WiseTech Global's $2.1 Billion Acquisition Of E2open: A Deep Dive

Table of Contents

Synergies and Strategic Advantages of the WiseTech Global-E2open Merger

The WiseTech Global-E2open merger offers numerous synergies and strategic advantages, creating a powerful force in the global supply chain management software market.

Enhanced Global Reach and Market Share

This acquisition dramatically increases WiseTech Global's global footprint and market share. E2open brings a substantial customer base and a strong presence in key regions where WiseTech Global had previously limited reach.

- Increased market penetration in key regions like North America and Europe: E2open's established presence in these regions provides WiseTech Global with immediate access to a wider customer pool and greater market penetration.

- Access to new industries and vertical markets served by E2open: The merger unlocks opportunities in sectors where E2open holds significant expertise, diversifying WiseTech Global's customer base and revenue streams. This expansion into new verticals strengthens their overall market position.

- Consolidation of market leadership, potentially leading to higher pricing power: With increased market share and a more comprehensive product offering, WiseTech Global may be able to command higher prices for its services, improving profitability.

Complementary Product Portfolios and Technological Integration

The combination of WiseTech's CargoWise platform and E2open's suite of solutions creates a truly comprehensive, end-to-end supply chain management system. This integration offers significant advantages for both existing and new customers.

- Integration of E2open's advanced planning and optimization capabilities with CargoWise's existing functionalities: This integration promises enhanced efficiency and visibility throughout the supply chain, allowing businesses to optimize their operations more effectively.

- Potential for cross-selling opportunities and enhanced value proposition for customers: The combined platform provides a broader range of functionalities, creating opportunities to upsell and cross-sell solutions to existing customers. This enhanced value proposition attracts new clients and increases customer lifetime value.

- Improved data analytics and visibility across the entire supply chain: The merger facilitates the integration of data from various sources, providing clients with a more holistic and accurate view of their supply chain operations, which enables better decision-making.

Financial Benefits and Return on Investment (ROI)

WiseTech Global anticipates substantial cost savings and synergies from the acquisition, promising a strong return on investment.

- Elimination of redundancies and streamlining of operations: The integration process will identify and eliminate overlapping functions, resulting in significant cost efficiencies.

- Increased revenue streams from cross-selling and upselling opportunities: The combined platform offers a wider range of solutions, creating more opportunities to generate revenue from existing and new customers.

- Enhanced profitability and shareholder value: The anticipated cost savings and increased revenue are projected to boost profitability and enhance shareholder value.

Challenges and Potential Risks Associated with the Merger

While the potential benefits are significant, the WiseTech Global-E2open merger also presents several challenges and risks.

Integration Complexity and Costs

Integrating two large, complex software companies is a substantial undertaking, potentially fraught with challenges.

- The need for extensive technical integration and data migration: Combining different software systems and migrating large amounts of data will require significant time, resources, and expertise.

- Potential for customer churn due to disruption during the integration process: Service interruptions or difficulties during the integration could lead to customer dissatisfaction and potential churn.

- Management of competing corporate cultures and employee integration: Merging two distinct corporate cultures and integrating employee teams requires careful planning and execution.

Regulatory Scrutiny and Antitrust Concerns

The acquisition may face thorough regulatory scrutiny from competition authorities globally.

- Potential antitrust investigations in key jurisdictions: Competition regulators may investigate the merger to assess its impact on market competition and consumer welfare.

- Need to address potential concerns about market dominance and competition: WiseTech Global will need to address potential concerns about the combined entity's market dominance and its impact on competition.

- Compliance with data privacy regulations: Integrating data from two large organizations requires strict adherence to various data privacy regulations worldwide.

Customer Retention and Satisfaction

Maintaining customer satisfaction throughout the integration process is paramount.

- Proactive communication with customers about the acquisition and integration plans: Open and transparent communication will help mitigate customer concerns and maintain trust.

