What Makes A Crypto Exchange Compliant In India? A Simple Guide For 2025

Table of Contents

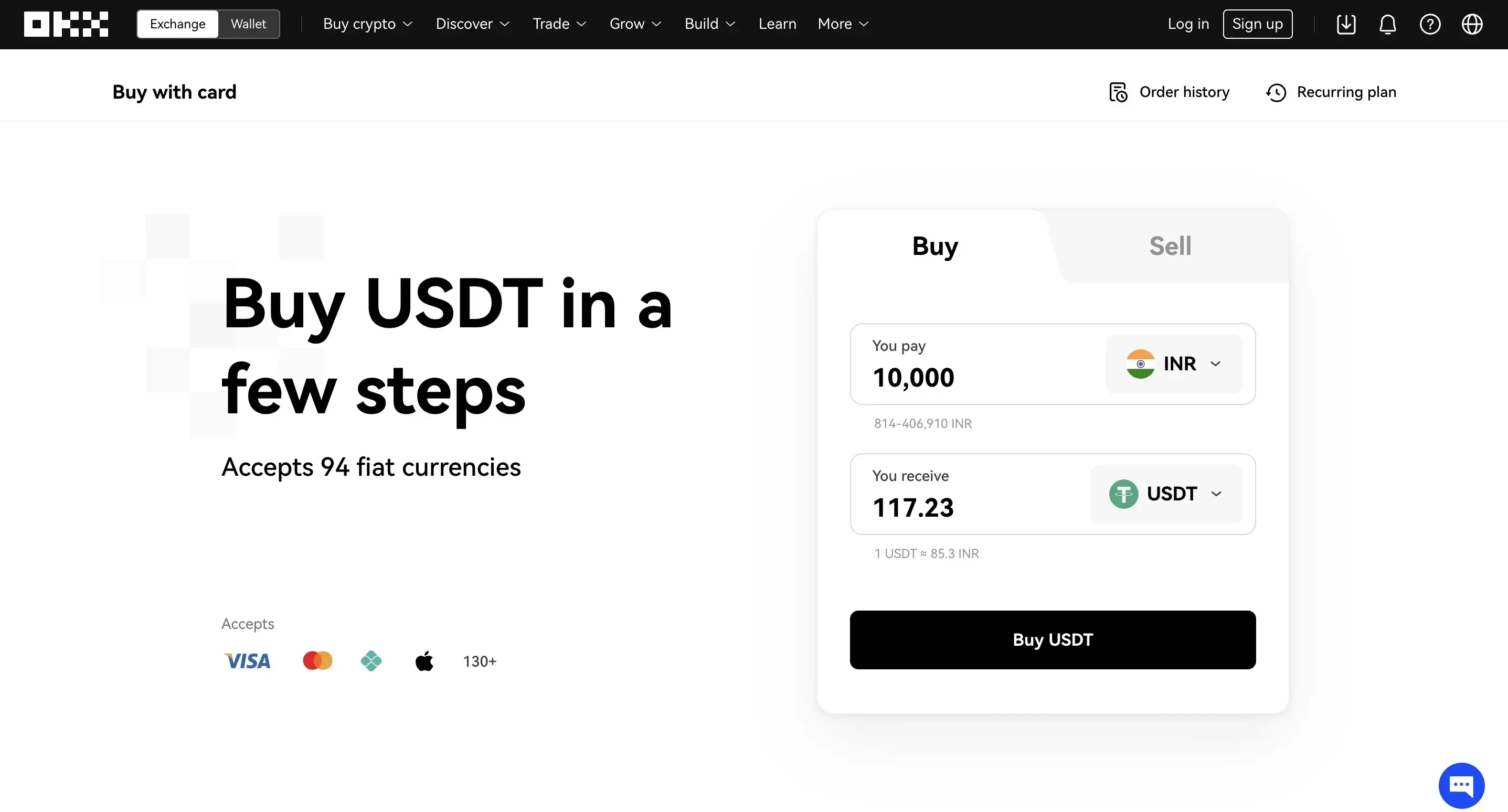

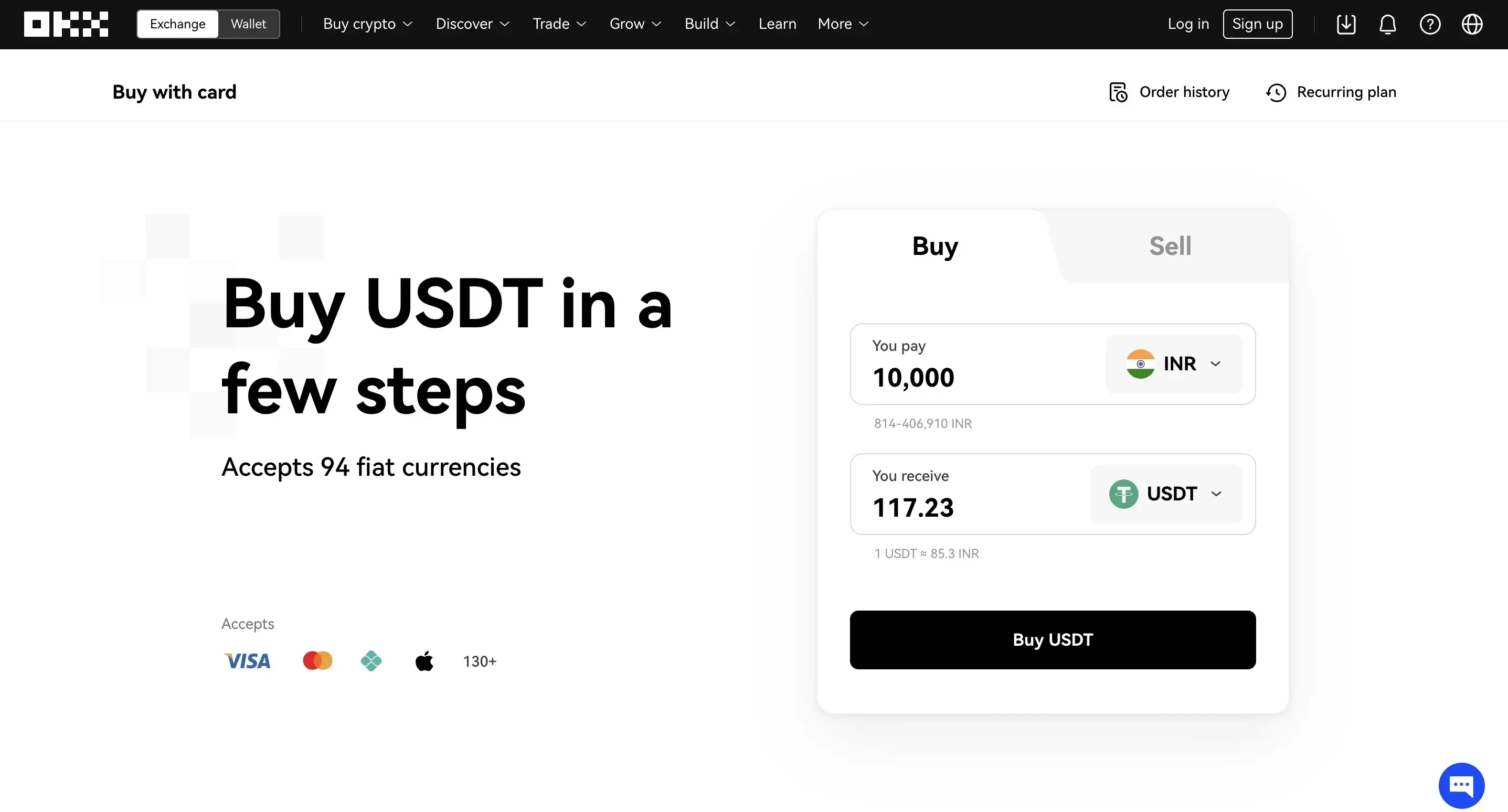

Understanding the Indian Regulatory Framework for Crypto

The legal status of cryptocurrencies in India remains undefined. While there's no comprehensive crypto law, the government is actively engaging in discussions to establish a clear regulatory framework. This ambiguity presents both opportunities and challenges for crypto exchanges operating within the country. The lack of specific legislation necessitates a proactive approach to compliance, focusing on existing laws and anticipating future regulations.

Key Regulatory Bodies and their Roles

Several key regulatory bodies in India play a significant role in shaping the crypto landscape:

- Reserve Bank of India (RBI): The RBI has expressed concerns about the potential risks associated with cryptocurrencies, including money laundering and financial instability. While not explicitly banning crypto, the RBI has issued guidelines to banks regarding their dealings with crypto businesses.

- Ministry of Finance: The Ministry of Finance is primarily responsible for formulating tax policies related to crypto transactions. They are actively involved in developing a comprehensive regulatory approach.

- Other Relevant Bodies: Other government agencies, such as the Enforcement Directorate (ED), also play a role in investigating and regulating financial activities, including those involving cryptocurrencies.

Potential future legislation is expected to clarify the legal status of cryptocurrencies and establish a regulatory framework for crypto exchanges, potentially including licensing requirements.

The Importance of KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Lauundering (AML) compliance are paramount for crypto exchanges in India. These procedures are crucial for preventing illicit activities like money laundering and terrorist financing. Strict adherence is not just good practice but also a vital step towards building trust and demonstrating a commitment to responsible operations.

- Strict adherence to KYC norms: This involves thorough verification of user identities, including address verification and source of funds checks.

- Implementation of robust AML protocols: This includes implementing transaction monitoring systems to detect suspicious activities and report them to the relevant authorities.

- Regular audits and compliance reporting: Regular internal and external audits are essential to ensure ongoing compliance with KYC/AML regulations. Maintaining detailed records for reporting purposes is critical.

