Westpac's (WBC) Falling Profits: A Deep Dive Into Margin Squeeze

Table of Contents

Rising Funding Costs

The increasing cost of funds is a major contributor to the Westpac margin squeeze. This pressure comes from two key areas: intensified competition and global interest rate hikes.

Increased Competition in the Lending Market

The Australian lending market has become increasingly competitive. Traditional banks face stiff competition from agile fintech companies offering innovative and often cheaper financial products. This competitive landscape forces Westpac to offer more attractive interest rates on deposits to retain and attract customers. This directly impacts their net interest margin (NIM), a key indicator of profitability.

- Aggressive deposit rate wars eating into profitability: Westpac is locked in a battle for deposits, leading to higher interest payments to customers.

- Pressure to offer attractive savings accounts and term deposits: The need to remain competitive necessitates offering higher returns on savings and term deposits, reducing profit margins.

- Loss of market share to more competitive offerings: Failure to offer compelling rates results in a loss of market share to competitors. This decreased customer base further contributes to the margin squeeze.

Global Interest Rate Hikes

The Reserve Bank of Australia's (RBA) recent interest rate hikes, while increasing lending rates and potentially boosting interest income, also significantly increase the cost of funds for Westpac. This creates a squeeze between the rate at which Westpac borrows money and the rate at which it lends.

- Increased cost of borrowing for Westpac: Higher interest rates on borrowed funds directly impact profitability.

- Lag between increasing lending and deposit rates impacting profitability: There's often a time lag between increasing lending rates and raising deposit rates, creating a short-term profit reduction.

- Difficulty in passing on all increased costs to borrowers: The ability of Westpac to fully pass on increased borrowing costs to customers is limited by market competition and economic conditions, further impacting profitability.

Increased Operational Costs

Beyond funding costs, Westpac faces escalating operational expenses, further exacerbating the Westpac margin squeeze. These increased costs stem from regulatory pressures and significant investments in technology.

Regulatory Compliance and Increased Scrutiny

Following past scandals, Westpac faces heightened regulatory scrutiny and stringent compliance requirements. Meeting these demands involves considerable investment and ongoing expenditure.

- Investments in improved risk management and compliance systems: Significant capital expenditure is required to enhance internal systems and processes.

- Increased legal and advisory fees: The need for specialized legal and advisory services to ensure compliance adds to operational costs.

- Penalties and fines related to past misconduct: Past regulatory breaches can result in substantial penalties, directly impacting profitability.

Investment in Technology and Digital Transformation

The rise of fintech companies necessitates significant investment in technology and digital transformation for Westpac to remain competitive. This involves substantial upfront costs and ongoing maintenance.

- Upgrades to digital banking platforms and cybersecurity measures: Modernizing digital infrastructure and ensuring robust cybersecurity are crucial but expensive.

- Recruitment and training of technology specialists: Attracting and retaining skilled IT professionals is a costly endeavor.

- Ongoing maintenance and updates to IT infrastructure: Maintaining and upgrading complex IT systems requires significant ongoing investment.

Weakening Economic Conditions

The current macroeconomic environment is another key factor contributing to the Westpac margin squeeze. High inflation, recessionary fears, and reduced consumer confidence are all impacting Westpac's bottom line.

