Why Current Stock Market Valuations Are Not A Cause For Alarm: BofA

Table of Contents

BofA's Methodology and Data Sources

BofA employed a comprehensive approach to assess current stock market valuations. Their analysis relied on a multifaceted methodology incorporating various valuation metrics and considering a broad range of data sources. They leveraged data from prominent indices like the S&P 500 and Nasdaq Composite, incorporating historical performance alongside current market conditions.

- Valuation Metrics: BofA utilized several key valuation metrics, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B). These metrics were analyzed across different sectors and industries to provide a holistic view of market valuations.

- Data Timeframes: The analysis incorporated historical data spanning several decades, allowing for comparisons with previous periods of high valuations. This historical perspective provided crucial context for interpreting current market conditions.

- Economic Indicators: BofA's analysis incorporated various macroeconomic indicators, such as interest rates, inflation rates, and GDP growth projections. These factors played a vital role in their overall assessment of market valuations. Specific models, such as discounted cash flow analysis, were also utilized to project future earnings and their impact on current valuations.

The Role of Interest Rates in Current Valuations

Interest rates have a significant influence on stock market valuations. Higher interest rates generally increase the discount rate used in valuation models, making future earnings appear less valuable in present terms. This can lead to lower stock prices.

- Discount Rate Impact: Rising interest rates directly impact the discount rate, which is a critical component in determining the present value of future cash flows. A higher discount rate reduces the present value of future earnings, potentially lowering valuations.

- Impact on Corporate Earnings: Interest rate hikes can influence corporate earnings, potentially squeezing profit margins and impacting future growth prospects. However, this effect isn't universally negative and depends on the specifics of each industry and company.

- Counterarguments: It's crucial to note that high interest rates do not automatically signal overvalued markets. Strong earnings growth and a robust economic outlook can offset the negative impact of higher interest rates, supporting current valuations.

Long-Term Growth Prospects and Future Earnings

BofA's analysis emphasizes the importance of considering long-term growth prospects and their impact on future corporate profitability. Their outlook for future earnings plays a central role in justifying current valuations.

- Strong Growth Sectors: BofA highlighted several key sectors poised for significant growth, such as technology, renewable energy, and healthcare. The anticipated growth in these sectors helps support current market valuations.

- Technological Advancements: Technological innovations continue to drive productivity and efficiency gains, contributing to sustained earnings growth across many industries. This factor underpins the justification for higher stock valuations.

- Drivers of Future Growth: Several factors, including global economic recovery, technological advancements, and demographic shifts, contribute to a positive outlook for future earnings growth, even in the face of current headwinds.

Comparison to Historical Market Valuations

Comparing current stock market valuations to historical levels offers valuable context. BofA's analysis includes a comparison with previous periods exhibiting similar valuation levels.

- Historical Parallels: The study identifies historical periods with comparable valuation metrics and examines their subsequent market performance. This comparison helps contextualize current valuations within a longer-term perspective.

- Visual Representations: Charts and graphs illustrating historical valuations alongside current levels provide a clear visual representation of the data, enhancing understanding and facilitating comparison. Inflation adjustments were applied where necessary for accurate comparisons across different time periods.

- Contextual Differences: BofA acknowledges that direct comparisons with historical periods may not always be accurate, highlighting the importance of considering the unique economic and market contexts that may differentiate the current situation from the past.

Addressing Common Concerns about Overvaluation

Many investors harbor concerns about potentially inflated stock prices. BofA directly addresses these concerns, offering evidence to counter claims of an imminent market correction.

- High Valuations ≠ Market Crash: The analysis emphasizes that high valuations do not automatically translate into a market crash. Several factors, such as strong earnings growth and sustained economic expansion, can support elevated valuations.

- Misconceptions about Metrics: BofA clarifies common misconceptions surrounding stock market valuation metrics, emphasizing the importance of considering a range of metrics and not relying on any single indicator.

