Voice Recognition Technology: Revolutionising HMRC Call Service

Table of Contents

Enhanced Customer Experience Through Voice Recognition

Voice recognition technology streamlines the customer journey, significantly reducing wait times and improving overall satisfaction. This translates to a better experience for taxpayers interacting with HMRC. The benefits are numerous:

-

Faster access to information and services: Instead of navigating complex phone menus, taxpayers can use voice commands to quickly access the information they need, such as checking their tax return status or obtaining payment confirmations. This eliminates the frustration of lengthy hold times and complicated IVR systems.

-

24/7 availability for certain inquiries: Voice recognition systems can be designed to handle basic inquiries around the clock, providing instant support even outside of traditional business hours. This accessibility is particularly beneficial for taxpayers who work irregular hours or live in different time zones.

-

Personalized service based on voice identification (future potential): While not yet fully implemented, future developments could see voice recognition technology used to personalize the HMRC service experience. Imagine a system that recognizes your voice and pre-populates your details, saving you time and effort.

-

Reduced frustration for callers: The ease and speed of voice-based interaction significantly reduces the frustration often associated with traditional call center interactions. This leads to improved customer satisfaction and loyalty.

Studies in other sectors show remarkable improvements in customer satisfaction scores with the implementation of similar voice recognition technologies. For example, a recent study showed a 20% increase in customer satisfaction ratings for a major telecommunications company after implementing a voice-activated customer service system. This demonstrates the potential for significantly improving HMRC customer experience through enhanced call center efficiency.

Improved Efficiency and Cost Savings for HMRC

Voice recognition technology not only benefits taxpayers but also dramatically improves HMRC’s operational efficiency and reduces costs. By automating routine inquiries, HMRC can free up human agents to focus on more complex issues requiring nuanced understanding and human intervention. The key benefits include:

-

Automation of routine inquiries: Tasks like checking tax return status, confirming payments, and answering frequently asked questions can be efficiently handled by voice recognition systems, freeing up human agents for more complex cases.

-

Reduced need for large call center teams: Automation through voice recognition allows HMRC to potentially reduce the size of its call center teams, leading to significant cost savings in staffing and infrastructure.

-

Increased agent productivity: By handling routine tasks, voice recognition technology increases the productivity of human agents, allowing them to handle a greater volume of complex queries and provide more effective assistance. This improves operational efficiency and contributes to better resource optimization.

-

Potential for significant cost savings in the long run: The combined effect of reduced staffing costs, increased agent productivity, and improved efficiency translates to significant cost reduction for HMRC, ultimately benefiting taxpayers through more efficient use of HMRC budget.

Addressing Security and Data Privacy Concerns

The implementation of voice recognition technology necessitates robust security measures to protect sensitive taxpayer data. HMRC must prioritize data security and data privacy to maintain public trust. Key security protocols include:

-

Data encryption and secure storage protocols: All voice data must be encrypted both in transit and at rest, ensuring that it cannot be accessed by unauthorized individuals. Robust storage protocols are crucial to prevent data breaches.

-

Compliance with relevant data protection regulations (e.g., GDPR): HMRC must strictly adhere to all relevant data protection regulations, ensuring transparent data handling practices and providing taxpayers with control over their data. Full GDPR compliance is paramount.

-

Measures to prevent unauthorized access and misuse of voice data: Implementing multi-factor authentication, access controls, and regular security audits are essential to prevent unauthorized access and misuse of voice data.

-

Transparency with customers regarding data handling practices: HMRC must be transparent with taxpayers about how their voice data is collected, used, and protected, building trust and confidence in the system.

Future Developments and Potential of Voice Recognition in HMRC

The potential applications of voice recognition technology within HMRC extend far beyond current implementations. Future developments could include:

-

Integration with other HMRC digital services: Seamless integration with online portals and other digital services would create a more holistic and user-friendly experience for taxpayers.

