XRP Commodity Classification Looms As Ripple, SEC Near Settlement

Table of Contents

The Ripple-SEC Lawsuit: A Summary

The SEC's case against Ripple alleges that Ripple conducted an unregistered securities offering through the sale of XRP. The core argument centers on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The SEC contends that XRP sales satisfied the Howey Test criteria, implying investors anticipated profits based on Ripple's efforts. This "investment contract" aspect is central to the SEC's claim that XRP is a security.

Ripple, on the other hand, argues that XRP is a decentralized digital asset and functions as a currency, not a security. They maintain that XRP sales were not investment contracts and that the SEC's claims overreach existing regulatory frameworks. Ripple's defense strategy emphasizes the decentralized nature of XRP and its use in various payment systems, highlighting its functional differences from securities.

Key events in the case include the initial filing of the lawsuit in December 2020, various court filings and motions, and the recent progress towards a potential settlement. The lawsuit's impact on XRP's price has been significant, with periods of volatility directly correlating to major developments in the case.

- Summary of the SEC's allegations: Unregistered securities offering through XRP sales, violating federal securities laws.

- Ripple's response and legal strategy: Claiming XRP is a decentralized digital asset functioning as a currency, not a security.

- Key dates and milestones in the case: December 2020 (lawsuit filed), various motion hearings and filings, and ongoing settlement negotiations.

- Impact of the lawsuit on XRP price: Significant price volatility directly tied to key developments in the case.

Potential Outcomes of the XRP Commodity Classification

The outcome of the Ripple-SEC lawsuit will significantly impact XRP's future. If XRP is classified as a commodity, it would likely experience a surge in price and trading volume, as the regulatory uncertainty surrounding it would significantly diminish. Exchanges that delisted XRP might relist it, and overall investor confidence would increase.

Conversely, if XRP is classified as a security, the consequences for Ripple could be severe, potentially including substantial fines and penalties. XRP holders could face uncertainty about their investments, and further regulatory scrutiny of other cryptocurrencies could ensue. This scenario could negatively impact the broader crypto market, creating uncertainty and possibly leading to further price corrections.

- Impact on XRP trading and price if classified as a commodity: Increased trading volume, price appreciation, and relisting on major exchanges.

- Potential legal ramifications for Ripple if classified as a security: Significant fines, penalties, and potential legal challenges.

- Effect on investor confidence and market sentiment: A commodity classification would boost confidence; a security classification would likely decrease it.

- Possible future regulatory frameworks for cryptocurrencies: The ruling could set a precedent for future regulatory actions impacting the entire crypto space.

The Settlement Negotiations and Their Significance

Recent reports suggest Ripple and the SEC are engaged in settlement negotiations. While specific details remain confidential, a settlement could involve Ripple agreeing to certain conditions in exchange for dropping the lawsuit. This might include paying a fine or altering its business practices. A settlement could avoid a potentially lengthy and unpredictable court battle, but the terms would significantly impact XRP's future and its classification.

The likelihood of a settlement remains uncertain. Both parties have strong incentives to negotiate; a settlement offers a degree of certainty, avoiding the risks and costs of a full trial. However, the core disagreements about XRP's classification could make reaching an agreement challenging.

- Reported details of the settlement discussions (if available): (Add details if available at the time of writing; cite sources.)

- Potential benefits and drawbacks of a settlement for both parties: Certainty vs. potential for a favorable court ruling.

- Analysis of the probability of a successful settlement: Assess the likelihood based on reported information and legal analysis.

- Impact of a settlement on the XRP classification debate: A settlement might not explicitly classify XRP, leaving the question open for future legal interpretation.

Impact on the broader Crypto Market

The Ripple-SEC case extends far beyond XRP. The ruling will serve as a significant precedent for future regulatory actions concerning other cryptocurrencies. A decision classifying XRP as a security could embolden the SEC to pursue similar cases against other crypto projects, potentially leading to increased regulatory scrutiny and market volatility. Conversely, a commodity classification could foster greater regulatory clarity and potentially boost investor confidence across the crypto market.

- Potential impact on other cryptocurrencies: Increased regulatory scrutiny or a more lenient regulatory approach depending on the XRP ruling.

- Effect on the overall regulatory landscape for digital assets: The ruling could set a precedent for how digital assets are regulated going forward.

- Long-term implications for cryptocurrency adoption: Greater regulatory clarity could accelerate adoption; continued uncertainty could hinder it.

