Warner Bros. Discovery's NBA Deal Loss: A $1.1 Billion Blow To Advertising Revenue

Table of Contents

The Financial Impact of Losing the NBA Deal

The $1.1 billion figure attached to Warner Bros. Discovery's lost NBA broadcasting rights represents a substantial and multifaceted loss. This isn't simply a reduction in projected income; it's a complex issue with both direct and indirect financial consequences.

Direct Revenue Loss

The most immediate impact is the direct loss of advertising revenue stemming from NBA broadcasts. This encompasses a wide range of advertising opportunities.

- Loss of lucrative advertising slots during high-profile games: High-demand advertising slots during playoff games, the NBA Finals, and nationally televised regular season games are now unavailable, significantly impacting revenue streams.

- Reduced potential for targeted advertising campaigns around NBA events: Warner Bros. Discovery lost the ability to create and sell targeted advertising campaigns leveraging the massive viewership and demographic data associated with NBA events. This represents a loss of potential revenue from highly effective, data-driven marketing strategies.

- Impact on overall advertising inventory and pricing strategies: The absence of NBA programming significantly alters the overall advertising inventory, affecting pricing strategies and potentially impacting the value of remaining advertising slots across Warner Bros. Discovery's platforms.

Indirect Revenue Impacts

The financial repercussions extend beyond the direct loss of ad revenue. Secondary effects could significantly impact the company's overall financial health.

- Decreased subscriber numbers for streaming services: If NBA content was a key driver for subscriptions to Warner Bros. Discovery's streaming services, the loss could lead to subscriber churn and diminished subscription revenue.

- Negative impact on brand perception and investor confidence: The loss of such a high-profile sports deal could negatively impact the company's brand perception and erode investor confidence, affecting the company's overall valuation and access to capital.

- Potential loss of synergistic opportunities with other Warner Bros. Discovery properties: The NBA deal might have facilitated synergistic marketing and cross-promotional opportunities with other Warner Bros. Discovery properties, the loss of which represents a missed opportunity for revenue generation.

Strategic Implications for Warner Bros. Discovery

The loss of the NBA deal necessitates a significant strategic shift for Warner Bros. Discovery, impacting both their sports broadcasting strategies and overall advertising approach.

Re-evaluating Sports Broadcasting Strategies

Warner Bros. Discovery must now reassess their approach to securing and broadcasting live sports content.

- Exploration of alternative sports rights acquisitions: The company will need to actively pursue other sports rights acquisitions, potentially focusing on different leagues or sports to fill the void left by the NBA. This requires a thorough market analysis and a competitive bidding strategy.

- Potential investment in other forms of programming to fill the gap: To maintain viewership and advertising appeal, Warner Bros. Discovery needs to invest in other forms of high-quality programming to replace the lost NBA content. This could include original series, movies, or other live events.

- Focus on enhancing existing non-sports content to attract viewers: The company should concentrate on improving the quality and appeal of its existing non-sports content to retain and attract viewers who may have tuned in primarily for NBA games.

Impact on Advertising Sales & Strategies

The loss of NBA advertising inventory forces Warner Bros. Discovery to revamp its advertising sales and marketing strategies.

- Focus on alternative programming for advertising opportunities: The company must now prioritize advertising opportunities around its remaining programming, maximizing the value of available inventory.

- Re-evaluation of advertising pricing and package deals: Advertising pricing and package deals will need to be reassessed to reflect the changed advertising inventory and to remain competitive.

- Increased emphasis on data-driven targeted advertising across their platforms: With a smaller overall inventory, data-driven targeted advertising will become even more crucial to maximize the effectiveness and value of each advertising slot.

The Broader Context of the Media Landscape

The loss of the NBA rights by Warner Bros. Discovery provides valuable insight into the current competitive landscape and future trends in media and advertising.

The Competitive Landscape of Sports Broadcasting

The fiercely competitive nature of the sports broadcasting market is highlighted by this loss.

