Will A Minority Government Weaken The Canadian Dollar? Expert Insight

Table of Contents

Understanding the Canadian Dollar's Volatility

The CAD, like any currency, is subject to a multitude of influences. Its value fluctuates based on a complex interplay of global economic trends, commodity prices (particularly oil and natural gas, given Canada's resource-based economy), interest rate decisions by the Bank of Canada, and overall investor confidence in the Canadian economy.

- Impact of oil prices on CAD value: Canada is a major oil exporter. Rising oil prices generally strengthen the CAD, while falling prices weaken it.

- Influence of Bank of Canada interest rate decisions: Higher interest rates attract foreign investment, increasing demand for the CAD and thus strengthening its value. Conversely, lower rates can weaken the currency.

- Role of international trade and foreign investment: A strong trade balance and significant foreign investment bolster the CAD's value, reflecting confidence in the Canadian economy.

- Effect of global economic uncertainty: Global economic downturns or geopolitical instability can negatively impact investor sentiment, leading to a weakening of the CAD.

Historically, the CAD has experienced significant fluctuations linked to both economic shocks (e.g., the 2008 financial crisis) and political events (e.g., changes in government or significant policy shifts). Understanding these historical patterns provides valuable context for assessing the potential impact of a minority government.

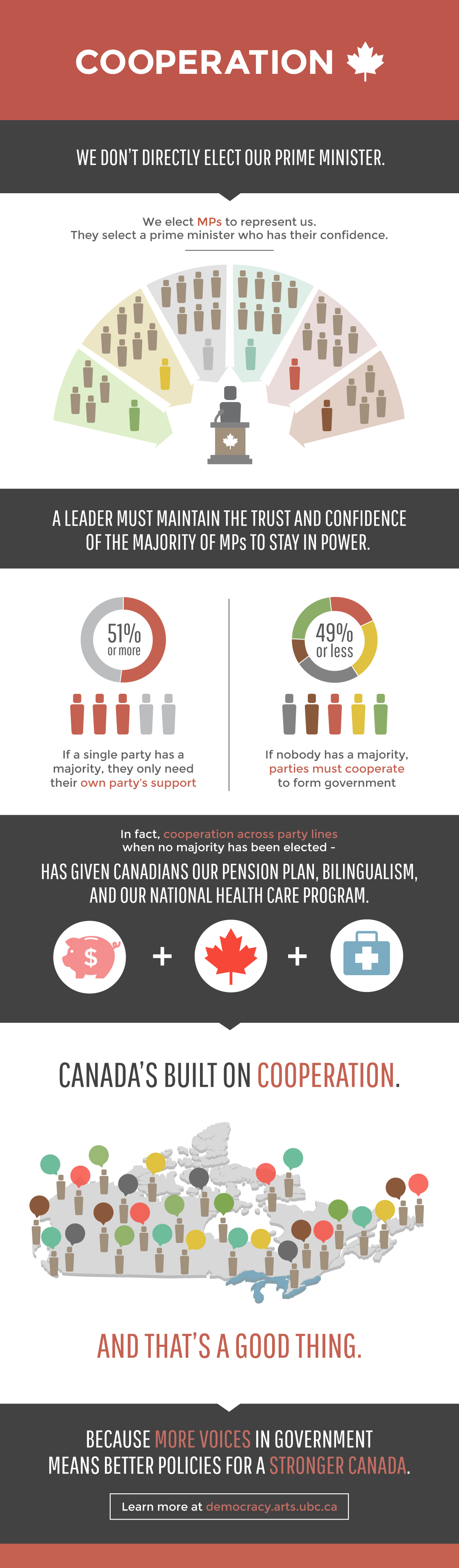

Minority Governments and Economic Policy Uncertainty

Minority governments, by their very nature, are inherently less stable than majority governments. This instability translates into uncertainty regarding economic policy consistency. The need to secure support from other parties for key legislation can lead to delays, compromises, and even the potential collapse of the government, triggering further uncertainty.