- Risk Mitigation Strategies: For investors who remain concerned, BofA suggests several risk mitigation strategies, such as diversification and a focus on high-quality companies with strong fundamentals.

Conclusion: Why Current Stock Market Valuations Are Not a Cause for Alarm: A BofA Perspective

BofA's analysis presents a compelling argument that current stock market valuations, while high, are not inherently alarming. Their comprehensive approach, incorporating diverse valuation metrics, historical comparisons, and an assessment of long-term growth prospects, provides a nuanced perspective on the current market environment. The consideration of interest rate dynamics and the careful rebuttal of common concerns contribute to a well-rounded analysis. Understanding stock market valuations requires considering long-term growth prospects, interest rate dynamics, and a thorough historical context. We encourage you to conduct further research on BofA's analysis and to consider a balanced investment strategy based on your risk tolerance and long-term financial goals. By effectively assessing stock market valuations and understanding their implications, you can make more informed decisions about your investment portfolio. Learn more about conducting your own stock market valuation analysis to make better investment choices.

Featured Posts

-

Energy Policy Reform Guido Fawkes Analyses The New Direction

May 03, 2025

Energy Policy Reform Guido Fawkes Analyses The New Direction

May 03, 2025 -

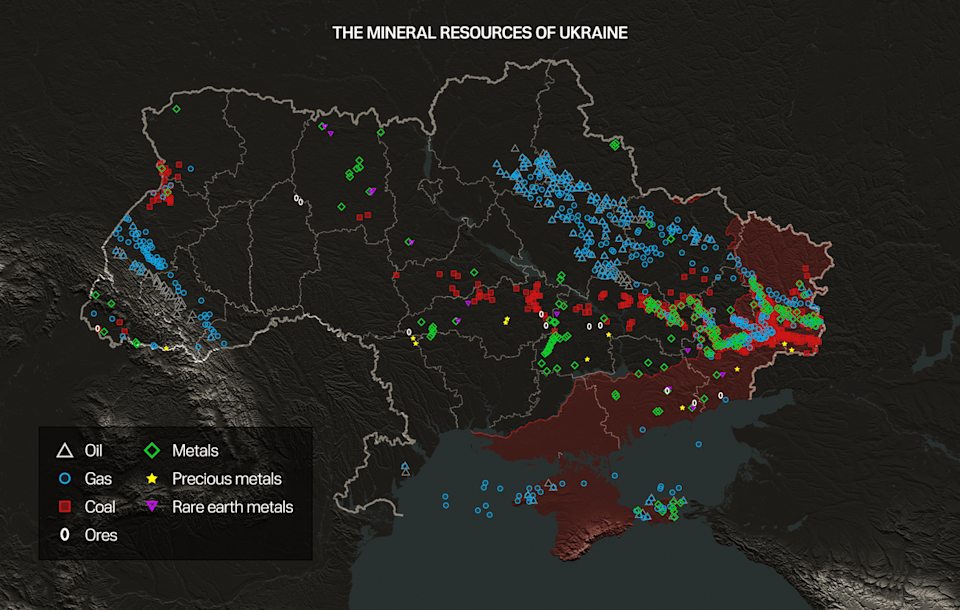

Ukraine Us Rare Earth Mineral Deal A Strategic Economic Partnership

May 03, 2025

Ukraine Us Rare Earth Mineral Deal A Strategic Economic Partnership

May 03, 2025 -

Sleet And Snow Expected In Tulsa City Crews Prepare Roads

May 03, 2025

Sleet And Snow Expected In Tulsa City Crews Prepare Roads

May 03, 2025 -

Discours De Macron Au Gabon Nouvel Ere Pour Les Relations Franco Africaines

May 03, 2025

Discours De Macron Au Gabon Nouvel Ere Pour Les Relations Franco Africaines

May 03, 2025 -

Nigel Farage And Rupert Lowe Public Dispute Intensifies

May 03, 2025

Nigel Farage And Rupert Lowe Public Dispute Intensifies

May 03, 2025