Will Palantir Be A Trillion-Dollar Company By 2030? An In-Depth Analysis

Table of Contents

Palantir's Current Financial Performance and Growth Projections

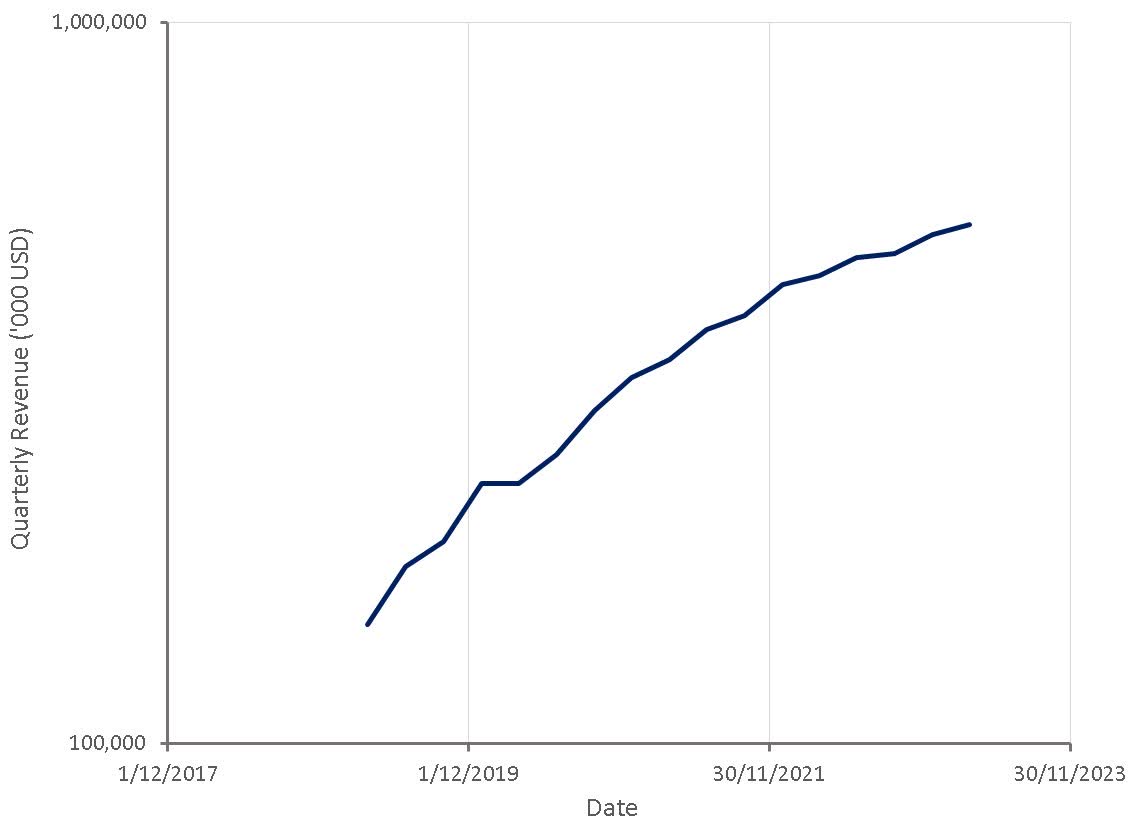

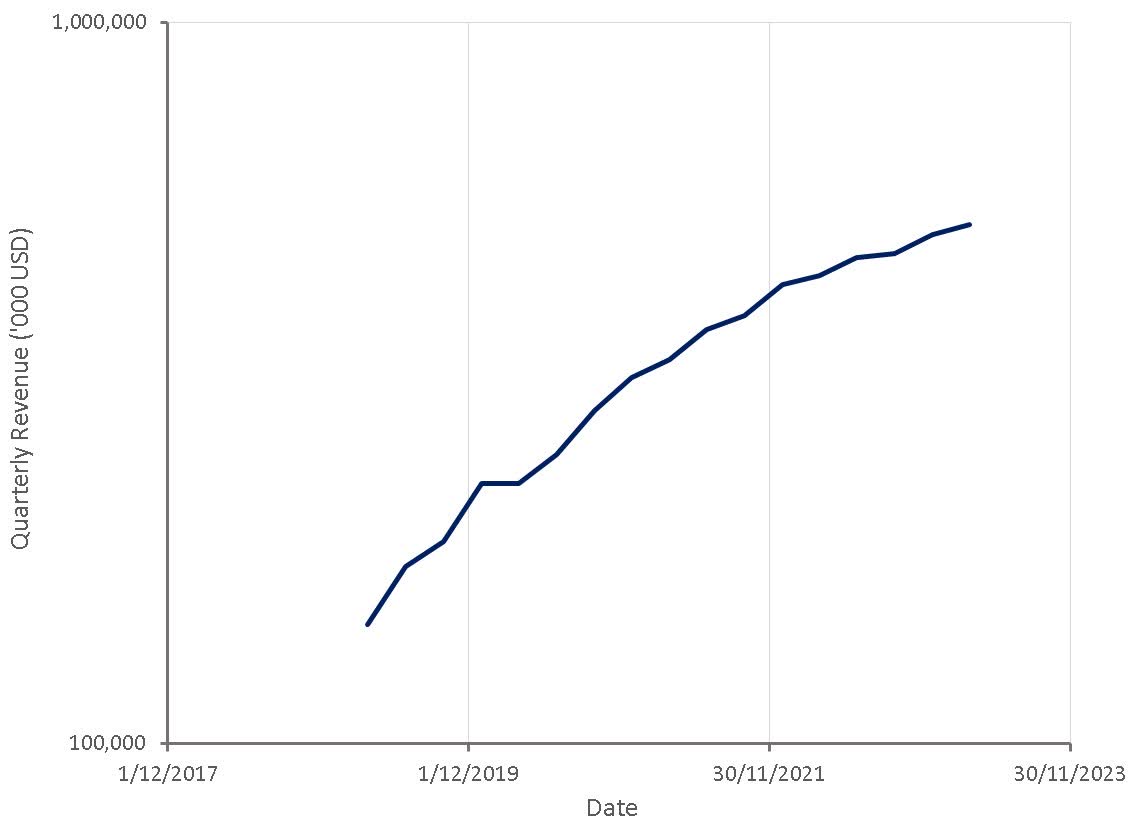

Analyzing Palantir's financial health is crucial to assessing its trillion-dollar potential. While the company has demonstrated consistent revenue growth, profitability remains a key focus. Examining Palantir revenue and Palantir profit figures, alongside its current market capitalization and Palantir stock price, paints a clearer picture. The growth of the broader big data and AI market significantly influences Palantir's potential. Positive forecasts from reputable analysts regarding the industry's future growth are vital in projecting Palantir's own trajectory.

- Recent Quarterly Earnings Reports: A detailed review of recent quarterly reports reveals trends in revenue growth, operating expenses, and net income. Analyzing these trends helps determine the sustainability of Palantir's growth.

- Impact of Government Contracts and Commercial Clients: Palantir's revenue stream is diverse, encompassing significant government contracts and a growing base of commercial clients. Understanding the revenue contribution from each sector is crucial. Are government contracts providing a stable foundation, or is the company's long-term growth reliant on success in the competitive commercial market?

- Sustainability of Growth Rate: Can Palantir maintain its current growth rate, or will market saturation, competition, and economic factors impact its future performance? Sustained high growth is a necessity for achieving a trillion-dollar valuation.

Competitive Landscape and Market Share

The data analytics and AI market is fiercely competitive. Palantir faces established players like Databricks and Snowflake, along with emerging startups. To become a trillion-dollar company, Palantir needs to maintain and expand its market share. This section analyzes Palantir's competitive advantages and disadvantages, identifying potential for market share gains and expansion.

- Comparison to Competitors: A detailed comparison of Palantir's offerings with those of Databricks, Snowflake, and other key players is essential. This assessment should focus on areas like platform capabilities, pricing models, and target markets.

- Unique Selling Propositions: What differentiates Palantir from its competitors? Does its focus on complex data integration and AI-powered insights provide a significant competitive edge?

- Potential Threats: Identifying potential threats to Palantir's market position—such as new entrants, technological disruption, or changing market dynamics—is crucial for a realistic assessment.

Technological Innovation and Future Outlook

Palantir's continued success hinges on its ability to innovate and adapt to the rapidly evolving technological landscape. Its investment in research and development (R&D), its technological roadmap, and the potential for disruptive innovations are critical factors.

- Palantir Foundry: This platform is central to Palantir's offerings. Analyzing its capabilities and potential for future development is key. Will it continue to attract new clients and drive innovation?

