White House Reaction To Moody's US Credit Rating Downgrade

Immediate White House Response and Official Statements

The White House's initial reaction to Moody's downgrade was swift, characterized by a mix of defiance and a commitment to fiscal responsibility. Press releases and statements from President Biden and Treasury Secretary Janet Yellen emphasized the administration's disagreement with Moody's assessment. The administration argued that the downgrade didn't reflect the underlying strength of the US economy and its capacity for growth.

- Specific quotes: President Biden, in a statement, characterized the downgrade as "outdated" and insisted that the US remains the world's leading economy. Secretary Yellen emphasized the administration's commitment to fiscal responsibility and its plans to reduce the deficit.

- Press conferences and briefings: The White House held several press briefings in the days following the downgrade, with key officials addressing concerns from journalists and the public. These briefings were crucial in shaping the narrative surrounding the downgrade.

- Tone and messaging: The White House adopted a defensive yet confident tone, highlighting the positive aspects of the US economy while acknowledging the need for continued fiscal prudence. The messaging focused on countering the negative perception created by the downgrade.

Economic Implications and the White House's Strategy

The downgrade's economic consequences are significant, primarily increasing borrowing costs for the US government. Higher interest rates will lead to increased expenses for servicing the national debt, potentially impacting future spending on social programs and infrastructure development.

- Legislative actions and executive orders: The White House is expected to explore legislative options to address the increased borrowing costs. This could include measures aimed at reducing the deficit and improving the country’s fiscal outlook. Executive orders might focus on streamlining government spending and improving efficiency.

- Fiscal responsibility measures: The administration has reiterated its commitment to fiscal responsibility, emphasizing the need for long-term sustainable fiscal policies to improve the country's creditworthiness. This involves efforts to reduce the budget deficit and control government spending.

- Economic forecasts: The administration's economic forecasts, while still projecting growth, are likely to be revised to incorporate the higher borrowing costs resulting from the downgrade. This will require a reassessment of the government's spending plans.

Political Fallout and the 2024 Elections

The credit rating downgrade has become a significant political issue, with the opposition party using it to criticize the current administration's economic policies. The Republicans are leveraging the downgrade to paint the Democrats as fiscally irresponsible, potentially influencing the upcoming 2024 elections.

- Public opinion polls: Public opinion polls reveal mixed reactions. While some Americans express concern about the downgrade and its potential impact, others remain confident in the US economy's resilience.

- Statements from Republican lawmakers: Republican lawmakers have seized upon the downgrade, highlighting it as evidence of the Democrats' mismanagement of the economy. They are using this as a campaign talking point.

- Potential effects on the 2024 presidential race: The downgrade could significantly impact the 2024 presidential race, potentially influencing voter choices and shaping the campaign narratives. It will become a key economic indicator in the debate.

International Reactions and Global Market Impact

Moody's downgrade of the US credit rating has triggered significant international reactions, affecting global perceptions of the US economy and its stability. International financial markets experienced volatility following the announcement.

- Statements from key international allies or rivals: International leaders have offered a mix of reactions, with some expressing concerns while others maintaining confidence in the US economy. Reactions from international allies and rivals alike have varied.

- Impact on global financial markets: The downgrade has led to increased uncertainty in global financial markets, impacting various asset classes and investment strategies. The ripple effect is global and extensive.

- Changes in international investment strategies: Some investors have begun to reassess their investment strategies, potentially shifting funds away from US assets. This can change the dynamics of global capital flow.

Conclusion

This article examined the White House's multifaceted response to Moody's downgrade of the US credit rating, covering immediate reactions, economic strategies, political fallout, and international implications. The downgrade presents significant challenges for the current administration, demanding a comprehensive approach that balances economic stability with political considerations. The long-term consequences of the downgrade remain uncertain, and its impact on the 2024 elections is still unfolding.

Call to Action: Stay informed about the evolving situation surrounding the White House reaction to Moody's downgrade and its impact on the US economy. Follow reputable news sources for the latest updates on this critical development, as further analysis of the White House's strategy is crucial for understanding the future trajectory of the US economy and the ramifications of this significant economic event. Understanding the White House's response to Moody's downgrade is vital for navigating the economic landscape ahead.