- Ensuring uninterrupted service and minimal disruption to customer operations: Minimizing disruptions to customer operations during the integration is critical for retaining customers.

- Investing in customer support and training to address any challenges: Providing adequate customer support and training will help customers adapt to the changes and ensure a smooth transition.

Conclusion

The WiseTech Global acquisition of E2open marks a significant turning point in the supply chain management software industry. While the integration poses substantial challenges, the potential synergies and strategic benefits are compelling. The combined entity is poised to become a market leader, offering a comprehensive solution for businesses seeking to optimize their global supply chains. The success of this merger will hinge on effective integration, regulatory compliance, and unwavering focus on customer satisfaction. To stay updated on the latest developments in this transformative deal and the future of WiseTech Global's supply chain solutions, continue following industry news and in-depth analyses of the WiseTech Global acquisition of E2open.

Featured Posts

-

40 Felett Terhes Ismerd Meg A Hiressegek Toerteneteit

May 27, 2025

40 Felett Terhes Ismerd Meg A Hiressegek Toerteneteit

May 27, 2025 -

Jackie Chan And Chris Tuckers Tiff Reunion A Look Back At Rush Hour And Whats Next

May 27, 2025

Jackie Chan And Chris Tuckers Tiff Reunion A Look Back At Rush Hour And Whats Next

May 27, 2025 -

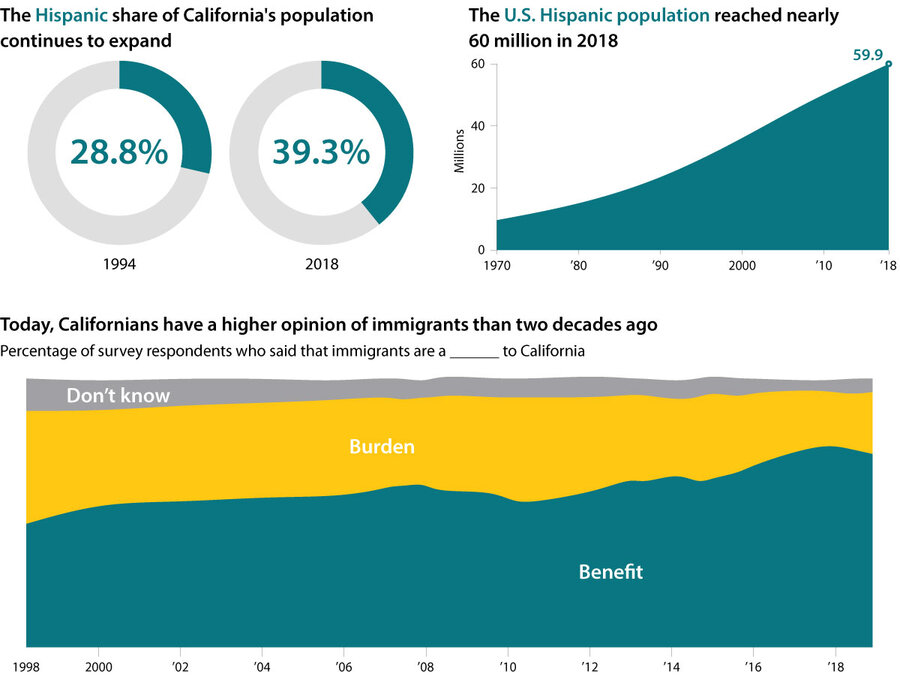

Analyzing The Contribution Of Immigration To Californias Population

May 27, 2025

Analyzing The Contribution Of Immigration To Californias Population

May 27, 2025 -

Gaza Doctor Loses Nine Children In Israeli Air Raid

May 27, 2025

Gaza Doctor Loses Nine Children In Israeli Air Raid

May 27, 2025 -

State Of Emergency Ineffective Port Of Spain Commuters Still Face Gridlock

May 27, 2025

State Of Emergency Ineffective Port Of Spain Commuters Still Face Gridlock

May 27, 2025