Why The Powell Fed Is Hesitant: Interest Rate Cuts, Trump's Pressure, And Economic Risks

Table of Contents

The Inflationary Threat: A Key Reason for Hesitation

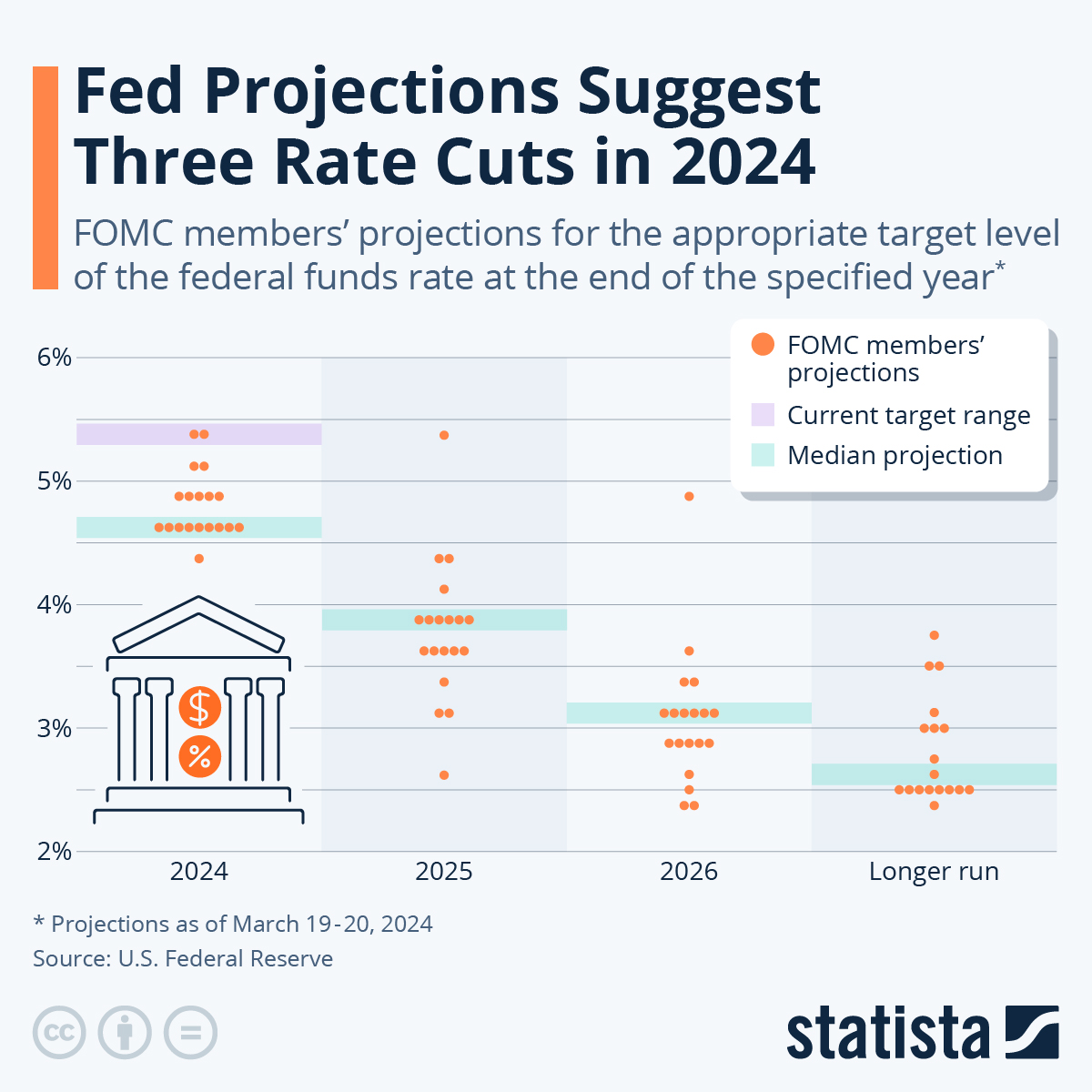

The Powell Fed's reluctance to aggressively cut interest rates stems significantly from persistent inflationary pressures. The current inflation rate remains above the Fed's target of 2%, a situation that demands careful consideration before implementing stimulative monetary policy.