The Future of XRP Classification: A Call to Action

The XRP commodity classification debate, central to the Ripple-SEC lawsuit, carries immense implications for XRP, Ripple, and the broader cryptocurrency market. The potential outcomes – a commodity classification boosting XRP's value and market confidence or a security classification with significant legal and market ramifications – highlight the significant uncertainty surrounding this case. The ongoing settlement negotiations add another layer of complexity, with the potential for a compromise that might not definitively resolve the classification question.

Staying informed about the developments of the XRP classification and its consequences is crucial for anyone involved in or interested in the cryptocurrency market. Continue researching the case, follow the news closely, and stay updated on any news regarding a potential Ripple SEC settlement. The future of XRP and a significant portion of the crypto landscape depends on the outcome.

Featured Posts

-

Merrie Monarch Festival Exploring The Rich Cultures Of The Pacific At Hoike

May 01, 2025

Merrie Monarch Festival Exploring The Rich Cultures Of The Pacific At Hoike

May 01, 2025 -

France Triumphs Over Italy Duponts Masterclass Performance

May 01, 2025

France Triumphs Over Italy Duponts Masterclass Performance

May 01, 2025 -

Kshmyr Tnaze Bhart Ky Fwjy Taqt Awr Mdhakrat Ky Ahmyt

May 01, 2025

Kshmyr Tnaze Bhart Ky Fwjy Taqt Awr Mdhakrat Ky Ahmyt

May 01, 2025 -

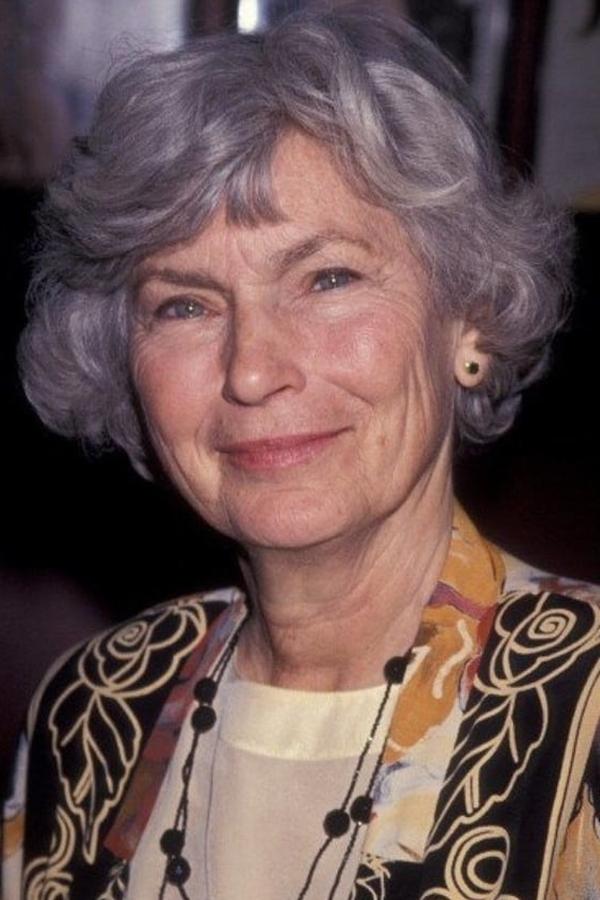

Priscilla Pointer Dies Dallas And Carrie Actress Passes Away

May 01, 2025

Priscilla Pointer Dies Dallas And Carrie Actress Passes Away

May 01, 2025 -

The Future Of French Rugby Six Nations 2025 And Beyond

May 01, 2025

The Future Of French Rugby Six Nations 2025 And Beyond

May 01, 2025

Latest Posts

-

Dallas Tv Stars Death A Tribute To An 80s Icon

May 01, 2025

Dallas Tv Stars Death A Tribute To An 80s Icon

May 01, 2025 -

The Loss Of Another Dallas Star The 80s Soap Opera World Mourns

May 01, 2025

The Loss Of Another Dallas Star The 80s Soap Opera World Mourns

May 01, 2025 -

A Dallas Stars Passing Honoring An 80s Tv Legend

May 01, 2025

A Dallas Stars Passing Honoring An 80s Tv Legend

May 01, 2025 -

Death Of A Dallas Tv Icon 80s Soap Opera Star Passes Away

May 01, 2025

Death Of A Dallas Tv Icon 80s Soap Opera Star Passes Away

May 01, 2025 -

Remembering A Dallas Legend 80s Soap Opera Star Dies

May 01, 2025

Remembering A Dallas Legend 80s Soap Opera Star Dies

May 01, 2025