XRP And The SEC: Navigating The Uncertainty Around Commodity Classification

Table of Contents

The SEC's Case Against Ripple and XRP

The SEC's lawsuit against Ripple alleges that the company offered and sold XRP as an unregistered security, violating federal securities laws. Their argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security. Key aspects of the SEC's case include:

-

The Howey Test and its Application to XRP: The Howey Test examines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argues that XRP sales satisfy these criteria, claiming purchasers anticipated profits based on Ripple's efforts.

-

The SEC's Claims Regarding Ripple's Sales of XRP: The SEC alleges that Ripple's various sales of XRP, including those to institutional investors and through programmatic sales, constituted the offer and sale of unregistered securities. They point to the expectation of profit among purchasers as evidence.

-

Ripple's Counterarguments: Ripple counters that XRP is a decentralized digital asset, functioning primarily as a utility token for facilitating cross-border payments on the RippleNet network. They argue that they do not control XRP's price or market and that its utility transcends investment considerations.

-

Potential Precedents and Similar Cases: The SEC's case against Ripple sets a significant precedent for how other cryptocurrency projects might be regulated in the future. The outcome will influence how other cryptocurrencies are classified and impact the broader regulatory landscape for digital assets.

The Arguments for XRP as a Commodity or Utility Token

Proponents of XRP argue that its functionality and decentralized nature support its classification as a commodity or utility token rather than a security. Several key points underpin this argument:

-

XRP as a Payment Mechanism on RippleNet: XRP serves as a crucial component of RippleNet, a global payment network enabling faster and cheaper cross-border transactions for financial institutions. This practical utility differentiates it from many other cryptocurrencies focused primarily on speculation.

-

XRP's Use in Decentralized Finance (DeFi): While less prominent than its use in traditional finance, XRP is finding applications within the DeFi ecosystem, further demonstrating its utility beyond investment.

-

Independent Validators and Lack of Central Control: Unlike some centralized cryptocurrencies, XRP operates on a decentralized network with independent validators, reducing Ripple's direct control and strengthening the argument against it being a security.

-

XRP's Utility Beyond Investment: The versatility of XRP as a payment token within the financial industry highlights its practical applications independent of investment returns, supporting its case as a functional utility.

