Will Broadcom's VMware Deal Result In A 1,050% Price Hike? AT&T Weighs In

Table of Contents

Analyzing the Potential for a VMware Price Hike Post-Acquisition

Broadcom's Acquisition Strategy and History

Broadcom has a history of significant acquisitions, and understanding its past actions provides valuable insights into its potential approach with VMware. Past acquisitions have often resulted in increased efficiencies and cost-cutting measures, leading to streamlined operations. However, these efficiencies haven't always translated to lower prices for consumers.

- Past Acquisitions: Analyzing Broadcom's previous mergers and acquisitions, including its purchase of CA Technologies and Symantec's enterprise security business, reveals a pattern of integrating acquired companies into its existing portfolio, sometimes leading to price adjustments.

- Stated Intentions: While Broadcom has publicly stated its commitment to VMware's existing customer base, the specifics of its long-term pricing strategy remain unclear. Detailed analysis of their statements to investors and regulatory bodies is crucial.

- Synergies and Cost-Cutting: Potential synergies between Broadcom and VMware are substantial, especially in areas like network infrastructure and cloud computing. However, cost-cutting measures could potentially impact research and development, support services, or even lead to job losses. Keywords: Broadcom acquisitions, merger and acquisition, cost synergies, economies of scale.

VMware's Market Position and Pricing Power

VMware holds a dominant position in the virtualization software market, providing a significant base for potential price increases. Its current pricing strategies and competitive landscape are key indicators of future pricing power.

- Market Share: VMware's substantial market share provides considerable leverage in setting prices. Competitors like Microsoft Azure and Amazon Web Services offer alternative solutions, but VMware's established customer base and ecosystem give it a strong advantage.

- Pricing Strategies: VMware's current pricing models, including licensing fees, subscription services, and support contracts, will likely be a major factor in any price changes following the acquisition. Analyzing their existing pricing strategies will inform predictions for the future.

- Increased Pricing Power: The acquisition could indeed grant Broadcom even greater pricing power, enabling them to raise prices without significantly impacting market share, particularly for its enterprise-grade virtualization solutions. Keywords: VMware market share, virtualization software, cloud computing pricing, competitive advantage.

AT&T's Concerns and Perspective

AT&T's public concerns highlight the potential impact of the merger on major enterprise customers. Their reliance on VMware products makes them particularly vulnerable to significant price hikes.

- AT&T's Statement: AT&T has publicly expressed serious concerns about potential price increases following the Broadcom-VMware merger. A deeper examination of their official statements and communications to regulatory bodies is necessary.

- Reliance on VMware: AT&T, like many large telecom companies, heavily relies on VMware’s virtualization and cloud solutions for its network infrastructure and operations. Any price increases would impact their operational costs significantly.

- Mitigation Strategies: AT&T and other large enterprise customers may explore alternative solutions, negotiate more favorable contracts, or lobby regulators to mitigate the impact of increased VMware pricing. Keywords: AT&T, telecom industry, enterprise customer, cost management, negotiation power.

Factors Influencing Potential Price Increases

Regulatory Scrutiny and Antitrust Concerns

The merger faces considerable regulatory scrutiny, and the outcome of antitrust investigations could significantly impact pricing.

- Antitrust Investigations: Regulatory bodies in various jurisdictions are closely examining the merger for potential anti-competitive practices. The outcome of these investigations will determine whether any limitations will be placed on Broadcom's pricing strategies.

- Regulatory Approval: The approval process itself is likely to involve extensive negotiations and possibly conditions imposed by regulatory bodies, potentially affecting Broadcom's pricing freedom. Keywords: antitrust laws, regulatory approval, competition commission, merger review.

Market Demand and Competitive Alternatives

The elasticity of demand for VMware products, and the availability of alternative solutions, will play a crucial role in determining the extent of any price hikes.

- Elasticity of Demand: The degree to which demand for VMware products changes in response to price changes will significantly affect Broadcom’s pricing decisions. A highly elastic demand might discourage substantial price increases.

