US Money Management Faces Scrutiny From $65 Billion Dutch Investment

Table of Contents

The $65 Billion Dutch Investment: Who and Why?

The significant investment fueling this scrutiny comes from APG Asset Management, one of the world's largest pension fund managers. APG, managing assets primarily for Dutch public-sector employees, has a significant portfolio allocated to US markets, reflecting their confidence in the long-term potential of the American economy. However, their recent actions suggest a growing unease with certain aspects of US money management.

Their motivation for this intense scrutiny likely stems from a confluence of factors:

- Growing Concerns about ESG (Environmental, Social, and Governance) Factors: APG, like many global investors, is increasingly focused on ESG considerations. Concerns about the lagging integration of ESG principles into US investment strategies are likely a major driver of their investigation.

- Potential for Higher Returns Through Improved Management Practices: APG believes that improvements in US money management practices could lead to significantly higher returns on their investments. Their scrutiny seeks to identify areas for improvement and to influence positive change.

- Seeking to Influence US Money Management Practices for Better Long-Term Sustainability: By actively engaging with US money managers, APG aims to promote long-term sustainability and responsible investment practices across the board.

APG's key concerns regarding current US money management practices include:

- High management fees relative to performance.

- Lack of transparency in investment strategies and fee allocation.

- Insufficient integration of ESG factors into investment decisions.

- Concerns about portfolio concentration and risk management.

Areas of Scrutiny: Key Issues in US Money Management

The $65 billion Dutch investment is placing a spotlight on several critical areas of US money management:

Fee Structures and Transparency

One major area of concern is the fee structure within US money management. Many firms charge relatively high management fees compared to global averages, leading to reduced returns for investors.

- High management fees compared to global averages: A common complaint is the disproportionately high fees charged by some US firms compared to their international counterparts.

- Lack of transparency in fee calculations and allocation: The complexity and lack of clarity in fee structures make it difficult for investors to fully understand the costs involved.

- Potential conflicts of interest affecting fee structures: The potential for conflicts of interest between money managers and their clients can influence fee structures, potentially disadvantaging investors.

ESG Integration and Sustainability

The Dutch investment's scrutiny also extends to the integration of ESG factors into US investment decisions.

- Insufficient incorporation of ESG criteria in investment decisions: Many US firms have been criticized for not adequately considering ESG factors in their investment strategies.

- Lack of robust reporting and disclosure on ESG performance: A lack of standardized reporting and disclosure makes it difficult to assess the true ESG performance of US money management firms.

- Concerns regarding environmental impact of investments: The environmental impact of investments is a major concern for investors like APG, and the US market's performance in this area is being closely scrutinized.

Risk Management and Portfolio Diversification

Another crucial area of concern is risk management and portfolio diversification.

- Concerns about concentrated portfolios and inadequate risk mitigation strategies: Over-concentration in specific sectors or asset classes can lead to significant vulnerabilities.

- Vulnerability to market fluctuations and potential economic downturns: Inadequate risk management practices can leave portfolios vulnerable to market downturns.

- Lack of sufficient diversification across asset classes: A lack of diversification can amplify the impact of market fluctuations on investment returns.

Potential Implications of the Scrutiny: Impact on the US Market

The intense scrutiny generated by the $65 billion Dutch investment is likely to have significant implications for the US market.

For US money management firms, the consequences could include:

- Increased pressure to improve transparency and reduce fees.

- Enhanced focus on ESG considerations in investment strategies.

- Adoption of more rigorous risk management practices.

For investors, potential effects include:

- Improved returns due to enhanced money management practices.

- Increased confidence in US markets due to greater transparency and accountability.

- Potential for a shift towards more sustainable investment options.

Potential positive and negative consequences for the broader US economy include:

- Positive: Increased efficiency in the financial sector, higher long-term investor confidence, and a shift towards more sustainable economic practices.

- Negative: Short-term market volatility, potential adjustments in investment strategies, and increased regulatory pressure on financial institutions.

Conclusion: Navigating the Future of US Money Management Under Increased Scrutiny

The $65 billion Dutch investment represents a watershed moment for US money management. The scrutiny surrounding fees, ESG considerations, and risk management practices is forcing a much-needed reassessment of the industry's approach. What does this $65 billion scrutiny mean for the future of US money management? Understanding the implications of this significant Dutch investment is crucial for navigating the evolving landscape of US money management and ensuring a more sustainable and transparent future for American financial markets.

