Which Cryptocurrency Offers The Best Protection Against Trade Wars?

Table of Contents

Trade wars cast a long shadow over global economies, creating instability and uncertainty in traditional financial markets. As tensions rise and tariffs fluctuate, many investors are seeking alternative assets to protect their portfolios from the potential fallout. This article investigates which cryptocurrencies might offer the best protection against the volatility and unpredictability inherent in trade war scenarios. We'll delve into various factors to determine which digital assets could provide the most resilience during these turbulent times.

Decentralization as a Hedge

The decentralized nature of cryptocurrencies is a key factor in their potential to act as a hedge against trade wars. This inherent characteristic minimizes reliance on centralized systems, such as national economies and government policies, which are often heavily impacted by trade conflicts.

Reduced Reliance on Centralized Systems

- Reduced exposure to sanctions and trade restrictions: Cryptocurrencies operate outside the traditional financial infrastructure, making them less susceptible to sanctions and trade restrictions imposed during trade disputes. Transactions are processed on a peer-to-peer network, bypassing intermediaries vulnerable to geopolitical pressures.

- Increased financial sovereignty for individuals and businesses: Decentralized cryptocurrencies empower individuals and businesses with greater control over their finances, shielding them from the disruptive impact of trade wars on national currencies and banking systems. This increased financial autonomy becomes increasingly important in volatile global landscapes.

- Bypassing traditional banking systems vulnerable to geopolitical pressures: Traditional banking systems are deeply intertwined with national economies and are therefore susceptible to the shocks and stresses created by trade wars. Cryptocurrencies offer an alternative, facilitating cross-border transactions without reliance on these potentially vulnerable institutions.

Examples of Decentralized Cryptocurrencies

Bitcoin (BTC), with its established network and widespread adoption, stands out as a prime example. Its decentralized nature and limited supply make it a potential store of value during economic uncertainty. Litecoin (LTC), another prominent cryptocurrency, shares similar decentralized features and offers faster transaction speeds compared to Bitcoin. Other cryptocurrencies with strong decentralized architectures also contribute to this diversified landscape.

Volatility and its Role in Trade War Protection

While the cryptocurrency market is known for its volatility, this very volatility can sometimes be less correlated with traditional market downturns triggered by trade wars. This lack of correlation can present an opportunity for diversification and risk mitigation.

Crypto Market Volatility vs. Traditional Markets

- Analyzing historical correlations between cryptocurrency prices and trade war events: While not perfectly uncorrelated, historical data suggests that the cryptocurrency market doesn't always move in lockstep with traditional markets during trade war escalations. This suggests a potential for hedging.

- Comparing volatility to other asset classes during periods of trade conflict: Compared to stocks and bonds, which can experience significant drops during trade wars, cryptocurrencies may offer a different risk profile. A thorough analysis of historical data is crucial in this assessment.

- Discussing risk tolerance and portfolio diversification strategies: Diversifying a portfolio to include cryptocurrencies alongside traditional assets can help mitigate overall risk. However, it’s important to remember that cryptocurrencies are inherently risky and investors need to assess their own risk tolerance.

Stablecoins as a Safe Haven

Stablecoins, such as Tether (USDT) and USD Coin (USDC), are pegged to fiat currencies like the US dollar. This pegging aims to minimize price volatility, making them potentially attractive as a safe haven during periods of economic uncertainty caused by trade wars. However, it's crucial to understand the risks associated with these stablecoins, including the potential for de-pegging from their underlying assets and counterparty risk.

Specific Cryptocurrency Considerations

Choosing the right cryptocurrency for protection against trade wars requires careful consideration of various factors.

Bitcoin's Position

Bitcoin's established market dominance and its growing acceptance as a "digital gold" make it a strong contender.

- Bitcoin's scarcity and limited supply: Bitcoin's fixed supply of 21 million coins contributes to its potential as a store of value, similar to gold, which can hold its value during times of economic turmoil.

- Bitcoin's historical performance during periods of global instability: While past performance is not indicative of future results, Bitcoin's price performance during previous periods of global uncertainty provides some insight into its potential resilience.

- Bitcoin's growing adoption by institutional investors: Increasing institutional interest in Bitcoin signifies a growing level of trust and acceptance, which can further contribute to its stability and resilience.

Alternative Cryptocurrencies

Beyond Bitcoin, other cryptocurrencies may offer unique advantages. Privacy coins like Monero (XMR) offer enhanced anonymity, which could be valuable in jurisdictions with stricter capital controls or during times of heightened regulatory scrutiny. Decentralized Finance (DeFi) protocols are also emerging as alternative financial systems that could be less vulnerable to trade war disruptions. However, these options also come with their own sets of risks and challenges, including technical complexity and regulatory uncertainty.

Risks and Considerations

While cryptocurrencies offer potential benefits as a hedge against trade wars, it’s crucial to acknowledge the inherent risks.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is still evolving, and this uncertainty can impact their effectiveness as a hedge.

- Varying levels of cryptocurrency regulation across different countries: The regulatory environment varies greatly from country to country, and these differences can create uncertainty for investors.

- Potential for increased regulatory scrutiny during times of geopolitical instability: Governments might increase regulatory scrutiny on cryptocurrencies during times of geopolitical tension, potentially impacting their usability and value.