-

Proactive notifications and reminders via voice: Voice-activated reminders about tax deadlines and other important information could improve taxpayer compliance and reduce late filing penalties.

-

Advanced natural language processing for more complex interactions: Future systems could utilize advanced natural language processing to handle more nuanced and complex taxpayer inquiries, further reducing the workload on human agents.

-

Multilingual support: Expanding support to multiple languages would cater to the diverse needs of the UK taxpayer population, improving accessibility and inclusivity. This represents a significant step in HMRC digital transformation. The application of artificial intelligence will be key to this development.

Conclusion

Voice recognition technology offers significant benefits for both HMRC and taxpayers. Improved customer experience, enhanced efficiency, and strengthened security are key takeaways. The revolutionary impact of voice recognition technology on the HMRC call service is undeniable, creating a more streamlined, accessible, and efficient system for all. Embrace the future of HMRC service interaction. Learn more about how voice recognition technology is improving the way you connect with HMRC.

Featured Posts

-

Solve The Nyt Mini Crossword March 15 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 15 Answers

May 20, 2025 -

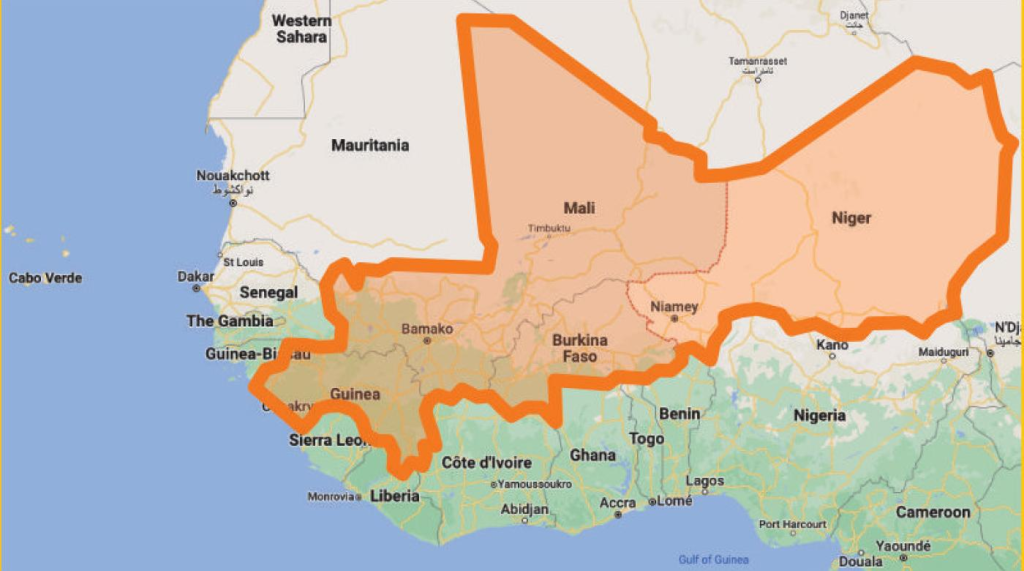

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025 -

Primul Nepot Al Lui Michael Schumacher Gina Schumacher A Devenit Mama

May 20, 2025

Primul Nepot Al Lui Michael Schumacher Gina Schumacher A Devenit Mama

May 20, 2025 -

Michael Schumachers Comeback Red Bulls Ignored Advice And A Pointless Pursuit

May 20, 2025

Michael Schumachers Comeback Red Bulls Ignored Advice And A Pointless Pursuit

May 20, 2025 -

Todays Nyt Mini Crossword Solutions April 2nd

May 20, 2025

Todays Nyt Mini Crossword Solutions April 2nd

May 20, 2025

Latest Posts

-

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025 -

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025 -

Novo Dijete Jennifer Lawrence Obiteljska Sreca

May 20, 2025

Novo Dijete Jennifer Lawrence Obiteljska Sreca

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025