Will BigBear.ai (BBAI) Skyrocket? A Penny Stock Investment Analysis.

Table of Contents

BigBear.ai (BBAI) is a technology company specializing in artificial intelligence (AI) and big data solutions. They primarily serve government and commercial clients, offering advanced analytics and decision support tools. While holding a notable position in the burgeoning AI sector, BBAI operates in a highly competitive market, making its future trajectory a subject of intense speculation. This analysis aims to provide a comprehensive overview, enabling informed decision-making.

BigBear.ai (BBAI) Business Model and Growth Potential

BigBear.ai's business model centers around providing cutting-edge AI and big data solutions to a diverse clientele. Understanding its revenue streams and competitive landscape is key to evaluating its growth potential.

Revenue Streams and Contracts

BBAI's revenue is primarily derived from government contracts and, increasingly, commercial partnerships. Securing large-scale government contracts is crucial for their financial stability and growth. Recent contract wins and losses significantly impact their overall performance and investor sentiment.

- Significant Contract Wins: While specific details often remain confidential due to national security concerns, publicly available information often highlights significant contract wins in areas such as national security, intelligence, and defense.

- Government Contracts: The majority of BBAI's revenue comes from government contracts, creating a dependence on government spending and procurement cycles. Monitoring shifts in government priorities is vital for assessing future revenue potential.

- Commercial Partnerships: Expanding into the commercial sector diversifies revenue streams and reduces reliance on government contracts. Success in securing commercial contracts will be a major indicator of BBAI's long-term viability and growth. This is an area to watch closely for revenue growth.

Competitive Landscape and Market Share

The AI and big data market is fiercely competitive, with established players and numerous emerging startups vying for market share. BBAI faces competition from both large multinational corporations and smaller, specialized firms.

- Key Competitors: BBAI competes against giants such as Palantir Technologies, as well as numerous smaller companies specializing in niche areas of AI and big data.

- Market Share: Determining BBAI's precise market share is difficult due to the competitive nature of the industry and the confidential nature of some contracts. However, tracking their growth rate compared to competitors offers valuable insights.

- Competitive Advantage: BBAI's competitive advantage lies in its specialized expertise in certain AI and big data applications, particularly within the government sector. Maintaining technological innovation is crucial to preserving this advantage.

Technological Innovation and Future Outlook

BBAI's future growth hinges on its ability to innovate and adapt to the rapidly evolving AI landscape. Investment in R&D and the development of proprietary technologies are key to maintaining a competitive edge.

- AI Technology: BBAI leverages advanced AI technologies like machine learning and natural language processing. Continued investment in these areas is essential for staying competitive.

- Big Data Analytics: Their expertise in big data analytics allows them to process and interpret vast datasets, providing valuable insights for their clients. The demand for such services is growing rapidly.

- Future Growth: BBAI's future growth depends on its ability to secure new contracts, expand into new markets, and develop innovative AI solutions. Technological innovation will play a crucial role in this future growth.

Financial Performance and Valuation

Analyzing BBAI's financial performance and valuation provides critical insights into the company's financial health and potential for future growth.

