Why Are Kentucky Storm Damage Assessments Delayed?

Table of Contents

The Sheer Scale of Damage

Widespread damage after a significant Kentucky storm overwhelms assessment teams, leading to substantial delays. The sheer number of affected properties makes it difficult for assessors to keep up with the demand. Consider the impact of a widespread tornado outbreak or severe flooding; the scale of destruction is often immense.

- Limited number of assessors available: The number of qualified assessors in Kentucky, and even in neighboring states, is finite. After a major disaster, this limited pool of professionals is quickly stretched thin.

- Extensive travel time across affected areas: Kentucky's geography means that affected areas can be spread across vast distances, requiring significant travel time for assessors to reach each damaged property. This time spent traveling reduces the time available for actual assessments.

- Prioritization of life-saving and critical infrastructure assessments: In the immediate aftermath of a storm, the focus is on search and rescue efforts and restoring critical infrastructure like power and water. Damage assessments to individual properties are often prioritized after these immediate needs are addressed.

- Examples of past storms and the scale of damage they caused in Kentucky: The devastating tornadoes of December 2021 serve as a stark reminder of the scale of damage and the resulting delays in assessments. Similar events in past years underscore the ongoing challenge.

Insurance Company Backlogs and Processes

Insurance companies play a crucial role in the damage assessment process. However, the high volume of claims following major storms often leads to significant backlogs and processing delays.

- High volume of claims after major storms: After a significant storm, insurance companies are inundated with claims, overwhelming their capacity to process them efficiently. This surge in demand leads to longer wait times for assessments.

- Complex claim processing procedures, including inspections and paperwork: Insurance claim processing is complex. It involves detailed inspections, extensive paperwork, and often requires multiple interactions between the homeowner and the insurance adjuster.

- Staffing limitations within insurance companies: Insurance companies, like other sectors, may face staffing limitations. This shortage can impact their ability to handle the increased workload after a major storm.

- Potential for delays due to disputes over coverage: Disagreements between homeowners and insurance companies about coverage can lead to additional delays as both parties attempt to resolve the issues. Clear documentation and a thorough understanding of your insurance policy are crucial to mitigate these conflicts.

- Importance of having proper documentation and policies: Maintaining detailed records, including photos, videos, and copies of relevant documents, is crucial for speeding up the claims process. Understanding your policy's terms and conditions is equally important.

Access and Safety Concerns

Reaching damaged areas after a storm can be incredibly challenging due to safety and accessibility concerns.

- Impassable roads and infrastructure damage: Storms often cause significant damage to roads and bridges, making it difficult or impossible for assessors to reach affected areas.

- Safety hazards in damaged buildings: Damaged buildings present safety hazards, including structural instability, downed power lines, and the presence of hazardous materials. Assessors must prioritize their safety before conducting an inspection.

- Need for specialized equipment and expertise: Some damage assessments require specialized equipment and expertise, particularly for complex structural damage. Securing these resources can take time.

