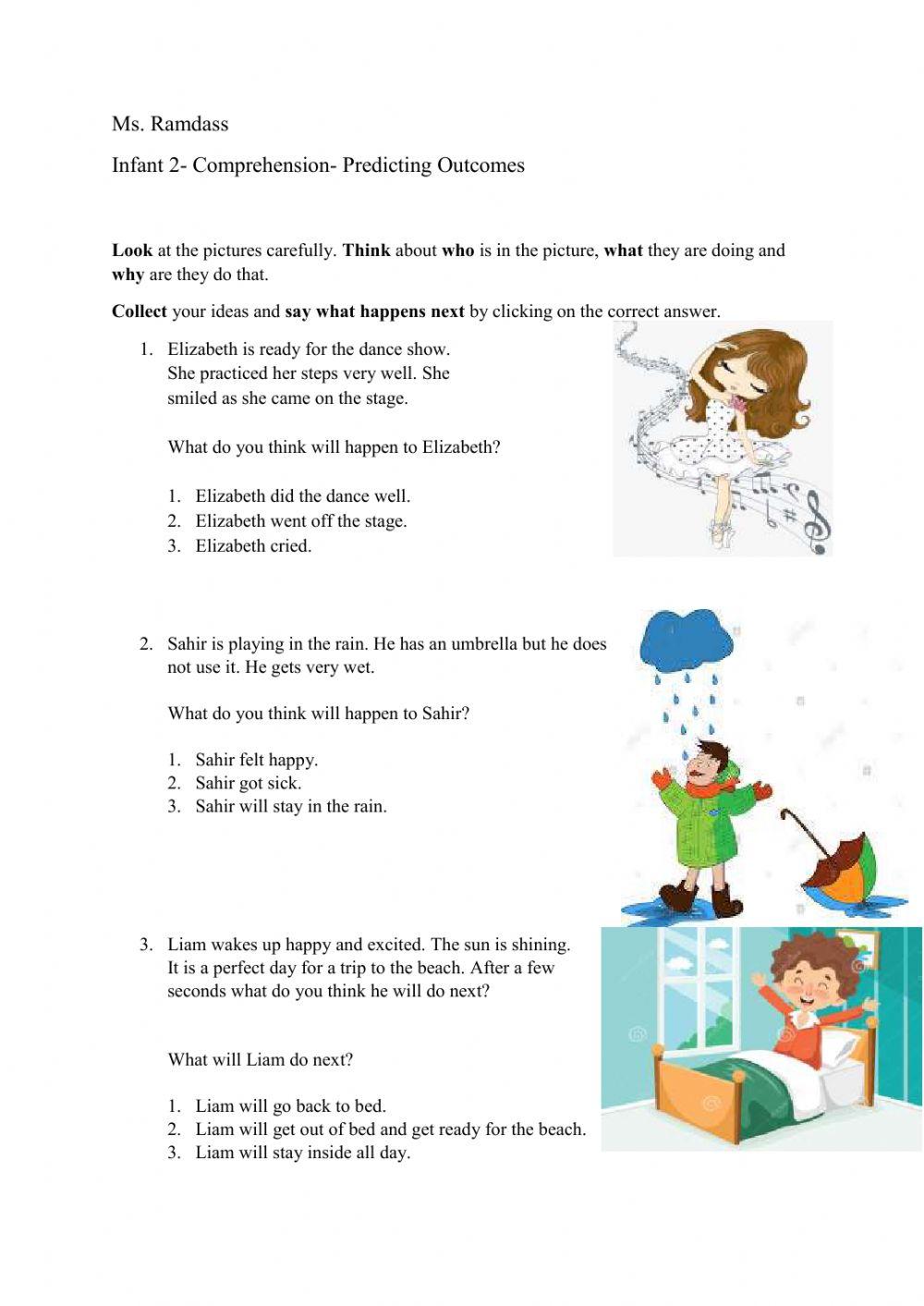

XRP On The Verge Of Record High: Grayscale ETF Filing Key Catalyst

Table of Contents

The Grayscale ETF Filing: A Game Changer for XRP?

Grayscale Investments' application for a spot Bitcoin ETF has sent ripples (pun intended!) through the crypto market, and the implications for XRP are significant. While not directly focused on XRP, a successful Grayscale Bitcoin ETF could pave the way for other crypto ETFs, including one potentially focused on XRP. This would be a monumental development.

The potential impact of a successful XRP ETF listing on liquidity and price discovery is immense. Increased accessibility and legitimacy would attract a new wave of institutional and retail investors.

- Increased institutional investment in XRP: Large institutional investors often require regulated investment vehicles like ETFs to participate in the crypto market. An XRP ETF would open the doors to billions in potential investment.

- Greater market accessibility for retail investors: ETFs provide a simple and regulated way for everyday investors to gain exposure to XRP, increasing overall demand.

- Enhanced price stability due to increased trading volume: Higher trading volumes, brought about by ETF trading, generally lead to more price stability.