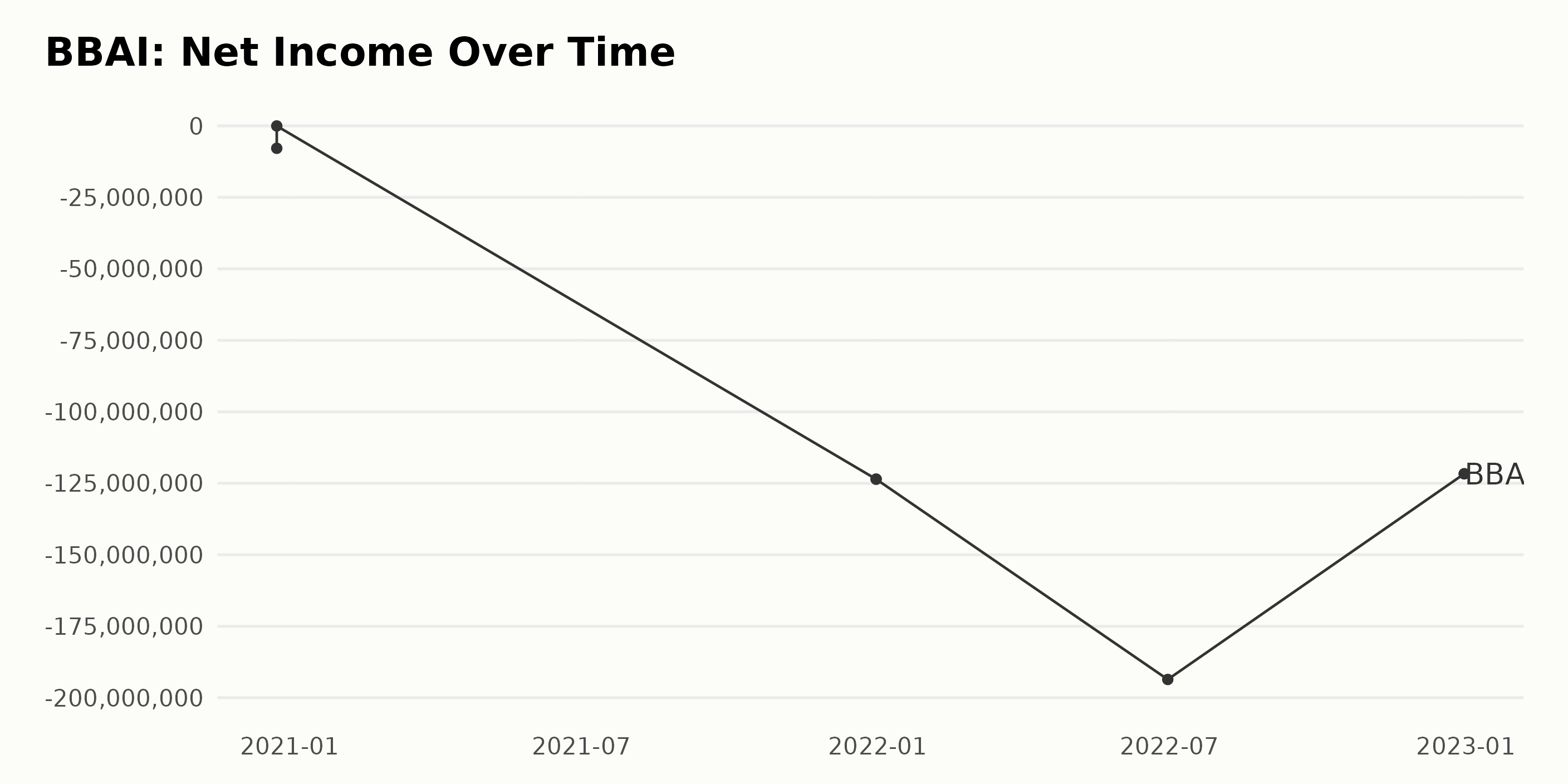

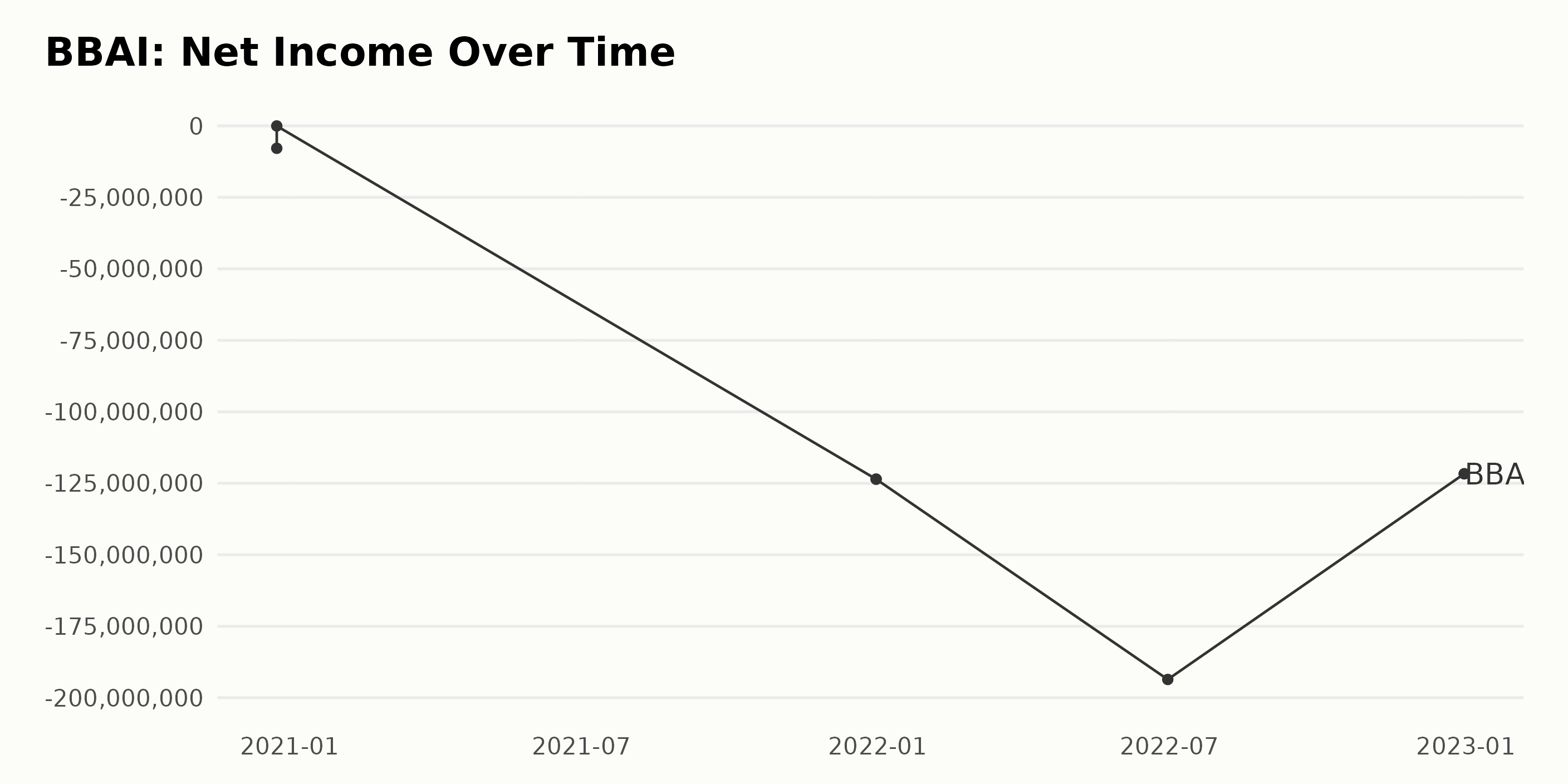

Recent Financial Results

Reviewing BBAI's recent financial statements, including revenue, earnings, debt, and cash flow, is crucial to assessing its financial performance.

- Revenue Growth: The consistent growth (or lack thereof) in revenue provides a key metric for assessing the company’s success in acquiring and delivering on contracts.

- Profitability: The company's ability to generate profits is critical. Analyzing profit margins and earnings per share (EPS) reveals its efficiency and operational success.

- Earnings Per Share (EPS): EPS trends indicate the company's profitability on a per-share basis, providing investors with a measure of return.

Valuation Metrics

Several valuation metrics help assess whether BBAI is currently undervalued or overvalued compared to its peers.

- P/E Ratio: The price-to-earnings ratio provides a measure of how much investors are willing to pay for each dollar of earnings. A high P/E ratio may suggest overvaluation.

- Price-to-Sales Ratio: This ratio compares the company's market capitalization to its revenue. It's useful for valuing companies that are not yet profitable.

- Market Capitalization: Market cap reflects the total value of all outstanding shares, offering a general overview of company size and valuation.

Debt and Liquidity

A company's debt levels and liquidity significantly influence its financial stability and ability to navigate economic downturns.

