Walleye's Commodities Division: Restructuring Credit And Team Focus

Table of Contents

Credit Restructuring Initiatives

The core of our restructuring plan involves a comprehensive overhaul of our credit management practices. This encompasses several key strategies designed to improve our financial health and mitigate credit risk within the Commodities Division. Effective debt management is paramount in the volatile commodities market.

Streamlining Credit Processes

We're implementing cutting-edge technologies and refining existing procedures to improve the efficiency and accuracy of credit assessment and monitoring. This includes:

- Automated Credit Scoring System: Implementing a new, sophisticated credit scoring system to provide a more objective and efficient assessment of creditworthiness. This reduces manual processing and minimizes human error.

- Real-time Data Integration: Integrating real-time data feeds from multiple sources to ensure our credit assessments are always up-to-date and reflect current market conditions. This enhances our ability to manage credit risk effectively.

- Process Automation: Automating repetitive tasks, such as data entry and report generation, freeing up our credit analysts to focus on higher-value activities like risk analysis and client relationship management.

Strengthening Credit Policies

Our revised credit policies prioritize risk mitigation and enhance the overall financial health of the division. This involves:

- Stricter Lending Criteria: Implementing stricter lending criteria to ensure we only extend credit to clients with a demonstrably strong credit history and a low risk profile.

- Enhanced Due Diligence: Enhancing our due diligence processes to include more thorough background checks and financial analysis of prospective borrowers. This helps us identify potential red flags early on.

- Robust Collateral Management: Implementing more robust collateral management practices to ensure adequate security for all outstanding loans. This minimizes our exposure to losses in case of defaults.

Addressing Non-Performing Loans

We are actively addressing our non-performing loan portfolio through a combination of strategies, including:

- Debt Restructuring Negotiations: Working collaboratively with borrowers to restructure their loans and develop repayment plans that are feasible and sustainable.

- Strategic Write-offs: In cases where debt restructuring is not feasible, we will implement a strategic write-off process to minimize further losses.

- Legal Recourse: Where necessary, we will pursue legal avenues to recover outstanding debts.

Enhanced Team Focus and Collaboration

Improving teamwork and collaboration is crucial to the success of our restructuring efforts. We are investing in our people and fostering a culture of open communication and knowledge sharing.

Investing in Employee Training and Development

We are committed to upskilling our employees to meet the challenges of the evolving commodities market. This includes:

- Specialized Training Programs: Providing specialized training programs in areas like risk management, advanced commodities trading strategies, and data analytics.

- Mentorship Programs: Establishing mentorship programs to foster knowledge transfer and career development within the team.

- Continuing Education Opportunities: Encouraging and supporting employees in pursuing continuing education opportunities to enhance their professional skills.

Fostering a Culture of Collaboration

We are implementing initiatives to promote open communication, knowledge sharing, and teamwork:

- Cross-Functional Teams: Creating cross-functional teams to break down silos and encourage collaboration across different departments.

- Regular Team Meetings: Holding regular team meetings to facilitate communication and knowledge sharing.

- Open-Door Policy: Establishing an open-door policy to encourage open communication and feedback.