Persistent Inflation: A Stubborn Problem

- Rising energy prices: Fluctuations in global energy markets continue to exert upward pressure on inflation, impacting consumer costs across the board.

- Supply chain disruptions: Lingering supply chain issues contribute to higher prices for various goods, further fueling inflation.

- Strong consumer demand: Robust consumer spending, while positive for economic growth, also puts upward pressure on prices.

Aggressive interest rate cuts risk exacerbating this already elevated inflation. Lower interest rates could stimulate further demand, leading to a wage-price spiral and undermining the Fed's long-term goal of price stability. This could ultimately lead to higher inflation and erode purchasing power, making it crucial to proceed cautiously with interest rate cuts.

Wage Growth and Inflationary Expectations: A Vicious Cycle?

The relationship between wage growth and inflation is complex and highly relevant to the Powell Fed's deliberations.

- Rapid wage growth: Strong wage growth, while beneficial for workers, can contribute to inflationary pressures if businesses pass increased labor costs onto consumers in the form of higher prices.

- Consumer spending fueled by wage increases: Higher wages boost consumer spending, further contributing to demand-pull inflation.

The Fed must carefully analyze the interplay between wage growth and inflation to avoid a scenario where rising wages lead to higher prices, which then necessitate further wage increases, creating a self-perpetuating cycle. The Powell Fed's actions significantly influence inflationary expectations among consumers and businesses. If the public anticipates rising inflation, they may adjust their behavior accordingly, potentially leading to a self-fulfilling prophecy.

Trump's Pressure and the Importance of Independence

The Powell Fed has faced considerable political pressure, particularly during the Trump administration. This pressure highlights the critical importance of maintaining the Fed's independence from political influence.

Past Criticism and Political Interference: A Threat to Central Bank Autonomy

- Public criticism of interest rate hikes: Former President Trump frequently criticized the Fed for raising interest rates, arguing that it hampered economic growth.

- Calls for lower interest rates: Trump repeatedly urged the Fed to lower interest rates to boost the economy, irrespective of underlying economic conditions.

These instances underscore the risk of political interference in monetary policy decision-making. The Fed's independence is essential for its ability to make objective, evidence-based decisions based on economic data and not political expediency. Compromising this independence risks undermining the credibility and effectiveness of the Fed's actions.

Balancing Political Pressure and Economic Realities: A Tightrope Walk

The Powell Fed faces the challenging task of navigating political pressure while prioritizing long-term economic stability.

- Potential for short-term gains, long-term pain: Succumbing to pressure for immediate interest rate cuts might provide short-term economic boosts, but could ultimately lead to higher inflation and greater instability down the line.

- Maintaining credibility: The Fed's credibility rests on its ability to make decisions based on sound economic principles, not political considerations. Compromising this credibility could have significant long-term consequences.

The Powell Fed must prioritize evidence-based decision-making in monetary policy. This involves analyzing comprehensive economic data, considering various scenarios, and making informed judgments based on the overall economic outlook.

Assessing Economic Risks and Potential Recessions

The Powell Fed's hesitancy also stems from a cautious assessment of current economic risks and the potential for a recession.

The Current Economic Outlook: Navigating Uncertainty

- GDP growth slowdown: Recent economic indicators suggest a potential slowdown in GDP growth, raising concerns about the overall health of the economy.

- Unemployment rate: While the unemployment rate remains relatively low, it is a key indicator that needs monitoring, especially given its potential link to inflation.

The Fed must carefully analyze these indicators to assess the overall health of the economy and anticipate potential shifts. The scenario of a "soft landing," where inflation cools without a significant economic downturn, is desirable, but uncertain. Conversely, a recessionary scenario remains a possibility.