Featured Posts

-

Hailee Steinfelds Angel Margarita Recipe A Premium Collaboration

May 28, 2025

Hailee Steinfelds Angel Margarita Recipe A Premium Collaboration

May 28, 2025 -

Raphinha Inspires Barcelona To Quarter Finals Victory

May 28, 2025

Raphinha Inspires Barcelona To Quarter Finals Victory

May 28, 2025 -

5 Defense Spending Target Nato Chief Ruttes Assessment Of Member Progress

May 28, 2025

5 Defense Spending Target Nato Chief Ruttes Assessment Of Member Progress

May 28, 2025 -

Opening Day Baseball Book Review A New Home Run Hit

May 28, 2025

Opening Day Baseball Book Review A New Home Run Hit

May 28, 2025 -

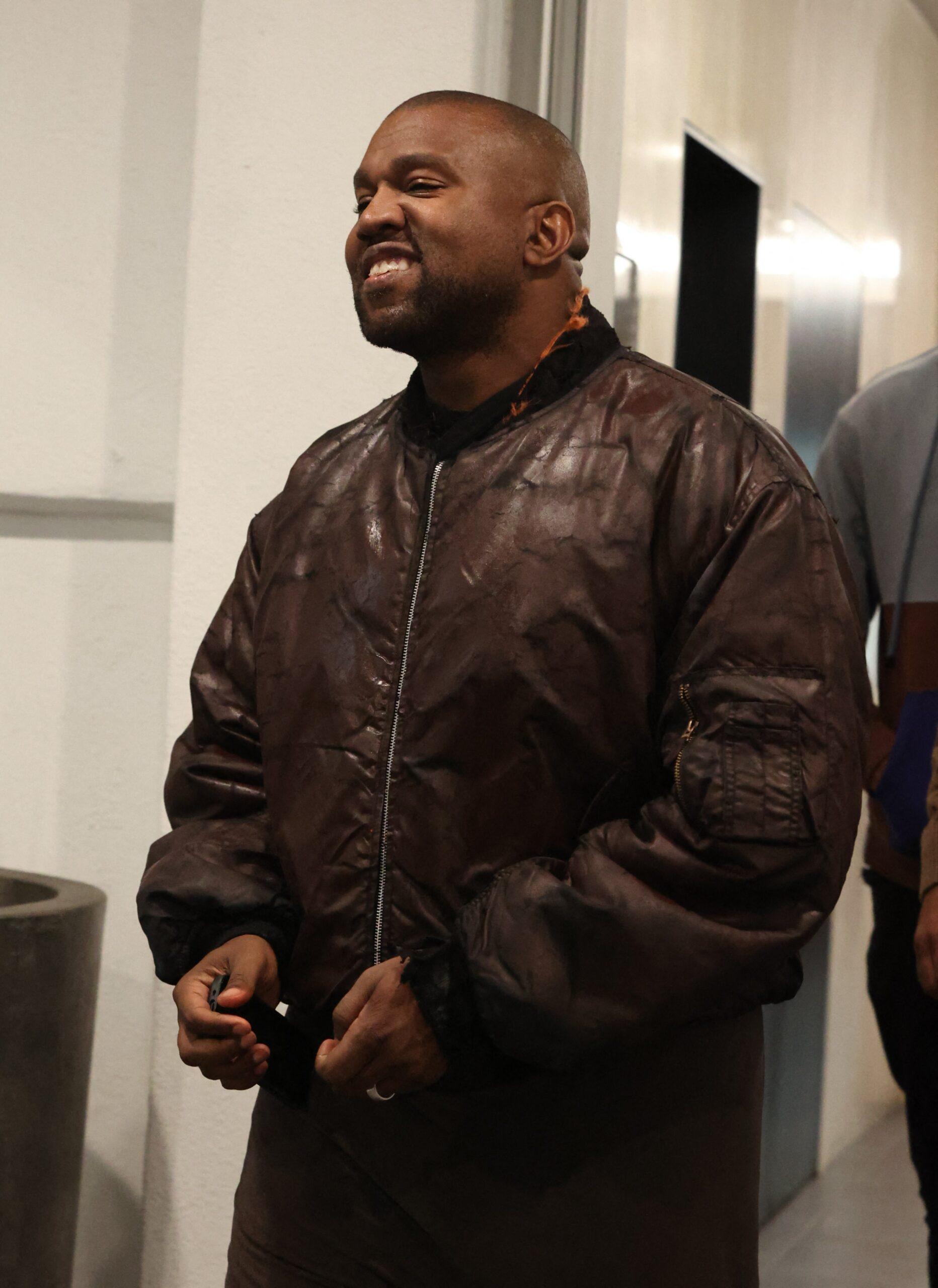

Kanye West Spotted With Bianca Censori Look Alike In Los Angeles

May 28, 2025

Kanye West Spotted With Bianca Censori Look Alike In Los Angeles

May 28, 2025