Wall Street's Next Big Winner: A BlackRock ETF Billionaires Are Betting On

Table of Contents

The Rise of iShares Core S&P 500 ETF (ITOT): A Deep Dive

The iShares Core S&P 500 ETF (ITOT) is a passively managed exchange-traded fund that seeks to track the investment returns of the S&P 500 Index. This index represents 500 of the largest publicly traded companies in the United States, offering broad diversification across various sectors of the American economy. Its market-cap-weighted methodology means larger companies hold a greater weight in the portfolio, reflecting their relative size in the overall market.

Key features of ITOT that make it attractive to investors include:

- Low Expense Ratio: ITOT boasts an incredibly low expense ratio, significantly lower than many competing S&P 500 ETFs. This means more of your investment stays invested, leading to potentially higher returns over time.

- Diversification across Large-Cap U.S. Companies: The ETF provides instant diversification across the 500 largest U.S. companies, reducing the risk associated with holding individual stocks.

- Strong Historical Performance: ITOT has consistently tracked the S&P 500's performance closely. Since its inception, it has delivered strong returns, reflecting the overall growth of the U.S. stock market (Note: Insert specific performance data with timeframes here, citing reliable sources).

- Tax Efficiency: ITOT is designed for tax efficiency, minimizing capital gains distributions to shareholders.

Why Billionaires are Choosing this BlackRock ETF

The significant interest from billionaires in ITOT stems from several key factors:

-

Market Stability and Predictability: The S&P 500, and by extension ITOT, is considered a relatively stable and predictable investment compared to more volatile asset classes. This stability appeals to investors seeking to preserve capital while achieving long-term growth.

-

Long-Term Growth Potential: The U.S. economy has historically demonstrated consistent long-term growth, and the S&P 500 has often reflected this trend. Investing in ITOT offers exposure to this long-term growth potential.

-

Safe Haven Asset in Uncertain Times: During periods of market uncertainty, investors often flock to established, large-cap companies represented in the S&P 500, making ITOT a relatively safe haven asset.

-

Alignment with Overall Portfolio Diversification Strategies: For billionaires managing vast and diversified portfolios, ITOT provides a cornerstone investment that offers broad market exposure with low risk.

-

Safety and Stability in Volatile Markets: ITOT's performance tends to be less volatile than other investment options, providing a sense of security.

-

Long-Term Growth Potential Tied to the U.S. Economy: Investing in the U.S. market through ITOT provides exposure to the long-term potential of the American economy.

-

Lower Risk Compared to Other Investment Options: While still carrying market risk, ITOT is considered a lower-risk investment compared to sector-specific ETFs or individual stocks.

-

Diversification Within a Single ETF: Investors gain broad market diversification with a single, low-cost investment.

Analyzing the Investment Risks and Potential Returns

While ITOT offers significant advantages, it's crucial to acknowledge potential risks:

- Market Risk: The value of ITOT will fluctuate with the overall performance of the S&P 500. Market downturns can lead to losses.

- Potential for Lower Returns than Other, Higher-Risk Investments: While generally considered less risky, ITOT may offer lower returns than investments with higher risk tolerances.

Comparing ITOT's performance to benchmarks like the S&P 500 itself reveals a close correlation, demonstrating its effectiveness in tracking the index. (Insert comparative performance data and charts here). Individual risk tolerance should be carefully considered before investing.

Comparing ITOT to Competitors

Several ETFs track the S&P 500. However, ITOT's incredibly low expense ratio sets it apart. (Insert a comparison table here showcasing key features of ITOT versus similar ETFs like IVV (iShares CORE S&P 500), SPY (SPDR S&P 500 ETF Trust), and VOO (Vanguard S&P 500 ETF), focusing on expense ratios, AUM, and other relevant factors.)

Conclusion

Billionaires are betting on ITOT because of its low expense ratio, broad diversification across the largest U.S. companies, and strong historical performance reflecting the overall growth of the U.S. market. While it offers a relatively stable investment opportunity, it's vital to remember that market risk remains. Potential returns are tied to the performance of the S&P 500, and past performance is not indicative of future results.

