Wednesday's Rise In CoreWeave (CRWV) Stock: A Detailed Look

Table of Contents

Potential Catalysts Behind Wednesday's CoreWeave (CRWV) Stock Surge:

Several factors could have contributed to the impressive increase in CoreWeave (CRWV) stock price on Wednesday. Let's explore the most likely catalysts:

Positive Earnings Report or Guidance: A positive earnings report or upbeat guidance from CoreWeave could significantly impact investor sentiment.

- Exceeding Earnings Expectations: CoreWeave may have surpassed analysts' projected earnings, demonstrating strong financial performance and exceeding market expectations for CoreWeave (CRWV) stock.

- Upward Revenue Revisions: Increased revenue projections, indicating robust growth and market demand for CoreWeave's services, would likely boost investor confidence in CoreWeave (CRWV) stock.

- Positive Future Outlook: An optimistic outlook provided by CoreWeave management, highlighting future growth opportunities and strategic initiatives, could bolster investor belief in the long-term prospects of CoreWeave (CRWV) stock.

- Announcements of New Partnerships or Contracts: Securing significant new partnerships or contracts with major clients could signify increased market share and revenue streams, positively impacting CoreWeave (CRWV) stock.

Market-Wide Trends Favoring Cloud Computing Stocks: The surge in CoreWeave (CRWV) stock might also reflect broader positive trends in the cloud computing sector.

- Increased Investor Interest in the Cloud Computing Sector: Growing investor confidence in the cloud computing industry as a whole could lead to increased investment in all related stocks, including CoreWeave (CRWV) stock.

- Positive Reports from Competitors: Positive news or strong performance from competing cloud computing companies could create a ripple effect, boosting overall sector sentiment and indirectly impacting CoreWeave (CRWV) stock.

- General Market Optimism: A generally positive market environment, characterized by increased investor confidence and risk appetite, could contribute to a broad-based rally, benefiting CoreWeave (CRWV) stock.

Speculative Trading and Investor Sentiment: Speculation and investor sentiment play a significant role in short-term stock price fluctuations.

- Social Media Buzz: Positive social media discussions and online forums could generate excitement and hype around CoreWeave (CRWV) stock, driving up demand.

- Analyst Upgrades: Positive ratings or price target increases from financial analysts could influence investor perceptions and lead to increased buying pressure for CoreWeave (CRWV) stock.

- Increased Trading Volume: A significant increase in trading volume for CoreWeave (CRWV) stock could indicate strong buying interest and contribute to price appreciation.

Analyzing CoreWeave's (CRWV) Fundamental Strength:

Beyond the short-term catalysts, understanding CoreWeave's fundamental strengths is crucial for long-term investment decisions.

CoreWeave's Business Model and Competitive Advantages: CoreWeave differentiates itself through a focused business model and key competitive advantages.

- Niche Focus within Cloud Computing: CoreWeave's specialization in a specific area within the broad cloud computing market could offer them a competitive edge, reducing direct competition.

- Innovative Technology: CoreWeave's utilization of cutting-edge technology and infrastructure could provide a significant advantage in terms of performance, scalability, and cost-effectiveness.

- Strong Customer Base: A robust and growing customer base, consisting of major enterprises and high-profile clients, suggests strong market acceptance and demand for their services.

Long-Term Growth Potential and Future Prospects: CoreWeave's strategic vision and long-term growth potential are promising.

- Expansion Plans: Ambitious expansion plans, including geographical reach or service offerings, could drive future revenue growth and market share expansion.

- Technological Advancements: Continuous investment in research and development, leading to ongoing technological improvements, could maintain CoreWeave's competitive position.

- Market Penetration Strategies: Effective market penetration strategies could help CoreWeave secure a larger share of the expanding cloud computing market.

Risk Factors and Considerations for CoreWeave (CRWV) Investors:

While the outlook for CoreWeave may appear positive, investors must acknowledge potential risks.

Volatility and Market Uncertainty: Investing in CoreWeave (CRWV) stock carries inherent risks due to its relative newness and the volatile nature of the stock market.

- Price Corrections: Significant price increases can be followed by corrections, resulting in temporary declines in stock value.

- Overall Market Downturns: A general economic downturn or market correction could negatively impact even fundamentally strong companies like CoreWeave.

