Will Trump's Policies Affect Bitcoin's Price? A $100,000 BTC Prediction

Table of Contents

Main Points:

2.1. Trump's Economic Policies and Bitcoin's Volatility

H3: Fiscal Policy and Inflation:

Trump's fiscal policies, characterized by significant tax cuts and increased government spending, had the potential to significantly impact inflation. High inflation often leads investors to seek assets that can hedge against the devaluation of fiat currencies. Bitcoin, with its limited supply, is frequently viewed as such a hedge.

- Increased Inflation Scenario: Higher inflation could boost Bitcoin adoption as investors seek to preserve their purchasing power. Demand could drive the price upwards.

- Decreased Inflation Scenario: Conversely, if inflation remained low or decreased under different economic conditions, Bitcoin's appeal as an inflation hedge might diminish, potentially impacting its price negatively.

[Insert relevant chart here showing correlation between inflation rates and Bitcoin price during Trump's presidency]. Data from [Source] suggests a [positive/negative] correlation between these two variables during this period.

H3: Regulatory Uncertainty and Bitcoin's Price:

Trump's administration took a relatively hands-off approach to cryptocurrency regulation, creating a climate of uncertainty. This regulatory ambiguity could have both positive and negative consequences for Bitcoin's price.

- Effects of Unclear Regulations: While a lack of heavy regulation could foster innovation and growth, it also created uncertainty among investors who prefer clear regulatory frameworks.

- Potential for Increased Scrutiny: The potential for increased regulatory scrutiny, even after Trump’s presidency, could lead to market corrections. Announcements related to regulatory changes often caused significant price swings.

- Influence of Regulatory Announcements: Any statement from regulatory bodies, even hints at future action, could dramatically impact investor sentiment and Bitcoin's price.

[Mention specific regulatory events during Trump’s presidency and their impact on the Bitcoin price, linking to credible news sources].

H3: US Dollar Strength and Bitcoin's Correlation:

The strength of the US dollar, influenced in part by Trump's economic policies, often shows an inverse correlation with Bitcoin's price.

- Inverse Correlation Explained: A strong dollar generally makes Bitcoin more expensive for holders of other currencies, potentially reducing demand and lowering the price.

- How a Strong Dollar Affects Bitcoin's Price: Periods of US dollar strength, often linked to increased investor confidence in the US economy, could lead to capital flowing back into traditional assets, decreasing demand for Bitcoin.

- Exceptions to the Correlation: However, global geopolitical events or a flight to safety could outweigh the impact of a strong dollar, driving up Bitcoin's price even during periods of USD strength.

[Include relevant economic indicators and their impact on the USD and Bitcoin, citing reputable financial sources].

2.2. Geopolitical Factors and Bitcoin's Appeal

H3: Trade Wars and Bitcoin as a Safe Haven Asset:

Trump's trade policies, including trade wars with several countries, created significant global economic uncertainty. This uncertainty often boosts Bitcoin's appeal as a safe-haven asset.

- Investors Turn to Bitcoin During Instability: Investors seeking to protect their assets from market volatility during times of trade disputes frequently sought refuge in cryptocurrencies like Bitcoin.

- Examples from Trump's Trade Conflicts: The impact of specific trade conflicts on Bitcoin's price should be analyzed, linking to relevant market data and news reports.

H3: International Relations and Bitcoin Adoption:

Trump's foreign policy decisions could have indirectly affected Bitcoin adoption in various countries.

- Impacts on International Relations: Changes in diplomatic relationships, sanctions, or other foreign policy actions could impact the accessibility and adoption of Bitcoin in specific regions.

- Affecting the Global Cryptocurrency Market: Increased global instability could drive demand for decentralized assets like Bitcoin, regardless of specific national policies.

2.3. The $100,000 Bitcoin Prediction: Reality Check

H3: Factors Supporting a $100,000 Bitcoin:

Several factors, independent of Trump's policies, could contribute to Bitcoin reaching a $100,000 price.

- Halving Events: The halving of Bitcoin's block reward, reducing the rate of new Bitcoin creation, contributes to scarcity.

- DeFi Growth: The rise of decentralized finance (DeFi) has increased interest and demand for cryptocurrencies.

- Institutional Adoption: Increased institutional investment in Bitcoin provides further price support.

H3: Factors Challenging a $100,000 Bitcoin:

Despite the potential for growth, several factors could prevent Bitcoin from reaching $100,000.

- Regulatory Hurdles: Increased regulatory pressure or bans in major markets could negatively impact the price.

- Market Manipulation Risks: The potential for market manipulation and price crashes remains a significant risk.

- Technological Limitations: Scaling challenges and technological vulnerabilities could also impact Bitcoin’s price trajectory.

Conclusion: Trump, Bitcoin, and the Future of Cryptocurrency

Trump's policies, while not solely determining Bitcoin's price, likely played a role in its volatility through their impact on inflation, regulatory uncertainty, the strength of the US dollar, and global geopolitical stability. The $100,000 Bitcoin prediction remains a complex issue, dependent on a multitude of interconnected factors beyond just political influence. While some of Trump's policies might have inadvertently fostered Bitcoin's appeal as a safe haven asset, others introduced uncertainties that affected market sentiment.

