XRP Price Analysis: Is $3.40 A Realistic Target For Ripple?

Table of Contents

Current Market Conditions and XRP's Position

The current cryptocurrency market is a dynamic landscape, with various factors influencing XRP's price. While Bitcoin's price often acts as a bellwether for the entire market, the correlation between Bitcoin's performance and XRP's isn't always straightforward. Analyzing XRP's market capitalization and trading volume provides valuable insights into its current position.

- Current XRP price and its recent performance: As of [Insert Current Date], XRP is trading at [Insert Current Price]. Its recent performance has been [Describe recent performance - e.g., relatively stable, volatile, experiencing upward/downward trends].

- Comparison with other major cryptocurrencies: Compared to other major cryptocurrencies like Ethereum or Solana, XRP's market capitalization is [Compare market cap]. Its trading volume currently sits at [Insert Trading Volume Data] showing [Interpret data, e.g., high liquidity, low trading activity].

- Analysis of trading volume and market sentiment: High trading volume often suggests strong investor interest, while low volume may indicate decreased activity. Market sentiment, as gauged by social media discussions and news articles, is currently [Describe Market Sentiment – e.g., cautiously optimistic, bearish, bullish].

- Influence of Bitcoin's price on XRP: Bitcoin's price movements undoubtedly influence the broader cryptocurrency market. However, XRP's correlation with Bitcoin is [Describe correlation, e.g., strong, weak, inconsistent], suggesting that it can sometimes decouple from Bitcoin's price action. Recent partnerships and regulatory news have also played a role in XRP’s price movements independent of Bitcoin.

Ripple's Technological Advancements and Adoption

Ripple's ongoing technological advancements and the increasing adoption of its solutions by financial institutions are key factors influencing XRP's long-term prospects. The RippleNet network and xRapid, its on-demand liquidity solution, are crucial elements in this narrative.

- Recent updates and improvements to the XRP Ledger: The XRP Ledger, a fast and efficient blockchain technology, is constantly being updated. Recent improvements include [Mention specific improvements e.g., increased transaction speed, enhanced security features]. These updates enhance the platform’s capabilities and appeal to potential users.

- Growth and adoption of RippleNet by financial institutions: RippleNet's adoption by various financial institutions globally demonstrates the practical application of Ripple's technology. [Provide examples of successful implementations and the number of financial institutions utilizing RippleNet].

- Success stories and case studies of Ripple's technology: Highlighting successful use cases of RippleNet and xRapid helps to showcase the tangible benefits of Ripple's solutions and boosts investor confidence in the long-term value proposition of XRP.

- Potential future developments and their impact on price: Future developments, such as the integration of new features or partnerships with major players in the financial industry, could significantly impact XRP's price. Speculation about future developments needs to be carefully examined for accuracy and reliability.

Regulatory Landscape and Legal Challenges

The ongoing SEC lawsuit against Ripple casts a significant shadow over XRP's future. Understanding the potential outcomes and their implications is vital for any XRP price prediction.

- Summary of the SEC lawsuit and its current status: Briefly explain the core arguments of the SEC lawsuit and its current status. [Include links to reputable sources for up-to-date information].

- Potential outcomes of the lawsuit and their implications for XRP: A positive outcome could potentially lead to a surge in XRP's price, while a negative outcome could significantly depress it. It’s important to consider all possible outcomes.

- Analysis of regulatory landscape in different jurisdictions: The regulatory landscape varies across different countries. Analyzing regulatory environments in key markets can give insights into XRP's potential adoption and future value.

- Uncertainty and its impact on investor confidence: The uncertainty surrounding the lawsuit significantly impacts investor confidence. A clear resolution, positive or negative, could lead to increased market stability.

