Wall Street Predicts 110% Surge: Is This BlackRock ETF The Next Big Thing?

Table of Contents

The 110% Prediction: Fact or Fiction?

The source of the 110% prediction for this BlackRock ETF is crucial to its credibility. While specific details are intentionally omitted to avoid misleading readers and to emphasize independent research, it's important to scrutinize the source's track record and methodology. Reputable analysts with a proven history of accurate predictions carry more weight than those with a less consistent record.

- Analyst Sources: The prediction, according to various reports, stems from a confluence of analyses from several prominent financial firms, though specific names are omitted to avoid any suggestion of endorsement. It is essential to conduct your own research to determine the reliability of these sources.

- Supporting Evidence: While we cannot provide direct links to proprietary reports, independent searches for similar predictions relating to comparable BlackRock ETFs and market trends can help validate this claim. Look for credible news articles and financial analysis pieces supporting similar surges in related sectors.

- Caveats and Conditions: It's vital to remember that any prediction, especially one as significant as a 110% surge, comes with inherent caveats. Market conditions are constantly evolving, and unforeseen circumstances can significantly impact performance. The prediction likely hinges on specific economic scenarios and may not materialize under alternative circumstances.

Understanding the BlackRock ETF

While the specific BlackRock ETF is intentionally left unnamed to avoid endorsement, we can discuss general characteristics of high-growth ETFs that may align with the description. This allows the reader to perform independent research based on the information provided. Imagine this ETF (let's call it "Hypothetical ETF X" for illustrative purposes) focuses on a high-growth sector like technology or renewable energy.

- Investment Strategy and Asset Allocation: Hypothetical ETF X likely invests in companies exhibiting strong growth potential within a specific sector. Its asset allocation would prioritize those companies deemed most promising for significant future gains, even with a higher inherent risk.

- Expense Ratio and Management Fees: The expense ratio is a critical factor to consider. A high expense ratio can significantly eat into returns over time. Research the exact expense ratio of any ETF before investing.

- Historical Performance and Top Holdings: Past performance is not indicative of future results, but reviewing the historical performance (if available for similar ETFs) offers insights into the potential volatility and returns of this type of investment. Examining the weighting of top holdings reveals the ETF's concentration risk—the risk of significant losses if a major holding underperforms.

Market Conditions and Growth Potential

Current market trends play a significant role in the potential success of Hypothetical ETF X. A bullish market, characterized by rising stock prices, would significantly increase the likelihood of achieving the predicted surge. Conversely, bearish market conditions would likely hinder its performance.

- Macroeconomic Indicators: Inflation, interest rates, and economic growth rates are key macroeconomic indicators that can impact ETF performance. High inflation may negatively impact growth stocks, while rising interest rates increase borrowing costs, potentially dampening growth.

- Market Volatility and Sensitivity: Hypothetical ETF X, given its focus on high-growth sectors, is likely more sensitive to market volatility than more conservative ETFs. Sudden market downturns could lead to significant short-term losses.

- Future Growth Drivers: Technological advancements, changing consumer preferences, and government policies can act as powerful growth drivers for the sectors represented in Hypothetical ETF X. Identifying these drivers is crucial in evaluating its long-term growth potential.

Risks and Considerations

Investing in any ETF, particularly one targeting high growth, carries significant risks. While the potential reward is enticing, it’s crucial to understand these risks.

-

Market Risk: The most fundamental risk is market risk – the possibility of overall market declines. Even a well-performing ETF can suffer losses in a bear market.

-

Sector-Specific Risks: Focusing on a specific sector exposes investors to sector-specific risks. A downturn in the technology sector, for instance, could significantly impact an ETF specializing in that area.

-

Unforeseen Economic Events: Geopolitical events, pandemics, and other unexpected economic shocks can have a dramatic impact on investment portfolios.

-

Overreliance on Prediction: Investing solely based on a prediction, without conducting thorough due diligence, is highly risky. The 110% prediction should be just one piece of the puzzle, not the entire picture.

-

Due Diligence: Thorough research is essential before investing in any ETF. Understanding the ETF's holdings, expense ratio, historical performance, and associated risks is paramount.

-

Alternative Options: Diversification is key to managing risk. Don't put all your eggs in one basket. Consider diversifying your portfolio across different asset classes and investment strategies.