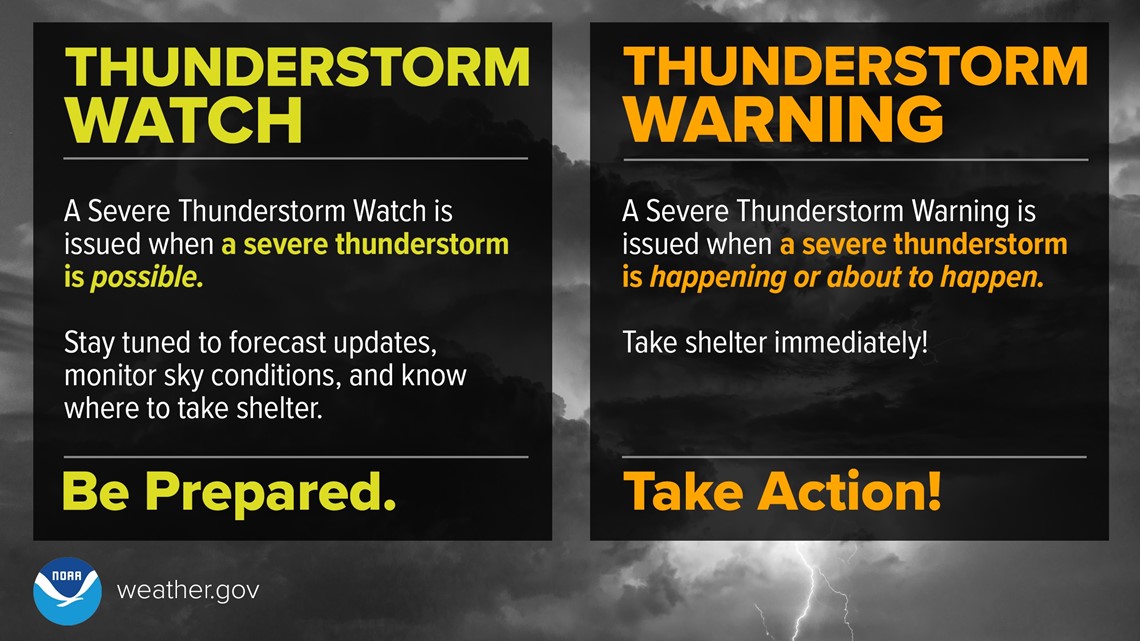

- Potential for weather-related delays in assessments: Further storms or inclement weather can further hinder access and delay assessments.

Navigating the Bureaucracy

Securing government assistance adds another layer of complexity to the process. Navigating the various agencies and programs involved can be time-consuming.

- Application processes and paperwork requirements: Applying for government aid often involves extensive paperwork and bureaucratic processes. This can be frustrating and overwhelming for homeowners already dealing with the aftermath of a storm.

- Multiple agencies involved in the assessment and aid distribution: Multiple agencies at the local, state, and federal levels are often involved in the assessment and distribution of aid. This can lead to delays as applications and information are passed between different entities.

- Funding limitations impacting the speed of aid disbursement: Limited funding for disaster relief programs can impact the speed at which aid is disbursed. This can further delay the recovery process for homeowners.

- Importance of accurate documentation for successful claims: Accurate and complete documentation is critical to ensure successful claims for government assistance.

What Homeowners Can Do to Expedite the Process

While many factors influence assessment delays, homeowners can take proactive steps to expedite the process:

- Document damage thoroughly with photos and videos: Comprehensive documentation of damage is crucial. Take numerous photos and videos from various angles, showing the extent of the destruction.

- Contact insurance company immediately: Report the damage to your insurance company as soon as it is safe to do so. The sooner you report, the sooner the assessment process can begin.

- Keep records of all communication with insurance adjusters and government agencies: Maintain detailed records of all communication, including dates, times, and names of individuals you speak with.

- Understand your insurance policy's coverage thoroughly: Review your policy carefully to understand your coverage and what expenses are likely to be covered.

- Seek assistance from legal professionals if needed: If you encounter difficulties with your insurance company or government agencies, consider seeking legal advice.

Conclusion

Delays in Kentucky storm damage assessments are often a result of the sheer scale of damage, insurance company backlogs, access limitations, and bureaucratic processes. However, proactive steps by homeowners can significantly impact the timeline. By being organized and persistent, you can navigate this difficult process more effectively. Understanding the reasons behind these delays empowers you to advocate for your needs and receive the assistance you deserve. Don't let delays overwhelm you; take control of your storm damage assessment today.

Featured Posts

-

Nws Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025

Nws Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025 -

Aircraft Carrier Accident Us Navy Loses 60 Million Fighter Jet

May 01, 2025

Aircraft Carrier Accident Us Navy Loses 60 Million Fighter Jet

May 01, 2025 -

Estevao Enjoo E Substituicao Em Partida Do Palmeiras Em Altitude

May 01, 2025

Estevao Enjoo E Substituicao Em Partida Do Palmeiras Em Altitude

May 01, 2025 -

Timberwolves Defeat Nets Edwards Key Role In Minnesota Victory

May 01, 2025

Timberwolves Defeat Nets Edwards Key Role In Minnesota Victory

May 01, 2025 -

Rodons Solid Outing Yankees Defeat Guardians In Series Finale

May 01, 2025

Rodons Solid Outing Yankees Defeat Guardians In Series Finale

May 01, 2025