XRP Price Prediction: Impact Of The SEC Lawsuit Ruling

Table of Contents

- The SEC Lawsuit Ruling and its Implications

- Summary of the Court Decision:

- Immediate Market Reaction and Price Volatility:

- Factors Influencing Future XRP Price Predictions

- Regulatory Clarity and its Impact:

- Technological Advancements and Ripple's Ecosystem:

- Market Sentiment and Investor Confidence:

- Potential XRP Price Scenarios and Predictions

- Bullish Scenario:

- Bearish Scenario:

- Neutral Scenario:

- Conclusion

The SEC Lawsuit Ruling and its Implications

The lengthy Ripple vs. SEC lawsuit concluded with a partial victory for Ripple. Understanding the nuances of this ruling is key to any accurate XRP price prediction.

Summary of the Court Decision:

The court's decision delivered a mixed bag for Ripple. While the judge ruled that programmatic sales of XRP did not constitute unregistered securities offerings, they did determine that certain other sales did.

- Key Findings: The judge found that sales of XRP on public exchanges were not securities.

- Institutional Impact: This ruling has significant implications for institutional investors and exchanges that now face less regulatory uncertainty concerning XRP trading.

- Regulatory Uncertainty Remains: However, the ruling's ambiguity surrounding certain XRP sales leaves some regulatory uncertainty.

Immediate Market Reaction and Price Volatility:

Following the ruling, XRP experienced a dramatic price surge, showcasing the market's sensitivity to regulatory developments. However, this initial jump was followed by some consolidation, highlighting the ongoing volatility and uncertainty surrounding the cryptocurrency.

- Price Fluctuations: [Insert chart illustrating XRP price fluctuations post-ruling]. The price movements reflect the dynamic interplay of investor sentiment, news cycles and ongoing market speculation.

- FUD Factor: Fear, Uncertainty, and Doubt (FUD) played a significant role in the initial price volatility. Misinterpretations of the ruling and lingering regulatory concerns fueled market fluctuations.

Factors Influencing Future XRP Price Predictions

Several key factors will shape the future trajectory of XRP's price. Accurately predicting the price requires a nuanced understanding of these interconnected elements.

Regulatory Clarity and its Impact:

The ongoing regulatory landscape remains a crucial factor in any XRP price prediction. Increased clarity in the US and globally could significantly impact adoption and price.

- US Regulatory Landscape: Future SEC actions, potential appeals, and further legal challenges will impact XRP's price.

- Global Regulatory Approaches: The regulatory stance of other jurisdictions will play a crucial role in the international adoption and, consequently, the price of XRP. A positive regulatory outlook in other major markets could boost XRP's value.

Technological Advancements and Ripple's Ecosystem:

Ripple's continuous technological advancements and the growth of the XRP Ledger (XRPL) are essential for long-term XRP price prediction.

- XRPL Improvements: Ongoing development and enhancements to the XRPL, focusing on speed, scalability, and security, will influence the attractiveness of XRP.

- Partnerships and Integrations: New partnerships and integrations with financial institutions and businesses using Ripple's technology boost adoption and potentially drive up XRP’s price.

Market Sentiment and Investor Confidence:

Market sentiment and investor confidence are powerful drivers of cryptocurrency price movements. Understanding these dynamics is vital for accurate XRP price prediction.

- Social Media Influence: Social media sentiment plays a crucial role in shaping investor perceptions and driving short-term price fluctuations.

- Whale Activity: The actions of large XRP holders ("whales") can significantly influence the price.