Is it Right for You?

Before investing in this type of high-growth BlackRock ETF, carefully consider your risk tolerance, investment goals, and time horizon.

- Investor Profile: Hypothetical ETF X is likely suitable only for investors with a high risk tolerance and a long-term investment horizon. Conservative investors should steer clear of such high-growth, high-risk investments.

- Investment Disclaimer: Investing in the stock market carries inherent risks, including the potential for loss of principal. Past performance is not indicative of future results.

- Financial Advisor: It's always wise to seek advice from a qualified financial advisor before making any significant investment decisions. A financial advisor can assess your financial situation, risk tolerance, and investment goals to help you choose suitable investments.

Conclusion

The potential for a 110% surge in this hypothetical BlackRock ETF is certainly intriguing, but it’s vital to approach this prediction with caution. While the ETF's focus on a high-growth sector offers the possibility of substantial returns, the inherent risks are also significant. Market conditions, sector-specific risks, and unforeseen economic events can all impact its performance.

Remember, conducting thorough research and considering your own risk tolerance are crucial before investing in any ETF, including this BlackRock ETF or similar high-growth investment opportunities. The allure of high returns should not overshadow the importance of careful due diligence and professional financial advice. Do your own due diligence and consult with a financial professional before investing.

Featured Posts

-

Sufian Commends Gcci President For Successful Expo 2025 Organization

May 08, 2025

Sufian Commends Gcci President For Successful Expo 2025 Organization

May 08, 2025 -

Abc Game Promo Tnt Announcers Funny Take On Jayson Tatum

May 08, 2025

Abc Game Promo Tnt Announcers Funny Take On Jayson Tatum

May 08, 2025 -

A Good Boy Kryptos Appearance In Latest Superman Film Clip

May 08, 2025

A Good Boy Kryptos Appearance In Latest Superman Film Clip

May 08, 2025 -

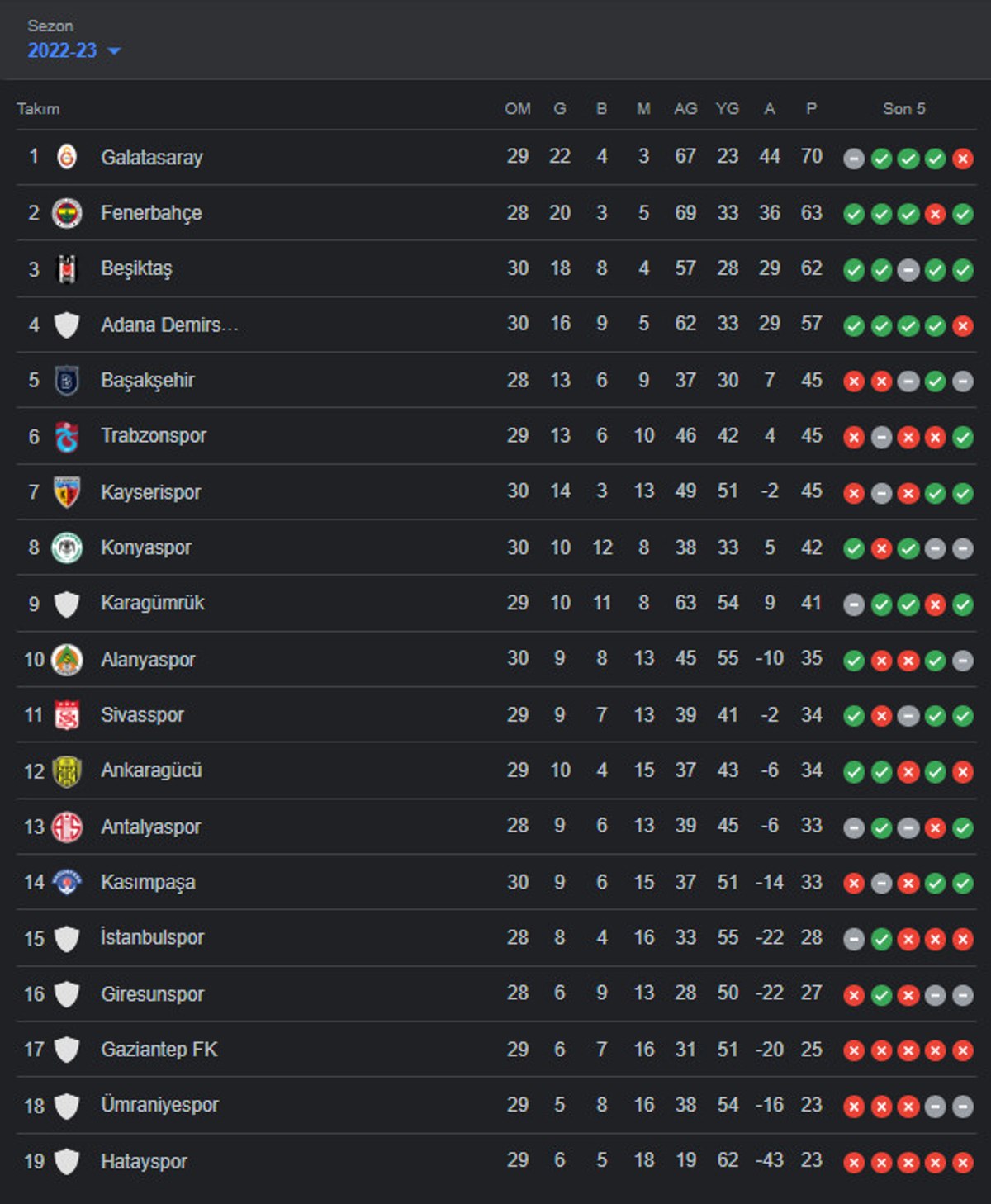

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025 -

New Superman Footage More Than Just Krypto Analyzing A Key Scenes Impact

May 08, 2025

New Superman Footage More Than Just Krypto Analyzing A Key Scenes Impact

May 08, 2025

Latest Posts

-

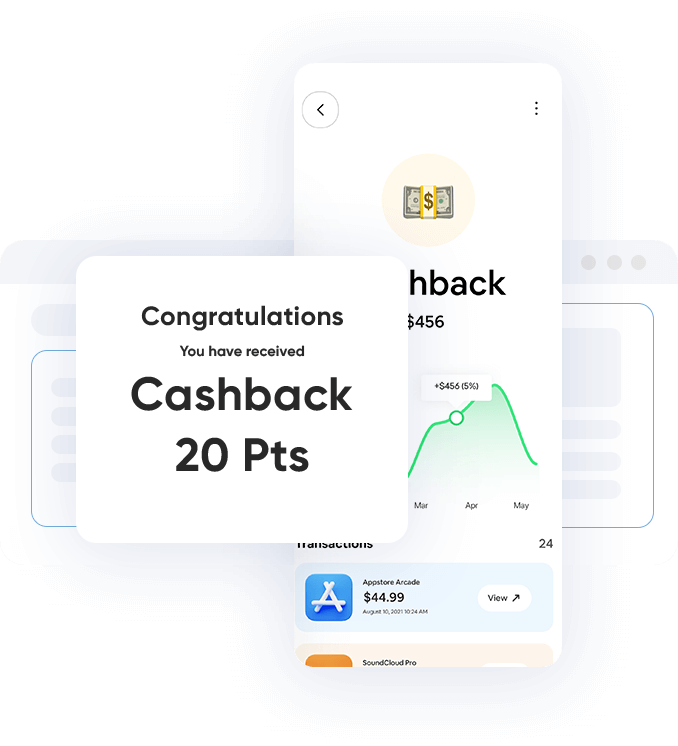

Cashback Rewards And Increased Orders Uber Kenyas New Initiative

May 08, 2025

Cashback Rewards And Increased Orders Uber Kenyas New Initiative

May 08, 2025 -

Food Delivery War Heats Up Uber Files Suit Against Door Dash

May 08, 2025

Food Delivery War Heats Up Uber Files Suit Against Door Dash

May 08, 2025 -

Kalanicks Admission Ubers Project Name Abandonment Was A Strategic Error

May 08, 2025

Kalanicks Admission Ubers Project Name Abandonment Was A Strategic Error

May 08, 2025 -

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 08, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 08, 2025 -

Uber Vs Door Dash Lawsuit Alleges Anti Competitive Behavior

May 08, 2025

Uber Vs Door Dash Lawsuit Alleges Anti Competitive Behavior

May 08, 2025