The Risks of Premature Rate Cuts: Avoiding Unintended Consequences

- Fueling inflation: Premature or excessive interest rate cuts could inadvertently fuel inflation, negating the intended stimulative effects and creating a more challenging situation to manage.

- Asset bubbles: Low interest rates can inflate asset bubbles, which can eventually burst, leading to instability and economic disruption.

Past instances demonstrate that premature interest rate cuts can have unintended negative consequences. The Powell Fed must carefully weigh the potential benefits of stimulating short-term growth against the risks of exacerbating long-term challenges like inflation and asset bubbles. The trade-offs involved are complex and demand a cautious and data-driven approach.

Conclusion

The Powell Fed's hesitation regarding interest rate cuts is driven by a confluence of factors: persistent inflationary pressures, the legacy of political pressure from the Trump administration, and the assessment of potential economic downturns. The complexities of managing monetary policy, balancing short-term political pressures with long-term economic stability, and navigating the uncertainties of a volatile global economy are significant. The key takeaway is that the Fed's decisions necessitate a careful balancing act, avoiding the pitfalls of premature rate cuts.

Understanding the complexities surrounding the Powell Fed's decisions on interest rate cuts is critical for navigating the current economic climate. Stay informed about the latest developments and the Fed's ongoing response to economic risks. [Link to Federal Reserve Website]

Featured Posts

-

Il Nuovo Conclave I Cardinali Scelti Da Papa Francesco E La Rappresentanza Del Sud Del Mondo

May 07, 2025

Il Nuovo Conclave I Cardinali Scelti Da Papa Francesco E La Rappresentanza Del Sud Del Mondo