- Impact of Competing Technologies: The emergence of disruptive technologies or enhanced offerings from competitors could pose a threat to CoreWeave's market position.

Competition in the Cloud Computing Industry: CoreWeave operates within a highly competitive market.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of major competitors like AWS, Azure, and Google Cloud is essential for assessing CoreWeave's competitive landscape.

- Competitive Pressures: Intense competition can lead to price wars, reduced profit margins, and challenges in maintaining market share.

Conclusion:

Wednesday's rise in CoreWeave (CRWV) stock is likely the result of a combination of positive financial news, favorable market trends, and investor speculation. While the company demonstrates fundamental strength and long-term growth potential, investors must also consider the risks associated with its relatively new status and the competitive nature of the cloud computing industry. While Wednesday's rise in CoreWeave (CRWV) stock presents an intriguing opportunity, thorough due diligence remains crucial. Continue your research on CoreWeave (CRWV) stock and make informed investment decisions based on your own risk tolerance and financial goals. Remember to consult with a financial advisor before making any investment decisions related to CoreWeave (CRWV) stock or any other security.

Featured Posts

-

Liverpool Manager Klopp To Return Before Seasons End

May 22, 2025

Liverpool Manager Klopp To Return Before Seasons End

May 22, 2025 -

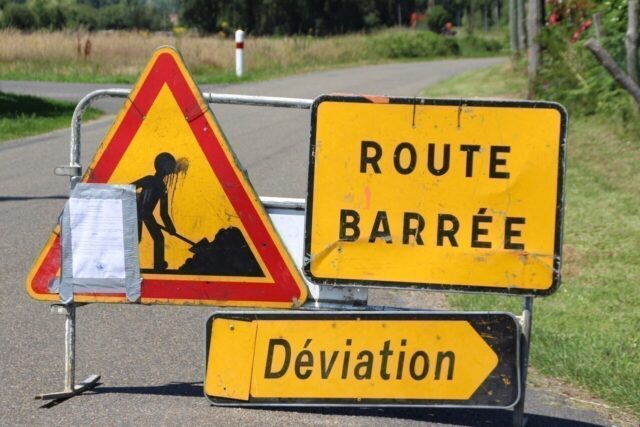

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025 -

Cassis Blackcurrant Cultivation Harvesting And Product Applications

May 22, 2025

Cassis Blackcurrant Cultivation Harvesting And Product Applications

May 22, 2025 -

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 22, 2025

Une Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Test En Cours

May 22, 2025 -

Second Colorado Gray Wolf Reintroduced To Wyoming Dies

May 22, 2025

Second Colorado Gray Wolf Reintroduced To Wyoming Dies

May 22, 2025

Latest Posts

-

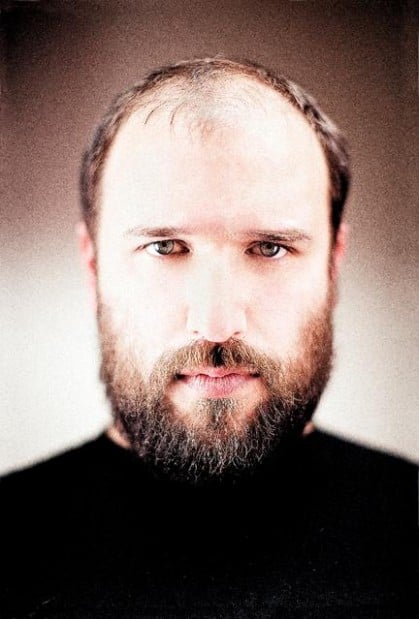

Remembering Frontmans Name Rock Music Loses A Star At 32

May 22, 2025

Remembering Frontmans Name Rock Music Loses A Star At 32

May 22, 2025 -

Frontmans Name Popular Rock Band Frontman Dies At 32 Remembering His Musical Contributions

May 22, 2025

Frontmans Name Popular Rock Band Frontman Dies At 32 Remembering His Musical Contributions

May 22, 2025 -

Rock Icon Dead At 32 Fans Mourn The Loss Of Band Name S Frontman

May 22, 2025

Rock Icon Dead At 32 Fans Mourn The Loss Of Band Name S Frontman

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Dies At 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies At 32

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025