XRP Price Recovery: Derivatives Market Slowdown

Table of Contents

Understanding the XRP Derivatives Market

Before examining the slowdown, let's clarify what the XRP derivatives market entails.

What are XRP Derivatives?

XRP derivatives are contracts whose value is derived from the price of XRP. They offer investors various ways to gain exposure to XRP's price movements without directly owning the cryptocurrency. Common types include:

- Futures: Agreements to buy or sell XRP at a predetermined price on a future date.

- Options: Contracts granting the buyer the right, but not the obligation, to buy or sell XRP at a specific price within a certain timeframe.

- Swaps: Agreements to exchange cash flows based on the price movements of XRP.

Market Size and Liquidity: XRP Futures Trading Volume, Options Open Interest, and Market Liquidity

The size and liquidity of the XRP derivatives market have fluctuated significantly. While precise figures are challenging to obtain due to the decentralized nature of many exchanges, observable trends suggest a recent decrease in trading activity. Data from major exchanges reveals a decline in XRP futures trading volume and a reduction in XRP options open interest. This decrease in liquidity can make it more difficult to enter or exit positions quickly, potentially impacting price discovery. Charting these trends over time provides valuable insights into the market's health and its potential effect on XRP's price.

The Role of Derivatives in Price Discovery

The XRP derivatives market plays a significant role in price discovery. It influences the spot price (the price of XRP on the open market) through:

- Hedging: Investors use derivatives to mitigate risk associated with their XRP holdings.

- Speculation: Traders utilize derivatives to bet on the future price movements of XRP.

- Arbitrage: Traders exploit price discrepancies between the spot and derivatives markets to generate profit. These activities collectively contribute to the overall price dynamics of XRP.

Evidence of a Derivatives Market Slowdown

Several indicators suggest a recent slowdown in the XRP derivatives market.

Decreased Trading Volume: XRP Trading Volume Decline

Data analysis shows a noticeable decline in trading volume for XRP derivatives contracts across various platforms. This reduced activity suggests less investor interest in leveraging XRP price movements through derivatives.

Reduced Open Interest: XRP Open Interest Decrease

Open interest, representing the total number of outstanding derivative contracts, has also decreased. A lower open interest indicates less commitment to future price movements, implying a decrease in speculative activity.

Lower Volatility: XRP Price Volatility

The reduced trading activity may be contributing to lower price volatility in the XRP market. With fewer trades driving price changes, the overall price movement tends to be less dramatic.

Potential Causes

Several factors could contribute to this slowdown:

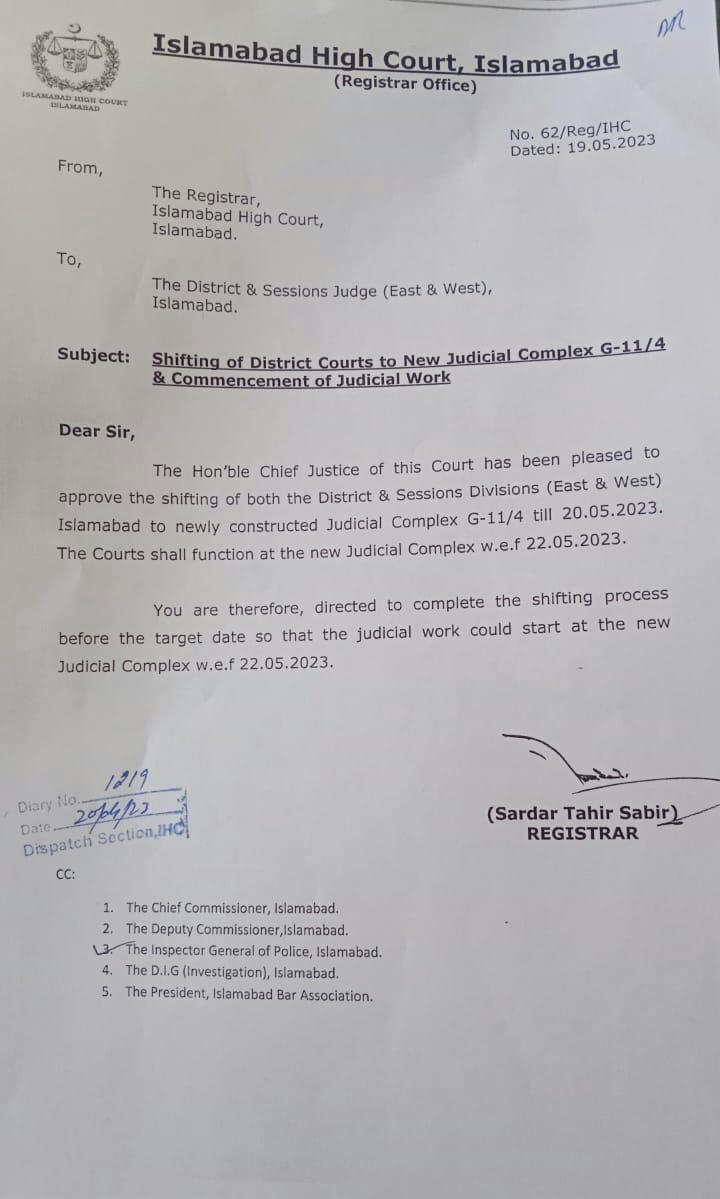

- Regulatory Uncertainty: The ongoing legal battle between Ripple and the SEC creates uncertainty, impacting investor confidence.

