Why Current Stock Market Valuations Are Not A Red Flag: BofA's Analysis

Table of Contents

BofA's Methodology: Understanding the Valuation Assessment

BofA's assessment of stock market valuations wasn't a simple gut feeling; it relied on a rigorous methodology incorporating several key valuation metrics. Their analysis involved a comprehensive review of various indicators, including:

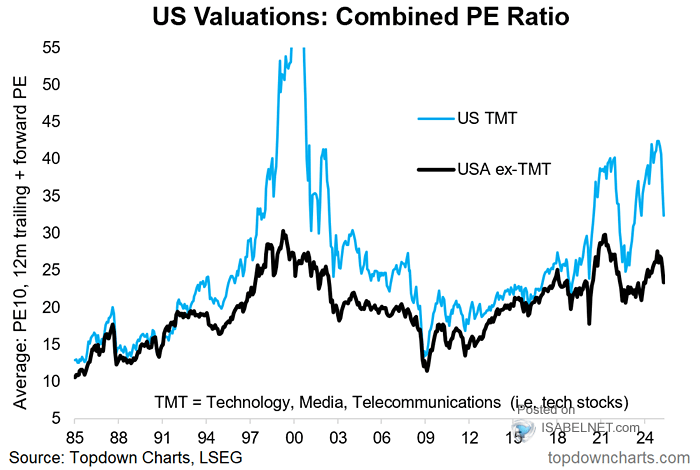

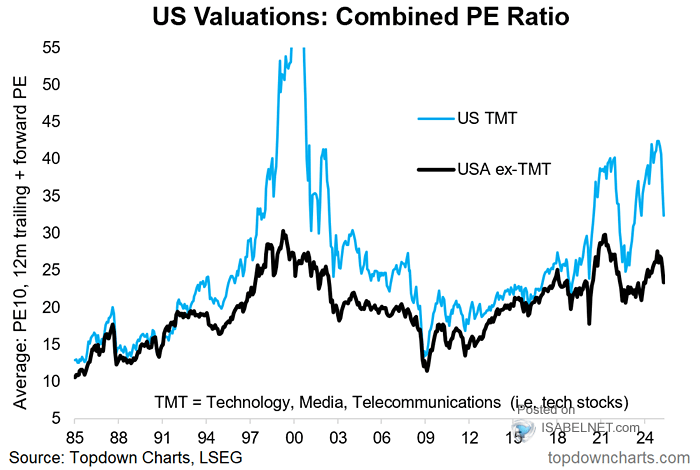

- Price-to-Earnings ratio (P/E): This fundamental metric compares a company's stock price to its earnings per share. A high P/E ratio generally suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher future growth expectations.

- Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): Also known as the CAPE ratio, this metric smooths out the effects of short-term earnings fluctuations by using an average of earnings over a longer period (typically 10 years). This provides a more stable measure of valuation over the economic cycle.

- Other relevant financial ratios: BofA likely incorporated other relevant financial ratios and indicators to create a holistic picture of market valuations. These could include dividend yield, price-to-book ratio, and various growth metrics.

It's crucial to understand the limitations of any valuation methodology. BofA's model relies on assumptions about future economic growth, interest rates, and corporate profitability. These assumptions, while based on data and projections, inevitably involve uncertainty.

Factors Supporting Current Valuations: A Bullish Perspective

BofA's analysis doesn't simply dismiss the high valuations; it identifies several factors that, in their view, justify them:

- Low Interest Rates: Historically low interest rates make borrowing cheaper for companies, boosting investment and potentially justifying higher P/E ratios. Investors may also shift from lower-yielding bonds to higher-growth equities.

- Strong Corporate Earnings Growth: BofA's projections suggest continued strong corporate earnings growth in the coming years. This growth outlook supports higher valuations, as investors anticipate increased future profits.

- Technological Innovation: The ongoing wave of technological innovation across various sectors contributes significantly to corporate earnings growth potential. This innovation drives productivity gains and creates new market opportunities.

- Inflationary Pressures (and BofA's take): While inflationary pressures are a potential concern, BofA likely factored them into their analysis. Their assessment may suggest that current inflation is manageable and won't significantly derail the economic outlook or corporate earnings.

Addressing Concerns about Market Overvaluation: Refuting Common Arguments

Many investors remain skeptical, citing potential market overvaluation. BofA addresses these concerns by:

- Comparison to Historical Data: BofA likely compared current valuations to historical market cycles. This comparison helps determine whether current valuations are unprecedented or fall within the range of historical norms, adjusted for various economic factors. While valuations may be high compared to historical averages, they may not be outside the realm of possibility given the unique economic environment.

- Addressing the "Bubble" Argument: BofA likely counters the "market bubble" argument by highlighting the underlying economic fundamentals supporting current valuations. The existence of a bubble often implies a significant disconnect between asset prices and underlying value, a disconnect that BofA's analysis seems to contradict.

- Diversification and Sectoral Analysis: BofA's analysis probably includes a sectoral breakdown of valuations, emphasizing the importance of diversification. Some sectors may be overvalued, while others present more attractive opportunities. A diversified portfolio mitigates the risk associated with individual sector overvaluation.

Potential Risks and Cautions: A Balanced Perspective

While BofA's analysis suggests current stock market valuations aren't necessarily a cause for immediate alarm, it's crucial to acknowledge potential risks:

- Geopolitical Risk: Geopolitical instability, such as international conflicts or trade wars, can significantly impact market sentiment and valuations.

- Interest Rate Hikes: Future interest rate hikes by central banks, intended to combat inflation, could increase borrowing costs for companies and reduce investor appetite for equities.

- Unexpected Economic Slowdown: An unexpected economic slowdown could negatively impact corporate earnings and reduce stock valuations.

BofA likely incorporates these risks into their assessment, offering a probabilistic view of potential market outcomes rather than a deterministic prediction. Risk management remains critical, even with a relatively positive outlook.

Conclusion: Why Current Stock Market Valuations Aren't Necessarily a Red Flag – Invest Wisely.

BofA's analysis concludes that while current stock market valuations are high, they are not necessarily unsustainable or indicative of an imminent market crash. Their methodology, incorporating various valuation metrics and considering significant economic factors, suggests that the current market environment, while demanding caution, doesn't warrant immediate panic selling. However, investors should remember that this is just one perspective. Thorough due diligence and consideration of various viewpoints, alongside a balanced approach to risk management, are crucial for informed investment decisions. Understanding current stock market valuations is crucial for informed investing. Review BofA's comprehensive report and make smart decisions based on a balanced assessment of the market. Don't let fear of market corrections dictate your investment strategy; instead, focus on building a diversified portfolio aligned with your long-term financial goals.

Featured Posts

-

Final Destination Bloodlines The Impact Of Tony Todds Return

May 19, 2025

Final Destination Bloodlines The Impact Of Tony Todds Return

May 19, 2025 -

Haalands New Bugatti Rs 44 Crore Supercar With 277 Mph Top Speed

May 19, 2025

Haalands New Bugatti Rs 44 Crore Supercar With 277 Mph Top Speed

May 19, 2025 -

Cooke Maroney Jennifer Lawrences Husband And His Art World Success

May 19, 2025

Cooke Maroney Jennifer Lawrences Husband And His Art World Success

May 19, 2025 -

Eurovision Voting System A Breakdown Of The Process

May 19, 2025

Eurovision Voting System A Breakdown Of The Process

May 19, 2025 -

Eu Crackdown Increased Emigration From Europe

May 19, 2025

Eu Crackdown Increased Emigration From Europe

May 19, 2025