Warren Buffett's Keys To Success: Avoiding Mistakes And Maintaining Humility

Table of Contents

The Importance of Long-Term Investing in Warren Buffett's Success

A cornerstone of Warren Buffett's success is his unwavering commitment to long-term investing. His famous "buy and hold" strategy, often cited as a key element of Warren Buffett's investing secrets, prioritizes patience and a long-term perspective over short-term market fluctuations. This approach offers several significant advantages:

- Avoids short-term market fluctuations: The volatile nature of the stock market can lead to impulsive decisions. Buffett's strategy transcends these temporary dips and surges, focusing on the underlying value of the investment.

- Focuses on intrinsic value over market price: Buffett famously looks beyond the market price to determine the true worth ("intrinsic value") of a company. This involves deep fundamental analysis, examining a company's financial health, competitive advantage, and long-term prospects.

- Allows for compounding returns over time: The magic of compounding returns is amplified by a long-term approach. Small gains accumulate over years, resulting in exponential growth. This is a core tenet of Warren Buffett's investment philosophy.

- Requires patience and discipline: Long-term investing demands patience, discipline, and the ability to resist the urge to panic-sell during market downturns. This is where Buffett's mental fortitude truly shines.

Buffett identifies undervalued companies by meticulously analyzing their financial statements, understanding their business models, and assessing their management teams. His successful long-term investments in Coca-Cola and American Express exemplify this strategy. Understanding the core principles behind Warren Buffett's success requires a deep dive into his value investing approach.

Warren Buffett's Risk Management Strategies: Avoiding Costly Mistakes

While known for his bold investments, Buffett is also renowned for his cautious approach to risk management. He emphasizes a thorough and meticulous process to minimize potential losses. His strategies include:

- Thorough due diligence and research: Buffett invests only after extensive research and due diligence. He thoroughly understands the business, its management, and its competitive landscape before committing any capital.

- Understanding the business model before investing: Buffett invests in businesses he understands, focusing on companies with strong fundamentals and sustainable competitive advantages. He famously advises investors to stick to their "circle of competence."

- Diversification across different sectors: While he makes concentrated bets, Buffett ensures diversification across different sectors, mitigating risk exposure to any single industry. This strategic diversification is another key component in understanding Warren Buffett's success.

- Avoiding speculation and following market trends blindly: He avoids speculation and the temptation to chase hot trends. He focuses instead on the long-term value of companies, uninfluenced by short-term market sentiment.

Buffett’s concept of a "circle of competence" is crucial. He focuses on investing in businesses he truly understands, avoiding ventures outside his area of expertise. This disciplined approach significantly reduces the risk of costly mistakes, a critical aspect of Warren Buffett's investment philosophy.

Humility and Continuous Learning in Warren Buffett's Success

Humility is a defining characteristic of Warren Buffett. This isn't just a personality trait; it's an integral part of his investment philosophy and a major factor contributing to his sustained success. This includes:

- Acknowledging limitations and mistakes: Buffett openly acknowledges his mistakes, learning from them and adjusting his approach accordingly. He understands that no one is infallible, and he embraces this reality.

- Seeking advice from experts and mentors: Buffett actively seeks advice from experienced investors and mentors, demonstrating a willingness to learn and expand his knowledge base.

- Adapting to changing market conditions: The market is constantly evolving, and Buffett adapts his strategies to respond to changing circumstances.

- Remaining open to new ideas and information: He remains open to new information and perspectives, constantly expanding his knowledge and understanding of the market.

Buffett’s commitment to lifelong learning is evident in his voracious reading habits and his continuous engagement with industry experts. His long-standing partnership with Charlie Munger underscores the importance of mentorship and collaboration in his journey to success. This consistent learning is essential to understanding Warren Buffett's success over decades.

The Power of Value Investing According to Warren Buffett

Value investing, at its core, involves identifying and acquiring undervalued assets. Buffett's mastery of this strategy is legendary, and it's built upon several key principles:

- Focusing on undervalued assets: Value investors search for companies whose market price is significantly below their intrinsic value.

- Long-term perspective: This strategy requires a long-term perspective, resisting the pressure to sell assets prematurely.

- Intrinsic value analysis: This process requires rigorous financial analysis to determine a company's true worth.

- Margin of safety: Buffett always builds in a margin of safety, ensuring that even if his valuation is slightly off, he still stands to profit.

By patiently identifying and investing in undervalued companies, Buffett capitalizes on market inefficiencies and realizes significant long-term gains. The patience required for value investing is often underestimated, but it's fundamental to understanding Warren Buffett's success.

Conclusion

In summary, Warren Buffett's extraordinary success is not a matter of luck but a result of a carefully crafted approach built upon several pillars: a commitment to long-term investing, rigorous risk management strategies, unwavering humility, continuous learning, and a deep understanding of value investing. By emulating these principles, investors can significantly enhance their prospects for financial success.

To delve deeper into the fascinating world of Warren Buffett's investment strategies and philosophy, explore his annual letters to Berkshire Hathaway shareholders, read biographies such as "The Snowball," and investigate resources dedicated to value investing. Understanding Warren Buffett's investing secrets, Buffett's investment strategies, and how to achieve success like Warren Buffett can equip you with invaluable knowledge for navigating the complexities of the financial world and building lasting wealth.