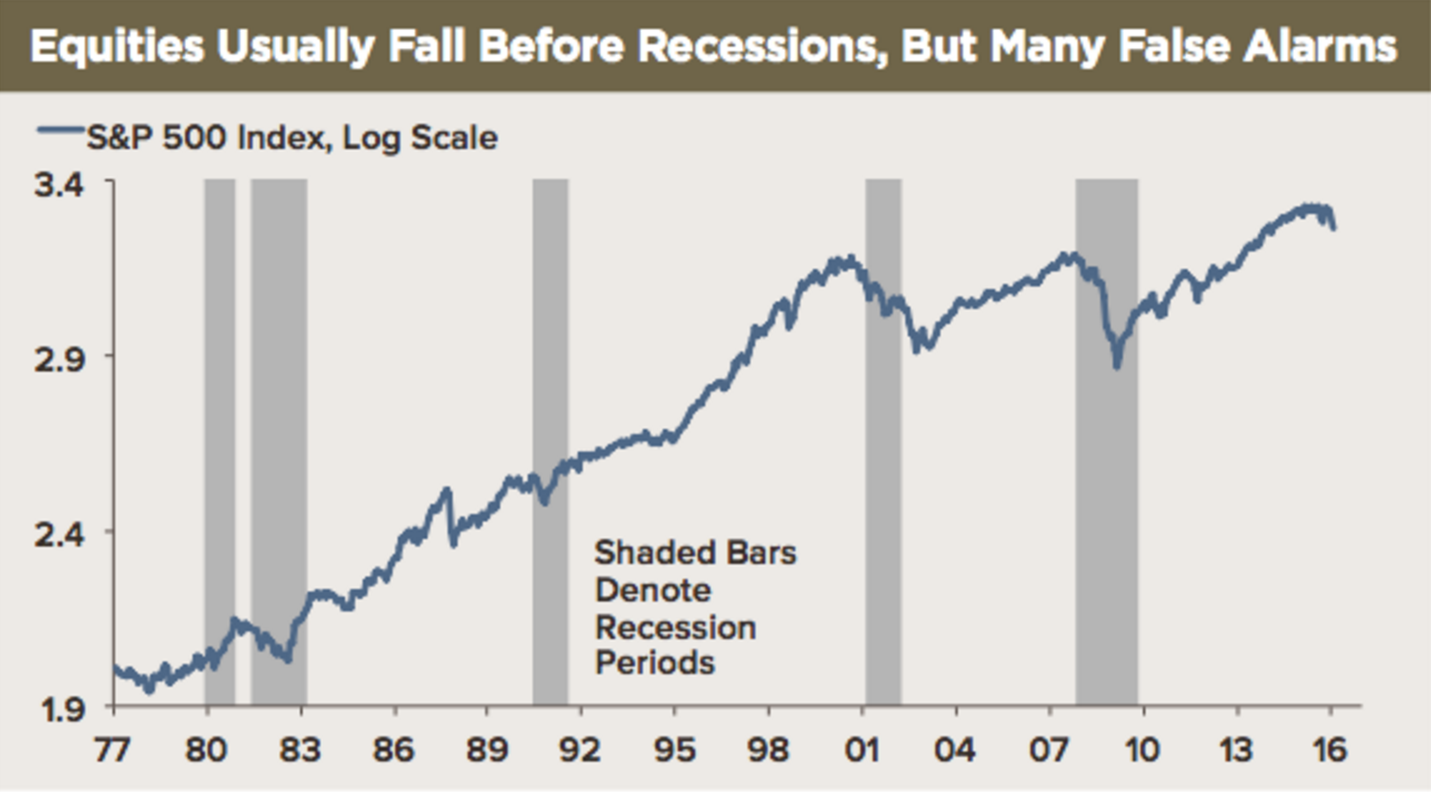

Impact of Inflation and Recessionary Fears

High inflation and recessionary fears are dampening consumer and business spending, impacting loan demand and increasing the risk of loan defaults.

- Reduced demand for mortgages and business loans: Economic uncertainty leads to decreased borrowing.

- Higher loan impairment charges due to increased defaults: A weakened economy increases the likelihood of loan defaults, leading to higher impairment charges.

- Negative impact on fee income from related services: Reduced economic activity lowers demand for related financial services, impacting fee income.

Reduced Consumer Confidence and Spending

Lower consumer confidence directly translates into decreased spending and investment, further negatively impacting loan demand and consequently Westpac's revenue.

- Lower credit card usage and transaction fees: Reduced consumer spending leads to lower credit card usage and associated transaction fees.

- Reduced demand for personal loans: Consumers are less likely to take on personal loans during uncertain economic times.

- Impact on wealth management services: Reduced investment activity and market volatility impact revenue from wealth management services.

Conclusion

Westpac's falling profits are the result of a multifaceted Westpac margin squeeze, driven by rising funding costs, increased operational expenses, and a weakening economic climate. These factors interact to create a challenging environment for the bank. Addressing this requires a multi-pronged strategic approach, including improving operational efficiency, navigating the intensely competitive lending landscape, and proactively adapting to the evolving regulatory environment. Staying informed on the ongoing developments related to the Westpac margin squeeze and its implications is essential for investors and stakeholders. For further in-depth analysis and the latest updates on Westpac's performance and the ongoing Westpac margin squeeze, be sure to follow leading financial news outlets.

