Why Stretched Stock Market Valuations Shouldn't Deter Investors: BofA

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Necessarily Overvalued

BofA's argument centers on several key factors that justify continued investment despite seemingly high valuations. Their analysis considers the broader economic landscape and future growth projections, not just current price-to-earnings (P/E) ratios.

- Low Interest Rates: Historically low interest rates significantly impact the present value of future earnings. Discounted cash flow models, commonly used to value companies, show that even with high current prices, the present value of future earnings streams remains attractive in a low-interest-rate environment. This means that future profits are worth more today, justifying higher current valuations.

- Strong Corporate Earnings Growth Projections: BofA's analysis points to robust corporate earnings growth projections for the coming years. This anticipated growth, fueled by factors like technological advancements and increasing consumer spending, supports higher valuations. Even with current high prices, the expected future earnings justify the current market capitalization.

- Historical Context: Comparing current valuations to historical averages reveals that periods of high valuations have often been followed by sustained periods of strong market performance. While not a guarantee, history suggests that high valuations alone are not a reliable predictor of an imminent market crash. Analyzing specific sectors reveals similar historical patterns, showing that high valuations within certain sectors can be sustainable.

- Sector-Specific Performance: BofA's analysis doesn't treat all sectors equally. Certain sectors, driven by innovation and strong underlying demand, show stronger growth potential than others, justifying higher valuations within those specific areas.

Key Supporting Arguments:

- Sustained Corporate Profit Margins: Despite high valuations, many companies continue to demonstrate strong and sustained profit margins, supporting the current market levels.

- Strong Economic Fundamentals: Underlying economic growth, though facing challenges, supports higher valuations in many sectors. Positive economic indicators like employment rates and consumer confidence contribute to this assessment.

- Innovation and Technological Advancements: New technologies, from artificial intelligence to renewable energy, are driving significant future earnings growth, justifying higher P/E ratios in related sectors.

Addressing the "Overvalued" Narrative: Counterarguments to Common Concerns

Many investors remain concerned about the current market conditions. Let's address some common concerns:

- High P/E Ratios: While P/E ratios appear high in aggregate, a closer look reveals significant variation across sectors. Comparing current P/E ratios to historical averages within specific sectors paints a more nuanced picture, showing that some sectors are not necessarily trading at unprecedented levels. Low interest rates also play a significant role in justifying higher P/E ratios.

- Market Corrections: Market corrections are a normal part of the investment cycle. While a correction is possible, BofA's analysis suggests that the underlying fundamentals support continued long-term growth. Investors can mitigate risk through diversification and a long-term investment strategy.

- Inflationary Pressures: Inflationary pressures are a concern, but BofA’s analysis incorporates this into their valuation models. Adjusting returns for inflation provides a more accurate picture of real returns, and strategies like investing in companies with pricing power can help mitigate the impact of inflation.

Counterarguments:

- P/E Ratios are Relative: Comparing current P/E ratios to historical averages within specific sectors shows that they are not necessarily unprecedented.

- Diversification Mitigates Risk: A diversified portfolio across various sectors and asset classes helps reduce the impact of market corrections.

- Inflation-Adjusted Returns: Analyzing returns after adjusting for inflation provides a more realistic assessment of performance.

Long-Term Growth Opportunities and Sector-Specific Analysis

BofA's analysis identifies several sectors poised for strong long-term growth, even with current high valuations. These include technology, healthcare, and renewable energy. These sectors are expected to benefit from ongoing technological advancements and increasing demand.

High-Growth Sectors:

- Technology: Driven by AI, cloud computing, and cybersecurity.

- Healthcare: Fueled by an aging population and advancements in medical technology.

- Renewable Energy: Driven by the global push for sustainable energy solutions.

Practical Investment Strategies Based on BofA's Analysis

BofA's analysis informs several practical investment strategies:

- Focus on Quality and Growth: Invest in companies with strong fundamentals, proven track records, and substantial growth potential, even if their valuations appear high compared to historical averages.

- Sector-Specific Allocation: Adjust portfolio allocation based on sector-specific growth projections. Consider overweighting sectors identified by BofA as having high growth potential.

- Long-Term Investment Horizon: Maintain a long-term investment perspective to ride out market fluctuations and benefit from long-term growth.

- Risk Management: Employ risk management techniques, including diversification and dollar-cost averaging, to mitigate potential losses.

Concrete Investment Strategies:

- Invest in undervalued growth stocks within high-growth sectors: Identify companies with strong growth prospects that might be trading at relatively lower valuations compared to their peers.

- Employ a long-term investment strategy: Focus on long-term growth potential rather than short-term market fluctuations.

- Consider dollar-cost averaging: Invest a fixed amount of money at regular intervals, reducing the impact of market volatility.

Conclusion: Navigating Stretched Stock Market Valuations with Confidence

BofA's analysis suggests that seemingly stretched stock market valuations don't necessarily signal an impending market crash. Factors like low interest rates, strong corporate earnings growth projections, and historical context support continued investment. By understanding the nuances of the current market and employing a well-informed investment strategy, investors can navigate these conditions with confidence. Remember to diversify your portfolio, adopt a long-term perspective, and consider seeking advice from a financial advisor. Don't let the narrative of "overvalued" markets deter you from making informed decisions regarding your investments. Understanding the underlying fundamentals and applying a strategic approach is crucial for navigating stretched stock market valuations successfully.