- New Applications and Markets: Identifying potential applications for Palantir's technology in new markets is crucial for future growth. Expansion beyond its current client base is vital for achieving the trillion-dollar goal.

- Risks and Uncertainties: Technological advancements are inherently risky. The potential for unexpected technological disruptions or the emergence of superior technologies poses a significant threat to Palantir's long-term prospects.

Government Contracts and Commercial Adoption

Palantir's revenue heavily relies on government contracts, particularly in defense and intelligence. However, diversifying into the commercial sector is crucial for long-term sustainability and achieving a trillion-dollar valuation.

- Geographic Diversification: Examining the geographic distribution of Palantir's clients—both government and commercial—highlights the company's reach and potential for further expansion.

- Challenges and Opportunities: Different client types (government vs. commercial) present unique challenges and opportunities. Understanding these nuances is critical for a balanced assessment.

- Long-Term Sustainability: Over-reliance on government contracts can be a vulnerability. Assessing the balance between government and commercial contracts, and the potential for future growth in each sector, is critical.

Conclusion: Palantir's Trillion-Dollar Path – A Realistic Assessment

Whether Palantir achieves a trillion-dollar valuation by 2030 is a complex question. While the company possesses significant technological capabilities and a strong foothold in key markets, numerous factors could hinder its growth. Sustained high revenue growth, increased profitability, successful expansion into new markets, and maintaining a competitive advantage are all vital. The company’s reliance on government contracts also presents a risk factor to consider. A realistic assessment necessitates careful consideration of these factors.

Call to Action: Stay informed on Palantir's progress and the evolving data analytics landscape to make informed decisions about Palantir stock and its potential as a future trillion-dollar company. Further research into Palantir's financial performance, competitive positioning, and technological innovations will be crucial for any potential investor.

Featured Posts

-

The Trump Tariff Debate A Fox News Hosts Financial Counterpoint

May 09, 2025

The Trump Tariff Debate A Fox News Hosts Financial Counterpoint

May 09, 2025 -

Changes To Uk Student Visa Policy Focus On Pakistan And Asylum Claims

May 09, 2025

Changes To Uk Student Visa Policy Focus On Pakistan And Asylum Claims

May 09, 2025 -

Increased Security For Mc Cann Family Amidst Stalking Concerns

May 09, 2025

Increased Security For Mc Cann Family Amidst Stalking Concerns

May 09, 2025 -

Hills Stellar Performance Golden Knights Beat Blue Jackets

May 09, 2025

Hills Stellar Performance Golden Knights Beat Blue Jackets

May 09, 2025 -

Wildfire Speculation The Ethics And Implications Of Betting On Natural Disasters

May 09, 2025

Wildfire Speculation The Ethics And Implications Of Betting On Natural Disasters

May 09, 2025