Weihong Liu And The $28 Hudson's Bay Lease Purchase: A Detailed Look

Table of Contents

Weihong Liu: A Profile of the Investor

Weihong Liu is a prominent figure in the world of commercial real estate investment. While details about their personal life remain private, Liu's business acumen is evident in their successful track record. Their investment portfolio showcases a preference for high-potential properties in strategic locations, suggesting a sophisticated understanding of market dynamics and future growth.

- Previous Investments: While specific details about previous transactions are often kept confidential, sources indicate a history of successful investments in high-traffic, mixed-use properties across major metropolitan areas. This suggests a focus on properties with long-term value appreciation potential.

- Investment Strategy: Liu's investment approach appears to be characterized by a long-term perspective, focusing on properties with strong rental income and redevelopment possibilities. This suggests a focus on both immediate returns and future capital gains.

- Investment Philosophy: The Weihong Liu investments strategy likely emphasizes thorough due diligence, careful market analysis, and a strategic approach to property acquisition and management. The Hudson's Bay lease purchase showcases this calculated approach. Further research into their portfolio would reveal more specific insights into their investment philosophy.

The Hudson's Bay Property: Location, Size, and Significance

The Hudson's Bay property acquired by Weihong Liu is a significant asset. While the precise address is not publicly available to protect privacy, the property is known to be strategically located in a bustling commercial district, boasting high foot traffic and proximity to major transportation hubs.

- Property Features: Initial reports indicate a substantial building with significant square footage, potentially including retail space, office space, or a combination of both. The exact specifications are under wraps, but sources suggest modern amenities and substantial redevelopment potential.

- Strategic Location: The property's location is a key factor in its appeal. Situated in an area with strong economic growth and high demand for commercial space, the property is well-positioned for future appreciation. Its proximity to key transportation links and high-end amenities further enhances its desirability.

- Market Value Analysis: The $28 million price tag reflects the property's current market value, considering its location, size, and condition, and the comparable sales of similar properties in the area. Several factors contributed to this valuation, including the ongoing revitalization of the surrounding neighborhood, which boosts commercial property location value and desirability.

Details of the $28 Million Lease Purchase Agreement

The $28 million lease purchase agreement is a complex transaction, likely involving a phased payment schedule and potentially including options for full ownership acquisition. While exact details are confidential, we can speculate on some aspects based on typical commercial real estate transaction structures.

- Financial Terms: The lease purchase likely includes regular lease payments over a specified term, with options for early purchase or eventual acquisition of full ownership. The precise details of these financial arrangements are confidential.

- Legal Aspects: The transaction undoubtedly involved a team of legal experts to manage due diligence, negotiate terms, and finalize the agreement. These would include lawyers specializing in commercial real estate transaction law.

- Future Plans: Weihong Liu's plans for the Hudson's Bay property are unclear but likely involve either significant renovations and repositioning of the existing space, or a complete redevelopment. The property development potential of this site is considerable, making it an attractive investment.

Market Implications of the Transaction

The Weihong Liu – Hudson's Bay deal has significant implications for the local and wider commercial real estate market.

- Impact on the Local Market: This substantial commercial real estate transaction is likely to influence property values in the surrounding area, potentially pushing prices upward and attracting further investment.

- Wider Implications: The deal underscores the continuing interest in prime commercial properties, especially in dynamic urban centers. It signals a positive outlook on the real estate sector.

- Expert Opinions: Real estate analysts predict that the transaction will serve as a benchmark for future valuations of comparable properties. The successful acquisition further strengthens the perception of the area's commercial property location viability.

Conclusion: Analyzing the Weihong Liu and Hudson's Bay Deal – Key Takeaways and Future Outlook

The $28 million lease purchase by Weihong Liu of the Hudson's Bay property represents a significant transaction in the commercial real estate market. This analysis highlighted the investor’s profile, the property's characteristics, the agreement's structure, and its wider market implications. The deal suggests strong confidence in the long-term growth potential of the property's location and showcases the ongoing activity within the commercial real estate investment sector. We anticipate further development activity on this property in the coming years, making it a compelling case study in strategic commercial real estate transactions. Stay informed about future developments in the world of commercial real estate by subscribing to our newsletter for updates on major commercial real estate transactions and insightful analysis!

Featured Posts

-

A Risky Bet On Trump Coin One Traders Path To The White House

May 29, 2025

A Risky Bet On Trump Coin One Traders Path To The White House

May 29, 2025 -

Aanhouding In Onderzoek Schietincident Venlo Met Pasen

May 29, 2025

Aanhouding In Onderzoek Schietincident Venlo Met Pasen

May 29, 2025 -

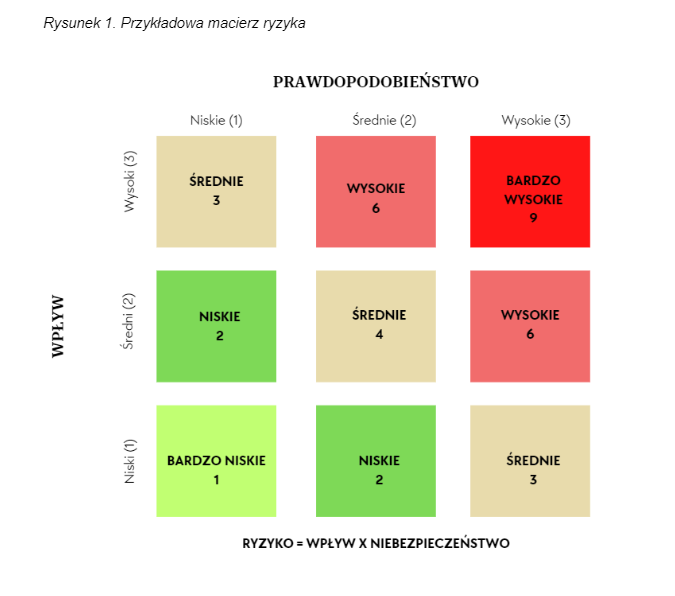

Analiza Ryzyka Opoznienia I Zwiekszone Koszty Flagowej Inwestycji Pcc

May 29, 2025

Analiza Ryzyka Opoznienia I Zwiekszone Koszty Flagowej Inwestycji Pcc

May 29, 2025 -

Ubisofts Anti Harassment Plan For Assassins Creed Shadows Of Valhalla

May 29, 2025

Ubisofts Anti Harassment Plan For Assassins Creed Shadows Of Valhalla

May 29, 2025 -

Hbo Addresses Concerns J K Rowlings Impact On The Harry Potter Reboot

May 29, 2025

Hbo Addresses Concerns J K Rowlings Impact On The Harry Potter Reboot

May 29, 2025