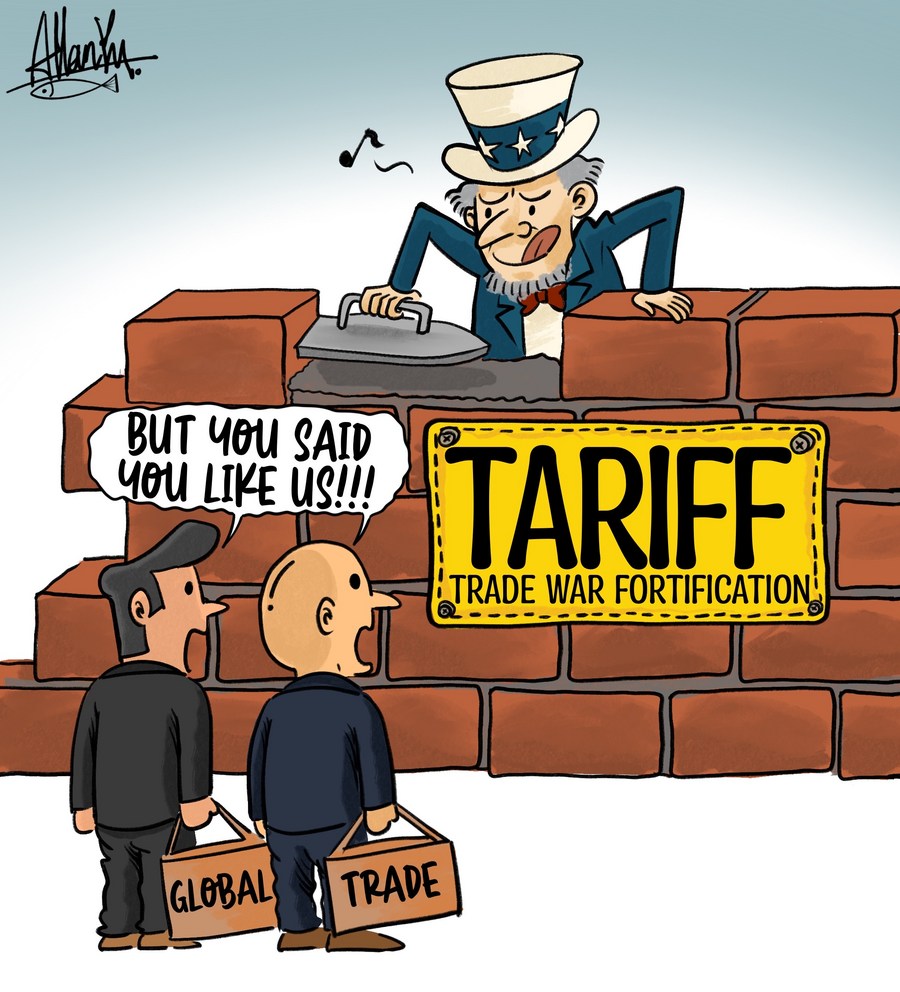

US Solar Tariffs: Hanwha And OCI's Strategy For Growth

Table of Contents

Hanwha Q CELLS' Response to US Solar Tariffs

Hanwha Q CELLS, a leading solar panel manufacturer, has implemented a multi-pronged strategy to mitigate the effects of US solar tariffs. Their approach focuses on vertical integration, increased domestic manufacturing, and aggressive marketing of their "American-made" products. This allows them to bypass tariffs, access government incentives, and appeal to a growing market demanding domestically-produced solar energy solutions.

-

Investment in US Manufacturing Facilities: Hanwha Q CELLS has significantly invested in expanding its US manufacturing capacity. This strategic move allows them to produce solar panels domestically, thereby avoiding tariffs imposed on imported panels. This investment directly contributes to the growth of American jobs in the solar sector.

-

Vertical Integration: By controlling more aspects of the solar panel production process, from polysilicon to finished panels, Hanwha Q CELLS reduces its reliance on external suppliers and minimizes its vulnerability to price fluctuations and supply chain disruptions caused by tariffs. This vertical integration strategy offers enhanced control and cost efficiency.

-

Expansion of Domestic Solar Panel Production: The company's expansion of its US production facilities has dramatically increased its capacity to meet the growing demand for domestically-produced solar panels. This strategic expansion ensures the company can supply both large-scale solar projects and residential customers.

-

Marketing "American-Made" Solar Panels: Hanwha Q CELLS actively markets its US-made solar panels, emphasizing their origin and appeal to consumers and businesses prioritizing American-made products. This targeted marketing strategy leverages the growing preference for domestically sourced goods.