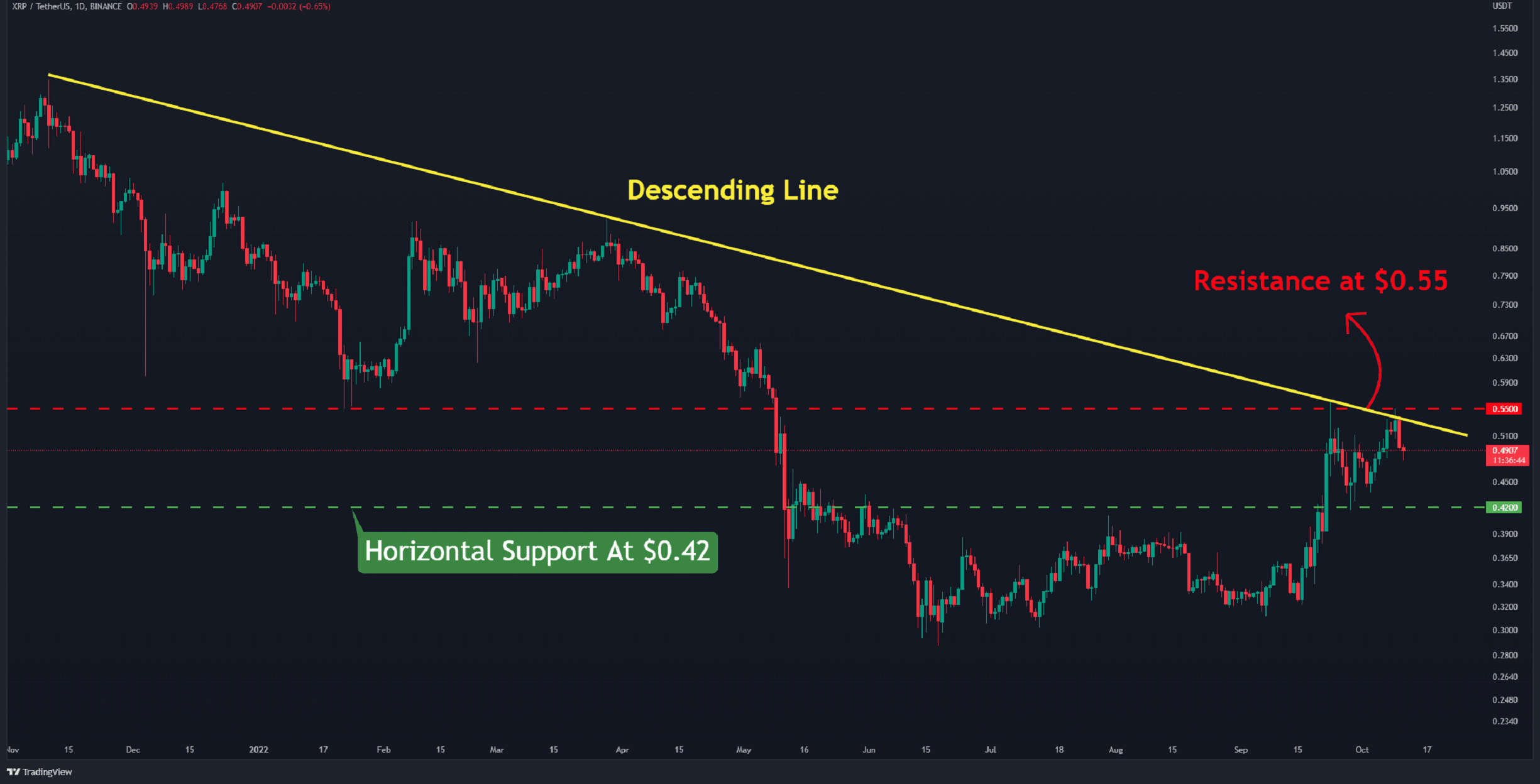

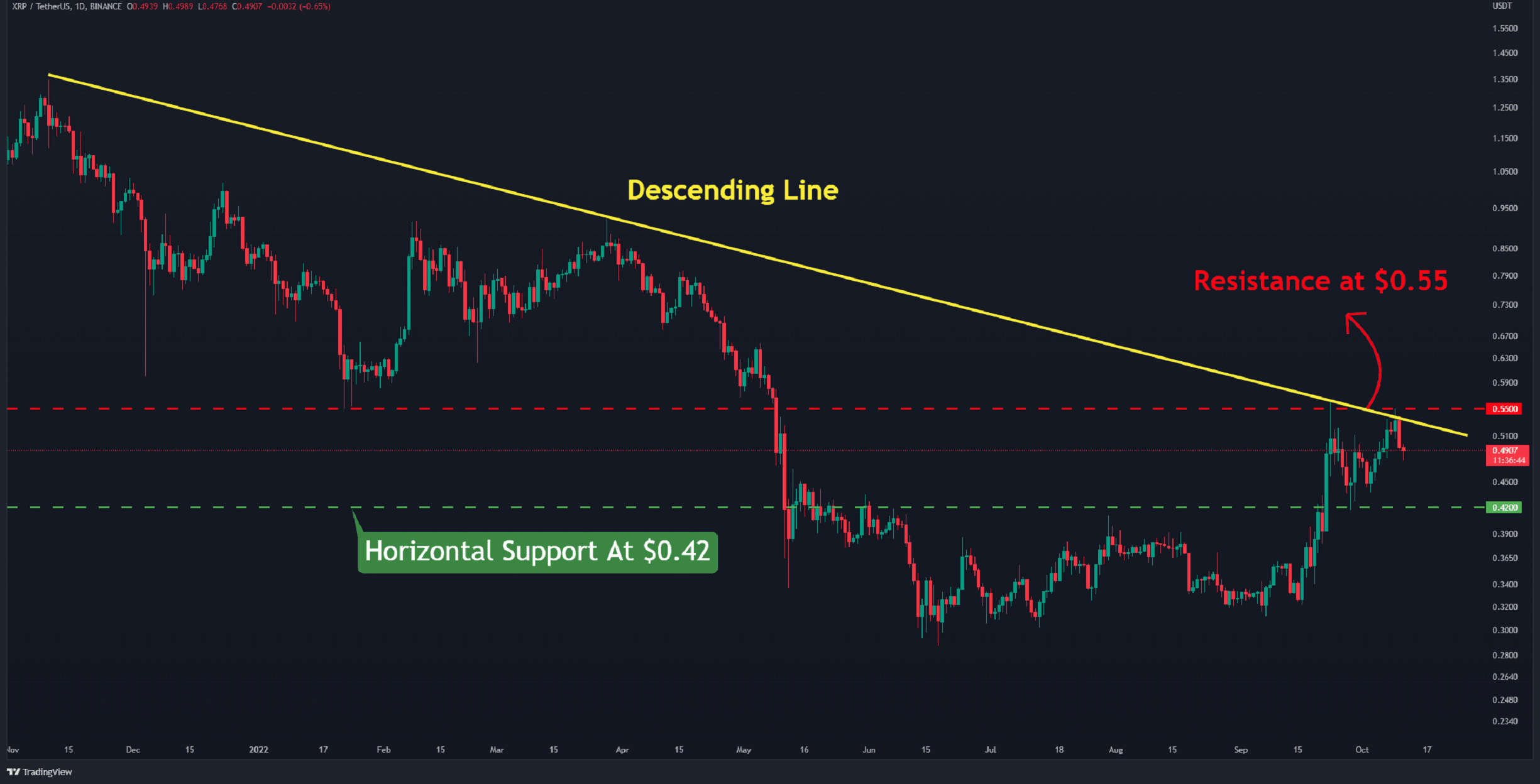

Technical Analysis of XRP Price Charts (Optional)

(This section should only be included if the author possesses the necessary expertise and clearly states that this is opinion, not financial advice.)

Analyzing XRP's price charts using technical indicators like moving averages, RSI, and identifying support and resistance levels can offer insights into potential price movements. [Insert technical analysis here, if appropriate, with clear disclaimers]. Remember, technical analysis is not foolproof and should be considered alongside fundamental analysis.

Conclusion

Determining whether XRP can reach $3.40 requires a careful consideration of various factors. While Ripple's technological advancements and growing adoption of its solutions are positive indicators, the ongoing SEC lawsuit introduces significant uncertainty. The current market conditions and the broader cryptocurrency landscape also play a crucial role. This XRP price analysis highlights the complexities involved and the importance of conducting thorough research before making any investment decisions. Remember, investing in cryptocurrencies like XRP carries significant risks. Stay informed on the latest XRP price analysis and Ripple news to make well-informed decisions about your investments.

Featured Posts

-

Isabela Merced On Playing Hawkgirl An Improvement Over Madame Web

May 07, 2025

Isabela Merced On Playing Hawkgirl An Improvement Over Madame Web

May 07, 2025 -

Saturday Lotto Draw Results April 12 2025

May 07, 2025

Saturday Lotto Draw Results April 12 2025

May 07, 2025 -

Mitchell And Mobley Lead Cavaliers To Dominant Victory Over Knicks

May 07, 2025

Mitchell And Mobley Lead Cavaliers To Dominant Victory Over Knicks

May 07, 2025 -

Legenda N Kh L Po Silovym Priemam Ukhodit Iz Khokkeya

May 07, 2025

Legenda N Kh L Po Silovym Priemam Ukhodit Iz Khokkeya

May 07, 2025 -

Trumps Impact On Hollywood A Shift In Film Production

May 07, 2025

Trumps Impact On Hollywood A Shift In Film Production

May 07, 2025

Latest Posts

-

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025 -

Este Betis Historico El Legado De Un Equipo Inolvidable

May 08, 2025

Este Betis Historico El Legado De Un Equipo Inolvidable

May 08, 2025 -

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025 -

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025 -

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025