Stay informed about the evolving relationship between Trump's legacy and the Bitcoin market. Understanding the potential impact of political decisions on cryptocurrencies is crucial for navigating the volatile world of Bitcoin and making informed investment choices. Further research into the intricate interplay between Trump's policies and Bitcoin's price is strongly encouraged for anyone interested in the future of cryptocurrency investment.

Featured Posts

-

Edmonton School Projects 14 Initiatives On Accelerated Timeline

May 09, 2025

Edmonton School Projects 14 Initiatives On Accelerated Timeline

May 09, 2025 -

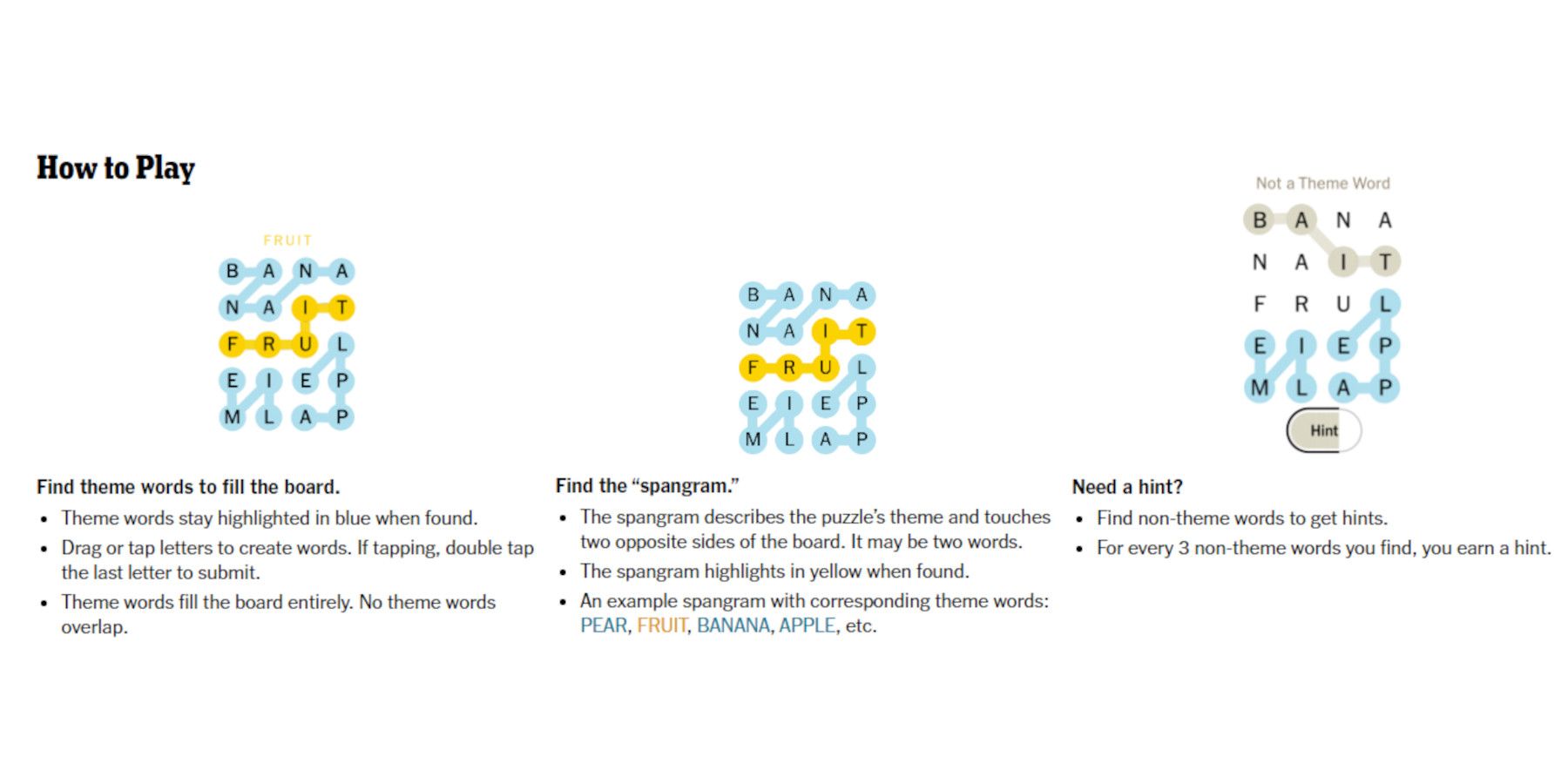

Solve Nyt Strands Game 354 February 20 Complete Hints And Answers

May 09, 2025

Solve Nyt Strands Game 354 February 20 Complete Hints And Answers

May 09, 2025 -

Ai In The Public Sector The Implications Of Palantirs New Nato Agreement

May 09, 2025

Ai In The Public Sector The Implications Of Palantirs New Nato Agreement

May 09, 2025 -

Proposed Uk Visa Changes Impact On Specific Nationalities

May 09, 2025

Proposed Uk Visa Changes Impact On Specific Nationalities

May 09, 2025 -

Nyt Strands Today April 4 2025 Clues Hints And Solutions

May 09, 2025

Nyt Strands Today April 4 2025 Clues Hints And Solutions

May 09, 2025