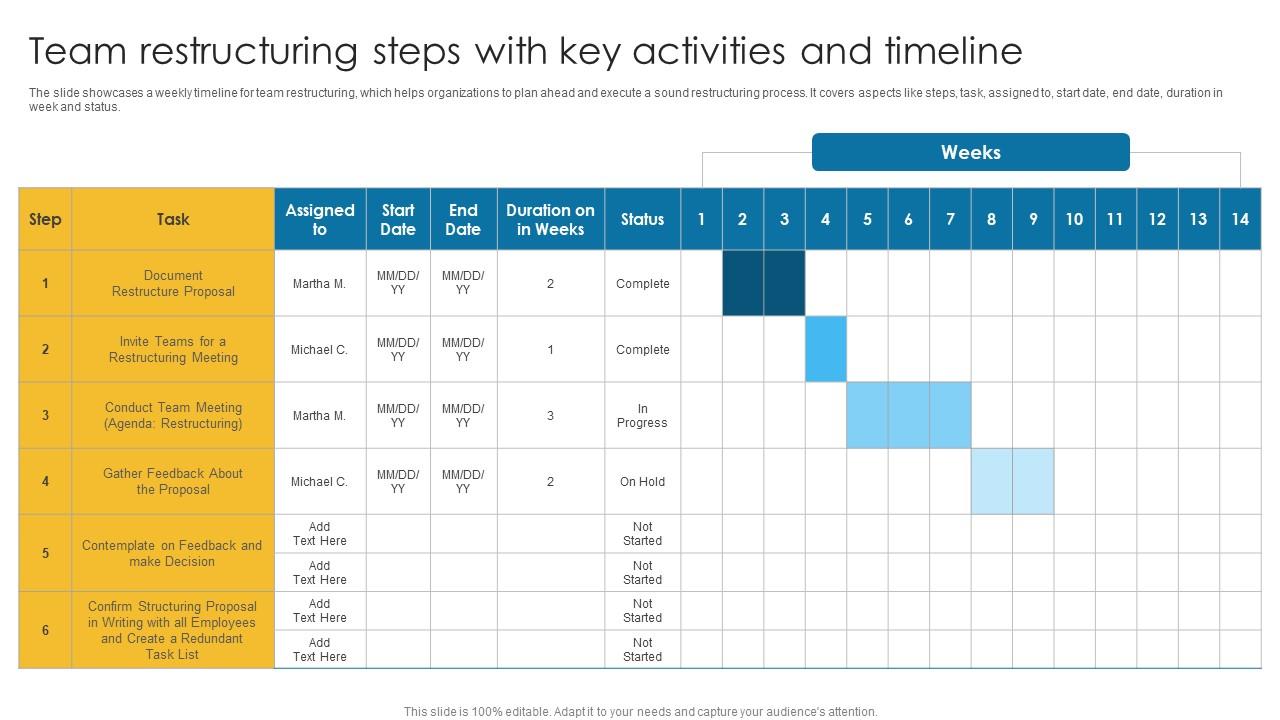

Optimizing Team Structures

We are restructuring our teams to improve efficiency and leverage individual expertise more effectively:

- Specialized Units: Creating specialized units focused on specific areas of expertise, such as credit analysis, risk management, and trading.

- Clear Roles and Responsibilities: Clearly defining roles and responsibilities within each team to minimize ambiguity and enhance accountability.

Measuring Success and Future Outlook

The success of our restructuring initiative will be measured by several key performance indicators (KPIs). We are committed to sustainable growth and adapting to the dynamic commodities market.

Defining Key Performance Indicators (KPIs)

We are tracking key metrics including:

- Improved Credit Ratings: Monitoring our credit ratings to assess the overall financial health of the division.

- Reduced Non-Performing Loans: Tracking the reduction in our non-performing loan portfolio as a measure of our credit risk management effectiveness.

- Increased Profitability: Monitoring our profitability to assess the overall financial impact of our restructuring efforts.

- Enhanced Team Performance Metrics: Tracking team performance metrics, such as efficiency, productivity, and employee satisfaction.

Predicting Future Challenges and Opportunities

We are actively analyzing the evolving commodities market landscape and developing strategies to address potential challenges and capitalize on emerging opportunities. This includes:

- Market Volatility Analysis: Continuously monitoring market volatility and developing strategies to mitigate its impact on our operations.

- Technological Advancements: Embracing new technologies to enhance efficiency and improve decision-making.

- Regulatory Changes: Staying informed about regulatory changes and adapting our practices to maintain compliance.

Conclusion:

Walleye's Commodities Division’s restructuring of credit and team focus represents a significant investment in the long-term success of the division. By addressing credit risk proactively and fostering a more collaborative and efficient work environment, the division is well-positioned to navigate market challenges and achieve sustained growth. The implementation of robust KPIs will allow for the ongoing monitoring and optimization of these initiatives. This strategic approach ensures Walleye's Commodities Division remains a strong and competitive player in the ever-evolving commodities market. Learn more about our commitment to improving our Walleye's Commodities Division and its credit restructuring efforts by contacting us today.