May 07, 2025 -

Commerce Advisor Highlights Governments Focus On Smooth Ldc Graduation

May 07, 2025

Commerce Advisor Highlights Governments Focus On Smooth Ldc Graduation

May 07, 2025 -

Close Game Warriors Win Lead Rockets 3 1 In Series

May 07, 2025

Close Game Warriors Win Lead Rockets 3 1 In Series

May 07, 2025 -

Mlb Betting Tigers Vs Mariners Prediction And Best Odds

May 07, 2025

Mlb Betting Tigers Vs Mariners Prediction And Best Odds

May 07, 2025 -

Competira Simone Biles En Los Angeles 2028 Sus Dudas Al Respecto

May 07, 2025

Competira Simone Biles En Los Angeles 2028 Sus Dudas Al Respecto

May 07, 2025

Latest Posts

-

Mitchells Prediction Cavs Rookie Finds Car Filled With Popcorn

May 07, 2025

Mitchells Prediction Cavs Rookie Finds Car Filled With Popcorn

May 07, 2025 -

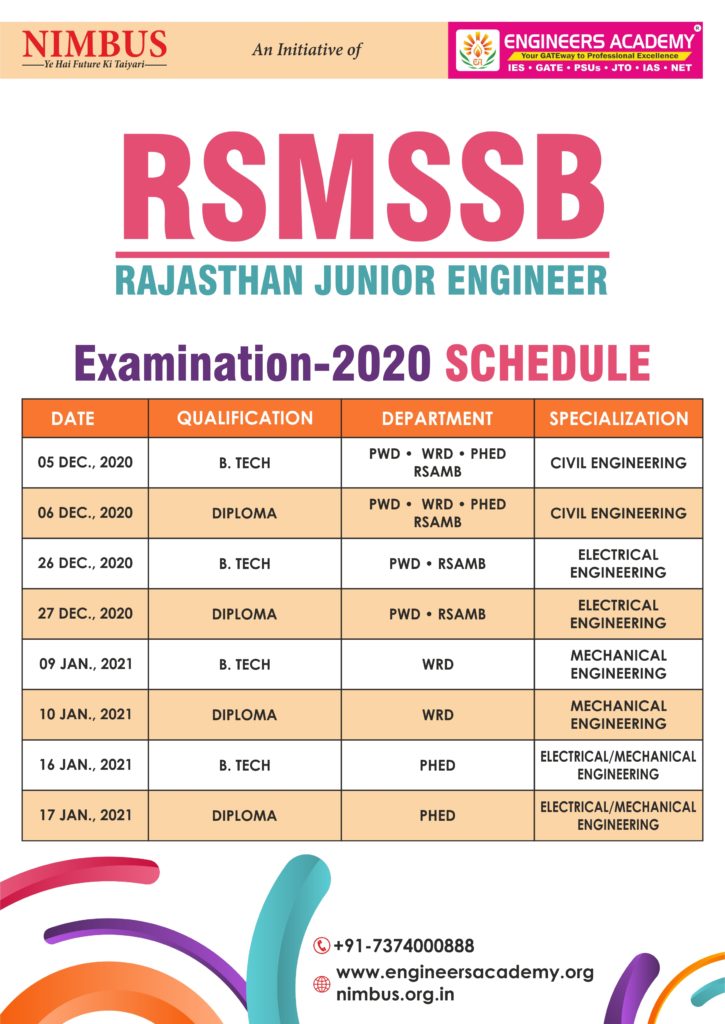

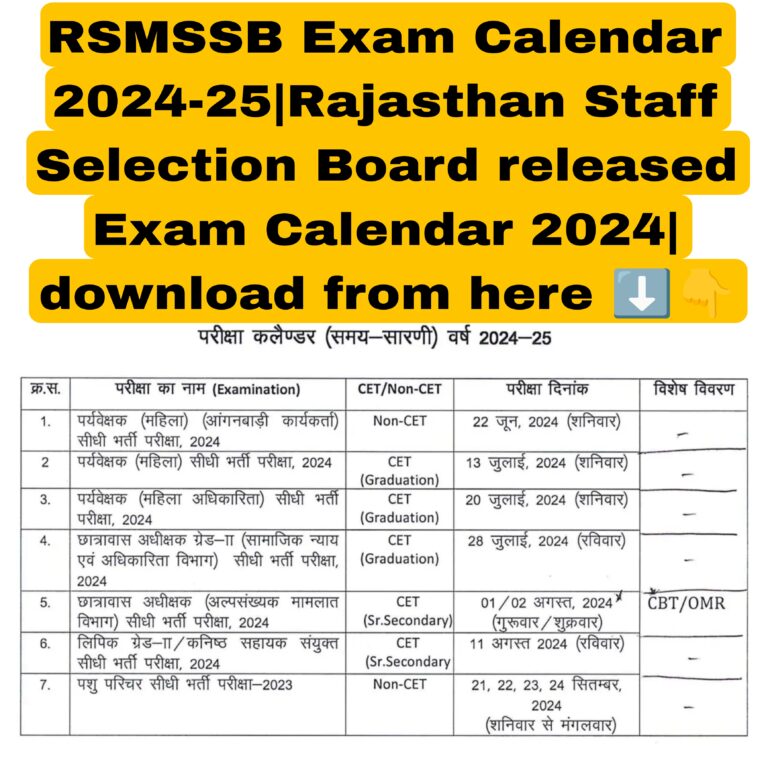

Rsmssb Exam Calendar 2025 26 Your Complete Guide To Exam Dates

May 07, 2025

Rsmssb Exam Calendar 2025 26 Your Complete Guide To Exam Dates

May 07, 2025 -

Complete Guide To The Rsmssb Exam Calendar 2025 26

May 07, 2025

Complete Guide To The Rsmssb Exam Calendar 2025 26

May 07, 2025 -

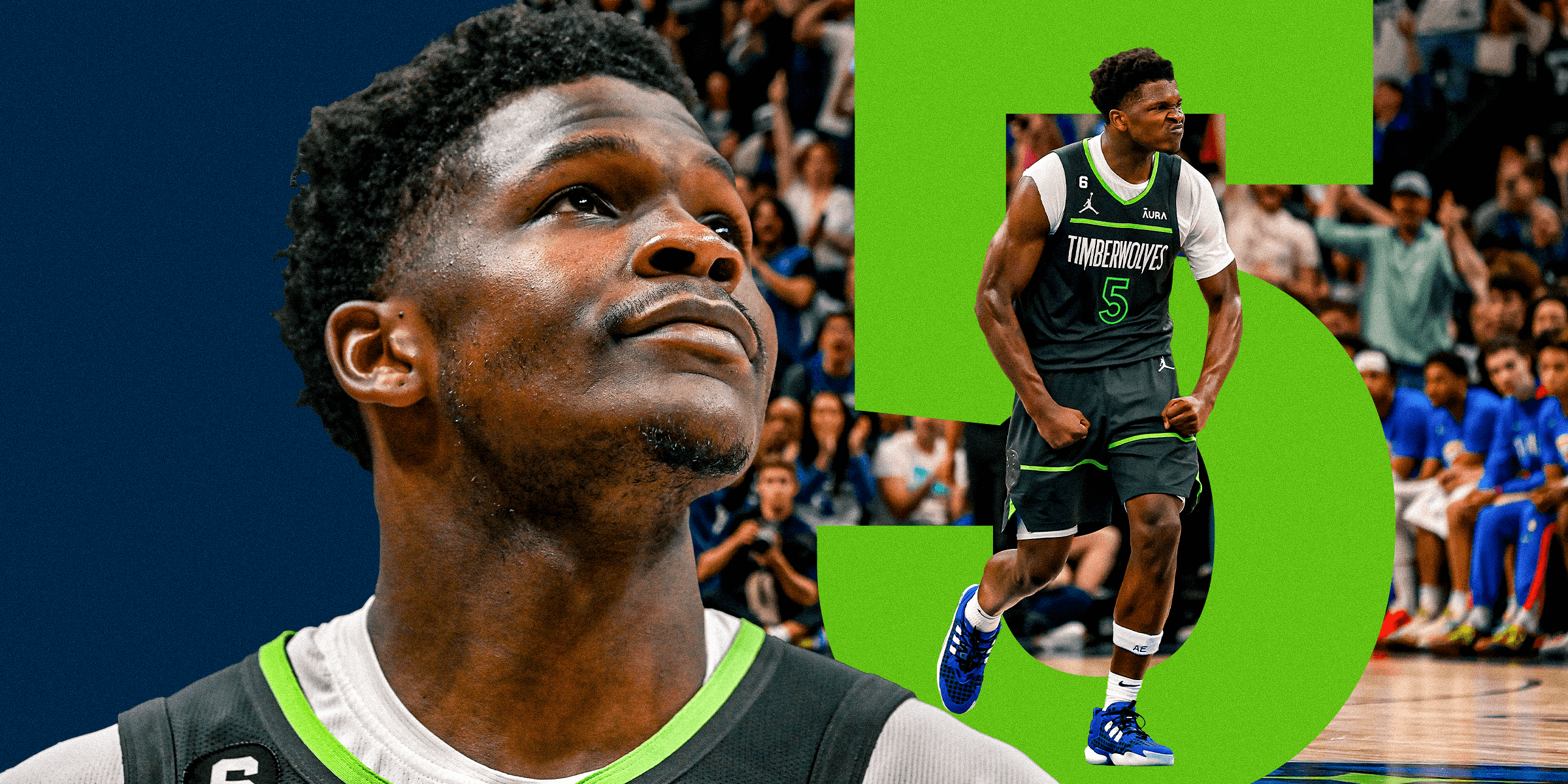

Anthony Edwards Shoving Match What Happened And Whats Next

May 07, 2025

Anthony Edwards Shoving Match What Happened And Whats Next

May 07, 2025 -

Rsmssb 2025 26 Exam Calendar Important Dates And Notifications

May 07, 2025

Rsmssb 2025 26 Exam Calendar Important Dates And Notifications

May 07, 2025