Featured Posts

-

Live Stock Market Data Dow S And P 500 And Nasdaq May 5th

May 06, 2025

Live Stock Market Data Dow S And P 500 And Nasdaq May 5th

May 06, 2025 -

Trumps Uncertain Stance On Upholding The Constitution

May 06, 2025

Trumps Uncertain Stance On Upholding The Constitution

May 06, 2025 -

Trumps Economic Policies Prioritizing Trade Despite Growing Concerns

May 06, 2025

Trumps Economic Policies Prioritizing Trade Despite Growing Concerns

May 06, 2025 -

Succeeding Or Failing In Meetings With Donald Trump A Practical Analysis

May 06, 2025

Succeeding Or Failing In Meetings With Donald Trump A Practical Analysis

May 06, 2025 -

Lady Gaga Converse And The Economy Social Media As A Recession Predictor

May 06, 2025

Lady Gaga Converse And The Economy Social Media As A Recession Predictor

May 06, 2025

Latest Posts

-

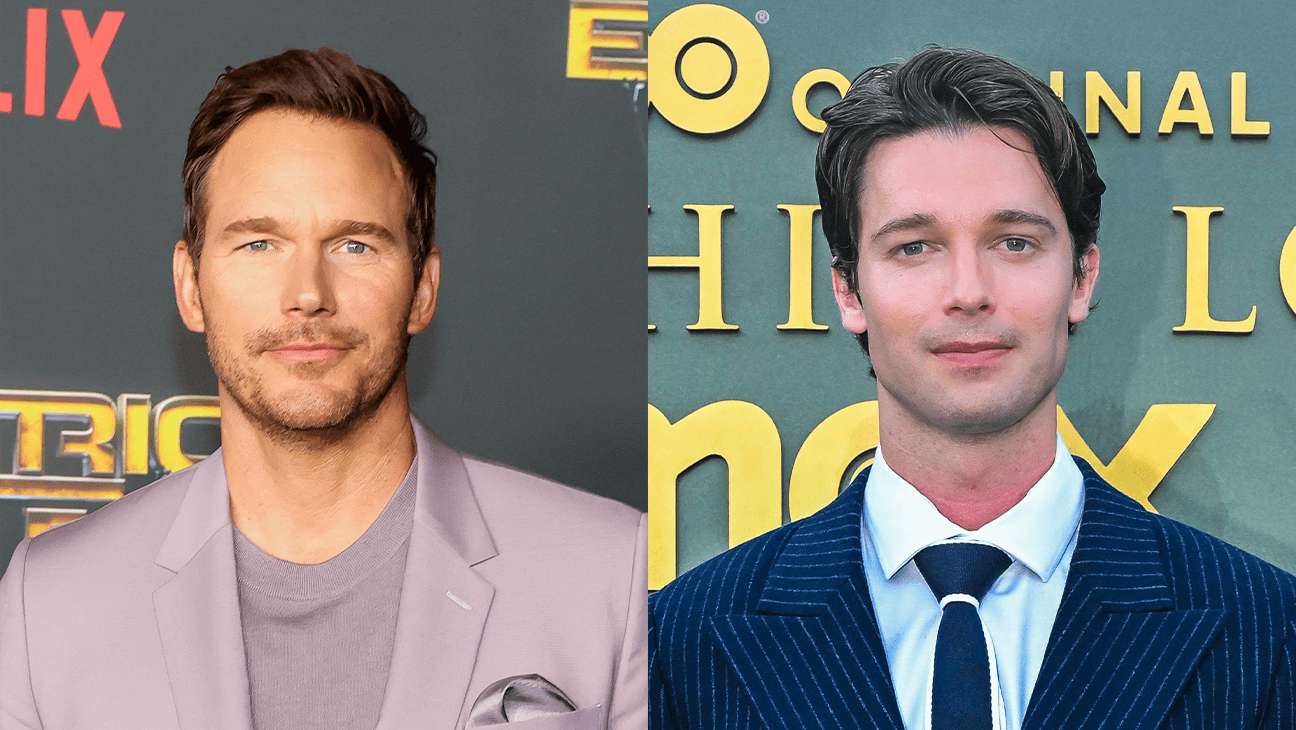

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

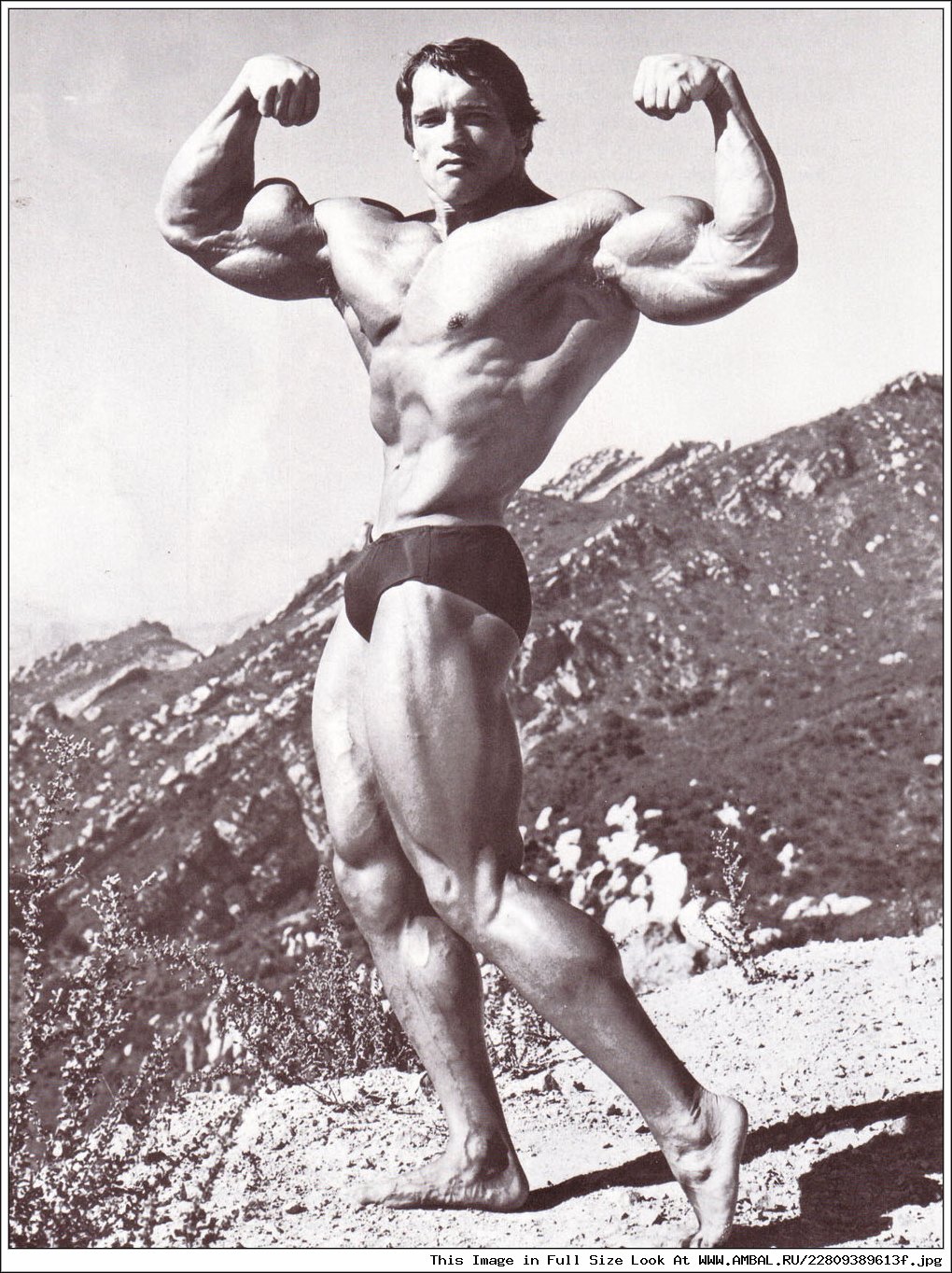

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025