- Analysis of competitor strategies and potential acquisitions: The deal loss necessitates a deep analysis of competitors’ strategies and potential acquisitions to understand the landscape and identify opportunities.

- Examination of the rising costs of securing major sports rights: The escalating cost of securing major sports rights underscores the increasing challenges for media companies in this space.

- Discussion of the evolving relationship between streaming services and traditional broadcasting: The dynamics between streaming platforms and traditional broadcasting networks are constantly shifting, impacting the strategies used to secure and distribute sports content.

The Future of Sports and Advertising

This significant loss underscores the shifting dynamics of the media industry and the imperative for adaptability.

- The influence of cord-cutting on traditional television advertising: The continuing trend of cord-cutting directly impacts traditional television advertising revenue, making diversification crucial for media companies.

- The growth of streaming and its impact on sports broadcasting deals: The growth of streaming services is fundamentally altering how sports are broadcast and how advertising revenue is generated, requiring new approaches.

- The increasing importance of data and analytics in advertising sales strategies: Data-driven insights are critical for optimizing advertising strategies and maximizing the value of limited inventory in the evolving media landscape.

Conclusion

The loss of the NBA broadcasting rights represents a significant challenge for Warner Bros. Discovery, resulting in a substantial $1.1 billion hit to advertising revenue and forcing a strategic reassessment of their media approach. This setback underscores the volatile nature of the sports broadcasting market and the ongoing need for adaptability in the ever-evolving media landscape. Warner Bros. Discovery must now actively explore alternative strategies to mitigate the impact of this loss and secure future growth. Understanding the full consequences of this Warner Bros. Discovery NBA deal loss is crucial for investors and industry professionals alike. Learn more about the impact of this significant loss on the future of media and advertising.