Essential Compliance Measures for Crypto Exchanges in India

Beyond KYC/AML, several other compliance measures are essential for crypto exchanges operating in India:

Data Security and Privacy

Protecting user data is paramount. Robust security measures are necessary to prevent data breaches and comply with relevant data protection laws, particularly in anticipation of the Personal Data Protection Bill.

- Robust cybersecurity measures: Implementing strong firewalls, intrusion detection systems, and regular security audits are crucial.

- Data encryption: Employing robust encryption techniques to protect sensitive user data, both in transit and at rest, is essential.

- Compliance with data privacy regulations: Adherence to existing data protection laws and preparing for the upcoming Personal Data Protection Bill is crucial.

Transaction Monitoring and Reporting

Maintaining transparent and auditable transaction records is essential for compliance. This enables authorities to trace transactions and detect any suspicious activities.

- Real-time transaction monitoring systems: Implementing systems that can identify potentially suspicious transactions in real time is vital.

- Suspicious activity reporting mechanisms: Establishing clear procedures for reporting suspicious activities to the relevant authorities is crucial.

- Maintenance of detailed transaction logs: Maintaining accurate and complete records of all transactions for auditing and reporting purposes is paramount.

Tax Compliance

Understanding and complying with the current tax implications for crypto transactions in India is crucial. The government has clarified that income from crypto trading is taxable, and GST may apply to certain transactions.

- Tax implications for income from crypto trading: Accurately reporting profits and losses from crypto trading is crucial.

- GST implications on crypto transactions: Understanding and complying with Goods and Services Tax (GST) regulations related to crypto transactions is essential.

- Accurate record-keeping for tax purposes: Maintaining meticulous records of all crypto transactions is vital for accurate tax reporting.

Future Trends and Predictions for Crypto Exchange Compliance in India

The regulatory landscape for crypto exchanges in India is constantly evolving. We can expect further clarity and potentially a more comprehensive regulatory framework in the coming years.

- Potential introduction of a regulatory framework for crypto exchanges: This could include licensing requirements, operational guidelines, and consumer protection measures.

- The role of self-regulatory organizations: Industry bodies may play a significant role in establishing best practices and promoting responsible operations.

- Likely future amendments to existing tax laws: Further clarifications and potential amendments to existing tax laws related to crypto transactions are anticipated.

Conclusion

Staying compliant as a crypto exchange in India requires a multi-faceted approach. Crypto Exchange Compliance in India hinges on robust KYC/AML procedures, stringent data security measures, transparent transaction monitoring and reporting, and meticulous tax compliance. The regulatory environment is dynamic, so continuous monitoring of updates is critical. Staying informed about Crypto Exchange Compliance in India is critical for ensuring a secure and legal operation in this dynamic market. Continue researching updates to stay ahead of the curve and maintain compliance with evolving regulations regarding Crypto Exchange Compliance in India.

Featured Posts

-

Aanstaande Actie Richt Zich Op Npo Directeur Frederieke Leeflang

May 15, 2025

Aanstaande Actie Richt Zich Op Npo Directeur Frederieke Leeflang

May 15, 2025 -

Carsamba Ledra Pal Da Dijital Veri Tabani Ile Isguecue Piyasasi Analizi

May 15, 2025

Carsamba Ledra Pal Da Dijital Veri Tabani Ile Isguecue Piyasasi Analizi

May 15, 2025 -

Proedria Ee Syzitiseis Kyproy Oyggarias Gia To Kypriako Kai Tis Dimereis Sxeseis

May 15, 2025

Proedria Ee Syzitiseis Kyproy Oyggarias Gia To Kypriako Kai Tis Dimereis Sxeseis

May 15, 2025 -

Kibris Ta Sehit Kaniyla Cizilen Kirmizi Cizgi Fatih Erbakandan Aciklama

May 15, 2025

Kibris Ta Sehit Kaniyla Cizilen Kirmizi Cizgi Fatih Erbakandan Aciklama

May 15, 2025 -

Euphoria Season 3 First Look At Cassies Wedding In Set Photos

May 15, 2025

Euphoria Season 3 First Look At Cassies Wedding In Set Photos

May 15, 2025

Latest Posts

-

Actie Tegen Npo De Rol Van Frederieke Leeflang Onder De Loep

May 15, 2025

Actie Tegen Npo De Rol Van Frederieke Leeflang Onder De Loep

May 15, 2025 -

Analyse De Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Analyse De Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

De Gevolgen Van De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

De Gevolgen Van De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Wordt Frederieke Leeflang Npo Baas Getroffen Door Een Nieuwe Actie

May 15, 2025

Wordt Frederieke Leeflang Npo Baas Getroffen Door Een Nieuwe Actie

May 15, 2025 -

Reacties Op De Actie Gericht Tegen Frederieke Leeflang Npo Baas

May 15, 2025

Reacties Op De Actie Gericht Tegen Frederieke Leeflang Npo Baas

May 15, 2025