Why Uber Stock Might Weather An Economic Downturn

Table of Contents

Uber's Diverse Revenue Streams as a Protective Hedge

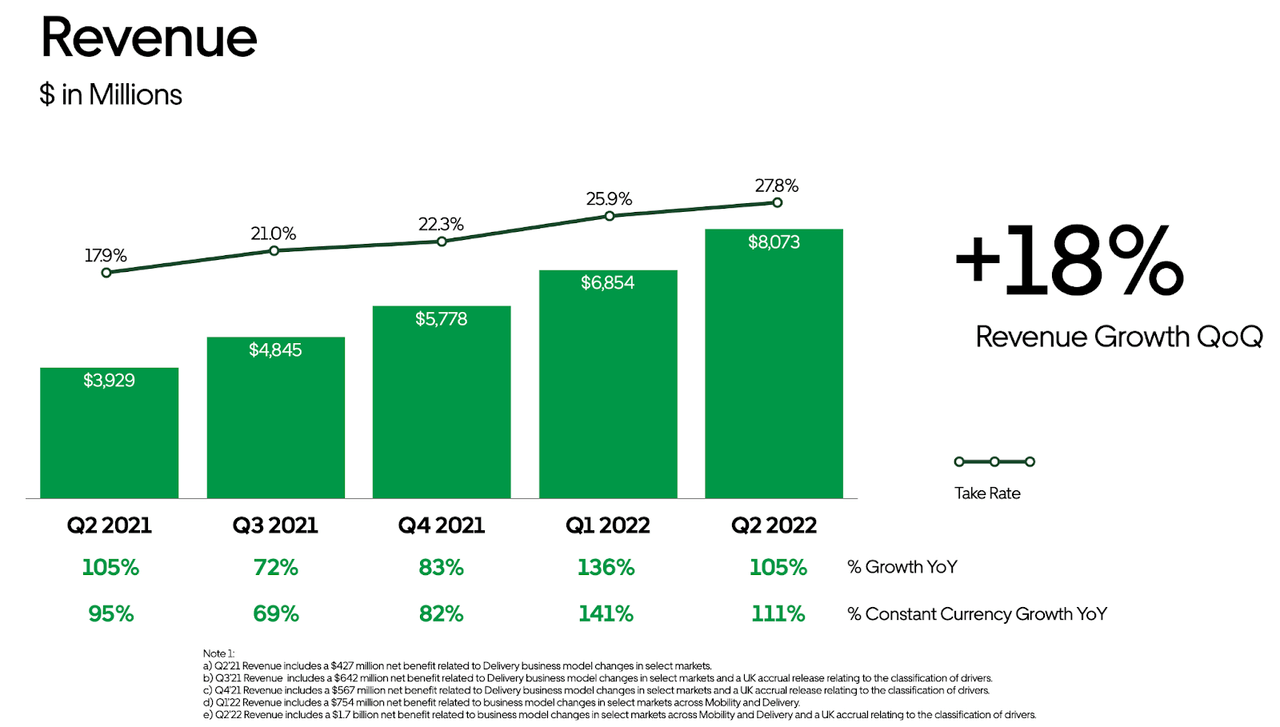

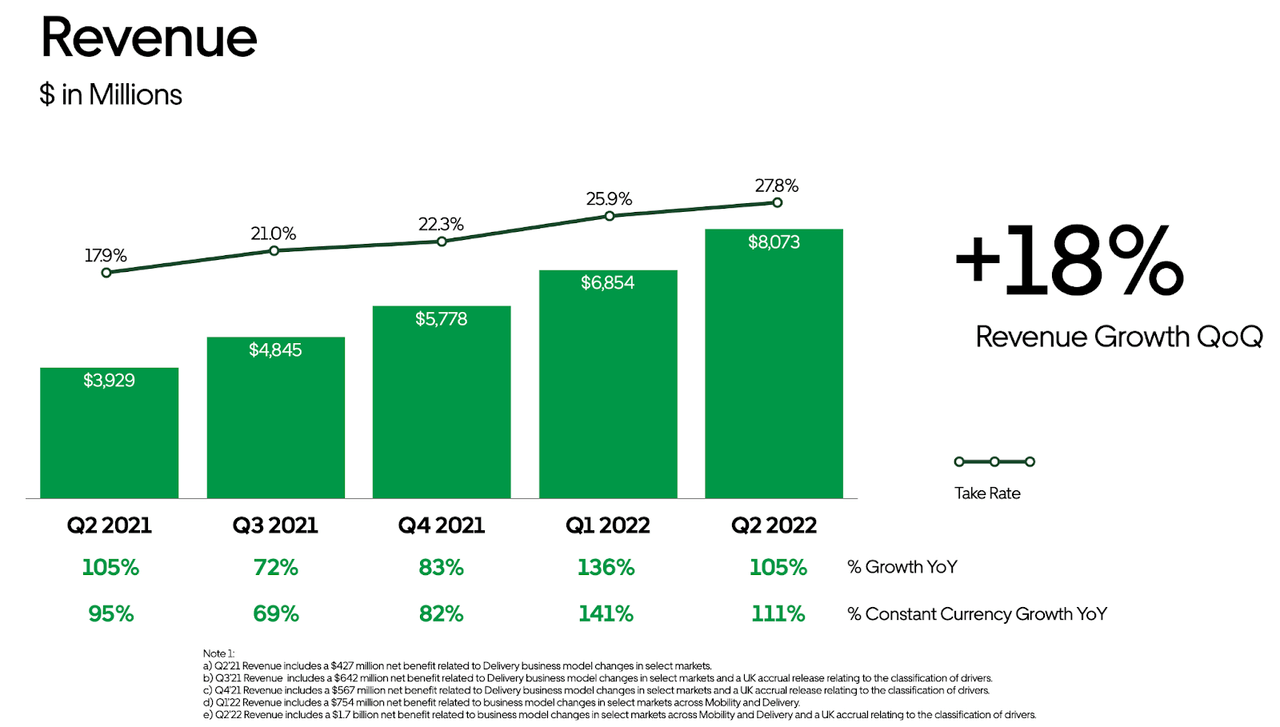

Uber's success isn't solely reliant on its ride-sharing services. Its diversified revenue streams act as a crucial protective hedge against economic downturns. This diversification mitigates risk and ensures a more stable income stream, even when one sector falters.

Ride-Sharing's Recession Resistance

While luxury ride-hailing might decrease during a recession, the core need for transportation remains. Essential trips to work, appointments, and errands will continue, irrespective of economic fluctuations. Uber's adaptability is key here.

- Cost-cutting measures: During previous economic slowdowns, Uber successfully implemented cost-cutting strategies, such as adjusting driver incentives and optimizing operational efficiency.

- Essential vs. luxury: A shift towards essential trips will impact revenue but does not equate to total collapse. Data from past recessions shows that while overall ride volume may decrease, essential trips remain consistent.

- Dynamic pricing: Uber's surge pricing mechanisms adjust to supply and demand, potentially offsetting some revenue losses during periods of reduced demand.

The Strength of Uber Eats and Delivery Services

Uber Eats, Uber's food delivery service, stands to benefit from a shift in consumer spending habits during a recession. People may cut back on expensive restaurant meals, but the convenience of home food delivery often persists.

- Increased demand: Historically, food delivery services see a surge in demand during economic slowdowns as consumers seek affordable and convenient meal options.

- Market share: Uber Eats maintains a significant market share in many regions, giving it a strong competitive advantage in the growing food delivery market.

- Pricing strategies: Uber Eats can adjust its pricing and promotional offers to attract budget-conscious consumers during a downturn.

Freight and Logistics as a Recession-Resistant Sector

Uber Freight, Uber's freight and logistics division, plays a vital role in the supply chain, a sector that remains relatively resilient during economic fluctuations. The consistent need for goods transportation ensures a relatively stable income stream.

- Growth potential: This division presents significant growth potential, especially with the increasing demand for efficient and reliable logistics solutions.

