XRP Price Prediction: Analyzing The Potential For A $10 Surge

Table of Contents

Ripple's Ongoing Legal Battle and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and overall market sentiment. Understanding the potential outcomes is crucial for any XRP price prediction.

The SEC Lawsuit and its Potential Outcomes

The SEC lawsuit against Ripple alleges that XRP is an unregistered security. The outcome will dramatically influence XRP's price.

- Potential for a favorable ruling: A win for Ripple could lead to a surge in XRP's price, as it would eliminate significant regulatory uncertainty. Investors might view this as a major catalyst for growth.

- Implications of a settlement: A settlement could lead to a less dramatic price increase, or even a temporary dip, depending on the terms agreed upon. The details of any settlement will be crucial in shaping market reaction.

- Impact of negative judgments on investor confidence: An unfavorable ruling could severely damage investor confidence, leading to a substantial price drop. The uncertainty surrounding the legal battle already causes price volatility.

- XRP price volatility during the legal process: The legal proceedings themselves create inherent volatility. Positive news tends to drive the price up, while negative news leads to dips. This underscores the importance of monitoring legal developments closely when considering any XRP price prediction.

Keywords: SEC lawsuit, Ripple vs SEC, legal uncertainty, XRP price volatility, regulatory clarity, XRP price prediction

The Ripple Defense and its Strengths

Ripple's defense strategy focuses on demonstrating that XRP is not a security. Their arguments and evidence presented in court are key to the outcome.

- Key arguments in Ripple's defense: Ripple argues that XRP functions as a decentralized digital asset, distinct from a security. They emphasize the open nature of the XRP Ledger and its use for cross-border payments.

- Expert testimonies: Ripple has presented expert testimonies from blockchain and financial experts to support their case, bolstering investor confidence.

- Legal precedents: Ripple's legal team utilizes various legal precedents to argue against the SEC's claims. The strength of these precedents will be a significant factor in the court's decision.

- Impact of a win on investor sentiment and price: A victory for Ripple would likely trigger a significant increase in XRP's price, driven by a renewed sense of confidence and reduced regulatory uncertainty.

Keywords: Ripple defense strategy, legal arguments, positive court outcome, XRP price increase, investor confidence, XRP price prediction

Technical Analysis: Chart Patterns and Price Predictions

Technical analysis provides insights into XRP's potential price movements, offering another perspective on the XRP price prediction.

Analyzing XRP's Historical Price Performance

Examining XRP's past price action reveals valuable patterns and trends.

- Historical price charts: Analyzing historical price charts helps identify key support and resistance levels, potential breakout points, and long-term trends.

- Significant price changes and the factors that caused them: Studying past price swings helps us understand the impact of news, market sentiment, and regulatory developments on XRP's value.

- Long-term trends: Long-term price charts provide a broader perspective on XRP's overall trajectory.

- Short-term fluctuations: Short-term analysis is useful for identifying potential trading opportunities, but it's less reliable for long-term XRP price prediction.

Keywords: XRP price chart, technical indicators, support and resistance levels, historical price analysis, trading volume, XRP price prediction

Predictive Models and Potential Price Targets

Several technical analysis tools can help predict future price movements.

- Moving averages: Moving averages smooth out price fluctuations and identify trends.

- RSI (Relative Strength Index): RSI helps determine whether XRP is overbought or oversold.

- MACD (Moving Average Convergence Divergence): MACD identifies momentum changes and potential trend reversals.

- Fibonacci retracements: Fibonacci retracements identify potential support and resistance levels based on historical price movements.

- Other relevant indicators: Various other technical indicators can provide additional insights and help refine the XRP price prediction.

Keywords: XRP price prediction, technical analysis tools, predictive models, price target, $10 XRP price, XRP price prediction

Market Adoption and Technological Developments

The adoption of RippleNet and technological advancements in the XRP Ledger are vital factors influencing the XRP price prediction.

Growing Adoption of RippleNet and XRP

The increasing use of RippleNet by financial institutions is crucial for XRP's long-term value.

- Number of financial institutions using RippleNet: The growing number of banks and payment providers using RippleNet indicates increased demand for XRP.

- Transaction volume: Higher transaction volume suggests wider adoption and usage of XRP for cross-border payments.