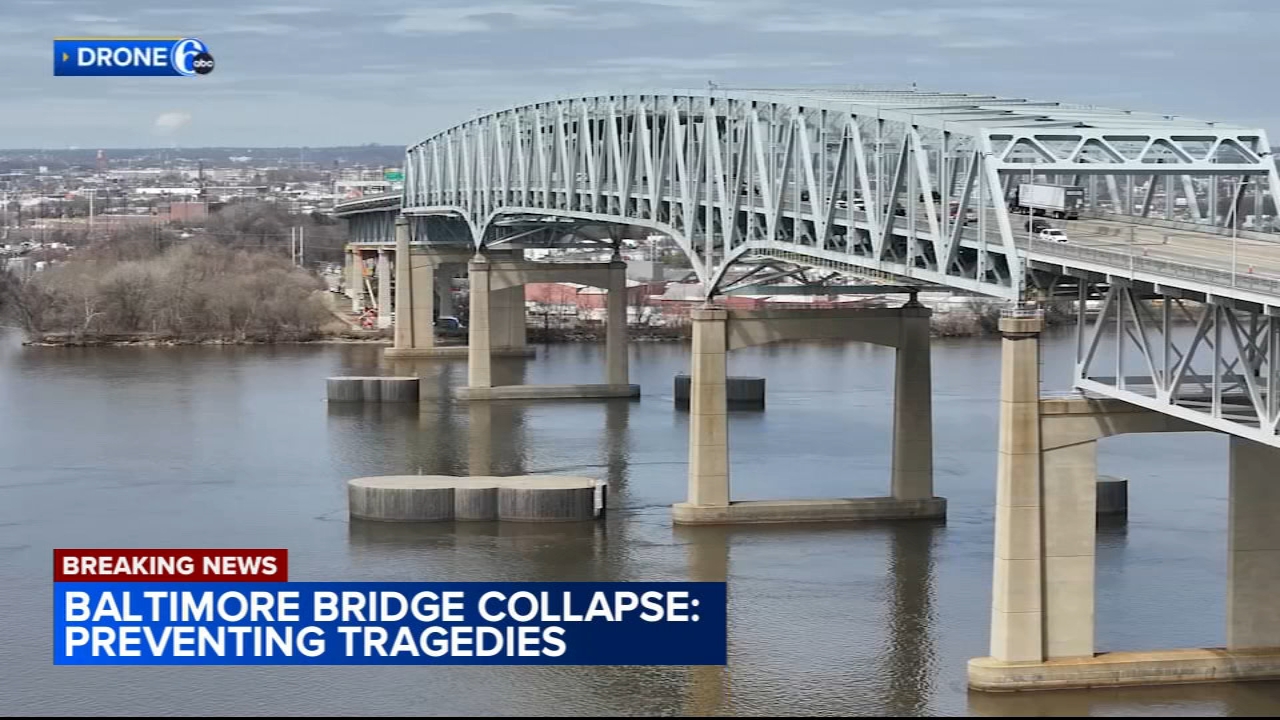

Nyc Bridge Safety Concerns Raised After Baltimore Collapse Urgent Inspection Ordered

Nyc Bridge Safety Concerns Raised After Baltimore Collapse Urgent Inspection Ordered

Japans Metropolis Connecting With Locals And Immersing In Culture

Japans Metropolis Connecting With Locals And Immersing In Culture

Dodgers Win Fifth Straight Game Behind Gonsolins Solid Performance

Dodgers Win Fifth Straight Game Behind Gonsolins Solid Performance

Nyc Half Brooklyn Bridge Run To Draw Huge Crowd

Nyc Half Brooklyn Bridge Run To Draw Huge Crowd

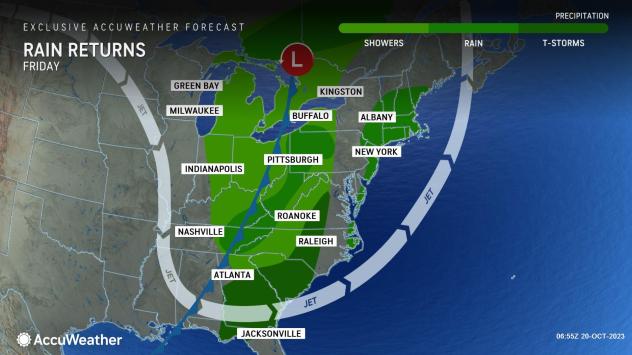

Dry Weather Could Douse Easter Bonfire Plans

Dry Weather Could Douse Easter Bonfire Plans