- Revenue diversification: Uber Freight contributes increasingly to Uber's overall revenue, further diversifying its income streams and reducing its reliance on ride-sharing alone.

- Reduced reliance on discretionary spending: Unlike ride-sharing, freight and logistics services are largely driven by essential business needs.

Cost-Cutting Measures and Operational Efficiency

Uber has consistently demonstrated an ability to adapt to economic challenges. Its history of implementing cost-cutting measures and improving operational efficiency positions it favorably to navigate future downturns.

Uber's History of Adapting to Economic Changes

Uber has a track record of successfully navigating past economic challenges. Its experience in streamlining operations and reducing costs is a significant asset.

- Past cost-cutting initiatives: Previous rounds of layoffs and restructuring have demonstrated Uber's commitment to maintaining profitability during tough times.

- Improved efficiency: Uber's continuous efforts to improve operational efficiency through technology and automation have enhanced its ability to weather economic storms.

- Successful restructuring: Past restructuring efforts have resulted in a leaner, more efficient organization capable of adjusting quickly to changing economic conditions.

Potential for Further Cost Optimization

There is further scope for cost reduction. Proactive cost management will be crucial in mitigating the impact of a potential recession.

- Marketing expense optimization: Refining marketing strategies and prioritizing high-return campaigns can significantly reduce marketing costs.

- Driver incentive adjustments: Optimizing driver incentives without compromising service quality is key to cost efficiency.

- Automation and technology: Continued investment in automation and technology can further streamline operations and reduce labor costs.

Long-Term Growth Potential and Market Position

Uber's strong market position, global reach, and focus on technological innovation provide a robust foundation for long-term growth, even during periods of economic uncertainty.

Uber's Expanding Market Share and Global Reach

Uber continues to expand its market share globally and penetrate new markets, demonstrating its adaptability and growth potential.

- Global market share: Uber holds significant market share in ride-sharing and food delivery in many countries, providing a strong base for continued growth.

- Ongoing expansion: Uber's continued expansion into new geographical regions offers opportunities for growth and revenue diversification.

- Untapped potential: Numerous underserved markets globally present opportunities for further expansion and market penetration.

Technological Innovation and Future Opportunities

Uber's investments in technological advancements, particularly in autonomous vehicles, open up exciting future opportunities for revenue growth and efficiency gains.

- Autonomous vehicle technology: This is a game-changer with the potential to significantly reduce operational costs and improve efficiency.

- New revenue streams: Technological innovation can lead to the creation of new revenue streams and services, further strengthening Uber's resilience.

- Strategic partnerships and acquisitions: Partnerships and acquisitions of innovative companies can accelerate growth and expand Uber's offerings.

Conclusion

In conclusion, while economic downturns pose a risk to all businesses, Uber's diversified revenue streams, proven cost-cutting capabilities, and robust long-term growth potential suggest that Uber stock may be better positioned than many other companies to weather the storm. Its adaptability, combined with its expansion into new markets and technological innovation, makes it a compelling investment option for those seeking resilience in uncertain times. Consider adding Uber stock to your portfolio as part of a diversified strategy. Research Uber's resilience and learn more about investing in Uber stock during economic uncertainty.