Featured Posts

-

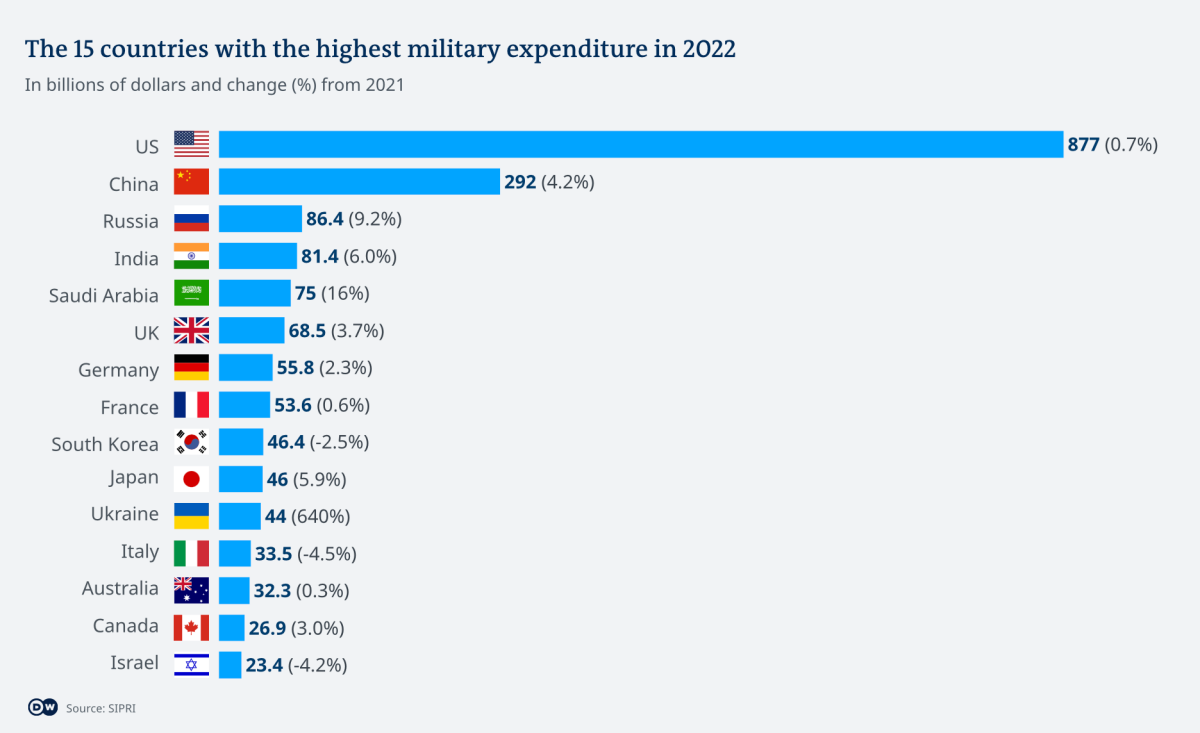

Increased Global Military Expenditure The European Security Dilemma

May 01, 2025

Increased Global Military Expenditure The European Security Dilemma

May 01, 2025 -

Ely Rda Syd Ka Mwqf Kshmyrywn Ke Hqwq Awr Khte Ka Amn

May 01, 2025

Ely Rda Syd Ka Mwqf Kshmyrywn Ke Hqwq Awr Khte Ka Amn

May 01, 2025 -

Ex Wallaby Claims Australian Rugby Lacks Hemispheric Dominance

May 01, 2025

Ex Wallaby Claims Australian Rugby Lacks Hemispheric Dominance

May 01, 2025 -

La Fires Fuel Landlord Price Gouging Controversy A Selling Sunset Star Speaks Out

May 01, 2025

La Fires Fuel Landlord Price Gouging Controversy A Selling Sunset Star Speaks Out

May 01, 2025 -

Wildfire Gambling Exploring The Ethics Of Betting On Las Disasters

May 01, 2025

Wildfire Gambling Exploring The Ethics Of Betting On Las Disasters

May 01, 2025

Latest Posts

-

Is Neal Pionk Traded Latest News And Updates

May 01, 2025

Is Neal Pionk Traded Latest News And Updates

May 01, 2025 -

Nhl Carlssons Two Goals In Vain As Ducks Drop Overtime Game To Stars

May 01, 2025

Nhl Carlssons Two Goals In Vain As Ducks Drop Overtime Game To Stars

May 01, 2025 -

Neal Pionk Performance Analysis Recent News And Highlights

May 01, 2025

Neal Pionk Performance Analysis Recent News And Highlights

May 01, 2025 -

Carlssons Double Score Overshadowed Ducks Fall To Stars In Ot

May 01, 2025

Carlssons Double Score Overshadowed Ducks Fall To Stars In Ot

May 01, 2025 -

Neal Pionk Injury Update And Game Highlights

May 01, 2025

Neal Pionk Injury Update And Game Highlights

May 01, 2025