Potential XRP Price Scenarios and Predictions

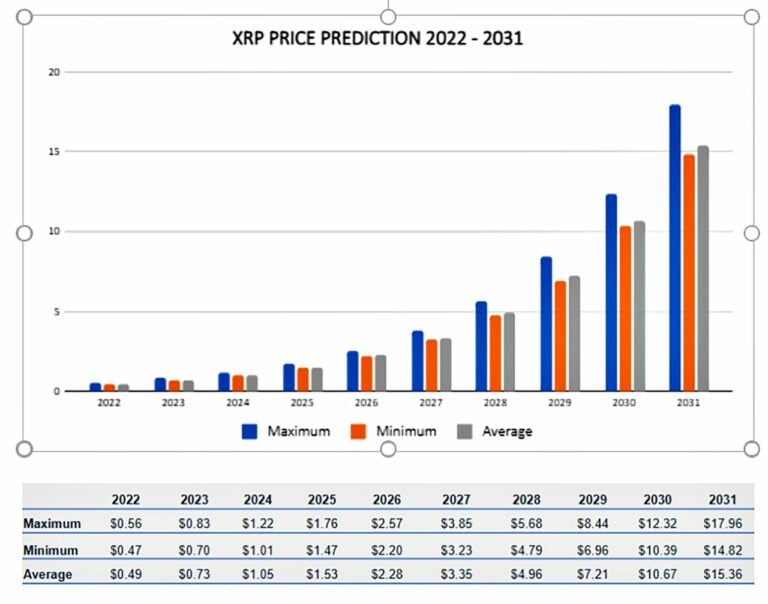

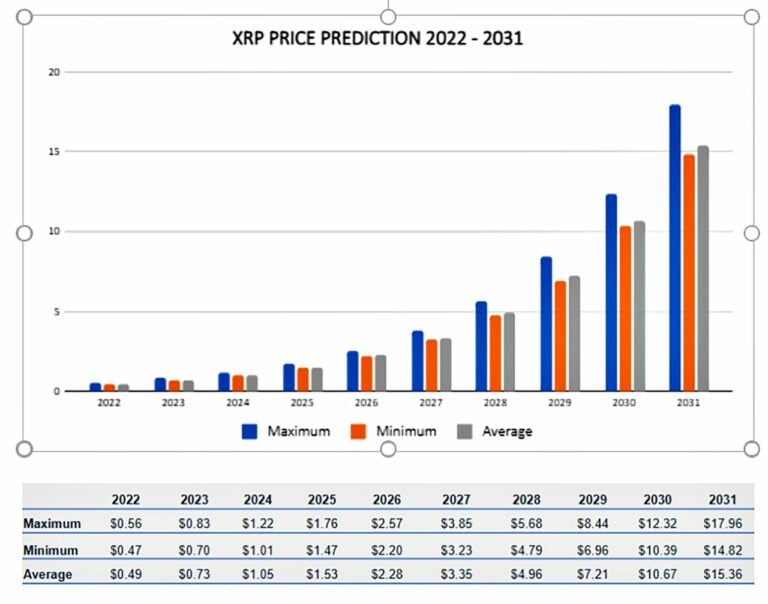

Based on the above factors, we can outline three potential XRP price scenarios:

Bullish Scenario:

A bullish scenario anticipates significant price growth driven by widespread adoption and regulatory clarity.

- Price Target: A potential price target of $5 within the next 3-5 years is feasible under a bullish scenario.

- Contributing Factors: Widespread institutional adoption, positive regulatory developments, and continued technological advancements on the XRPL are key contributors to this optimistic prediction.

Bearish Scenario:

A bearish scenario suggests limited price growth or even a decline.

- Price Target: A bearish outlook could see XRP trading around its current price or even declining to below $0.50 in the next few years.

- Contributing Factors: Negative regulatory developments, increased competition from other cryptocurrencies, and a prolonged period of market uncertainty contribute to this negative outlook.

Neutral Scenario:

A neutral scenario anticipates moderate price growth reflecting a period of consolidation and uncertainty.

- Price Range: A price range between $1 and $3 within the next 3-5 years represents a neutral scenario.

- Contributing Factors: Mixed regulatory developments, gradual adoption, and continued market volatility contribute to this moderate projection.

Conclusion

The impact of the SEC lawsuit ruling on XRP's price remains uncertain. While the partial victory for Ripple brought some clarity, regulatory uncertainty and market sentiment will continue to influence XRP's trajectory. Our analysis suggests a range of potential outcomes, from a bullish scenario with significant price growth to a bearish scenario with limited growth or decline. A neutral scenario reflects a period of consolidation and uncertainty. Remember, this is not financial advice. Before investing in XRP or any cryptocurrency, conduct thorough research, understand the risks involved, and consider your personal risk tolerance. Stay informed on the latest developments regarding the XRP price prediction and make calculated decisions based on your risk tolerance.

The Future Of Phones Nothings Modular Approach

The Future Of Phones Nothings Modular Approach

Chris Kaba Panorama Police Watchdog Challenges Bbc Broadcast With Ofcom Complaint

Chris Kaba Panorama Police Watchdog Challenges Bbc Broadcast With Ofcom Complaint

Kensington Palace Shares Thoughtful Photo Of Prince William

Kensington Palace Shares Thoughtful Photo Of Prince William

France Wins Six Nations Englands Strong Performance Scotland And Ireland Underperform

France Wins Six Nations Englands Strong Performance Scotland And Ireland Underperform

Prince William Witnessing New Partnership Announcement For Royal Initiative

Prince William Witnessing New Partnership Announcement For Royal Initiative