Featured Posts

-

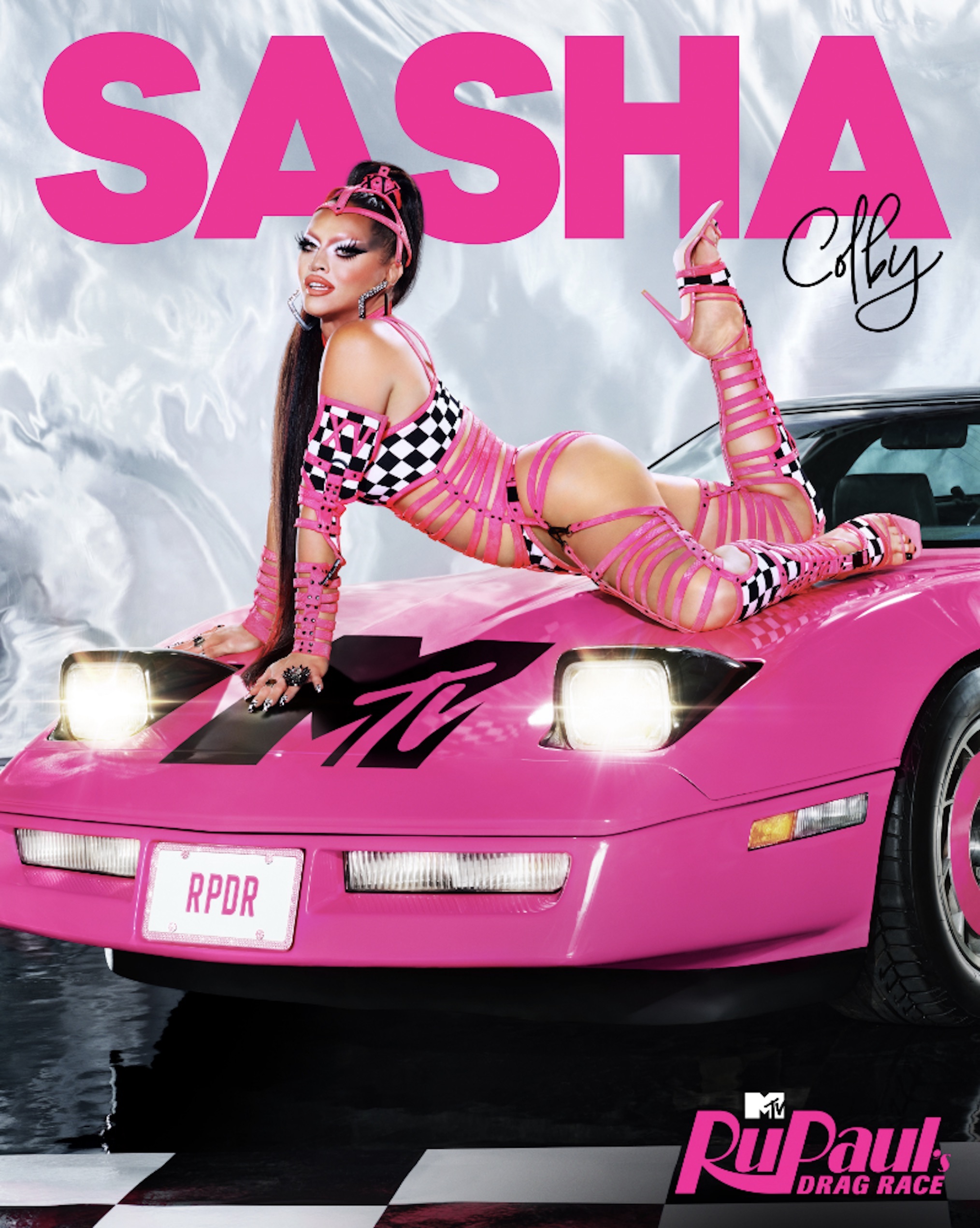

Ru Pauls Drag Race S17 E14 Live Journal Discussion Fan Reactions To Oh No They Didn T

May 06, 2025

Ru Pauls Drag Race S17 E14 Live Journal Discussion Fan Reactions To Oh No They Didn T

May 06, 2025 -

Beauty School Extra Long Nails A Detailed Look

May 06, 2025

Beauty School Extra Long Nails A Detailed Look

May 06, 2025 -

Analysis Bill Mahers Critique Of Nikes So Win Super Bowl 2025 Commercial And Its Portrayal Of Patriarchy

May 06, 2025

Analysis Bill Mahers Critique Of Nikes So Win Super Bowl 2025 Commercial And Its Portrayal Of Patriarchy

May 06, 2025 -

Fenty Beauty Paris Rihannas Glamorous Appearance And Fan Interaction

May 06, 2025

Fenty Beauty Paris Rihannas Glamorous Appearance And Fan Interaction

May 06, 2025 -

Ddgs Dont Take My Son Diss Track Ignites Controversy Aimed At Halle Bailey

May 06, 2025

Ddgs Dont Take My Son Diss Track Ignites Controversy Aimed At Halle Bailey

May 06, 2025

Latest Posts

-

Colman Domingo Top 10 Movies And Tv Shows To Watch

May 06, 2025

Colman Domingo Top 10 Movies And Tv Shows To Watch

May 06, 2025 -

Rianna Fotosesiya U Spokuslivomu Rozhevomu Merezhivi

May 06, 2025

Rianna Fotosesiya U Spokuslivomu Rozhevomu Merezhivi

May 06, 2025 -

Nova Fotosesiya Rianni Epatazh U Rozhevomu Merezhivi

May 06, 2025

Nova Fotosesiya Rianni Epatazh U Rozhevomu Merezhivi

May 06, 2025 -

Rihanna And A Ap Rocky A New Couple Fans React To Romance Rumors

May 06, 2025

Rihanna And A Ap Rocky A New Couple Fans React To Romance Rumors

May 06, 2025 -

Rihannas Casual Yet Stylish Santa Monica Outing

May 06, 2025

Rihannas Casual Yet Stylish Santa Monica Outing

May 06, 2025