Featured Posts

-

Analyzing The Karate Kid Part Ii Themes Of Cultural Understanding And Self Discovery

May 07, 2025

Analyzing The Karate Kid Part Ii Themes Of Cultural Understanding And Self Discovery

May 07, 2025 -

Rihannas Engagement Ring The Details And Her Chic Red Heel Choice

May 07, 2025

Rihannas Engagement Ring The Details And Her Chic Red Heel Choice

May 07, 2025 -

Navrat Svetoveho Pohara V Hokeji Nhl Oznamila Termin 2028

May 07, 2025

Navrat Svetoveho Pohara V Hokeji Nhl Oznamila Termin 2028

May 07, 2025 -

Fotosessiya Rianny Rozovoe Kruzhevo I Strast

May 07, 2025

Fotosessiya Rianny Rozovoe Kruzhevo I Strast

May 07, 2025 -

Cavs Vs Spurs Injury News Game Day Report March 27 Fox Sports 1340 Wnco

May 07, 2025

Cavs Vs Spurs Injury News Game Day Report March 27 Fox Sports 1340 Wnco

May 07, 2025

Latest Posts

-

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

May 08, 2025 -

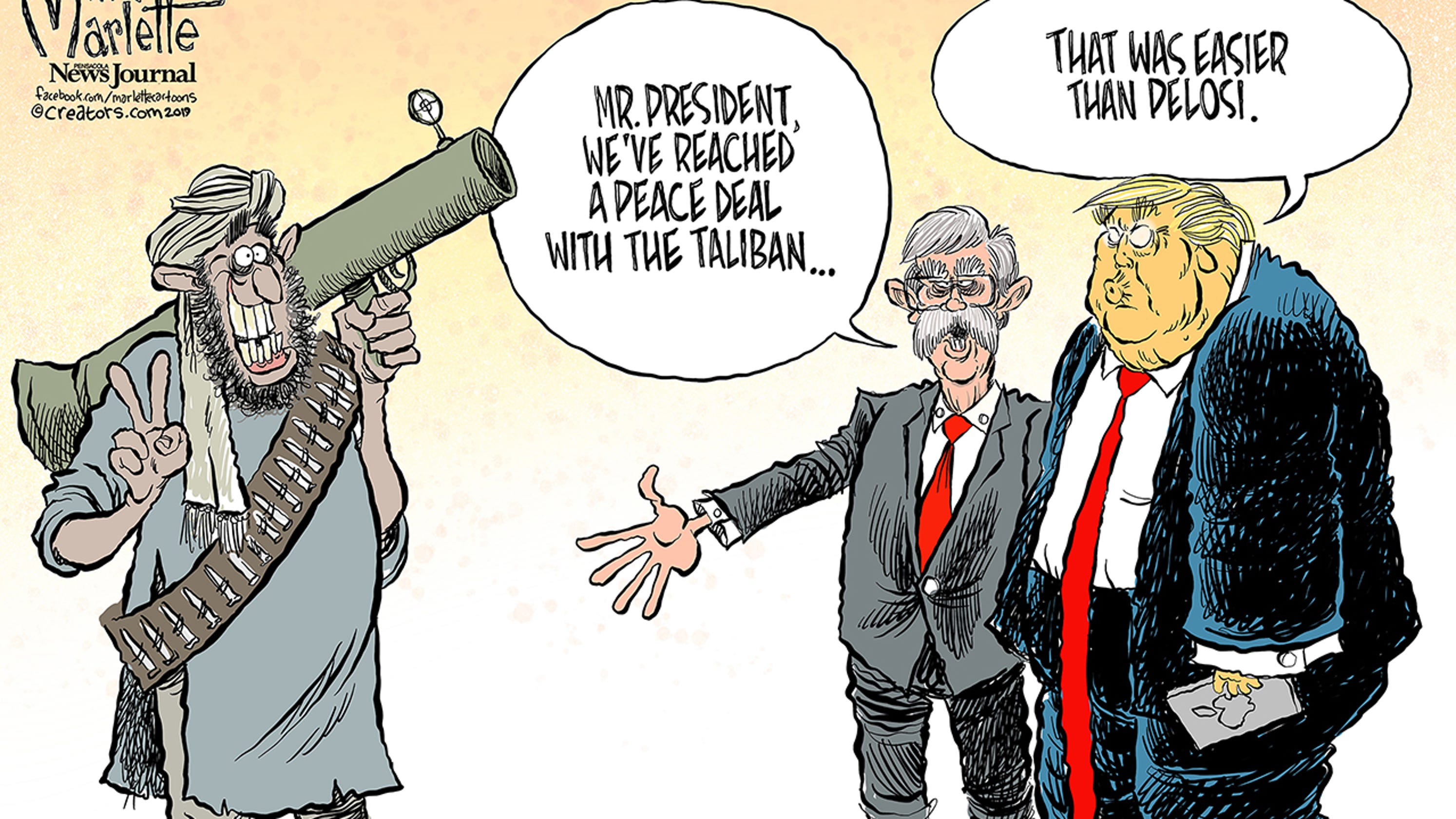

Is Trump Right Assessing Chinas Influence In Greenland

May 08, 2025

Is Trump Right Assessing Chinas Influence In Greenland

May 08, 2025 -

Federal Charges Millions Stolen Via Compromised Office365 Executive Accounts

May 08, 2025

Federal Charges Millions Stolen Via Compromised Office365 Executive Accounts

May 08, 2025 -

Trumps Greenland Concerns Is China A Real Threat

May 08, 2025

Trumps Greenland Concerns Is China A Real Threat

May 08, 2025 -

Millions Made From Executive Office365 Account Breaches Federal Investigation

May 08, 2025

Millions Made From Executive Office365 Account Breaches Federal Investigation

May 08, 2025