Why This AI Quantum Computing Stock Is A Buy On The Dip

Table of Contents

The Undervalued Potential of AI Quantum Computing

The convergence of artificial intelligence and quantum computing represents a technological leap with transformative potential across numerous sectors. This synergy promises to unlock unprecedented computational power, leading to breakthroughs previously deemed impossible.

Disruptive Technological Advancements

The marriage of AI and quantum computing is poised to revolutionize various industries. AI algorithms can leverage the immense processing power of quantum computers to solve complex problems far beyond the capabilities of classical computers. This opens doors to innovations in:

- Drug Discovery: Accelerated drug development through the simulation of molecular interactions, leading to faster and more effective treatments for diseases.

- Materials Science: Design of novel materials with superior properties for various applications, such as stronger and lighter construction materials or more efficient energy storage solutions.

- Financial Modeling: Development of more sophisticated and accurate financial models for risk management, portfolio optimization, and fraud detection.

These are just a few examples; the potential applications of AI quantum computing are virtually limitless. Breakthroughs in quantum supremacy – achieving computational tasks beyond the reach of even the most powerful classical computers – are becoming increasingly frequent, signaling the dawn of a new era in computing. The resulting advancements in AI quantum computing applications will drive significant market expansion.

Long-Term Growth Prospects

The long-term growth prospects for the AI quantum computing market are exceptionally promising. Industry analysts predict exponential growth over the next decade.

- Market Size Projections: Reports forecast a multi-billion dollar market within the next 10 years, with some estimates exceeding tens of billions.

- Growth Rate Estimates: The market is expected to experience a compound annual growth rate (CAGR) significantly exceeding the average for other technology sectors.

- Key Market Drivers: Factors driving this growth include increased investment in R&D, the development of more powerful quantum computers, and the growing awareness of the technology's potential across various industries. The future of quantum computing looks bright, creating a strong foundation for long-term investment.

Why This Specific AI Quantum Computing Stock is a Strong Buy

While the potential of AI quantum computing is undeniable, the specific company highlighted here stands out due to several key factors that make it a strong buy.

Strong Fundamentals

This AI quantum computing company boasts robust financial health and a promising trajectory.

- Key Financial Metrics: The company demonstrates consistent revenue growth, improving profitability margins, and manageable debt levels.

- Comparisons to Competitors: Compared to its competitors, this company shows superior financial performance and faster growth rates.

- Positive Financial Indicators: Several key financial indicators point towards a positive outlook, suggesting sustainable growth and profitability. These factors contribute to a strong stock valuation.

Competitive Advantages

Several factors differentiate this company from its rivals within the competitive landscape of the quantum computing market.

- Proprietary Technology: The company possesses groundbreaking patented technology that provides a significant competitive edge in the development and deployment of AI quantum computing solutions.

- Strong Management Team: The company's leadership comprises seasoned professionals with extensive experience in quantum computing, AI, and business management.

- Strategic Partnerships: It has forged strategic alliances with key players in the industry, securing access to resources and expanding its market reach. This technological innovation is setting the company up for market leadership.

Current Market Dip – A Buying Opportunity

The recent dip in the stock price presents a compelling opportunity for investors. This correction is primarily driven by temporary market factors rather than any fundamental weaknesses in the company itself.

- Market Sentiment Analysis: The current negative market sentiment is largely unwarranted, given the company’s strong fundamentals and future potential.

- Temporary Factors Impacting the Stock Price: The drop appears to be a result of broader market fluctuations and temporary concerns unrelated to the company's performance.

- Undervalued Potential: The current stock price significantly undervalues the company's long-term growth potential, making it a prime example of a buy the dip strategy.

Mitigating Investment Risks

While this AI quantum computing stock offers considerable potential, it's crucial to acknowledge potential risks associated with investing in this emerging technology.

Understanding the Risks

Investing in a rapidly evolving sector like AI quantum computing comes with inherent risks.

- Technological Hurdles: Further development and refinement of the technology are required before widespread adoption can occur.

- Regulatory Uncertainty: The regulatory landscape surrounding quantum computing is still developing and may introduce uncertainties.

- Competition: The market is becoming increasingly competitive, potentially impacting the company’s market share. Thorough due diligence and risk assessment are essential.

Diversification and Risk Management Strategies

Investors can mitigate these risks through effective strategies.

- Portfolio Diversification: Diversifying your investment portfolio across different asset classes can help reduce overall risk exposure.

- Investment Strategies: Employing strategies like dollar-cost averaging can help to reduce the impact of short-term market fluctuations.

- Risk Tolerance: Ensure that your investment aligns with your individual risk tolerance and long-term financial goals. Effective risk mitigation is critical.

Conclusion

This AI quantum computing stock presents a compelling investment opportunity. Its strong fundamentals, competitive advantages, and the current market dip combine to create a unique buying opportunity. The long-term growth potential within the burgeoning AI quantum computing market is substantial, promising significant returns for long-term investors. Don't miss out on this chance to capitalize on this revolutionary sector. Research this AI quantum computing stock further and consider adding it to your portfolio as a long-term investment. This might be your chance to buy the dip and secure significant gains in this revolutionary sector.

Featured Posts

-

Novost Dzhennifer Lourens Rodila Vtorogo Malysha

May 20, 2025

Novost Dzhennifer Lourens Rodila Vtorogo Malysha

May 20, 2025 -

Nyt Mini Crossword Solutions March 18

May 20, 2025

Nyt Mini Crossword Solutions March 18

May 20, 2025 -

Abidjan Accueille L Ivoire Tech Forum 2025 Transformation Numerique Et Innovation

May 20, 2025

Abidjan Accueille L Ivoire Tech Forum 2025 Transformation Numerique Et Innovation

May 20, 2025 -

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 20, 2025

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 20, 2025 -

Cote D Ivoire Le Diletta Geant Maritime Arrive Au Port D Abidjan

May 20, 2025

Cote D Ivoire Le Diletta Geant Maritime Arrive Au Port D Abidjan

May 20, 2025

Latest Posts

-

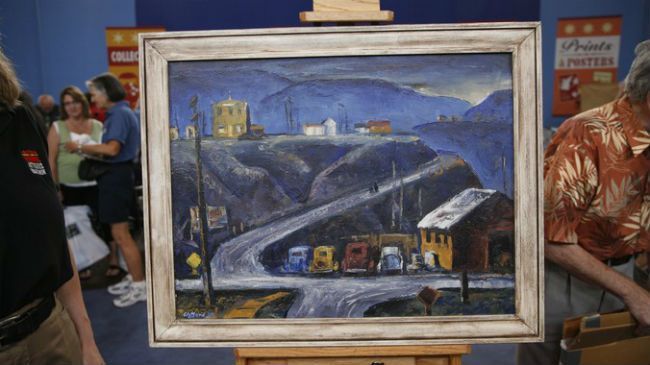

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025 -

Bbc Antiques Roadshow Us Couple Arrested In Uk After Episode Appearance

May 21, 2025

Bbc Antiques Roadshow Us Couple Arrested In Uk After Episode Appearance

May 21, 2025 -

Bbc Breakfast Guests Unexpected Live Broadcast Interruption

May 21, 2025

Bbc Breakfast Guests Unexpected Live Broadcast Interruption

May 21, 2025 -

Record Breaking Run Fastest Crossing Of Australia On Foot

May 21, 2025

Record Breaking Run Fastest Crossing Of Australia On Foot

May 21, 2025 -

Unexpected Interruption Bbc Breakfast Guest Disrupts Live Show

May 21, 2025

Unexpected Interruption Bbc Breakfast Guest Disrupts Live Show

May 21, 2025