-

Exploration of Alternative Supply Chains: While focusing on domestic production, Hanwha Q CELLS also explores alternative supply chains and strategic partnerships to further mitigate the impact of tariffs and ensure consistent supply.

-

Specific Examples: Hanwha Q CELLS has invested hundreds of millions of dollars in expanding its US manufacturing facilities, resulting in a substantial increase in domestic solar panel production. Specific production figures and investment details are publicly available through their financial reports and press releases.

OCI's Strategy in the Face of US Solar Tariffs

OCI, a major producer of polysilicon – a crucial raw material in solar panel manufacturing – has adopted a different yet equally effective strategy. Their focus is on increasing polysilicon production to meet the growing demand fueled by US solar tariffs and government incentives.

-

Increased Polysilicon Production: Anticipating the increased demand for polysilicon driven by the tariffs and the growth of the US solar market, OCI has invested in expanding its polysilicon production capacity. This proactive approach positions them to capitalize on the increased demand.

-

Supplying High-Quality Solar-Grade Polysilicon: OCI focuses on supplying high-quality solar-grade polysilicon specifically to US solar manufacturers, solidifying its role within the domestic supply chain. This targeted approach ensures a reliable supply for American solar panel production.

-

Strategic Partnerships: OCI has forged strategic partnerships with key US solar panel manufacturers, securing long-term contracts and guaranteeing a steady supply of polysilicon. This strategic collaboration ensures both companies' success.

-

Technological Advancements: OCI is continuously exploring new technologies and production methods to enhance efficiency, reduce costs, and maintain a competitive edge in the global polysilicon market. Innovation is central to their long-term strategy.

-

Adapting to Price Fluctuations: OCI actively manages its operations to adapt to fluctuations in polysilicon pricing influenced by global supply and demand. Their experience and market knowledge help them navigate price volatility.

-

Production Capacity and Market Share: OCI is a major global supplier of polysilicon, holding a significant market share. Detailed production capacity and market share data can be found in their public financial reports.

Comparative Analysis of Hanwha and OCI's Strategies

Hanwha Q CELLS and OCI have adopted contrasting yet equally effective strategies in response to US solar tariffs. Hanwha's vertical integration and emphasis on domestic manufacturing provides a resilient, long-term approach. OCI, by focusing on its core competency of polysilicon production, secures a critical role within the US solar supply chain.

-

Investment Comparison: Hanwha's investment is focused on downstream manufacturing (solar panel production), while OCI's investment is upstream (polysilicon production). Both are significant investments supporting the US solar market.

-

Navigating Tariff Challenges: Hanwha directly addresses tariffs through domestic production, while OCI indirectly benefits from the increased demand for its polysilicon.

-

Long-Term Implications: Both strategies offer long-term sustainability and growth potential within the US solar market. Hanwha secures direct market access, while OCI secures a strong position within the supply chain.

-

Impact on the US Solar Market: Both companies contribute significantly to the growth of the US solar industry, albeit through different approaches. Hanwha provides domestically-produced panels, and OCI supplies a crucial raw material.

-

Competitive Advantages and Disadvantages: Hanwha benefits from brand recognition and direct customer relationships, while OCI benefits from a more stable, less volatile market for polysilicon. Both face competitive pressures but are well-positioned for continued growth.

Conclusion

Hanwha Q CELLS and OCI have demonstrated remarkable resilience and adaptability in response to the challenges posed by US solar tariffs. Hanwha's focus on domestic manufacturing and vertical integration positions it strategically for long-term growth. OCI, by strategically increasing polysilicon production, ensures a vital role within the US solar supply chain. Both companies exemplify the adaptability and innovation within the solar industry.

Understanding the strategies employed by companies like Hanwha Q CELLS and OCI is crucial for anyone involved in or interested in the US solar market. Stay informed about the evolving landscape of US solar tariffs and the innovative strategies businesses are using to navigate this dynamic market. Learn more about the impact of US solar tariffs and the future of solar energy.

Featured Posts

-

How Deutsche Banks Fixed Income And Currencies Fic Traders Are Becoming World Leaders

May 30, 2025

How Deutsche Banks Fixed Income And Currencies Fic Traders Are Becoming World Leaders

May 30, 2025 -

Jon Jones Petition Over 100 000 Signatures Demand Title Stripping

May 30, 2025

Jon Jones Petition Over 100 000 Signatures Demand Title Stripping

May 30, 2025 -

Moto Gp Sprint Races High Risk Low Reward A Statistical Analysis

May 30, 2025

Moto Gp Sprint Races High Risk Low Reward A Statistical Analysis

May 30, 2025 -

Tampa Bay Rays Longoria Announces Retirement

May 30, 2025

Tampa Bay Rays Longoria Announces Retirement

May 30, 2025 -

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025