- Challenges in passing key economic legislation: Negotiating with opposition parties can significantly slow down the legislative process, delaying crucial economic reforms or fiscal measures.

- Increased political gridlock and slower decision-making: The need for consensus can lead to slower decision-making, hindering the government's ability to respond effectively to economic challenges.

- Potential for conflicting economic priorities among coalition partners: Coalition partners may have differing economic priorities, resulting in policy compromises that may not be optimal for economic growth and stability.

- Impact on business investment and consumer confidence: Uncertainty surrounding economic policy can deter business investment and dampen consumer confidence, potentially impacting economic growth and, in turn, the CAD's value.

Expert Opinions on the Minority Government – CAD Connection

Economists and financial analysts offer varying perspectives on the potential impact of a minority government on the Canadian economy and the CAD. While some believe the impact will be minimal, emphasizing the importance of long-term economic fundamentals, others express concerns about increased short-term volatility.

- Quote from a financial analyst predicting potential short-term volatility: "A minority government could introduce short-term uncertainty into the market, leading to increased volatility in the CAD as investors assess the potential impact on economic policy."

- Quote from an economist emphasizing the importance of long-term economic fundamentals: "While political uncertainty can create short-term market fluctuations, the long-term value of the CAD will ultimately depend on the strength of the Canadian economy and its underlying fundamentals."

- Summary of the range of expert opinions and their supporting arguments: The consensus among experts suggests that while a minority government might increase short-term volatility, the long-term impact on the CAD will depend on broader economic factors and the government's ability to maintain fiscal responsibility and economic stability.

Historical Examples: Minority Governments and the Canadian Dollar

Examining past instances of minority governments in Canada reveals a mixed correlation with CAD fluctuations. While some minority government periods have coincided with periods of CAD weakness, others have seen relative stability. A comprehensive analysis requires considering the broader economic context of each period.

- Case study of a past minority government and its effect on the CAD: [Insert specific example, including data on CAD performance and relevant economic conditions].

- Comparison with periods of majority government and their respective economic performance: [Compare and contrast the economic performance and CAD value during periods of majority versus minority governments].

- Statistical data illustrating CAD performance during minority government periods: [Present relevant statistical data, such as average annual CAD performance during different government types, supported by credible sources].

Conclusion: Will a Minority Government Weaken the Canadian Dollar? A Final Verdict

The potential impact of a minority government on the Canadian dollar is multifaceted and complex. While increased political uncertainty can contribute to short-term volatility in the CAD, the long-term value remains significantly dependent on factors like commodity prices, interest rates, and overall global economic conditions. Expert opinions diverge, with some forecasting short-term fluctuations and others emphasizing the dominance of long-term economic fundamentals. A definitive prediction is impossible; the actual impact will depend on the specific actions and policies of the government and the evolving global economic landscape.

To effectively navigate this uncertainty and understand the potential impacts on your financial decisions, stay informed about the Canadian economy and political landscape. By closely monitoring economic indicators and political developments, you can better assess the potential risks and opportunities related to the "Minority government impact on CAD," the "Canadian dollar forecast under minority government," and "Analyzing the Canadian dollar's stability."

Featured Posts

-

Ia Da Meta Recursos E Comparacao Com O Chat Gpt

May 01, 2025

Ia Da Meta Recursos E Comparacao Com O Chat Gpt

May 01, 2025 -

Davina Mc Calls Brain Tumour Amanda Holdens Reaction

May 01, 2025

Davina Mc Calls Brain Tumour Amanda Holdens Reaction

May 01, 2025 -

Predicting The Eurovision 2025 Winner Top Contenders Revealed

May 01, 2025

Predicting The Eurovision 2025 Winner Top Contenders Revealed

May 01, 2025 -

Dragon Den Unexpected Twist As Entrepreneur Snubs Top Offers

May 01, 2025

Dragon Den Unexpected Twist As Entrepreneur Snubs Top Offers

May 01, 2025 -

Channel 4 And Michael Sheen Face Legal Action Over Documentary

May 01, 2025

Channel 4 And Michael Sheen Face Legal Action Over Documentary

May 01, 2025