- Macroeconomic Factors: Broader macroeconomic conditions, such as interest rate hikes, can affect investor risk appetite and reduce trading activity across all asset classes, including cryptocurrency derivatives.

- Lack of Investor Interest: A lack of significant positive news or catalysts could lead to reduced investor interest in both XRP and its derivatives.

Impact of the Slowdown on XRP Price Recovery

The slowdown in the XRP derivatives market can significantly impact its price recovery.

Reduced Price Pressure

Decreased derivative activity might lessen both upward and downward price pressure on XRP. Fewer speculative trades mean fewer large price swings.

Impact on Market Sentiment

A quieter derivatives market might negatively affect overall investor sentiment. Reduced activity can be interpreted as a lack of confidence in XRP's future performance.

Long-Term Implications: XRP Price Prediction, XRP Future Outlook, XRP Long-Term Investment

A sustained slowdown could have significant long-term implications for XRP's price trajectory. While it might lead to greater price stability in the short term, it could also hinder a robust price recovery if broader market sentiment remains subdued.

Other Factors Affecting XRP Price

While the derivatives market slowdown is a notable factor, it's not the only one influencing XRP's price.

Ripple's Legal Battle: Ripple SEC Lawsuit

The ongoing legal battle between Ripple and the SEC continues to significantly impact XRP's price. A positive outcome could lead to increased investor confidence and price appreciation.

Adoption and Usage: XRP Adoption Rate

The adoption and usage of XRP in payments and other use cases are crucial factors. Growing adoption could increase demand and positively influence the price.

Overall Crypto Market Sentiment: Crypto Market Sentiment

The broader cryptocurrency market sentiment plays a crucial role. A positive overall market trend can boost XRP's price, while a negative trend can exert downward pressure.

Conclusion: Navigating the XRP Price Recovery in a Slowing Derivatives Market

The slowdown in the XRP derivatives market is likely contributing to the current price trajectory, but it's not the sole determining factor. The Ripple SEC lawsuit, adoption rates, and overall crypto market sentiment all play significant roles. Monitoring both the spot and derivatives markets provides a more comprehensive picture of XRP's price movement. While a cautious outlook for XRP's immediate recovery is warranted given the current uncertainties, the long-term prospects remain contingent on various factors. Continue researching and monitoring the XRP price and the XRP derivatives market to make informed investment decisions. Understanding the complexities of the XRP market is crucial before making any investment choices.

Featured Posts

-

Play Station And Xbox Gamers Rejoice Gears Of War Remaster Confirmed

May 07, 2025

Play Station And Xbox Gamers Rejoice Gears Of War Remaster Confirmed

May 07, 2025 -

Check The Rsmssb Exam Calendar 2025 26 Complete Exam Schedule

May 07, 2025

Check The Rsmssb Exam Calendar 2025 26 Complete Exam Schedule

May 07, 2025 -

Warriors Pursuit Of Looney Nba Free Agency Update

May 07, 2025

Warriors Pursuit Of Looney Nba Free Agency Update

May 07, 2025 -

Laura Kenny And Jason Kenny Announce Daughters Birth

May 07, 2025

Laura Kenny And Jason Kenny Announce Daughters Birth

May 07, 2025 -

A Memoir From Cassidy Hutchinson Unseen Perspectives On The January 6th Hearings

May 07, 2025

A Memoir From Cassidy Hutchinson Unseen Perspectives On The January 6th Hearings

May 07, 2025

Latest Posts

-

Lahwr Ky Ahtsab Edaltwn Ka Mstqbl 5 Edaltyn Bnd

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Ka Mstqbl 5 Edaltyn Bnd

May 08, 2025 -

Lahwr Ahtsab Edaltwn Ky Tedad Myn Kmy 5 Edaltyn Khtm

May 08, 2025

Lahwr Ahtsab Edaltwn Ky Tedad Myn Kmy 5 Edaltyn Khtm

May 08, 2025 -

Lahwr Ky Panch Ahtsab Edaltyn Khtm Ahm Pysh Rft

May 08, 2025

Lahwr Ky Panch Ahtsab Edaltyn Khtm Ahm Pysh Rft

May 08, 2025 -

Lahore Punjab Eid Ul Fitr Weather Prediction Next 48 Hours

May 08, 2025

Lahore Punjab Eid Ul Fitr Weather Prediction Next 48 Hours

May 08, 2025 -

Impact Of Psl Matches On Lahore School Timings

May 08, 2025

Impact Of Psl Matches On Lahore School Timings

May 08, 2025