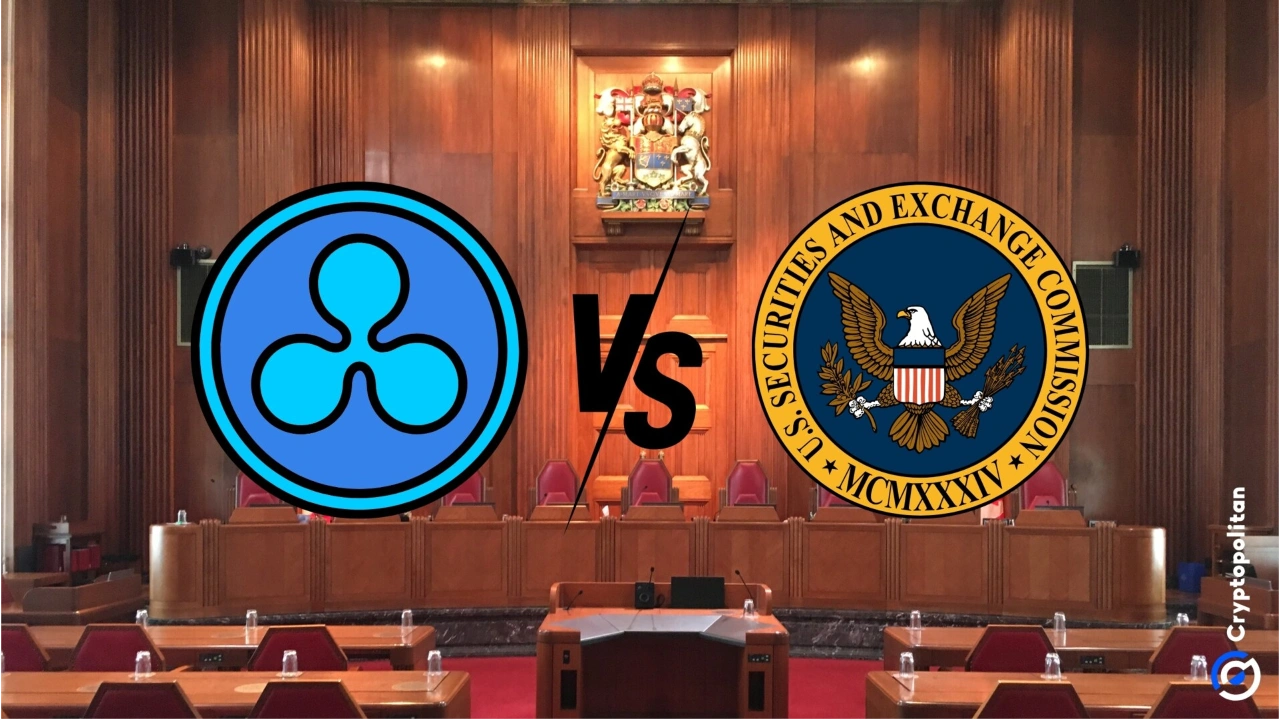

The Impact of Regulatory Uncertainty on XRP's Market Value and Adoption

The SEC's actions have significantly impacted XRP's market value, investor confidence, and overall adoption. This regulatory uncertainty creates a challenging environment:

-

XRP Price Fluctuations Since the SEC Lawsuit: A clear illustration of the impact is seen in the volatile price movements of XRP since the lawsuit commenced. (A chart illustrating this would be beneficial here).

-

Impact on Investor Sentiment and Trading Volumes: Investor confidence has been negatively affected, leading to decreased trading volumes on certain exchanges and a cautious approach by some investors.

-

Effects on XRP's Adoption by Businesses and Financial Institutions: The uncertainty has made businesses and financial institutions hesitant to fully integrate XRP into their operations, impacting its potential for widespread adoption.

-

Potential for Future Regulatory Developments: The outcome of the Ripple lawsuit will undeniably shape future regulatory approaches to cryptocurrencies, affecting not only XRP but the entire digital asset landscape.

Navigating the Risks and Opportunities in Investing in XRP

Investing in XRP, amidst the ongoing regulatory uncertainty, requires careful consideration of both the risks and potential rewards:

-

Importance of Thorough Research and Due Diligence: Before investing in XRP, investors must conduct comprehensive research, understanding the legal complexities and potential outcomes of the lawsuit.

-

Key Risk Factors Associated with XRP Investment: These include regulatory uncertainty, market volatility, and the potential for substantial losses if the SEC prevails.

-

Strategies for Managing Risk: Diversification of investment portfolios, limiting exposure to XRP, and staying updated on legal developments are crucial risk-management strategies.

-

Potential for Long-Term Growth: Depending on the outcome of the legal battle, XRP holds potential for significant long-term growth, contingent upon achieving regulatory clarity and widespread adoption.

Conclusion

The ongoing legal battle surrounding XRP's commodity classification highlights the complex and evolving regulatory landscape for cryptocurrencies. The SEC's lawsuit against Ripple, and the counterarguments presented by Ripple, underscore the difficulties in applying traditional securities law frameworks to decentralized digital assets. Understanding the arguments for and against XRP's classification as a security is crucial for navigating this uncertainty.

Call to Action: Stay informed about the ongoing legal battle and future regulatory developments surrounding XRP and its commodity classification. Conduct thorough research and understand the associated risks before making any investment decisions related to XRP or other digital assets. Continue to follow updates on the XRP and SEC case for clarity on this complex issue.

Featured Posts

-

Zendaya Faces Family Drama Before Tom Holland Wedding

May 07, 2025

Zendaya Faces Family Drama Before Tom Holland Wedding

May 07, 2025 -

Bmo Study Recession Worries Chill Canadian Housing Market

May 07, 2025

Bmo Study Recession Worries Chill Canadian Housing Market

May 07, 2025 -

7 Sezon Chernogo Zerkala Vse Chto My Znaem O Date Vykhoda

May 07, 2025

7 Sezon Chernogo Zerkala Vse Chto My Znaem O Date Vykhoda

May 07, 2025 -

V Nasih Srcih Ohranjanje Spomina Na Drage Ljudi

May 07, 2025

V Nasih Srcih Ohranjanje Spomina Na Drage Ljudi

May 07, 2025 -

Twsye Rhlat Alkhtwt Almlkyt Almghrbyt Almzyd Mn Alrbt Byn Saw Bawlw Waldar Albydae

May 07, 2025

Twsye Rhlat Alkhtwt Almlkyt Almghrbyt Almzyd Mn Alrbt Byn Saw Bawlw Waldar Albydae

May 07, 2025

Latest Posts

-

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025 -

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025 -

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025 -

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025