- The impact of government crackdowns on cryptocurrency markets: Government crackdowns on cryptocurrency markets can lead to significant price drops and disruptions.

Market Manipulation and Security Risks

The cryptocurrency market is susceptible to manipulation and hacking. Investors need to be aware of these risks and take appropriate precautions.

- Due diligence is crucial: Thorough research and due diligence are essential before investing in any cryptocurrency.

- Secure storage practices: Utilizing secure storage methods, such as hardware wallets, is crucial to protect your cryptocurrency holdings from theft.

Conclusion

This article explored how cryptocurrencies, especially those emphasizing decentralization, might offer some protection against the economic effects of trade wars. While no cryptocurrency guarantees complete insulation from market fluctuations, a well-diversified portfolio incorporating assets like Bitcoin and potentially stablecoins could offer a more resilient investment strategy. However, understanding the inherent volatility of the crypto market and the potential for regulatory risks is crucial. Don't forget to consider your individual risk tolerance before investing.

Call to Action: Learn more about how you can strategically use cryptocurrencies as part of a diversified investment strategy to mitigate the risks associated with trade wars. Research which cryptocurrency offers the best protection for your unique circumstances and risk profile.

Featured Posts

-

Cantina Canalla El Mejor Restaurante Mexicano De Malaga

May 08, 2025

Cantina Canalla El Mejor Restaurante Mexicano De Malaga

May 08, 2025 -

Psg Nice Canli Yayin Izleme Secenekleri Ve Rehberi

May 08, 2025

Psg Nice Canli Yayin Izleme Secenekleri Ve Rehberi

May 08, 2025 -

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025 -

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025 -

Psg Fiton Minimalisht Pas Pjeses Se Pare

May 08, 2025

Psg Fiton Minimalisht Pas Pjeses Se Pare

May 08, 2025

Latest Posts

-

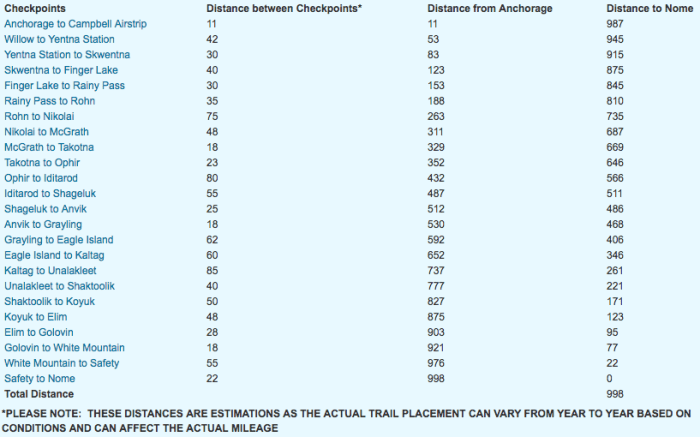

Iditarod 2024 Following 7 Rookie Teams To Nome

May 09, 2025

Iditarod 2024 Following 7 Rookie Teams To Nome

May 09, 2025 -

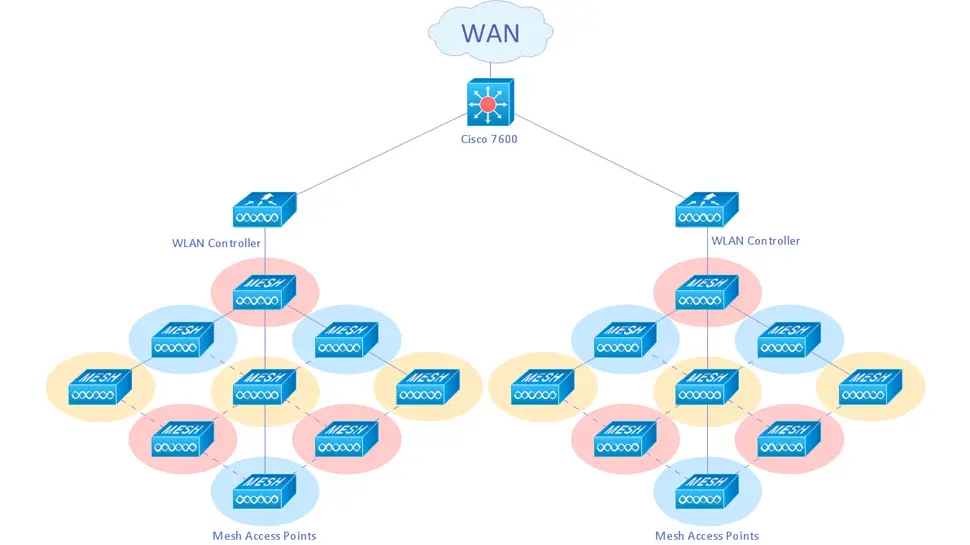

Wireless Mesh Network Market To Expand At A 9 8 Cagr Market Size And Trends

May 09, 2025

Wireless Mesh Network Market To Expand At A 9 8 Cagr Market Size And Trends

May 09, 2025 -

Seven Iditarod Newbies Chasing Nome Their Stories

May 09, 2025

Seven Iditarod Newbies Chasing Nome Their Stories

May 09, 2025 -

8 Cagr Wireless Mesh Network Market Growth Analysis And Forecast

May 09, 2025

8 Cagr Wireless Mesh Network Market Growth Analysis And Forecast

May 09, 2025 -

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025