Featured Posts

-

Uber Stock Soars Understanding Aprils Double Digit Gains

May 17, 2025

Uber Stock Soars Understanding Aprils Double Digit Gains

May 17, 2025 -

Toronto Tempo Wnba Team Recent Announcements And Future Prospects

May 17, 2025

Toronto Tempo Wnba Team Recent Announcements And Future Prospects

May 17, 2025 -

Giants Vs Mariners Series Injured List Update April 4 6

May 17, 2025

Giants Vs Mariners Series Injured List Update April 4 6

May 17, 2025 -

Pga Championship Opening Round Unexpected Leader Struggling Favorites

May 17, 2025

Pga Championship Opening Round Unexpected Leader Struggling Favorites

May 17, 2025 -

Prestamos Estudiantiles Impagos El Departamento De Educacion Actua

May 17, 2025

Prestamos Estudiantiles Impagos El Departamento De Educacion Actua

May 17, 2025

Latest Posts

-

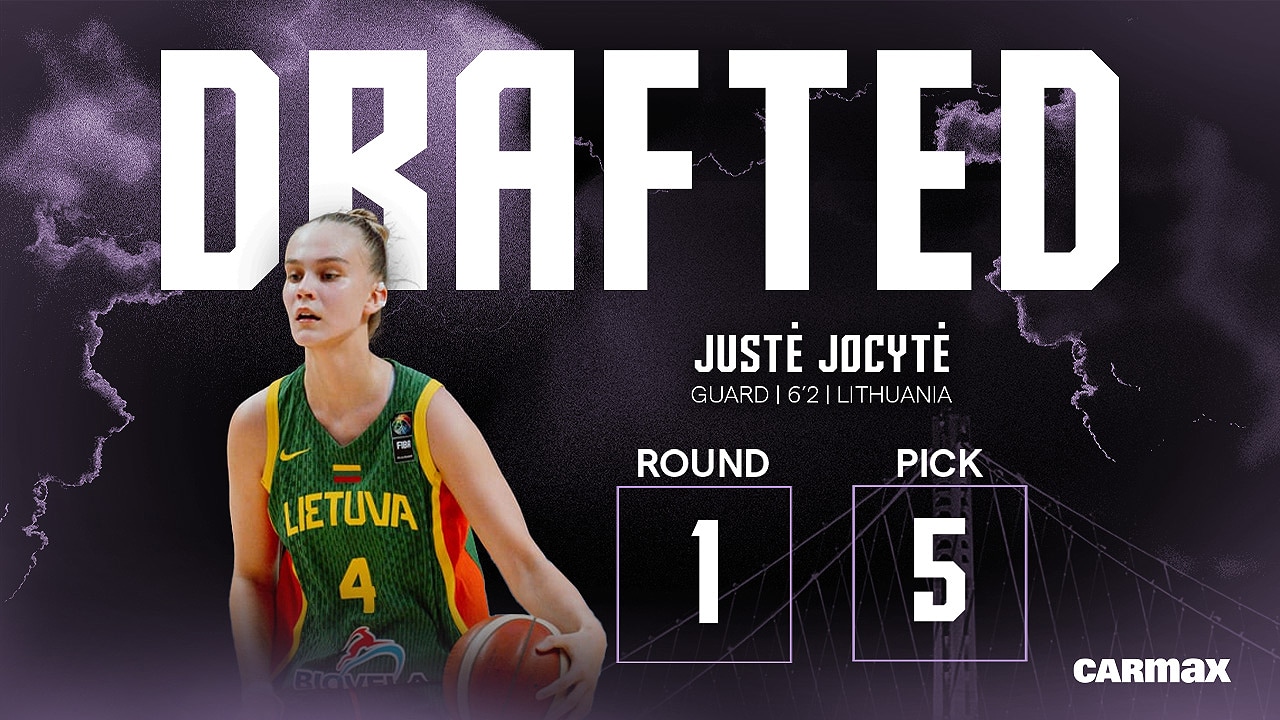

Juste Jocyte Palieka Vilerna Karjeros Etapo Pabaiga

May 17, 2025

Juste Jocyte Palieka Vilerna Karjeros Etapo Pabaiga

May 17, 2025 -

2025 Indiana Fever Preseason How To Watch Caitlin Clark

May 17, 2025

2025 Indiana Fever Preseason How To Watch Caitlin Clark

May 17, 2025 -

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaiga

May 17, 2025

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaiga

May 17, 2025 -

Indiana Fever Preseason Games Caitlin Clark And The 2025 Season

May 17, 2025

Indiana Fever Preseason Games Caitlin Clark And The 2025 Season

May 17, 2025 -

Indiana Fever Preseason Schedule 2025 Watch Caitlin Clarks Wnba Debut

May 17, 2025

Indiana Fever Preseason Schedule 2025 Watch Caitlin Clarks Wnba Debut

May 17, 2025