- Potential for price appreciation due to increased demand: The surge in demand from institutional and retail investors is likely to drive XRP's price upwards.

Ripple's Legal Victory and its Influence on XRP's Price

The Ripple vs. SEC lawsuit has cast a long shadow over XRP's price. A favorable ruling for Ripple would significantly reduce regulatory uncertainty, a major factor impacting investor sentiment and price. Recent developments suggest a positive outcome is increasingly likely.

A clear win for Ripple would dramatically impact XRP's price:

- Reduced regulatory uncertainty: A favorable ruling would provide clarity on XRP's regulatory status in the US, reducing a major bearish factor.

- Increased confidence among investors: Certainty breeds confidence. A positive court decision would boost investor trust and attract new investment.

- Positive media coverage boosting XRP's image: Positive news coverage would improve XRP's public perception, attracting more interest.

- Removal of a significant bearish factor impacting price: The lawsuit has been a major overhang on XRP's price. Resolution would remove this significant headwind.

Growing Adoption and Utility of XRP

Beyond the legal battles and ETF speculation, XRP's underlying utility and growing adoption are key drivers of its potential. RippleNet, Ripple's payment network, continues to expand its global reach, facilitating cross-border transactions for numerous financial institutions.

The increasing adoption and utility of XRP are evident in:

- Expansion of RippleNet's global reach: RippleNet continues to onboard new financial institutions, increasing the usage of XRP for cross-border payments.

- Integration of XRP into new payment platforms: More and more payment platforms are integrating XRP, making it more accessible and convenient to use.

- Growing partnerships with financial institutions: Strategic partnerships with major banks and financial institutions further solidify XRP's position in the global payments ecosystem.

- Development of new use cases for XRP beyond payments: Exploration of new use cases, such as supply chain finance and other DeFi applications, could broaden XRP's appeal and utility.

Technical Analysis: Predicting XRP's Future Price

Technical analysis suggests a potential upward trajectory for XRP. Certain chart patterns and indicators point towards bullish momentum. However, it's crucial to remember that technical analysis is not foolproof, and predictions are not financial advice.

- Chart patterns indicating upward momentum: Several chart patterns, such as bullish flags and pennants, suggest potential upward price movements.

- Key technical indicators supporting bullish sentiment: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) may show bullish signals.

- Potential price targets based on technical analysis: Based on technical analysis, several price targets can be projected. However, these are just projections and not guarantees.

- Disclaimer: This is not financial advice. Always conduct your own thorough research and consult a financial advisor before making any investment decisions.

Conclusion

The confluence of the Grayscale ETF filing, Ripple's ongoing legal battle, and the increasing adoption of XRP creates a potent combination that could propel XRP to new record highs. While uncertainty remains, the current outlook is decidedly bullish. The potential for increased liquidity, reduced regulatory uncertainty, and expanding utility makes XRP a compelling asset to watch.

Call to Action: Stay informed about the latest developments concerning XRP and its potential to reach new heights. Continue researching XRP, monitor the Grayscale ETF application, and consider the implications of this exciting development for your investment portfolio. Remember to always conduct thorough research and seek professional financial advice before making any investment decisions regarding XRP or any other cryptocurrency.

Featured Posts

-

High Stakes White House Meeting Predicting The Outcome Of The Carney Trump Discussion

May 07, 2025

High Stakes White House Meeting Predicting The Outcome Of The Carney Trump Discussion

May 07, 2025 -

A Deep Dive Into The Papal Conclave Rules Procedures And History

May 07, 2025

A Deep Dive Into The Papal Conclave Rules Procedures And History

May 07, 2025 -

The Papal Conclave A Detailed Explanation Of The Process To Elect The Pope

May 07, 2025

The Papal Conclave A Detailed Explanation Of The Process To Elect The Pope

May 07, 2025 -

Harvard Presidents Response To Trumps Criticism The Fight Came To Me

May 07, 2025

Harvard Presidents Response To Trumps Criticism The Fight Came To Me

May 07, 2025 -

The Timberwolves And Julius Randle A Case Study In Player Development

May 07, 2025

The Timberwolves And Julius Randle A Case Study In Player Development

May 07, 2025

Latest Posts

-

Kripto Piyasasi Coekuesue Ve Yatirimci Tepkisi Satislar Artti

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Tepkisi Satislar Artti

May 08, 2025 -

Tuerkiye De Kripto Varliklar Icin Yeni Duezenleme Spk Nin Aciklamasi

May 08, 2025

Tuerkiye De Kripto Varliklar Icin Yeni Duezenleme Spk Nin Aciklamasi

May 08, 2025 -

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Para Duesuesue Yatirimcilar Neden Satiyor

May 08, 2025 -

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025 -

Kripto Para Piyasasindaki Duesues Yatirimci Satis Dalgasi

May 08, 2025

Kripto Para Piyasasindaki Duesues Yatirimci Satis Dalgasi

May 08, 2025