XRP And The SEC: Decoding The Commodity Debate And Future Outlook

Table of Contents

The SEC's Case Against XRP: A Security or a Commodity?

The SEC's case hinges on its definition of a "security," primarily based on the Howey Test. This test determines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argues that Ripple's sale of XRP tokens meets this criteria. They contend that Ripple raised billions of dollars through XRP sales, offering investors the expectation of profit based on Ripple's efforts to promote and develop the XRP ecosystem.

The SEC's key allegations against Ripple include:

- Unregistered Securities Offering: The SEC claims Ripple conducted an unregistered securities offering, violating federal securities laws.

- Profit Generation from Investors' Funds: The SEC alleges Ripple used proceeds from XRP sales to fund its operations and further its own interests, creating a profit expectation for investors.

- Centralized Control by Ripple: The SEC argues that Ripple maintained significant control over XRP's distribution and development, contradicting the decentralized nature often associated with cryptocurrencies.

While the SEC's filings are publicly available and can be accessed on their website, interpreting the legal complexities requires a deep understanding of securities law.

Ripple's Defense and Counterarguments

Ripple vehemently denies the SEC's accusations, arguing that XRP is a decentralized digital asset and functions primarily as a payment currency, not a security. Their defense rests on several key arguments:

- Decentralized Nature of XRP Ledger: Ripple emphasizes the decentralized nature of the XRP Ledger, highlighting its open-source code and lack of central control by Ripple itself. They argue that this key difference separates XRP from traditional securities.

- Lack of Direct Investment Contract: Ripple argues there was no direct investment contract between Ripple and XRP purchasers. They maintain that XRP buyers were not purchasing a stake in Ripple's business but rather acquiring a digital asset with inherent utility.

- Focus on XRP's Utility as a Payment Currency: Ripple stresses XRP's use as a rapid and low-cost payment currency, emphasizing its functionality within the global financial system. They cite various partnerships and integrations of XRP into payment platforms as evidence of its practical applications.

Ripple’s defense also includes referencing various legal precedents and expert opinions supporting their position on XRP’s decentralized functionality and lack of an investment contract.

The Ongoing Legal Battle and Potential Outcomes

The SEC vs. Ripple lawsuit is currently ongoing, with significant developments unfolding regularly. Potential outcomes include a favorable ruling for Ripple, a victory for the SEC, or a settlement. Each scenario carries substantial implications:

- Favorable Ruling for Ripple: This outcome would likely lead to a significant surge in XRP's price and bolster investor confidence in the cryptocurrency market. It could set a precedent for other cryptocurrencies facing similar regulatory challenges.

- SEC Victory: An SEC victory would likely result in a substantial drop in XRP's price and potentially impact other crypto projects categorized as unregistered securities. It could also lead to tighter regulation within the crypto space.

- Settlement: A settlement could involve Ripple agreeing to certain conditions, potentially including fines or restrictions on XRP sales. The impact on XRP's price and market position would depend on the specifics of the settlement.

The Future Outlook for XRP and the Crypto Market

The SEC's actions have broader implications for the future of the cryptocurrency market. Increased regulatory clarity is crucial for fostering innovation and investor confidence. However, predicting the long-term trajectory of XRP and the crypto market remains challenging.

Potential future scenarios for XRP include:

- Price Predictions Based on Different Legal Outcomes: The price of XRP will undoubtedly fluctuate based on the outcome of the SEC lawsuit.

- Potential Use Cases for XRP in the Future: Even with regulatory uncertainty, XRP's utility as a fast and efficient payment currency could drive future adoption.

- Integration with Other Blockchain Technologies: Future developments may see XRP integrated with other blockchain networks and technologies, expanding its functionality.

Conclusion: Understanding the XRP and SEC Debate: What's Next?

The "XRP and the SEC" case highlights the complex legal and regulatory landscape surrounding cryptocurrencies. Both the SEC and Ripple present compelling arguments, and the final outcome will significantly impact the future of the crypto market. Understanding the intricacies of this debate is crucial for navigating the evolving regulatory environment. Stay informed about the ongoing developments in the XRP and SEC case by following reputable news sources and legal updates. The future of XRP, and indeed a significant portion of the cryptocurrency market, hinges on the resolution of this landmark legal battle.