- Geographical expansion of RippleNet: Expansion into new markets signifies growing global acceptance and potential for future price increases.

- Potential for broader adoption: Continued growth in RippleNet adoption could lead to a significant increase in XRP's demand and price.

Keywords: RippleNet adoption, XRP utility, cross-border payments, financial institutions, market capitalization, XRP price prediction

Technological Advancements and Future Developments

Upgrades to the XRP Ledger enhance its functionality and efficiency, influencing the XRP price prediction.

- Upgrades to XRP Ledger: Ongoing development and upgrades to the XRP Ledger improve transaction speeds, scalability, and overall performance.

- Improvements in transaction speed and efficiency: Faster and more efficient transactions enhance XRP's appeal to financial institutions and users.

- New features: New features and functionalities added to the XRP Ledger could attract more users and increase demand.

- Scalability enhancements: Improved scalability allows the XRP Ledger to handle a larger volume of transactions, essential for wider adoption.

Keywords: XRP Ledger upgrades, technological advancements, scalability, transaction speed, improved efficiency, XRP price prediction

Conclusion

Predicting the future price of XRP involves uncertainty. However, analyzing the ongoing legal battle, technical indicators, and market adoption provides a clearer perspective on the potential for XRP to reach $10. While a $10 price point represents a significant increase, the factors discussed suggest it's not impossible. Continued positive developments in Ripple's legal case, widespread RippleNet adoption, and further XRP Ledger advancements could fuel price increases. Stay informed, conduct your own research, and continue to monitor the XRP price prediction to make your own informed investment decisions. Remember to invest responsibly and only what you can afford to lose.

Featured Posts

-

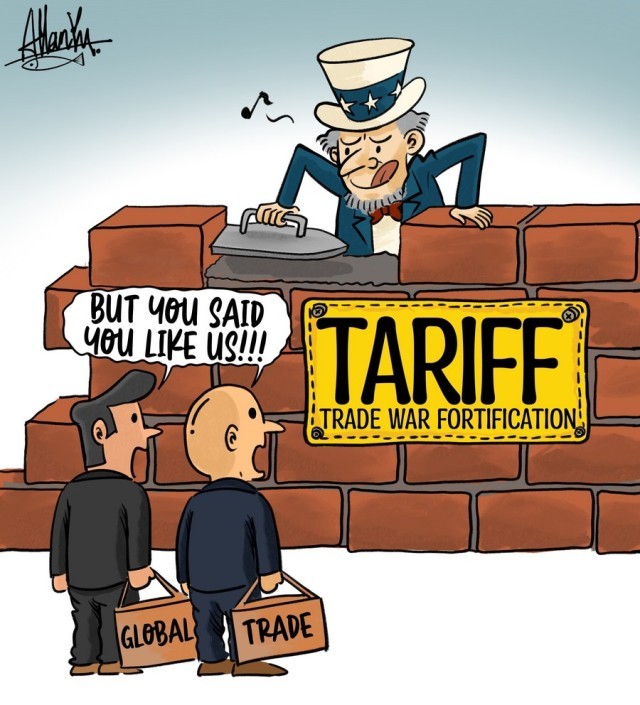

Exclusive Report Trumps Approach To Reducing Automotive Tariff Impact

May 01, 2025

Exclusive Report Trumps Approach To Reducing Automotive Tariff Impact

May 01, 2025 -

Michael Sheen Net Worth Actor Writes Off Significant Debt On Channel 4

May 01, 2025

Michael Sheen Net Worth Actor Writes Off Significant Debt On Channel 4

May 01, 2025 -

Englands Late Surge Secures Dramatic Win Against France

May 01, 2025

Englands Late Surge Secures Dramatic Win Against France

May 01, 2025 -

Ripples Ripple Effect How Etf Decisions And Sec Changes Will Shape Xrps Price

May 01, 2025

Ripples Ripple Effect How Etf Decisions And Sec Changes Will Shape Xrps Price

May 01, 2025 -

150 Bet Mgm Bonus Code Rotobg 150 For Tonights Nba Action

May 01, 2025

150 Bet Mgm Bonus Code Rotobg 150 For Tonights Nba Action

May 01, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni