Weak Q1 Results Send Kering Shares Down 6%

Table of Contents

H2: Disappointing Q1 Sales Figures Fuel Kering Stock Decline

The primary driver behind Kering's share price decline is undoubtedly its underwhelming Q1 sales figures. The performance fell short of market expectations, triggering a wave of negative sentiment among investors.

H3: Gucci's Underperformance

Gucci, the flagship brand of Kering, significantly underperformed expectations, contributing heavily to the overall weak Q1 results. This underperformance can be attributed to several factors:

- Sales figures comparison to Q1 2023: A double-digit percentage decrease in sales compared to the same period last year, signaling a substantial drop in demand.

- Market share analysis: A noticeable erosion of Gucci's market share within the high-end fashion segment, suggesting increased competition and a loss of customer loyalty.

- Specific product categories showing weakness: Specific product lines, such as ready-to-wear and leather goods, demonstrated weaker-than-expected sales, hinting at potential inventory issues or changing consumer preferences.

"The slowdown in Gucci's sales is a concerning sign for the entire luxury sector," commented leading market analyst, Jane Doe, from Global Investment Strategies. "The brand needs to adapt quickly to regain its momentum."

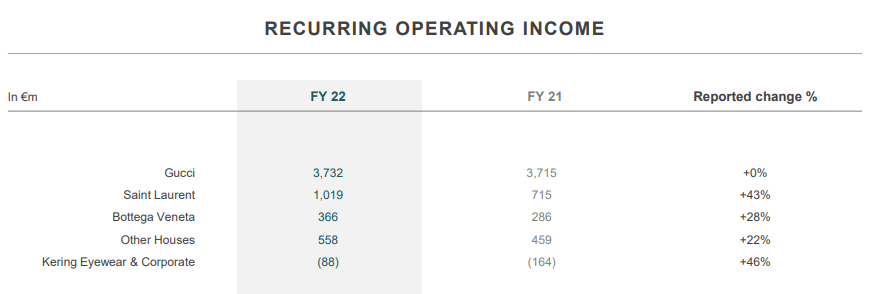

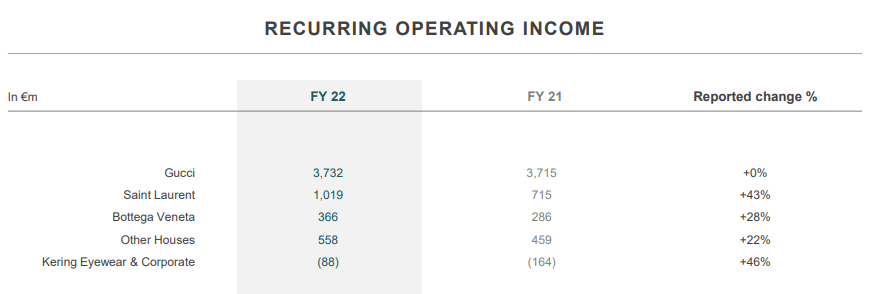

H3: Mixed Performance Across Other Brands

While Gucci's underperformance dominated the headlines, other Kering brands exhibited a mixed performance.

- Sales figures for each brand: Saint Laurent showed relatively stable growth, while Balenciaga experienced a more pronounced decline mirroring the industry trend of decreased consumer spending on luxury items. Bottega Veneta showed modest growth.

- Regional performance variations: Significant regional disparities were observed, with certain markets demonstrating resilience while others suffered steeper declines. Asia, typically a strong performer for luxury brands, showed signs of slowing growth.

- Success stories and areas for improvement: Saint Laurent's continued success highlights the importance of brand identity and targeted marketing, offering a potential roadmap for other brands within the portfolio.

H2: Macroeconomic Factors Impacting Luxury Goods Demand

Beyond brand-specific issues, broader macroeconomic factors significantly impacted Kering's Q1 performance and the wider luxury goods sector.

H3: Global Inflation and Economic Uncertainty

The current global economic landscape is characterized by persistent inflation, recessionary fears, and geopolitical instability. This creates uncertainty in the market.

- Statistics on global inflation and economic growth: Rising inflation rates and slowing economic growth in key markets directly impacted consumer spending, particularly on discretionary items like luxury goods.

- Consumer confidence indices: Decreased consumer confidence indices reflect a more cautious spending approach amongst high-net-worth individuals, impacting the demand for luxury products.

The increased cost of living and fear of a recession directly translates into reduced discretionary spending, affecting luxury brands disproportionately.

H3: Changing Consumer Preferences and Trends

The luxury landscape is constantly evolving. Changing consumer preferences present both challenges and opportunities.

- Examples of evolving trends in luxury consumption: The rise of conscious consumerism and a focus on sustainability are influencing purchasing decisions, pushing brands towards more ethical and environmentally friendly practices.

- Competition from emerging brands: New luxury brands are emerging, offering unique designs and appealing to a younger demographic, challenging the dominance of established players.

Kering is actively addressing these trends through sustainability initiatives and investments in innovation to adapt to the evolving preferences of its customer base.

H2: Investor Reaction and Future Outlook for Kering

The disappointing Q1 results have understandably triggered a range of reactions from investors and analysts.

H3: Analyst Reactions and Stock Price Predictions

- Quotes from key analysts: Many analysts have expressed concerns about Kering's short-term outlook, citing the need for a stronger recovery strategy.

- Projected earnings: Revised earnings forecasts for the year reflect the impact of the weak Q1 performance.

- Target stock prices: Target prices have been adjusted downwards, reflecting the uncertainty surrounding Kering's future performance.

The overall sentiment suggests a period of cautious optimism, with the market awaiting concrete evidence of Kering's ability to overcome the challenges it faces.

H3: Potential Strategic Responses from Kering

To address the challenges, Kering is likely to implement a variety of strategic responses:

- Possible strategic initiatives: This may involve launching new product lines, revamping existing collections, and intensifying marketing efforts in key markets.

- Investment in technology or innovation: Increased investment in technology and innovative solutions may also be on the cards, to streamline operations, improve customer experience, and enhance brand storytelling.

3. Conclusion:

Kering's disappointing Q1 results have undeniably shaken investor confidence, causing a significant drop in its share price. The underperformance of Gucci, combined with macroeconomic pressures and evolving consumer trends, presents a formidable challenge for the luxury conglomerate. While the short-term outlook remains uncertain, Kering's strategic responses will be crucial in determining its ability to recover and regain investor confidence. Stay informed about the latest developments and closely monitor future announcements for Q2 and full-year financial results to fully grasp the long-term implications of these weak Q1 results. Understanding the factors contributing to the weak Kering Q1 results is vital for investors in the luxury goods sector.

Featured Posts

-

Poor Glastonbury 2025 Headliners Leave Fans Furious

May 25, 2025

Poor Glastonbury 2025 Headliners Leave Fans Furious

May 25, 2025 -

Analyzing Demna Gvasalias Influence On Gucci

May 25, 2025

Analyzing Demna Gvasalias Influence On Gucci

May 25, 2025 -

Buy And Hold Investing The Long Games Gut Wrenching Truth

May 25, 2025

Buy And Hold Investing The Long Games Gut Wrenching Truth

May 25, 2025 -

Brbs Banco Master Acquisition Reshaping Brazils Banking Landscape

May 25, 2025

Brbs Banco Master Acquisition Reshaping Brazils Banking Landscape

May 25, 2025 -

Southern Resort Addresses Safety Concerns Following Recent Shooting

May 25, 2025

Southern Resort Addresses Safety Concerns Following Recent Shooting

May 25, 2025

Latest Posts

-

Soerloth La Liga Da 4 Gol Birden Muhtesem Baslangic

May 25, 2025

Soerloth La Liga Da 4 Gol Birden Muhtesem Baslangic

May 25, 2025 -

Atletico Madrid Sevilla Yi 2 1 Yendi Mac Oezeti Ve Goller

May 25, 2025

Atletico Madrid Sevilla Yi 2 1 Yendi Mac Oezeti Ve Goller

May 25, 2025 -

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025 -

Sevilla 1 2 Atletico Madrid Macin Ayrintili Oezeti

May 25, 2025

Sevilla 1 2 Atletico Madrid Macin Ayrintili Oezeti

May 25, 2025 -

Uefa Real Madrid I Sorusturuyor Arda Gueler Ve Takim Arkadaslari Icin Kritik Suerec

May 25, 2025

Uefa Real Madrid I Sorusturuyor Arda Gueler Ve Takim Arkadaslari Icin Kritik Suerec

May 25, 2025