Doenemin Baslangici

May 08, 2025

Kripto Piyasalari Icin Spk Dan Oenemli Aciklama Yeni Doenemin Baslangici

May 08, 2025 -

Van Hits Motorcycle In Apparent Road Rage Incident Cnn

May 08, 2025

Van Hits Motorcycle In Apparent Road Rage Incident Cnn

May 08, 2025 -

Rogues Team A Look At Her Place In Marvel Comics

May 08, 2025

Rogues Team A Look At Her Place In Marvel Comics

May 08, 2025

Latest Posts

-

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

Six Month Universal Credit Rule Dwp Clarifies New Regulations

May 08, 2025

Six Month Universal Credit Rule Dwp Clarifies New Regulations

May 08, 2025 -

Dwp Breaks Silence On Universal Credit Six Month Rule

May 08, 2025

Dwp Breaks Silence On Universal Credit Six Month Rule

May 08, 2025