- Debt Levels: High debt levels can be a cause for concern, particularly for a company with volatile revenue streams.

- Liquidity Ratios: Liquidity ratios measure a company's ability to meet its short-term obligations. Healthy liquidity is essential for financial stability.

Risks and Challenges

Investing in BBAI, or any penny stock, involves substantial risks. Understanding these risks is crucial before making any investment decisions.

Market Volatility and Penny Stock Risks

Penny stocks are known for their high volatility. BBAI's share price can fluctuate dramatically in short periods, leading to significant potential losses.

- High Volatility: Rapid price swings in BBAI shares pose a substantial risk to investors. News events, market sentiment, and financial results can all lead to dramatic price changes.

- Liquidity Risk: The limited trading volume in penny stocks can make it challenging to buy or sell shares quickly, potentially leading to losses.

Competition and Industry Challenges

BBAI faces various challenges, including intense competition, technological disruptions, and economic downturns.

- Competitive Threats: New entrants and established players continually pressure BBAI, demanding constant innovation to maintain a competitive edge.

- Technological Disruptions: Rapid advancements in AI and big data could render BBAI's current technology obsolete.

- Economic Uncertainty: Economic downturns can significantly impact government spending, affecting BBAI's revenue from government contracts.

Conclusion: Will BigBear.ai (BBAI) Soar? A Final Verdict on This Penny Stock

BigBear.ai (BBAI) presents a compelling investment opportunity within the rapidly expanding AI and big data sectors. Its focus on government contracts provides a strong foundation, but reliance on this sector also carries inherent risks. The company's growth potential hinges on securing new contracts, successfully expanding into the commercial market, and continuing to innovate within a fiercely competitive landscape. While the potential for BBAI to skyrocket exists, this potential is interwoven with the significant volatility inherent in penny stocks. Therefore, caution is advised.

The analysis reveals that while BBAI has growth potential, its valuation, financial stability, and competitive position warrant careful consideration. The substantial risk associated with investing in penny stocks should not be overlooked. While some evidence suggests potential for growth, significant risks are also present.

Call to Action: While the potential for BigBear.ai (BBAI) to skyrocket is present, remember to conduct your own thorough due diligence before investing in this volatile penny stock. Understanding the risks and rewards associated with BBAI is crucial for making informed investment decisions. Analyze the financial statements, understand the competitive landscape, and assess your own risk tolerance before investing in BBAI or any other penny stock.

Featured Posts

-

Sasol Sol 2023 Strategy Update What Investors Need To Know

May 20, 2025

Sasol Sol 2023 Strategy Update What Investors Need To Know

May 20, 2025 -

Baggelis Giakoymakis Mia Analysi Tis Ypothesis Bullying Kai Toy Thanatoy Toy

May 20, 2025

Baggelis Giakoymakis Mia Analysi Tis Ypothesis Bullying Kai Toy Thanatoy Toy

May 20, 2025 -

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025 -

Find The Nyt Mini Crossword Answers For April 13

May 20, 2025

Find The Nyt Mini Crossword Answers For April 13

May 20, 2025 -

Acquista Hercule Poirot Per Ps 5 Meno Di 10 E Su Amazon

May 20, 2025

Acquista Hercule Poirot Per Ps 5 Meno Di 10 E Su Amazon

May 20, 2025

Latest Posts

-

Jail Sentence For Tory Politicians Wife After Southport Migrant Incident

May 21, 2025

Jail Sentence For Tory Politicians Wife After Southport Migrant Incident

May 21, 2025 -

Uk News Tory Politicians Wifes Jail Term Confirmed For Migrant Remarks

May 21, 2025

Uk News Tory Politicians Wifes Jail Term Confirmed For Migrant Remarks

May 21, 2025 -

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 21, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 21, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 21, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 21, 2025 -

Racial Hatred Tweet Update On Ex Tory Councillors Wifes Appeal

May 21, 2025

Racial Hatred Tweet Update On Ex Tory Councillors Wifes Appeal

May 21, 2025