Featured Posts

-

Eskisehir De Tip Egitimi Ve Stres Yoenetimi Boksun Etkisi

May 01, 2025

Eskisehir De Tip Egitimi Ve Stres Yoenetimi Boksun Etkisi

May 01, 2025 -

Kampen Start Kort Geding Tegen Enexis Stroomvoorziening Duurzaam Schoolgebouw Vertraagd

May 01, 2025

Kampen Start Kort Geding Tegen Enexis Stroomvoorziening Duurzaam Schoolgebouw Vertraagd

May 01, 2025 -

Warri Itakpe Rail Line Shut Down Engine Failure Causes Suspension By Nrc

May 01, 2025

Warri Itakpe Rail Line Shut Down Engine Failure Causes Suspension By Nrc

May 01, 2025 -

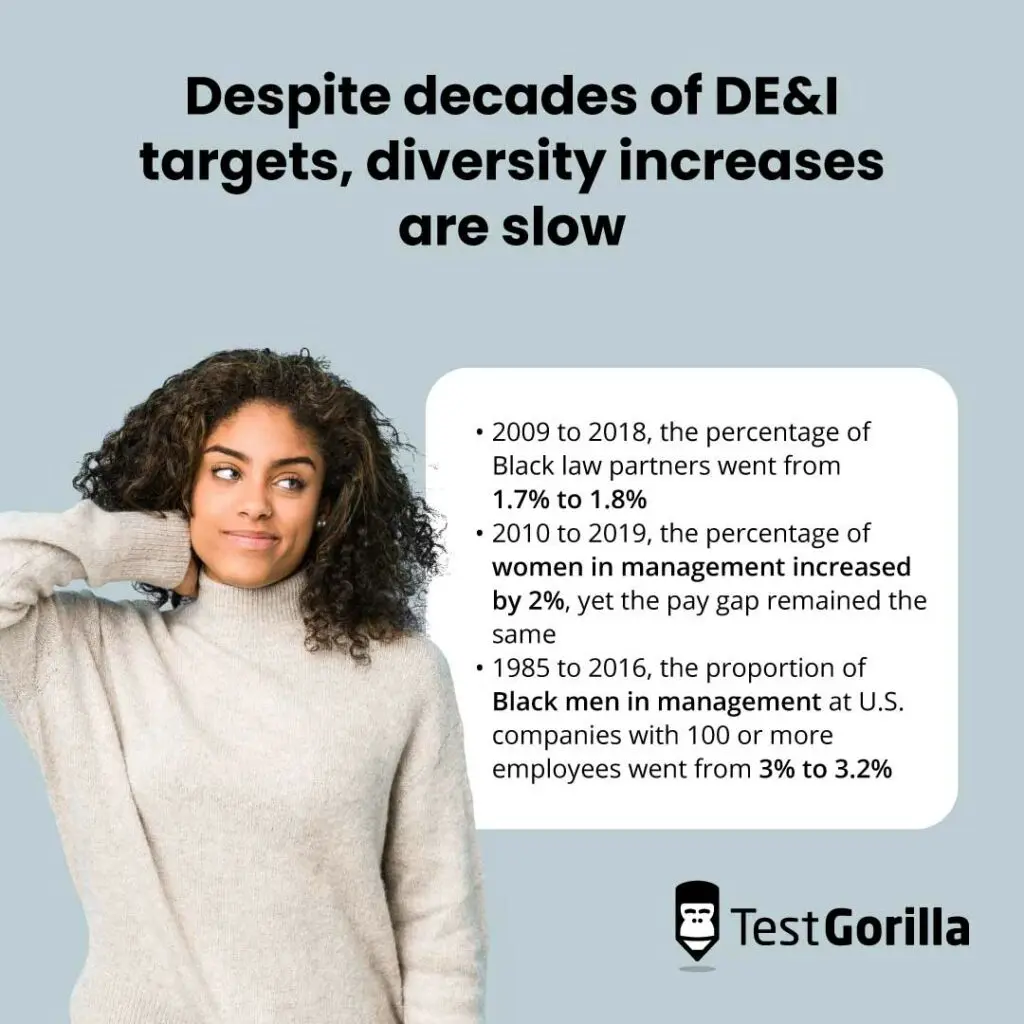

The Business Impact Of Targets Controversial Dei Decision

May 01, 2025

The Business Impact Of Targets Controversial Dei Decision

May 01, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Dang Quang

May 01, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Dang Quang

May 01, 2025