Featured Posts

-

Economic Disaster Looms For Spanish Towns Following Brexit Deal

May 13, 2025

Economic Disaster Looms For Spanish Towns Following Brexit Deal

May 13, 2025 -

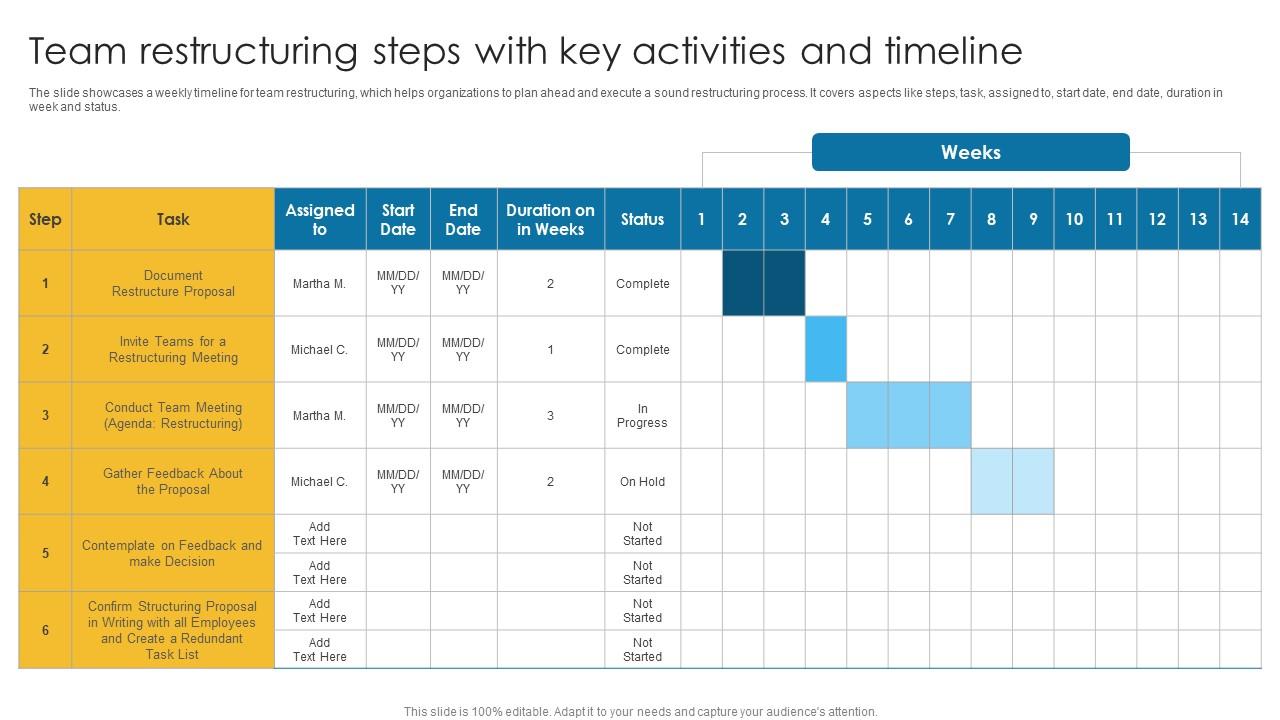

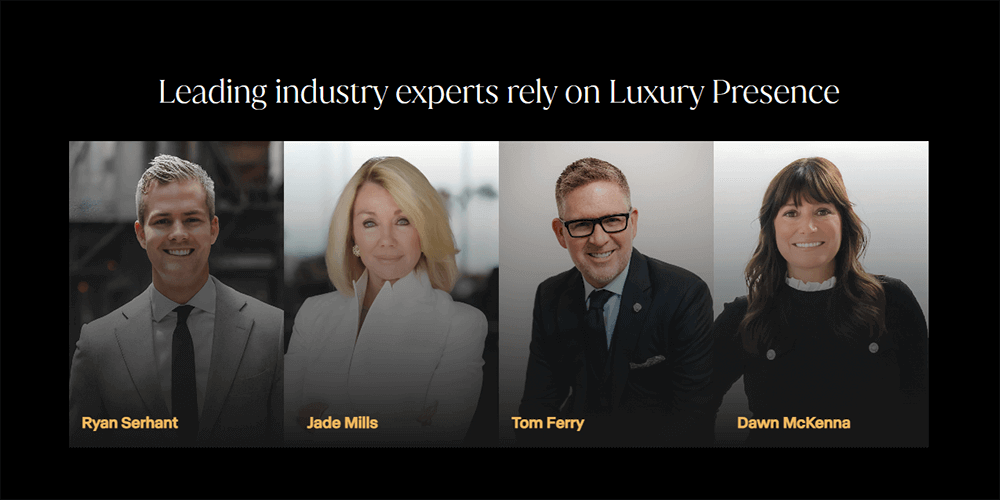

Off Market Luxury Real Estate A New Hub From Luxury Presence

May 13, 2025

Off Market Luxury Real Estate A New Hub From Luxury Presence

May 13, 2025 -

Dzherard Btlr 8 Godini S Osinovenoto Mu Blgarsko Kuche

May 13, 2025

Dzherard Btlr 8 Godini S Osinovenoto Mu Blgarsko Kuche

May 13, 2025 -

The Da Vinci Codes Impact On Popular Culture And Religious Discourse

May 13, 2025

The Da Vinci Codes Impact On Popular Culture And Religious Discourse

May 13, 2025 -

Can 3 Mortgage Rates Help Canadas Housing Market Bounce Back

May 13, 2025

Can 3 Mortgage Rates Help Canadas Housing Market Bounce Back

May 13, 2025