Are you ready to join the billionaires and explore the potential of this top-performing BlackRock ETF? Learn more about ITOT and its investment strategy today. Consider adding this strategic BlackRock ETF to your portfolio for potential long-term growth. Conduct thorough research and consult a financial advisor before making any investment decisions. Remember, past performance is not indicative of future results.

Featured Posts

-

Williams F1 Doohans Position Following Colapinto Driver Rumors

May 09, 2025

Williams F1 Doohans Position Following Colapinto Driver Rumors

May 09, 2025 -

Harry Styles Snl Impression A Disappointing Take

May 09, 2025

Harry Styles Snl Impression A Disappointing Take

May 09, 2025 -

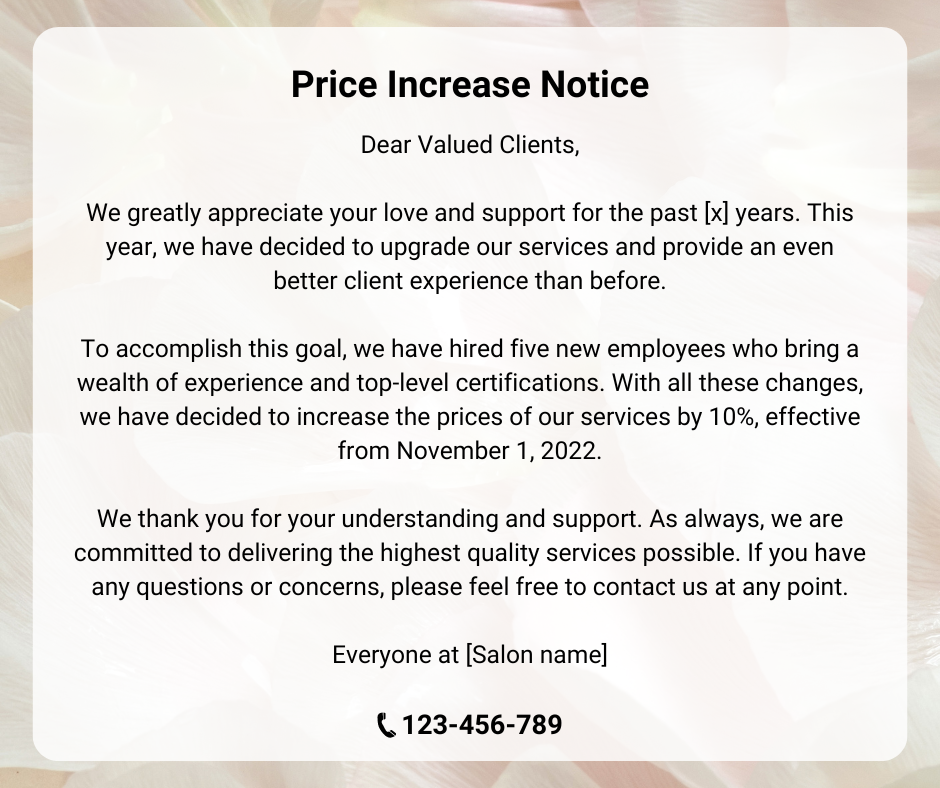

1050 V Mware Price Increase At And Ts Reaction To Broadcoms Proposal

May 09, 2025

1050 V Mware Price Increase At And Ts Reaction To Broadcoms Proposal

May 09, 2025 -

Analyzing The 2025 Nhl Playoffs Following The Trade Deadline

May 09, 2025

Analyzing The 2025 Nhl Playoffs Following The Trade Deadline

May 09, 2025 -

Uk To Tighten Visa Rules For Pakistan Nigeria And Sri Lanka

May 09, 2025

Uk To Tighten Visa Rules For Pakistan Nigeria And Sri Lanka

May 09, 2025