- Competitive Alternatives: The availability of competing virtualization and cloud computing platforms will limit Broadcom's ability to significantly raise prices without losing market share. Keywords: market competition, alternative solutions, price elasticity, substitute products.

Broadcom's Long-Term Strategy and Financial Goals

Broadcom's financial projections and return on investment targets will heavily influence its pricing decisions following the acquisition.

- Financial Projections: Broadcom's financial models will likely factor in projected revenue increases from potential price hikes, alongside operational efficiencies.

- Return on Investment: Broadcom will strive to maximize its return on investment from the VMware acquisition, and this could translate into strategic pricing adjustments to achieve their financial goals. Keywords: financial performance, ROI, shareholder value, long-term strategy.

Conclusion: The Future of VMware Pricing After the Broadcom Deal

While a 1050% price hike seems highly unlikely, the Broadcom-VMware merger undoubtedly presents a significant risk of price increases for enterprise software. AT&T's concerns are a valid reflection of the potential impact on major customers and the broader industry. The final price adjustments will depend on a complex interplay of factors, including regulatory scrutiny, market competition, and Broadcom's long-term financial strategy. A more realistic scenario may involve smaller, yet still substantial, price hikes on specific VMware products and services. To stay informed about the latest developments regarding the Broadcom VMware deal and its potential impact on your pricing, subscribe to our newsletter! Follow us for ongoing analysis of the Broadcom VMware acquisition and its effect on the price of virtualization software!

Featured Posts

-

Carlos Alcarazs Monte Carlo Masters Triumph First Title After Musetti Victory

May 30, 2025

Carlos Alcarazs Monte Carlo Masters Triumph First Title After Musetti Victory

May 30, 2025 -

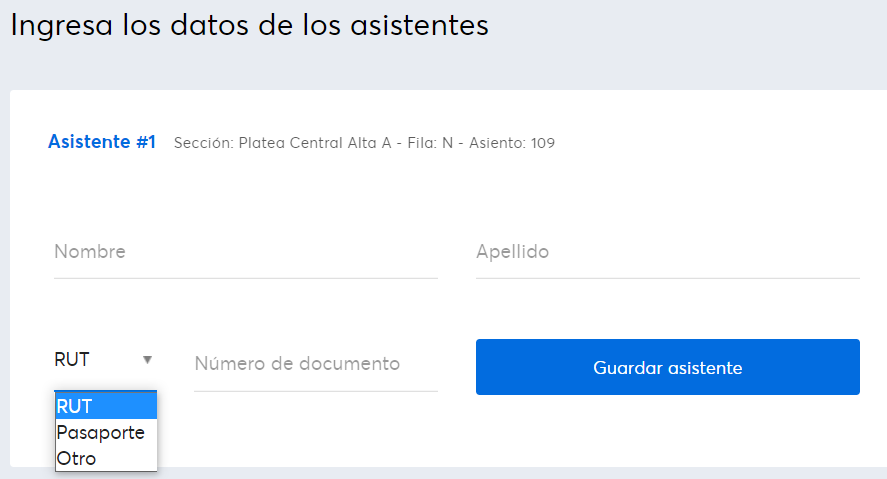

Virtual Venue De Ticketmaster Compra De Entradas Reimaginada

May 30, 2025

Virtual Venue De Ticketmaster Compra De Entradas Reimaginada

May 30, 2025 -

Jyrw Iytalya Dyl Twrw Yktb Altarykh Llmksyk Akhbar Jrydt Alryad

May 30, 2025

Jyrw Iytalya Dyl Twrw Yktb Altarykh Llmksyk Akhbar Jrydt Alryad

May 30, 2025 -

Jacob Alon A Rising Star To Watch

May 30, 2025

Jacob Alon A Rising Star To Watch

May 30, 2025 -

Andre Agassi Revenirea Surprinzatoare In Pickleball

May 30, 2025

Andre Agassi Revenirea Surprinzatoare In Pickleball

May 30, 2025